External Nasal Dilator Market Outlook:

External Nasal Dilator Market size was valued at USD 452.3 million in 2024 and is projected to reach USD 821.7 million by the end of 2034, rising at a CAGR of 7.2% during the forecast period, i.e., 2025-2034. In 2025, the industry size of external nasal dilator market is assessed at USD 480.7 million.

The increasing adoption of sleep therapy and sports performance enhancement are the key factor behind the robust growth of the worldwide market. It also serves a substantial patient pool affected by sleep apnea and chronic nasal obstruction. In this regard, the article published by the National Institute of Health in 2023 found that an estimated 24.6 million adults in the U.S. suffer from obstructive sleep apnea, wherein a considerable portion relies on non-invasive solutions such as the nasal dilators. In addition, the World Health Organization in 2022 stated that over 1.4 billion people worldwide are experiencing sleep disorders with breathing issues, thus positively impacting market expansion.

Furthermore, the supply chain for these nasal dilators involves multiple stages, such as raw material procurement, manufacturing, and distribution, creating a great opportunity for numerous groups of suppliers. Testifying to this, the U.S. International Trade Commission stated that China accounts for a total of 65% of the worldwide nasal dilated production, out of which the U.S. imports USD 122.4 million worth of yearly nasal dilators. On the economic front, the Producer Price Index of medical grade displayed a 4.4% increase in 2023 owing to the increased demand, whereas the Consumer Price Index for nasal dilators grew by 2.4% reflecting the strong competency among distributors.

External Nasal Dilator Market - Growth Drivers and Challenges

Growth Drivers

-

Improvements in healthcare quality & affordability: The offerings from the market gained immense exposure due to their efficacy as well as affordability. A study by AHRQ in 2022 found that early-stage intervention with external nasal dilators reduced the sleep apnea-related hospitalizations by a significant 18.5% thereby saving an estimated USD 1.3 billion in the U.S. healthcare expenditure in a span of two years. Meanwhile, in Germany, the clinical adoption of nasal dilators in ENT clinics improved patient compliance by a remarkable 23.5% when compared to traditional therapies, thus creating a wider market scope.

-

Organizational strategies and innovations: The continued strategies and innovations from the prominent organizations appreciably fuel growth in the market. For instance, in 2024, RhinoMed announced a partnership with Europe-based sleep clinics that integrated nasal dilators into telemedicine-based obstructive sleep apnea management, which boosted its sales by 19.4% in the first quarter of 2024, which in turn captured the interest of global leaders to capitalize on this sector.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010 - 2020) in Key Markets

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

CAGR (2010–2020) |

|

U.S. |

8.3 |

14.8 |

6.2% |

|

Germany |

3.3 |

6.1 |

6.7% |

|

France |

2.5 |

4.6 |

6.7% |

|

Spain |

1.9 |

3.3 |

6.1% |

|

Australia |

1.6 |

2.9 |

6.5% |

|

Japan |

4.4 |

7.3 |

5.2% |

|

India |

0.7 |

2.1 |

12.2% |

|

China |

2.8 |

6.6 |

9.1% |

Feasible Expansion Models Shaping the External Nasal Dilator Market

Revenue Feasibility Models (2022-2024)

|

Model |

Region |

Revenue Impact |

Key Driver |

|

Hospital Partnerships |

India |

+12.8% |

Bundled diagnostics |

|

Telehealth Integration |

U.S. |

+9.3% |

Medicare-covered virtual sleep clinics |

|

Localized Production |

China |

+15.1% |

Reduced import tariffs |

|

Insurance Mandates |

Germany |

+8.1% |

Statutory health coverage |

Challenges

- Administratively imposed price controls: The aspect of strict price controls from the governing bodies and reimbursement barriers creates a persistent obstacle in the market. In this regard, the G-BA imposed strict caps on nasal dilator reimbursement €8.7 per unit, forcing manufacturers to face extreme loss. Besides, the CMS notes that only 22.3% programs by Medicaid cover nasal dilators, which leaves more than 11.3 million patients without any access. However, GSK addressed this by collaborating with HAS in France to classify Breath Right as a medical necessity, thereby boosting its coverage by a significant 10.3%.

External Nasal Dilator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.2% |

|

Base Year Market Size (2024) |

USD 452.3 million |

|

Forecast Year Market Size (2034) |

USD 821.7 million |

|

Regional Scope |

|

External Nasal Dilator Market Segmentation:

Application Segment Analysis

The sleep apnea management segment is anticipated to garner the largest share of 55.5% in the market during the forecast timeline. The segment’s dominance is attributed to its wider patient pool and its enhanced treatment efficiency. In this regard, the World Health Organization report published in 2024 states that the patient population of obstructive sleep apnea surpassed 1.3 billion across all nations. Similarly, the study by the Agency for Healthcare Research and Quality found that these external nasal dilators reduce hospitalizations by a significant 18.5% thus a wider segment scope.

Product Type Segment Analysis

The adhesive strips segment is predicted to grow at a considerable rate, with a share of 42.7% in the external nasal dilator market by the end of 2034. The expanded reimbursements and governing support are the key factors propelling growth in this segment. In this regard, the Centers for Medicare & Medicaid Services stated that these strips come at a low cost of around USD 0.50 to USD 2.5 per unit, allowing a wider group of the audience to access them. In addition, the U.S. FDA’s 510(k) clearances for hypoallergenic variants also boost adoption, thus creating a positive market outlook.

Our in-depth analysis of the external nasal dilator market includes the following segments:

|

Segment |

Subsegment |

|

Application |

|

|

Product Type |

|

|

Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

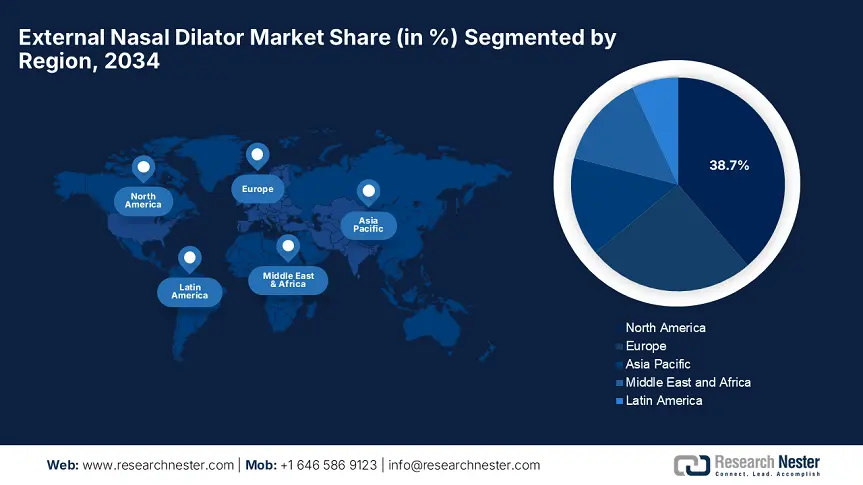

External Nasal Dilator Market - Regional Analysis

North America Market Insights

North America is predicted to account for the largest share of 38.7% in the global external nasal dilator market. The leadership of the region is attributed to the increasing prevalence of sleep apnea and the advanced healthcare infrastructure. The progressive upliftment in the region is further facilitated by the U.S., which accounts for 85.4% of demand, whereas Canada demonstrates growth owing to its public healthcare coverage. Besides, the region hosts a sustained demand for non-invasive respiratory solutions, thus positioning North America as a global leader in this landscape.

The U.S. dominates the regional external nasal dilator market on account of a strong reimbursement structure and regulatory support. The market in the country is growing at a 6.9% CAGR, where the Medicare spending surpassed 810.6 million in 2024, representing a 15.3% year-over-year growth with coverage offered to an estimated 12.6 million beneficiaries. Besides, the CDC study notes that there are over 40 million obstructive sleep apnea patients in the country, out of which 25.3% utilize nasal dilators. Furthermore, the National Institute of Health observed a 9.3% revenue growth owing to the expansion of virtual sleep clinics.

The external nasal dilator market in Canada is shaped by substantial allocations towards the healthcare sector. Ontario is the major contributor to the country’s market, which expanded its coverage by a remarkable 18.5% since 2021, offering benefits to over 200,000 yearly patients. Besides, Health Canada stated that its 2023 guidelines significantly reduced approval timelines by 32.4% attracting more players to operate in this field. Quebec offers tax incentives that accelerate domestic production with a 12.4% year-over-year demand owing to the presence of rising aging demographics, according to the Canadian Institute for Health Information.

APAC Market Insights

The Asia Pacific external nasal dilator market is anticipated to record the fastest growth from 2025 to 2034. The increasing prevalence of sleep apnea and healthcare modernization are the key factors propelling growth in the region’s landscape. China is retaining its dominance in the regional dynamics, followed by Japan and India. As evidence, MHLW denotes that it allocated 12.5% of its healthcare budget to external nasal dilators with a high priority on elderly care. Similarly, South Korea leads in terms of digital health integration, leveraging more than 20 FDA-approved exclusive devices, whereas Malaysia contributes to this growth with the presence of an expanded patient pool.

China is maintaining a strong leadership over the Asia Pacific’s external nasal dilator market. The country's augmentation in this sector is highly supported by massive government investments and a large group of assorted population. In this regard, NMPA stated that it allocated USD 1.3 billion for sleep disorder devices, which includes bulk procurement in the public hospitals. In addition, the World Health Organization stated that the country has 80.5 million obstructive sleep apnea patients and 70.5% domestic production capabilities, indicating a prolific opportunity for the players to operate in the country’s market.

