Disposable Aseptic Isolation Systems Market Outlook:

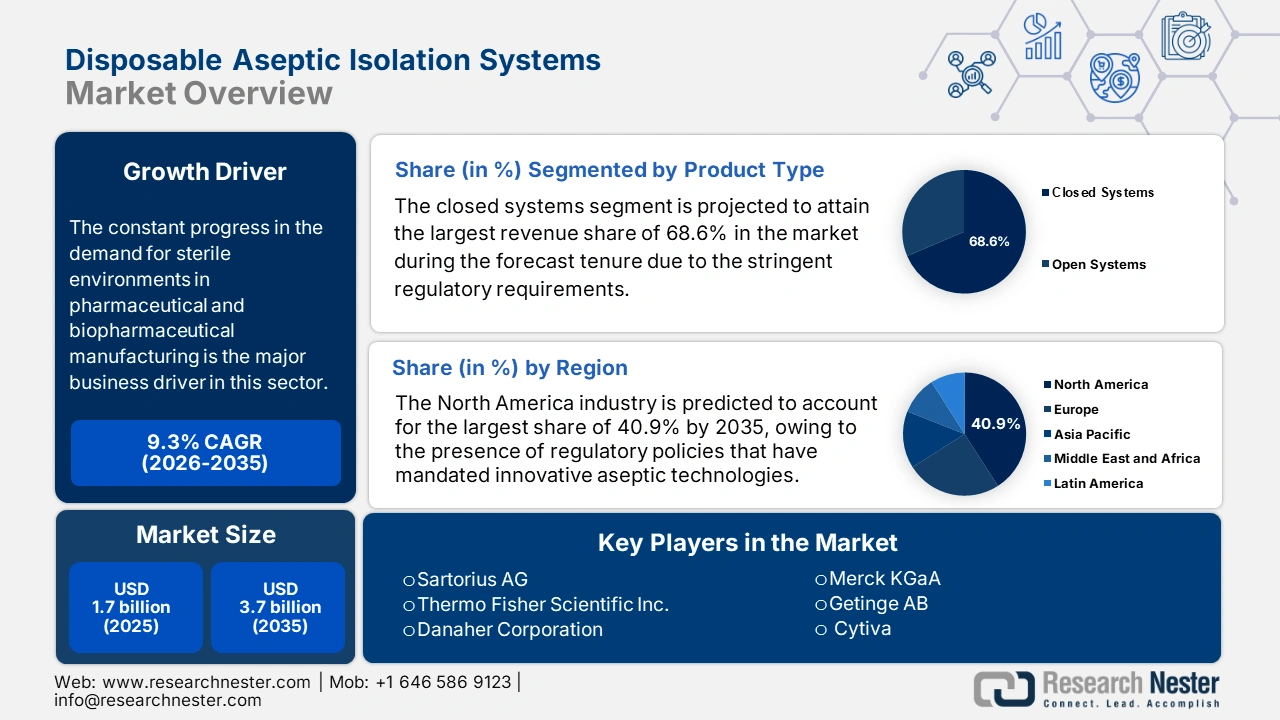

Disposable Aseptic Isolation Systems Market size was valued at USD 1.7 billion in 2025 and is projected to reach USD 3.7 billion by the end of 2035, rising at a CAGR of 9.3 % during the forecast period, i.e., 2026‑2035. In 2026, the industry size of the disposable aseptic isolation systems is estimated at USD 1.8 billion.

The constant progress in the demand for sterile environments in pharmaceutical and biopharmaceutical manufacturing is the major business driver in this sector. Also, immunocompromised patients, undergoing chemotherapy or bone marrow transplants, individuals with severe burns, and those requiring organ transplants necessitate extremely sterile environments. As evidence, GODT revealed that in 2023, a substantial 172,409 organ transplants were performed across the world, which marks a 9.5% increase when compared to the previous year, denoting the presence of heightened demand in this field.

Furthermore, the surge in this field is highly reinforced by the rising production of injectable drugs, biologics, and vaccines, which are remarkably necessitating stringent aseptic processing standards. As per an article published by NIH in August 2022, there has been a significant rise in the production of complex injectable products such as liposomes, microspheres, nanoparticles, and depot injections, which is reshaping the pharmaceutical landscape, especially in sterile drug delivery, and is hence suitable for standard market growth.

Key Disposable Aseptic Isolation Systems Market Insights Summary:

Regional Insights:

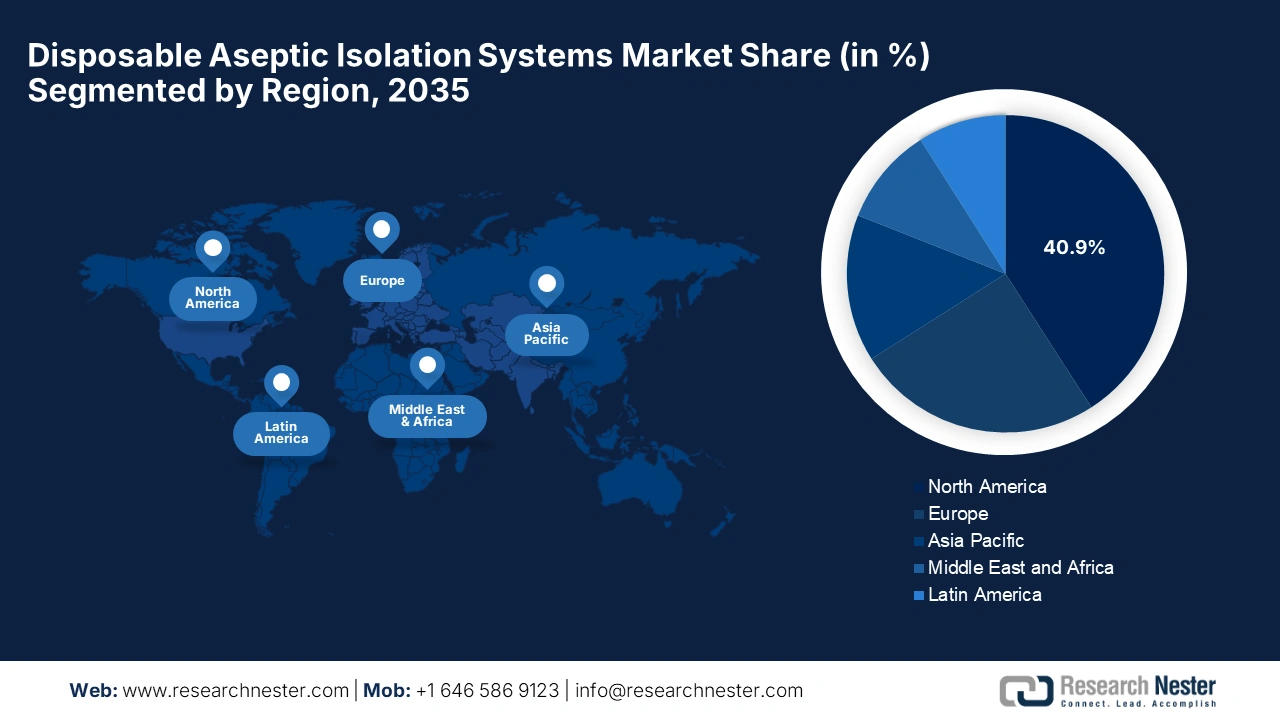

- North America is projected to hold the largest 40.9% share of the Disposable Aseptic Isolation Systems Market by 2035, fueled by stringent regulatory policies mandating innovative aseptic technologies and strategic collaborations among leading healthcare firms.

- The Asia Pacific region is anticipated to exhibit the fastest growth from 2026–2035, impelled by expanding biopharmaceutical operations and robust administrative reforms.

Segment Insights:

- The closed systems segment is projected to command a 68.6% revenue share in the Disposable Aseptic Isolation Systems Market by 2035, propelled by stringent sterility regulations for injectable drugs and advanced therapies.

- The aseptic filling & compounding segment is expected to capture a 45.3% share by 2035, driven by increasing demand for biologics and cell & gene therapies.

Key Growth Trends:

- Stringent regulatory guidelines

- Growth in biologics and vaccines

Major Challenges:

- Barriers to patient affordability

- Vulnerabilities in the supply chain

Key Players: Sartorius AG,Thermo Fisher Scientific Inc.,Danaher Corporation (Pall Corporation),Merck KGaA,Getinge AB,Cytiva,Meissner Filtration Products, Inc.,Saint-Gobain,Corning Incorporated,Lonza Group Ltd,Entegris, Inc.,ABEC, Inc.,Pierre Guérin (GEA Group),ESCO Group,Azbil Corporation,Samsung Biologics,Bioprocess International (BPI),Aptus Biotech S.L.,AUSTAR,Becton, Dickinson and Company (BD)

Global Disposable Aseptic Isolation Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 3.7 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 6 October, 2025

Disposable Aseptic Isolation Systems Market - Growth Drivers and Challenges

Growth Drivers

- Stringent regulatory guidelines: This is the primary fueling factor for the market since the healthcare industry is witnessing increasing regulatory scrutiny regarding sterile manufacturing practices. Testifying to this in August 2022, EC reported that it adopted a revised version of Annex 1 of the EU’s GMP guidelines, which was designed to bring the document in line with modern manufacturing practices, reflecting the latest developments in technology and regulatory science. It also stated that there will be a stronger focus on implementing a contamination control strategy, along with an application of quality risk management principles in the manufacturing process.

- Growth in biologics and vaccines: The continued progress in advanced therapies, along with vaccines and biologics, is reshaping the foundation in the market, driving demand for aseptic isolation systems. In February 2023, WuXi Vaccines notified that it had completed mock-up testing of its first isolator filling line at the Suzhou Site, which is its first independently owned vaccine production facility in China. It also stated that the product will support aseptic fill & finish for various vaccines, thereby adding an annual capacity of 20 million vials.

- Advances in technology & automation: The readily escalating advancements in aseptic isolation systems are yet another important driver in this landscape. The newly introduced systems are currently incorporating robotics, automation, and advanced filtration, which is enhancing adoption in this field. For instance, in June 2024, 3P innovation declared that it had partnered with S3 Process to make its advanced liquid fill-finish technologies more accessible by combining its innovative, ultra-compact aseptic fill-finish platforms with S3’s products in design, installation, and validation.

Key Industry Updates and Advances in Aseptic and Sterile Pharmaceutical Manufacturing

|

Year |

Organization/Company |

Update Summary |

|

2025 |

PDA |

Highlights advanced aseptic manufacturing tech: robotics, remote manipulators, and sensors to reduce contamination risks. |

|

2025 |

NMPA |

Draft GMP guidelines focus on contamination control, cleanroom design, risk management, and personnel training for sterile products. |

|

2022 |

Extract Technology & Dec Group |

Expanded UK and US manufacturing facilities to boost capacity and innovation in aseptic and cell therapy technologies. |

|

2022 |

Dec Group & AWL |

AWL acquired by Dec Group to enhance continuous processing capabilities in pharmaceuticals and related industries. |

Source: Official Press Releases

Challenges

- Barriers to patient affordability: The aspect of increased expenses that is prevalent in the disposable aseptic isolation systems market, which has developed significant disparities in healthcare. For instance, most of the rural hospitals in developing regions are unable to afford disposable isolation technology and rely on ancient laminar flow hoods instead, which offer inferior protection. Besides, a maximum of healthcare infrastructures does not comprise any institutions to ensure superior sterility.

- Vulnerabilities in the supply chain: The international supply chain disruptions have revealed severe vulnerabilities in isolator manufacturing, which has caused a hindrance in the disposable aseptic isolation systems market. The tariffs imposed by certain nations have enhanced the production expenses, and pandemic-specific shipping delays have resulted in long-lasting backlogs. Besides, several organizations have retorted by diversifying suppliers and onshoring production.

Disposable Aseptic Isolation Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 3.7 billion |

|

Regional Scope |

|

Disposable Aseptic Isolation Systems Market Segmentation:

Product Type Segment Analysis

Based on product type, the closed systems segment is projected to attain the largest revenue share of 68.6% in the disposable aseptic isolation systems market during the forecast tenure. The stringent regulatory requirements for sterility in injectable drugs and advanced therapies are the main fueling factor for this subtype’s dominance. Also, these closed systems enable superior protection against contamination when compared to open configurations, making it preferable by a wider audience group, hence denoting a wider segment scope.

Application Segment Analysis

In terms of application, the aseptic filling & compounding segment is likely to grow at a considerable rate, with a share of 45.3% in the disposable aseptic isolation systems market by the end of 2035. The segment’s growth is highly subject to a surge in the demand for biologics and cell & gene therapies since they are predominantly administered through injection. In February 2025, Recipharm reported the operation of a new modular sterile filling system, which is designed for process development, pilot scale, and clinical supply, thus accelerating the market growth.

End user Segment Analysis

Based on end user pharmaceutical & biotech companies’ segment, it is predicted to gain a lucrative share of 60.3% in the disposable aseptic isolation systems market during the assessed timeframe. The massive R&D investments and in-house manufacturing of high-value drugs by these firms are the key factors propelling growth in this segment. For instance, in February 2023, Genentech announced the construction of a next-generation biologics manufacturing facility at its Oceanside, CA campus. It also stated that the facility is designed for flexible, efficient commercial production of biologics targeting rare diseases and personalized medicines.

Our in-depth analysis of the disposable aseptic isolation systems market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

System |

|

|

Material |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Aseptic Isolation Systems Market - Regional Analysis

North America Market Insights

North America in the disposable aseptic isolation systems market is projected to dominate with the largest share of 40.9% by the end of 2035. The region’s dominance in this sector is propelled by the presence of regulatory policies that have mandated innovative aseptic technologies and increasing collaborations between the pioneering healthcare firms. In July 2025, TurboFil Packaging Machines announced that it is collaborating with Ravona to provide integrated and standalone isolation technologies for pharmaceutical and biotech manufacturers in North America, hence benefiting the overall market growth.

The disposable aseptic isolation systems market in the U.S. is dominating the overall region, attributed to the presence of key product manufacturers and suitable reimbursements. In May 2021, the U.S. Department of Defense, in coordination with the Department of Health and Human Services, granted a total of USD 226.3 million to expand domestic production capacity of critical aseptic products, which include nitrile gloves essential for sterile pharmaceutical manufacturing, supporting increased manufacturing of sterile gloves and raw materials, and strengthening the supply chain for aseptic isolation systems.

The disposable aseptic isolation systems market in Canada is significantly growing due to green and sustainable isolators, cross-province reimbursement, and public-private research and development, which are other trends that are responsible for uplifting the market in the country. As per an article published by Health Canada in May 2024, it underscored the pivotal role of contamination control strategies and the use of barrier technologies such as isolators to lower human intervention and maintain Grade A conditions. It also supports single-use systems for reducing contamination risks, since they are effectively validated for sterility, integrity, and compatibility with the product.

Healthcare-Associated Infection (HAI) Metrics and Historic Trends in the U.S.

|

Metric |

Value / Change |

|

Patients with ≥1 HAI on any given day |

1 in 31 hospital patients |

|

Increase in surgical site infections after abdominal hysterectomy |

8% |

|

Increase in CAUTI infections in IRFs |

8% |

|

States performing better on ≥3 infection types (compared to 2015 baseline) |

49 states |

|

Estimated HAIs in US acute care hospitals (2015) |

687,000 |

|

Estimated deaths in patients with HAIs during hospitalization (2015) |

72,000 |

Source: CDC,2024

APAC Market Insights

The Asia Pacific region is expected to capture the fastest growth trajectory of the international disposable aseptic isolation systems market during the forecast timeline. The market’s development in the region is subject to expansion in biopharmaceuticals and the existence of strict administrative reforms. Manufacturers in prominent countries such as Japan, South Korea, and Southeast Asia are readily making investments in systems that reduce cleaning validation and downtime, thereby significantly maintaining high levels of contamination control.

The disposable aseptic isolation systems market in China is anticipated to grow due to the isolators mandate required for biologics production, and the government is increasing spending. In January 2025, Shanghai Marya notified that it has completed a turnkey cleanroom HVAC project that spans 427 square meters, built in compliance with GMP and ISO standards for solid preparations in Ecuador, underscoring its capability as a total solution provider in sterile pharmaceutical filling, hence suitable for standard market growth.

The disposable aseptic isolation systems market in India is displaying expedited growth, effectively backed by increasing integration of isolator-based systems in fill-finish, R&D, and quality control environments. In November 2023, CPHI & PMEC India reported that Syntegon and its joint venture partner, Klenzaids, showcased advanced pharmaceutical solutions, which include the semi-automated VIS 1000 vial inspection system and the IsoKlenz ISP 1000, which is an aseptic filling line isolator for prefilled syringes, facilitating effective sterilization with minimal residual hydrogen peroxide.

Europe Market Insights

Europe in the disposable aseptic isolation systems market is expected to garner a significant share by the end of the forecast period. This upliftment is highly propelled by the existence of strict EMA regulatory policies that contribute towards biopharmaceutical expansion. In December 2024, Farmak International reported that it had expanded its European footprint with a new sterile medicines production facility in Barberà del Vallès, Spain, which was engineered and constructed by Telstar. It spans around 1,800m² and features advanced production, R&D labs, and logistics areas designed for scalability and future automation.

The disposable aseptic isolation systems market in Germany is readily dominating the region, which is highly fueled by innovation in biopharmaceutical and the presence of strong government support. In September 2025, the Groninger Group reported that it had acquired Reinraumtechnik Ulm GmbH to expand its cleanroom and isolator technology expertise, which is extremely crucial for the pharmaceutical industry. Further, this move underscores the responsible approach respecting industry standards and existing partnerships, hence boosting market growth.

The disposable aseptic isolation systems market in the UK is expected to showcase evident growth owing to its highly influential pharmaceutical industry. Besides the country’s regulatory bodies, such as the Medicines and Healthcare products Regulatory Agency, which is deliberately enforcing robust aseptic manufacturing standards, thereby encouraging adoption of single-use isolator systems. In September 2022, Extract Technology announced an expansion of its ISO 9001 manufacturing facility in the country, adding a new building to support growing global demand for aseptic and containment pharmaceutical solutions.

Key Disposable Aseptic Isolation Systems Market Players:

- Sartorius AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Pall Corporation)

- Merck KGaA

- Getinge AB

- Cytiva

- Meissner Filtration Products, Inc.

- Saint-Gobain

- Corning Incorporated

- Lonza Group Ltd

- Entegris, Inc.

- ABEC, Inc.

- Pierre Guérin (GEA Group)

- ESCO Group

- Azbil Corporation

- Samsung Biologics

- Bioprocess International (BPI)

- Aptus Biotech S.L.

- AUSTAR

- Becton, Dickinson and Company (BD)

The global disposable aseptic isolation systems market is partially fragmented yet dominated by the pioneers such as Sartorius, Thermo Fisher, and Danaher, who captured the largest revenue shares through extensive product portfolios. On the other hand, the key pioneers are aggressively pursuing mergers and acquisitions to expand their technological capabilities and geographic presence as well. Furthermore, there has been a strong emphasis on R&D to develop systems with lower extractables and improved integration with robotic platforms, hence suitable for boosting overall market growth.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In March 2025, Syntegon introduced its SynTiso line at Pharmatag, developed in collaboration with pharmaceutical partners, which delivers up to 600 containers per minute. SynTiso features a gloveless isolator, contactless transport, and full Annex 1 compliance, minimizing contamination and operator intervention.

- In June 2023, Getinge announced the launch of ISOPRIME, which is a rigid-wall aseptic isolator designed to deliver high-end contamination control in a cost-efficient, entry-level format. The product features a 4-glove design, optional unidirectional or turbulent airflow, and integrated H₂O₂ bio-decontamination (Steritrace),

- Report ID: 4267

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Aseptic Isolation Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.