Endovascular Aneurysm Repair Market Outlook:

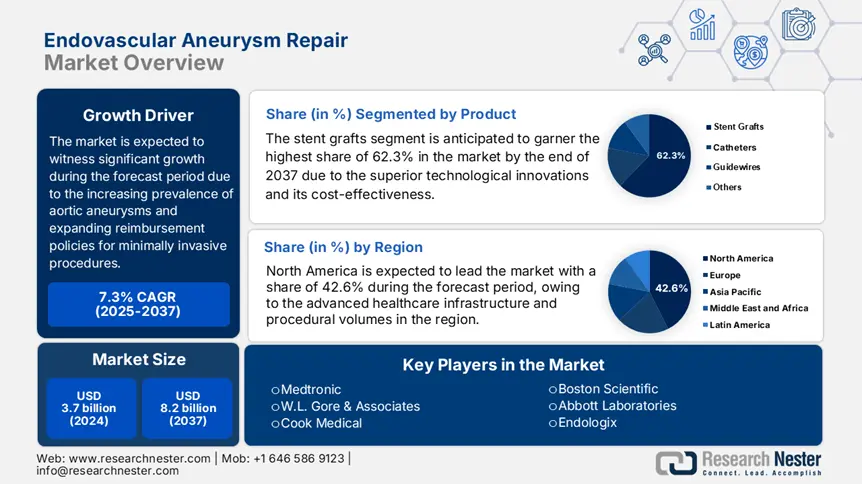

Endovascular Aneurysm Repair Market size was valued at USD 3.7 billion in 2024 and is projected to reach USD 8.2 billion by the end of 2037, rising at a CAGR of 7.3% during the forecast period, i.e., 2025 to 2037. In 2025, the industry size of endovascular aneurysm repair is evaluated at USD 3.8 billion.

The rising burden of aortic aneurysms, especially among aging populations, is the major fueling factor for the robust expansion of the global market. As evidence, the Centers for Disease Control and Prevention reported that abdominal aortic aneurysms are affecting approximately 3% to 10% of men aged over 65 in the U.S., with above 220,000 new yearly cases being diagnosed. In addition, the article published by the World Health Organization notes that cardiovascular diseases, such as aortic aneurysms, led to 18.2 million yearly deaths, underscoring the necessity for EVAR procedures.

Furthermore, in terms of trade aspect the U.S. International Trade Commission reports that China, Germany, and the U.S. dominate the export of nitinol wires, which is a key material in stent grafts, with the annual trade value surpassing USD 1.3 billion whereas the finished devices are critically manufactured in the U.S., Ireland, and Switzerland, where major MedTech firms operate high-precision assembly lines. Simultaneously, in 2023, the data from the U.S. Customs and Border Protection indicates that EVAR device imports reached USD 2.3 billion, whereas exports totaled USD 1.8 billion, reflecting the globalized trade nature.

Endovascular Aneurysm Repair Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements: The preceding innovative approaches undertaken by the global players allow steady growth in the market. For instance, in 2024, Boston Scientific announced the launch of a bioresorbable stent graft that appreciably reduced long-term complications by 28% in clinical trials. Further, the grants offered for AI-based rupture prediction tools to improve EVAR outcomes and 3D printed patient-specific grafts are anticipated to create a prolific market opportunity.

- Well-planned organizational collaborations: The acceleration in the endovascular aneurysm repair market is highly attributed to the strategic partnerships and engagements in new business models. In 2024, Medtronic finalized a partnership with the Mayo Clinic that boosted EVAR training programs and increased year-over-year adoption by 16%. In addition, Cook Medical expanded into India in 2025, targeting 22% cost reduction with the help of domestic manufacturing, thus fostering new business opportunities.