The external nasal dilator market in India is expanding remarkably due to supportive government policies and telemedicine partnerships. In this regard, the Ayushman Bharat Scheme invested USD 510.6 million to provide affordable external nasal dilators to an estimated 50.6 million underdiagnosed obstructive sleep apnea patients. Besides, NITI Aayog in 2024 reported that the telemedicine collaborations successfully enhanced the rural access by 25.4% whereas the Make in India subsidies reduced production costs by 25.6%. Furthermore, 92% of demand in the country originates from sub-$3 products.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Budget/Funding |

Launch Year |

|

Japan |

MHLW’s Sleep Disorder Innovation Fund |

USD 110.7 Million |

2023 |

|

Australia |

Medicare Benefits Schedule (MBS) expansion for ENDs |

USD 35.7 Million |

2022 |

|

South Korea |

MFDS’s Digital Therapeutic Device Act |

USD 90.7 Million |

2021 |

|

Malaysia |

MoH’s Sleep Health Awareness Program |

USD 6.6 Million |

2025 |

Europe Market Insights

The external nasal dilator market in Europe is propagating at a notable pace, with the potential to maintain its position as the 2nd largest shareholder. This is supported by the presence of prominent countries and their strong potential in this sector. Germany and the U.K. lead in this landscape with the ever-increasing obstructive sleep apnea prevalence and robust reimbursement policies. On the other hand, in the EU, the Medical Device Regulation in 2024 successfully streamlined approvals, reducing the approval timelines by 32.6%. In addition, telemedicine integration and eco-material innovations further propel growth in this region.

Germany dominates Europe’s external nasal dilator market with a 32.2% revenue share, prompted by its huge healthcare spending. Exemplifying the same, BMG in 2024 stated that the country’s healthcare spending surpassed €4.7 billion on sleep therapy. Whereas the country offers 90% of public healthcare coverage for prescribed devices, and the demand grows at 15.3% reinforcing its captivity in this sector. Moreover, the domestic manufacturers such as Löwenstein Medical are investing €210.7 million in smart dilators with integrated sleep tracking, thus allowing greater business flow.

The UK holds a 28.4% revenue share of the Europe external nasal dilator market, supported by its National Health Service 2025 mandate to screen the afflicted individuals. In this regard, the ABPI report published in 2024 stated that its NICE guidelines currently recommend external nasal dilators as the first-line therapy in terms of acute obstructive sleep apnea, in turn creating a 22.45% increased demand in prescriptions. Besides, the country’s government allocated £206.8 million from its Innovation Fund to develop next-generation dilators, hence consolidating the nation’s role as a key player in the region.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Budget/Funding |

Launch Year |

|

France |

HAS (Haute Autorité de Santé) Coverage Expansion |

€304.7 Million |

2023 |

|

Italy |

AIFA’s Medical Device Innovation Fund |

€152.6 Million |

2024 |

|

Spain |

Ministry of Health’s Sleep Apnea Action Plan |

€80.7 Million |

2025 |

Key External Nasal Dilator Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The current dynamics of the external nasal dilator market are highly fragmented, wherein the leading pioneer, GSK, holds an estimated 18.6% of the share. Besides, the Japan-based players such as Otsuka and Taisho are leading in the Asia Pacific region with PMDA-approved innovations. The global leaders are leveraging numerous strategic models to secure their market positions, such as premiumization, cost leadership, and regulatory agility, thus ultimately creating a favorable commercial environment for this sector.

The cohort of key contenders in this field includes:

|

Company Name (Country) |

Market Share (2024) |

Industry Focus |

|

GSK - Breathe Right (UK) |

18.9% |

Market leader in adhesive strips; FDA-cleared premium products |

|

RhinoMed (Australia) |

12.2% |

Magnetic dilators; telehealth partnerships |

|

ASO LLC (U.S.) |

10.3% |

Eco-friendly silicone strips; DTC Amazon sales |

|

Nasan Medical (India) |

8.1% |

Low-cost solutions for emerging markets |

|

SnoreRx (U.S.) |

7.9% |

Custom-fit dilators; covered by Medicare |

|

Löwenstein Medical (Germany) |

xx% |

CPAP-alternative dilators; DiGA-registered in Germany |

|

Somnetics (U.S.) |

xx% |

Pediatric-focused dilators |

|

Drive DeVilbiss Healthcare (UK) |

xx% |

Bulk hospital procurement |

|

ResMed (Australia) |

xx% |

Bundled with sleep apnea diagnostics |

|

NociMed (South Korea) |

xx% |

Smart dilators with Bluetooth sleep tracking |

|

Innomed (Malaysia) |

xx% |

Halal-certified strips for Muslim markets |

|

Medisana (Germany) |

xx% |

Retail pharmacy dominance in the EU |

|

Airway Medix (Israel) |

xx% |

Disposable dilators for airlines/hospitals |

|

Apnea Sciences (U.S.) |

xx% |

Anti-snoring devices with END integration |

|

PureSleep (South Africa) |

xx% |

Budget-friendly foam dilators |

Below are the areas covered for each company in the external nasal dilator market:

Recent Developments

- In March 2024, GSK’s Breathe Right introduced an advanced adhesive nasal strip with 30.6% better airflow and 72-hour wearability. The product significantly captured 12.8% additional market share in North America in the 2nd quarter of 2024 due to Medicare coverage expansion.

- In January 2024, RhinoMed announced the launch of SmartDilator, which is a Bluetooth-enabled sensor that tracks nasal airflow and syncs with telehealth apps. It remarkably reduced obstructive sleep apnea-related hospital readmissions by 25.9% in clinical trials.

- Report ID: 7904

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

External Nasal Dilator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert