Faecal Extraction System Market Outlook:

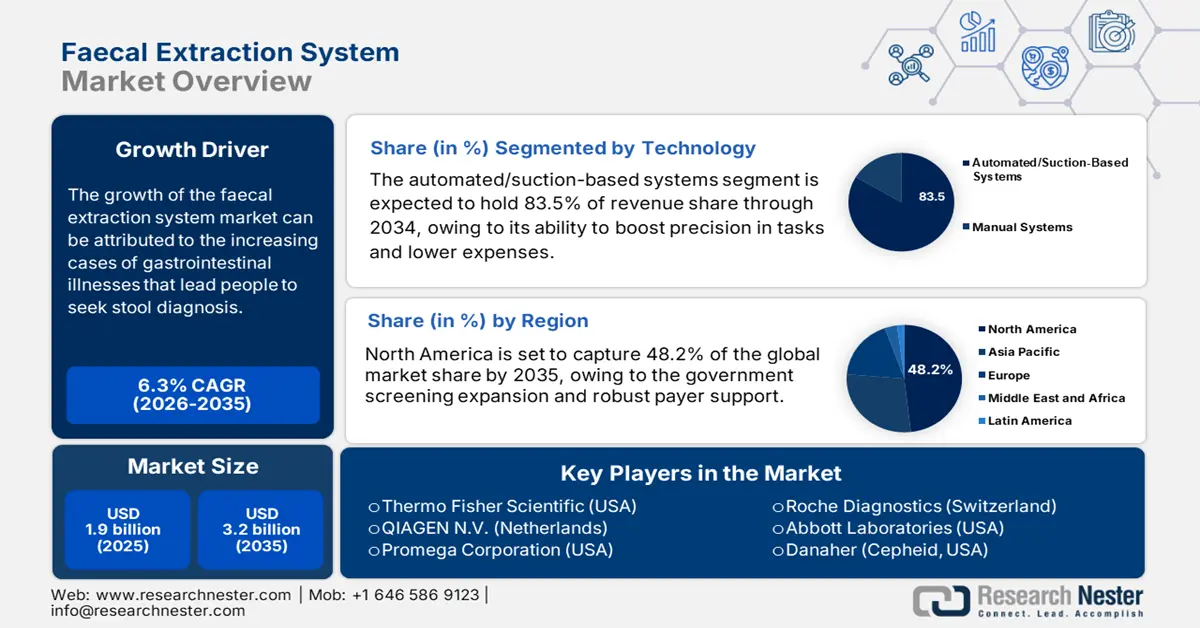

Faecal Extraction System Market size was USD 1.9 billion in 2025 and is anticipated to reach USD 3.2 billion by the end of 2035, increasing at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of faecal extraction system is assessed at USD 2 billion.

The international market is gaining increased traction, owing to an upsurge in the patient pool, especially for gastrointestinal illnesses, which has led to increased hospitalizations, showcasing a rise in the demand for a stool-based diagnostic system. According to an article published by NLM in June 2023, rotavirus accounts for 29.3% of overall diarrheal deaths, followed by astroviruses, catering to 0.5% to 15.0% of diarrheal outbreaks, based on which the market is readily uplifting. In addition, sapovirus accounts for an incidence rate of 22.8 cases per 100 children, with a 95% confidence interval usually ranging from 18.9 to 27.5, thus suitable for boosting the market.

Moreover, the need for the faecal extraction system industry is extremely strengthened by reducing the dependency on invasive diagnostic procedures. Besides, the supply chain for these systems caters to intricate logistics, as well as necessitating raw materials procurement and API manufacturing. Besides, as per an article published by Cell Host and Microbe in May 2023, faecal microbiota transplantation (FMT) has been investigated as the most standard treatment for recurrent Clostridioides difficile infection (rCDI), displaying a continuous success rate of 90%. Meanwhile, generous investments for research and development are also driving the market’s exposure globally.

Key Faecal Extraction System Market Insights Summary:

Regional Highlights:

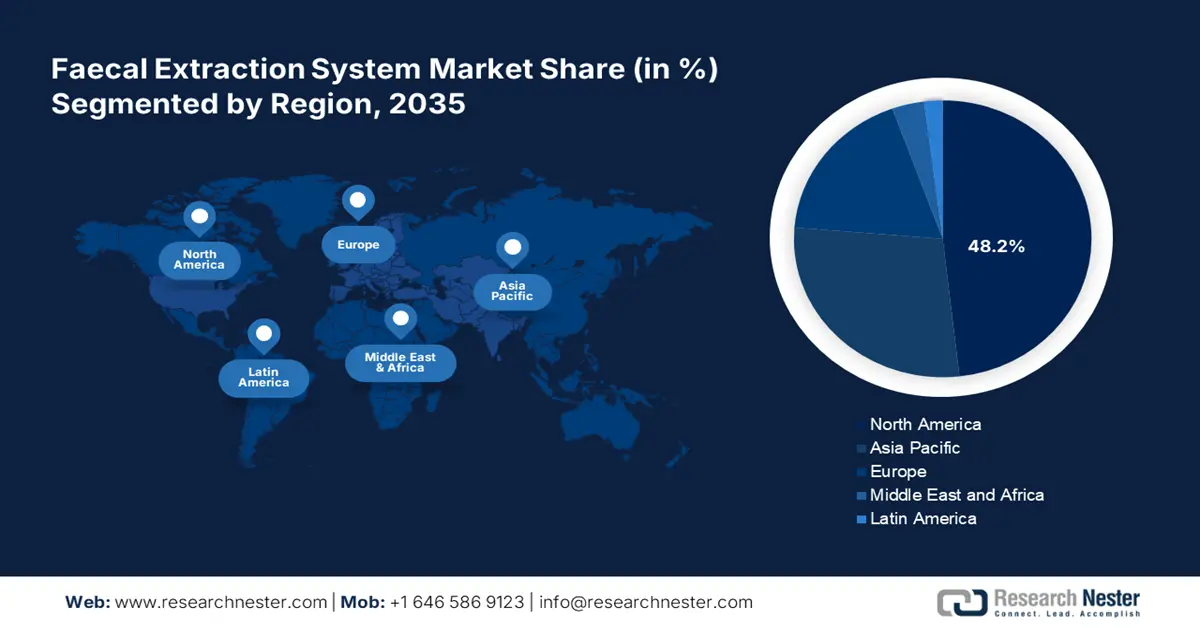

- North America is anticipated to garner the highest share of 48.2% in the faecal extraction system market by the end of 2035, driven by expanded government screening programs and strong payer support.

- Asia Pacific is expected to emerge as the fastest growing region in the faecal extraction system market during the projected timeline, owing to the rising incidence of gastrointestinal diseases.

Segment Insights:

- The automated/suction-based systems segment is anticipated to account for the largest share of 83.5% in the faecal extraction system market by 2035, propelled by enhanced efficacy, precision, safety, and cost reduction in healthcare and manufacturing tasks.

- The chronic faecal incontinence segment is projected to cater the second-largest share during the predicted timeline, driven by the need to address economic, health, and social burdens and improve quality of life.

Key Growth Trends:

- An increase in the incidence of gastrointestinal diseases

- Technological automation and innovation

Major Challenges:

- Reimbursement gaps and government-based price caps

- Prolonged and strict administrative approvals

Key Players: QIAGEN N.V., Promega Corporation, Roche Diagnostics, Abbott Laboratories, Danaher (Cepheid), bioMérieux SA, BÜHLMANN Laboratories AG, ALPCO, Arbor Assays, DRG Instruments, Svar Life Science / Calpro AS, Bioserv Diagnostics, Epitope Diagnostics, Meridian Bioscience.

Global Faecal Extraction System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.5 billion

- 2026 Market Size: USD 17.8 billion

- Projected Market Size: USD 61.8 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

Largest Region: North America (48.2% share by 2035)

Fastest Growing Region: Asia Pacific

Dominating Countries: United States, Germany, Japan, France, Canada

Emerging Countries: India, China, Brazil, Australia, South Korea

Last updated on : 30 September, 2025

Faecal Extraction System Market - Growth Drivers and Challenges

Growth Drivers

- An increase in the incidence of gastrointestinal diseases: The need for the market is highly fueled by an upsurge in inflammatory bowel disease, along with colorectal cancer. According to an article published by the Gastro Organization in September 2022, almost 40% of the population in America readily restricted routine activities, owing to uncomfortable bowel symptoms, including 19% exercise, 17% running errands, and 16% time spent with friends and families. In addition, an estimated 60 to 70 million people in the overall region are effectively suffering from gastrointestinal diseases, which has created severe disruptions in regular life, thereby bolstering the market’s demand.

- Technological automation and innovation: The significant inclination towards implementing DNA-based solutions is one of the most suitable growth factors for the market internationally. Different organizations are readily partnering with tech-specific companies to develop cloud-based diagnostic platforms. As stated in the January 2025 World Economic Forum article, a single-payer system is readily utilized in Taiwan by researchers to diminish the time undertaken to complete tasks by 31%. Besides, autonomous robotic vehicles have been incorporated in the U.S. to deliver pharmaceuticals in hospitals, thereby uplifting the overall market globally.

- Increased focus on patient dignity: There is an increasing recognition in the global healthcare and medical community regarding the importance of preserving patient dignity, which is positively impacting the market. Faecal extraction systems provide a dignified management service to enhance patients' lives, which in turn, is surging purchase decisions. As indicated in the November 2022 NLM article, chromatographic separation was readily conducted on a Vanquish Accucore C18 + UNPLC analytical column, which denoted a 400 μL, while electrospray ionization was also utilized as a ionization approach, which was set at 3,900 V and 2,500 V, demonstrating the usefulness of these systems.

Colorectal Cancer Incidence Driving the Market

|

Years/Components |

Cases |

Death Rate |

|

2022 |

35.4 observed rate and 35.1 modeled rate |

12.8 |

|

2023 |

- |

12.7 |

|

2025 |

154,270 (7.6%) |

52,900 (8.6%) |

|

Survival Rate |

65.4% |

|

Source: National Cancer Institute

Challenges

- Reimbursement gaps and government-based price caps: The presence of strict price control from the NHS has readily compelled different manufacturers to negotiate discounts for products to get reimbursed, which has caused a hindrance in the market. However, BÜHLMANN successfully outmaneuvered the challenge by effectively partnering with the HAS, which is located in France, to significantly increase the market accessibility. Apart from this, the World Health Organization (WHO) has reported that the majority of low-income nations lack standard reimbursement policies, which also negatively impacts the market.

- Prolonged and strict administrative approvals: This is yet another challenge that has limited the market’s growth across different countries. In this regard, the presence of the Pharmaceuticals and Medical Devices Agency, particularly in Japan, has readily caused a delay in gaining approval of FES devices from ALPCO for more than a year. Besides, the WHO has indicated that more than half of the population in Africa lacks standardization, which has resulted in a delay of over two years for achieving entry into the current marketplace, thereby limiting the market’s exposure internationally.

Faecal Extraction System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 3.2 billion |

|

Regional Scope |

|

Faecal Extraction System Market Segmentation:

Technology Segment Analysis

Based on the technology, the automated/suction-based systems segment in the faecal extraction system market is anticipated to account for the largest share of 83.5% by the end of 2035. The segment’s growth is highly attributed to its capability to effectively enhance the efficacy and precision in tasks, such as healthcare and manufacturing, while boosting safety and diminishing expenses. In this regard, the March 2022 NLM article stated that a real-time cognitive workload assessment system can be utilized to successfully detect 80% of accuracy. Therefore, with the existence of a standard system, there is a huge growth opportunity for the segment.

Indication Segment Analysis

Based on the indication, the chronic faecal incontinence segment in the faecal extraction system market is projected to cater the second-largest share during the predicted timeline. The segment’s growth is highly fueled by the aspect of addressing economic, health, and social burden, and impacting the quality of life. According to an article published by NLM in September 2022, fecal incontinence incidence ranges from 2% to 21%, with an average range of 7.7%. In addition, the prevalence is reported to be 7% among women within 30 years of age, which is poised to increase to 22%, thereby making it suitable for the market to gain increased exposure globally.

Product Segment Analysis

Based on the product, the consumables and accessories segment in the faecal extraction system market is expected to account for the third-largest share by the end of the projected period. The segment’s development is highly driven by its supremacy, which is readily anchored in the crucial razor-and-blade business model. Besides, while evacuation pumps are considered a one-time purchase, every device requires a high-volume and continuous sterile supply, along with single-use components, such as sealing systems, collection canisters, and rectal catheters. Therefore, this develops a recurring and predictable revenue stream, which is extremely resilient and suitable for the segment’s growth internationally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Indication |

|

|

Product |

|

|

End user |

|

|

Patient Care Setting |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Faecal Extraction System Market - Regional Analysis

North America Market Insights

North America in the faecal extraction system market is anticipated to garner the highest share of 48.2% by the end of 2035. The market’s upliftment in the overall region is highly attributed to an expansion in government screening, as well as strong payer support presence. In addition, the economic modeling projected that the testing based on the stool results in lower expenses for members in the region. According to an article published by NLM in January 2025, the National Institutes of Health (NIH) has initiated the majority of investments, amounting to USD 48 billion, as a generous budget for medical research, which creates an optimistic outlook for the market in the region.

The faecal extraction system industry in the U.S. is growing significantly, owing to the aspect of extension, which is readily supported by federal reforms, along with a rise in the payer reimbursement approaches. In addition, the NIH is also effectively supporting research and development, particularly for self-sampling kits, with the intention to enhance compliance and diminish laboratory workload. As per an article published by Grants Government in 2025, the Centers for Disease Control and Prevention’s (CDC) Procurement and Grants Office (PGO) has been readily awarded more than 25,000 acquisitions, along with an estimated USD 11 billion in federal funding, which denotes a positive impact on the market in the country.

The market in Canada is also growing due to an upsurge in the number of screening programs, which is effectively backed by government-based funding. In this regard, the March 2024 NLM article stated that there has been an increase in the colorectal cancer screening uptake by 60%, which has been possible by the utilization of the OncoSim-Colrectal model. Besides, different research programs, such as CanSCCRN have readily endeavored to successfully streamline screening uptakes in the country. Meanwhile, the promotion of affordable diagnostic solutions as well as patient-centric preventive care models are also augmenting the market.

First-aid Boxes and Kits 2023 Export and Import in North America

|

Countries |

Export |

Import |

|

U.S. |

USD 22.1 million |

USD 49.2 million |

|

Mexico |

USD 5.7 million |

USD 1.2 million |

|

Canada |

USD 1.3 million |

USD 8.1 million |

|

Panama |

USD 36,600 |

USD 431,000 |

|

Barbados |

USD 9,570 |

USD 91,100 |

|

Costa Rica |

USD 9,490 |

USD 143,000 |

|

Guatemala |

USD 8,460 |

USD |

Source: OEC

APAC Market Insights

Asia Pacific in the faecal extraction system market is expected to emerge as the fastest-growing region during the projected timeline. The market’s development in the region is highly propelled by a rise in the incidence of gastrointestinal diseases. As per an article published by NLM in September 2024, stomach cancer has been considered the highest disease burden in the region, accounting for 16.4 million cases. This is followed by colon and rectum cancer catering to 1.0 incidence, while gastrointestinal tumors are immensely common among patients aged more than 70 years, thereby making it suitable for the market to expand.

The market in China is gaining increased exposure, owing to the presence of government-specific screening programs for cancer, with increased focus on colorectal cancer. As indicated in the March 2024 Journal of the National Cancer Center article, there has been a record of 517,100 colorectal cancer cases, severely impacting 65.0% of males in the country, whereas in the case of females, the cancer type affected 63.7% of females. In addition, the volume of colorectal cancer deaths in the country accounts for 240,000 deaths, thereby denoting a huge growth opportunity for the overall market.

The market in India is also developing due to the aspect of an upsurge in government spending on health and medical aspects. Additionally, there has been an increase in the need for accurate, along with early diagnosis, which has readily uplifted the market’s demand in the country. Besides, the market is also booming, owing to a surge in government approaches to successfully upgrading the diagnostic facility. Meanwhile, regional organizations, such as Alpha Laboratories, are proactively infusing generous funds into research and development to address the burgeoning demand, thus making them suitable for the market’s growth.

Europe Market Insights

Europe in the faecal extraction system market is predicted to grow steadily by the end of the forecast duration. The market’s growth in the region is highly fueled by the increased emphasis on early colorectal cancer detection, which is deliberately leading to extraction-based fecal immunochemical test deployment. According to an article published by NLM in April 2025, 131 oncology-based drugs have been successfully cleared by the Europe Medical Agency (EMA), along with 166 indications evaluated for additional benefits. Therefore, with the existence of administrative bodies, the market is poised to grow significantly.

The faecal extraction system industry in Germany is gaining increased traction, owing to the presence of government funding, which has readily increased, along with the launch of FIT tests to be effectively utilized for high-throughput faecal extractors. As per an article published by the ITA in August 2025, the medical device market is roughly valued at USD 44 billion, which makes up almost 26.5% of the market in the overall region. Besides, the country generates a yearly economic footprint of USD 838 billion, which is approximately 12.8% of the country’s GDP, thereby creating a growth opportunity for the market.

The faecal extraction system market in France is also developing due to the existence of the centralized health and medical system, robust governmental focus on geriatric care, the role of the French National Authority for Health in ensuring economic and clinical evidence for reimbursement, and the aging prioritization by the Ministry of Solidarity and Health. As stated in the August 2025 ITA data report, the medical device market in the country comprises an approximate turnover of €37.4 billion as of 2023, while the export turnover amounts to an estimated €9.5 billion, which caters to 25% of the overall market, thus making it suitable for the overall market growth in the country.

Articles of Gut 2023 Import in Germany

|

Countries |

Import |

|

France |

USD 1.2 million |

|

Belgium |

USD 357,000 |

|

Germany |

USD 229,000 |

|

Ireland |

USD 59,000 |

|

Sweden |

USD 10,300 |

|

UK |

USD2,170 |

|

Norway |

USD 5,430 |

Source: OEC

Key Faecal Extraction System Market Players:

- Thermo Fisher Scientific (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- QIAGEN N.V. (Netherlands)

- Promega Corporation (USA)

- Roche Diagnostics (Switzerland)

- Abbott Laboratories (USA)

- Danaher (Cepheid, USA)

- bioMérieux SA (France)

- BÜHLMANN Laboratories AG (Switzerland)

- ALPCO (USA)

- Arbor Assays (USA)

- DRG Instruments (Germany)

- Svar Life Science / Calpro AS (Sweden)

- Bioserv Diagnostics (Germany)

- Epitope Diagnostics (USA)

- Meridian Bioscience (USA)

The global competitive landscape of the faecal extraction system market is rapidly revolutionizing since healthcare firms, established key players, and new organizations are effectively investing in notable medicines. Besides, key organizations in the market are extremely focused on creating the latest technologies and products that constitute the ability to cater to strict regulatory policies, along with consumer demand. In addition, these players are incorporating different approaches, such as mergers and acquisitions, partnerships, novel product launches, and joint ventures, with the intention to bolster their product base and uplift their position in the market.

Here is a list of key players operating in the global market:

Recent Developments

- In December 2024, GSK plc decalted that the U.S. FDA has successfully approved the breakthrough therapy designation for Jemperli, which has been developed for aiding patients with regionally advanced mismatch repair deficient instability-high rectal cancer.

- In January 2024, Merck announced a strategic agreement with Inspirna, inc. for ompenaclid, which is the first-ever in-class oral inhibitor, readily suitable for aiding patients with colorectal cancer.

- Report ID: 4061

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Faecal Extraction System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.