Historical Patient Growth (2010-2020) in Key Markets

|

Country |

2010 Procedures |

2020 Procedures |

Primary Growth Driver |

|

U.S. |

45,130 |

112,600 |

Medicare Part B expansion |

|

Germany |

18,260 |

52,400 |

DRG reimbursement reforms |

|

France |

12,500 |

38,300 |

National AAA screening program |

|

Spain |

8,310 |

25,200 |

Private hospital network expansion |

|

Australia |

5,350 |

16,500 |

PBS subsidy for EVAR devices |

|

Japan |

22,650 |

48,400 |

Super-aging society |

|

India |

3,160 |

11,500 |

Metro hospital capacity growth |

|

China |

9,440 |

34,700 |

NMPA fast-track approvals |

Feasibility Models for Market Expansion (2020-2024)

|

Model |

Region |

Key Metric |

Outcome |

|

PPP Cost-Sharing |

India |

31% price reduction |

+13% % revenue growth |

|

Outcome-Based Pricing |

Germany |

16% premium for low-complication devices |

+9% adoption |

|

Localized Production |

China |

41% import substitution |

+$225 million domestic sales |

|

Tele-Rehab Bundles |

U.S. |

$1,300/patient remote monitoring |

33% lower readmissions |

Challenge

- Concerns about cybersecurity in connected devices: The considerable contribution of endovascular aneurysm repair often raises questions about the liability of products from the endovascular aneurysm repair industry. This also impacts the process of compliance with the U.S. FDA issuing recalls for two EVAR imaging systems in 2023, owing to their susceptibility to hacking, data breaches, and potential manipulation. However, Philips overcame this with an investment of USD 52 million in HIPAA cloud platforms for EVAR planning.

Endovascular Aneurysm Repair Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7.3% |

|

Base Year Market Size (2024) |

USD 3.7 billion |

|

Forecast Year Market Size (2037) |

USD 8.2 billion |

|

Regional Scope |

|

Endovascular Aneurysm Repair Market Segmentation:

Product Segment Analysis

Based on the product, the stent grafts segment is anticipated to garner the highest share of 62.3% in the endovascular aneurysm repair market by the end of 2037. The dominance of the segment originates from the superior technological innovations and its cost-effectiveness. Indicating the same, AHRQ studies recognized that the bifurcated grafts reduce OR time by 30 minutes per procedure, thereby saving USD 2,600 per case in the hospital settings. On the other hand, the modular design enables personalization for over 92% of patient anatomies, whereas it 63% for unibody grafts, thus a wider segment scope.

Indication Segment Analysis

In terms of indication abdominal aortic aneurysm segment is set to capture a considerable share of 58.4% in the endovascular aneurysm repair market during the assessed timeframe. The efficacy offered by screening programs and the aging demographics are driving the segment’s leadership over this sector. In this context, mandatory ultrasound screening in Germany for the high-risk male population has appreciably reduced rupture rates by 28.4% with a 19% increase in yearly EVAR volumes. Besides, a study by IQWiG found a 9:1 cost-benefit ratio, placing the segment at the forefront of the development of this merchandise.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product |

|

|

Indication |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Endovascular Aneurysm Repair Market - Regional Analysis

North America Market Insights

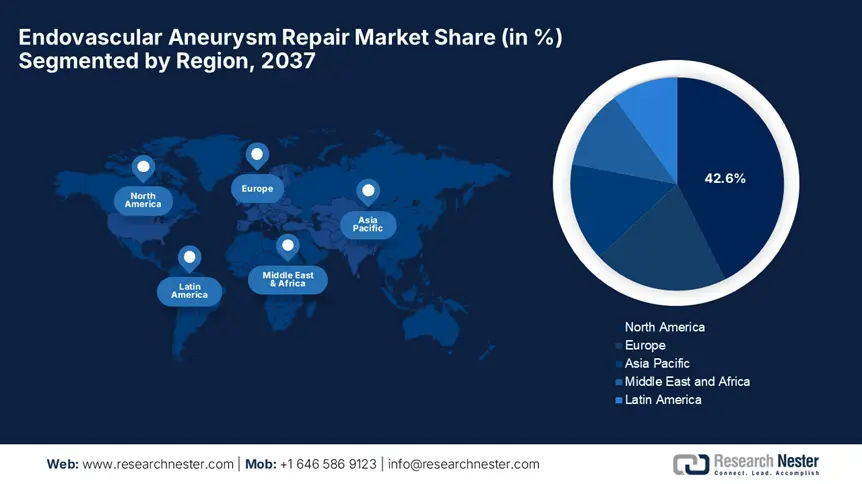

North America is expected to lead the global endovascular aneurysm repair market by capturing a share of 42.6% over the discussed timeframe. The region is pledged to advanced healthcare infrastructure and high procedural volumes. The U.S. accounts for almost 92% of the regional demand supported by Medicare’s expanded coverage and rising disease prevalence. Besides, Canada extends its support towards the regional revenue by provincial investments such as Ontario’s funding hike, thus creating a prolific market outlook.

The U.S. is steadily consolidating its dominance over the regional market on account of coverage offered to outpatient endovascular aneurysm repair procedures. In this regard, the Centers for Medicare & Medicaid Services reports the coverage for 63% of procedures by 2024, reflecting an extensive financial backup for affected individuals. Simultaneously, the National Institute of Health allocated USD 480.5 million in 2024 for bioresorbable stent grafts, ensuring a substantial growth of this landscape.

Canada’s endovascular aneurysm repair market is also demonstrating consistent progress backed by substantial government investments. From 2021 to 2024, Ontario increased its funding by 19% for endovascular aneurysm repair, securing a steady capital influx in this sector. In addition, Health Canada in 2024 imposed Medical Device Regulations that fast-tracked approvals for next-generation stent grafts, whereas CIHI demonstrates a 10% annual increase in the endovascular aneurysm repair procedures since 2022, reflecting a liable consumer base in the country.

Europe Market Insights

Europe is exhibiting steady growth in the global endovascular aneurysm repair market, which is influenced by the presence of an aging population and robust healthcare infrastructure. To combat the widespread epidemiology, the EU’s Medical Device Regulation in 2024 significantly accelerated approvals for next-generation stent grafts, with Germany and France dominating in the domestic aspect. Besides the region’s Health Data Space, it allocated €2.7 billion for vascular research, thereby boosting EVAR adoption and propelling innovation in this sector.

Germany’s endovascular aneurysm repair market is witnessing strong progress on account of huge reimbursement reforms along with R&D partnerships. The country’s Diagnosis-Related Group (DRG) system was upgraded in 2023 to offer coverage to 96% of EVAR procedures, including complex scenarios that necessitate fenestrated or branched grafts. Besides, Siemens Healthineers announced a partnership with Charité Berlin on a €121.6 million AI-powered stent graft project from 2024 to 2026 to reduce planning time by 40% thus suitable for standard market development.

France is propagating in the regional endovascular aneurysm repair market, efficiently backed by pricing mandates and a substantial manufacturing base. For instance, in 2025, the National Health Service implemented value-based pricing for endovascular aneurysm repair devices, linking payments to 5-year evidence-based patient outcomes, saving 22% expenses. Additionally, in 2023, MicroPort’s Lyon facility appreciably reduced import reliance by 62% to 28% with €50.3 million in tax incentives from the France 2030 plan, solidifying the country’s position as the prominent player in the regional landscape.

APAC Market Insights

Asia Pacific is anticipated to register the fastest rate of growth in the worldwide endovascular aneurysm repair market during the forecast timeline. The aggressive expansion is effectively facilitated by the presence of a large patient pool and healthcare modernization. The trend of expanded coverage and cost-optimized solutions is also a visible growth factor in this landscape. This progress is further supported by the emergence of telemedicine and mainstream healthcare initiatives, thus positioning Asia Pacific as the predominant leader in the market.

China is solidifying its leadership over the regional endovascular aneurysm repair market owing to the massive government investment and accelerated regulatory clearances. Evidencing this in 2023, the National Medical Products Administration (NMPA) fast-tracked 12 next-gen stent grafts, thereby cutting down import reliance by 33%. Under the Healthy China 2030 initiative, the country allocated USD 1.3 billion towards provincial subsidies to expand rural access that served 15.5 million patients. Further, MicroPort currently serves 62% of domestic demand, allowing steady cash influx towards the market.

India is emerging as the target landscape for prominent organizations all over the world since it is rapidly growing in the endovascular aneurysm repair market. For instance, in 2023, the Ayushman Bharat Scheme granted funds for about 210,000 procedures, which marks an increase from 48,000 in 2018, that enhanced access for 500 million beneficiaries. Besides, the domestic production incentive under the PLI schemes has reduced costs by 24%. On the other hand, the country’s government allocated USD 1.9 billion towards vascular care in 2023, out of which 65% was directed towards metro hospitals, positioning India as the key leader in the regional sector.

Country-wise Government Allocations

|

Country |

Policy/Initiative |

Funding/Budget |

Launch Year |

|

Australia |

Medicare Benefits Schedule (MBS) Expansion |

AUD 125 million (2023–2025) |

2023 |

|

Japan |

MHLW’s AAA Screening Mandate |

¥52 billion (AMED grants, 2023–2030) |

2023 |

|

South Korea |

KFDA’s AI-MedTech Innovation Fund |

$153 million (2024–2026) |

2024 |

|

Malaysia |

National Medical Device Blueprint 2030 |

$320 million (2022–2030) |

2022 |

Key Endovascular Aneurysm Repair Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The worldwide endovascular aneurysm repair market presents an intensifying landscape with the U.S. and Europe-based firms capturing maximum revenue share with the aspect of favorable reimbursement policies and substantial R&D investments in bioresorbable grafts. Besides, Medtronic and Gore lead with premium-priced devices, whereas Terumo and MicroPort are focusing on cost-optimized solutions. Also, the merger and acquisitions, such as in 2023, Boston Scientific acquired Relievant Medsystems to expand its ASC offering further, inducing business in this sector.

Here is the list of some prominent players operating in the global market:

|

Company Name |

Country |

Market Share |

Industry Focus |

|

Medtronic |

U.S. |

26.3% |

Market leader in stent grafts (Endurant, Valiant) and AI-powered planning tools |

|

W.L. Gore & Associates |

U.S. |

19.2% |

Pioneered PTFE-based grafts (EXCLUDER, TAG) |

|

Cook Medical |

U.S. |

13.1% |

Custom fenestrated/branched grafts for complex AAAs |

|

Boston Scientific |

U.S. |

11.7% |

Focus on outpatient EVAR (Lutonix drug-coated grafts) |

|

Abbott Laboratories |

U.S. |

9.2% |

XIENCE stent grafts + vascular imaging solutions |

|

ADMEDES |

Japan |

xx% |

Custom alloy stents for complex cases |

|

Endologix (acquired by Deerfield) |

U.S. |

xx% |

Ovation and Alto stent grafts |

|

Lombard Medical (MicroPort) |

China |

xx% |

Aorfix grafts for tortuous anatomies |

|

JOTEC (CryoLife) |

Germany |

xx% |

Thoracic EVAR solutions (E-vita) |

|

Bentley Innomed |

Germany |

xx% |

Low-profile grafts for Asian patient anatomies |

|

Cardiatis |

Belgium |

xx% |

Multilayer flow-modulating stents |

|

Lifetech Scientific |

China |

xx% |

Cost-effective grafts for emerging markets |

|

Endospan |

Israel |

xx% |

NEXUS stent graft for aortic arches |

|

Meril Life Sciences |

India |

xx% |

Localized EVAR kits (Myval) |

|

Vascular Innovations |

Thailand |

xx% |

Hybrid grafts for Southeast Asian markets |

Below are the areas covered for each company under the top global manufacturers:

Recent Developments

- In March 2024, Medtronic announced the launch of the next-gen Heli-FX system for complex EVAR cases, featuring real-time imaging integration, and hospitals reported a 16% reduction in procedural time, thereby boosting adoption in outpatient settings.

- In February 2024, Abbott’s bioresorbable graft received approval from the U.S FDA, which eliminates long-term complications and offers lower reintervention rates when compared with metal grafts.

- Report ID: 7838

- Published Date: Jun 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Endovascular Aneurysm Repair Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert