Dimethyl Carbonate Market Outlook:

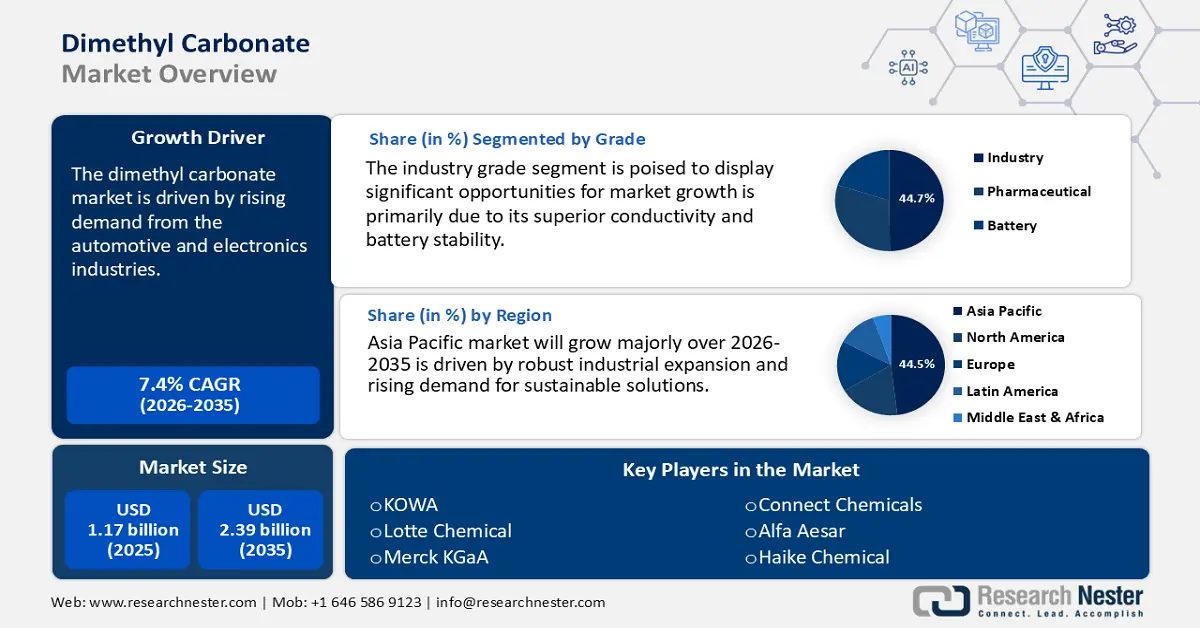

Dimethyl Carbonate Market size was over USD 1.17 billion in 2025 and is projected to reach USD 2.39 billion by 2035, growing at around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dimethyl carbonate is evaluated at USD 1.25 billion.

The dimethyl carbonate market is experiencing significant growth, largely driven by rising demand from the automotive and electronics industries. DMC is a highly soluble solvent that is widely used to prepare electrolytes for lithium-ion batteries, a key component of EVs. As the global automotive industry undergoes a transition toward electric mobility, the need for efficient and sustainable battery components is boosting the demand for DMC.

Beyond batteries, DMC is a crucial intermediate in the production of polycarbonate, a high-performance plastic valued for its lightweight, durability, impact resistance, and thermal stability. Polycarbonate is extensively used in automotive parts such as dashboards, glazing systems, and lighting components to enhance fuel efficiency and reduce emissions. In the electronics sector, it is used in the manufacturing of semiconductors, printed circuit boards (PCBs), and device casings, where its electrical insulation properties are highly beneficial.

Global policy support, such as the U.S. Inflation Reduction Act and the EU’s Net Zero Industry Act, has catalyzed substantial investment, approaching USD 500 billion between 2022 and 2023, in EV and battery technologies. These initiatives are reinforcing the momentum of DMC’s role in supporting green technologies.

Sustainability concerns are further enhancing DMC’s market appeal, with increased adoption of non-phosgene production methods, offering an eco-friendlier alternative to traditional chemical processes. A notable example is Covestro AG, which in 2023 announced enhancements in its polycarbonate production through advanced recycling technologies, reinforcing the circular economy and improving the environmental footprint of materials derived from DMC.

Key Dimethyl Carbonate Market Insights Summary:

Regional Highlights:

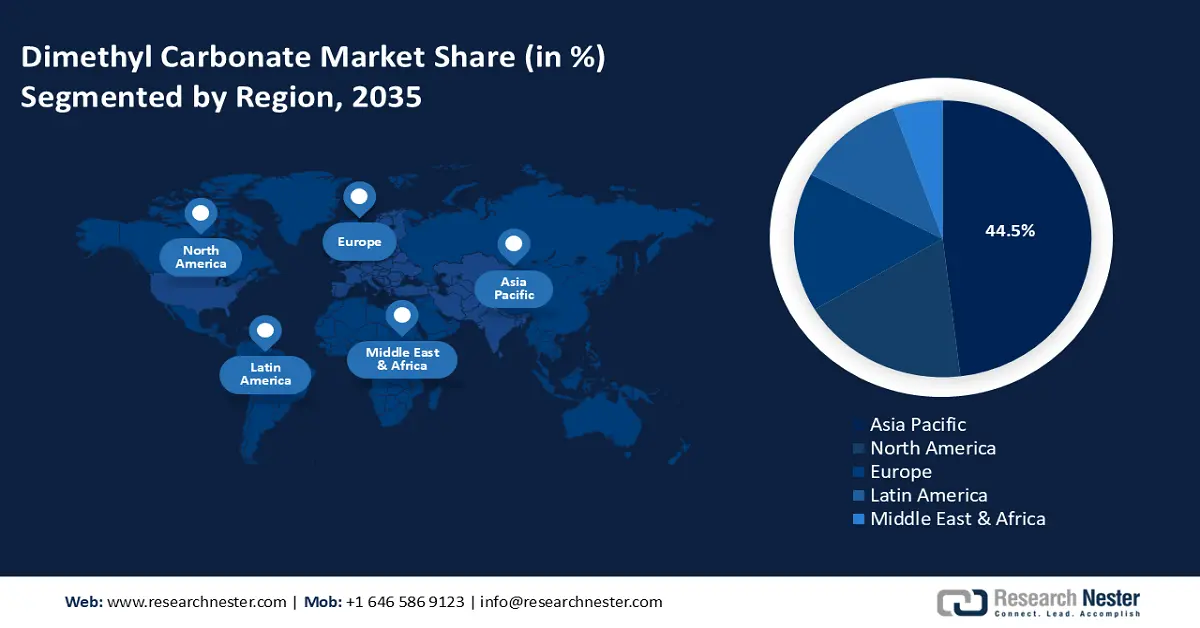

- Asia Pacific dimethyl carbonate market will secure around 44.50% share by 2035, driven by industrial expansion and demand for sustainability.

- Europe market will achieve significant revenue share by 2035, driven by strong environmental regulations.

Segment Insights:

- The industrial grade dmc segment in the dimethyl carbonate market is forecasted to hold a 44.70% share by 2035, driven by the high purity needed for battery electrolytes and coatings.

- The polycarbonate synthesis segment in the dimethyl carbonate market is anticipated to achieve a substantial share by 2035, fueled by polycarbonate's impact resistance and lightweight properties.

Key Growth Trends:

- Increasing need in the pharmaceutical sector

- Increasing need for eco-friendly chemicals

Major Challenges:

- High production costs

- Raw material price volatility

Key Players: Connect Chemicals, Dongying Hi-tech Spring Chemical Industry Co., Ltd., Guangzhou Tinci Materials Technology Co., Ltd., Haike Chemical Group, Hebei New Chaoyang Chemical Stock Co., Ltd., Kishida Chemical Co. Ltd., Kowa Company Ltd., Lotte Chemical, Merck KGaA, Shandong Depu Chemical Industry Science and Technology Co., Ltd., Shandong Shida Shenghua Chemical Group Co., Ltd., Tokyo Chemical Industry Co., Ltd., Qingdao Aspirit Chemical Co., Ltd..

Global Dimethyl Carbonate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.17 billion

- 2026 Market Size: USD 1.25 billion

- Projected Market Size: USD 2.39 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 21 May, 2025

Dimethyl Carbonate Market Growth Drivers and Challenges:

Growth Drivers

- Increasing need in the pharmaceutical sector: The pharmaceutical industry's growing emphasis on sustainability and cost-effectiveness has led to increased adoption of Dimethyl Carbonate (DMC) as a solvent and intermediate in drug synthesis. DMC is favored for its low toxicity, biodegradability, and environmental friendliness compared to traditional solvents like methanol, acetone, and dichloromethane. Its methylating and carbonylation properties make it particularly valuable in the synthesis of active pharmaceutical ingredients (APIs), enhancing reaction efficiency and yield.

From an economic perspective, DMC offers cost advantages due to its efficient reaction profiles and competitive pricing, making it an attractive option for pharmaceutical manufacturers seeking to optimize processes and reduce environmental impact. A notable example is UBE Corporation, a leading Japanese chemical manufacturer. UBE produces high-purity DMC using a proprietary gas-phase nitrous acid process, using carbon monoxide and methanol as raw materials. This method not only ensures a high-quality product but also minimizes by-products and impurities, aligning with the principles of green chemistry.

UBE's DMC is used as a pharmaceutical intermediate to facilitate reactions such as methylation, carbonylation, and carbomethoxylation in API synthesis. Additionally, its application as an environmentally friendly solvent in cleaning agents underscores its versatility in pharmaceutical processes. By integrating DMC into pharmaceutical manufacturing, companies can achieve enhanced process efficiency, reduced environmental footprint, and compliance with evolving regulatory standards.

- Increasing need for eco-friendly chemicals: The escalating demand for environmentally friendly chemicals is significantly propelling the growth of the dimethyl carbonate market . Recognized for its low toxicity, biodegradability, and minimal environmental impact, DMC serves as a safer alternative to traditional solvents like methanol and dichloromethane. Its applications span various industries, including polycarbonate synthesis, battery electrolytes, and solvent formulations, aligning with global sustainability goals and stringent environmental regulations.

A notable example is BASF, a leading German chemical manufacturer. BASF has committed to achieving net-zero greenhouse gas emissions by 2050 and is actively working to reduce its carbon footprint through various initiatives. The company employs a mass balance approach to replace fossil-based raw materials with certified renewable resources in its production processes, thereby reducing the cradle-to-gate carbon footprint of its products. For instance, BASF's biomass balance portfolio includes chemical intermediates produced using renewable feedstocks, contributing to lower CO₂ emissions compared to conventional products. Additionally, BASF's Verbund concept enables efficient resource utilization by intelligently linking production processes, further enhancing sustainability. These efforts underscore BASF's commitment to providing environmentally friendly chemical solutions. Through such initiatives, BASF exemplifies how chemical manufacturers can integrate eco-friendly practices and expand production capacities to meet the global demand for sustainable chemicals, thereby contributing to a greener and more sustainable future.

Challenges

- High production costs: The high production costs associated with synthesizing Dimethyl Carbonate (DMC) could hinder market growth. Current production methods, such as oxidative carbonylation of methanol, rely on expensive homogeneous catalysts, high energy consumption, and complex processes, driving up manufacturing expenses. Additionally, fluctuating methanol prices further increases cost unpredictability. These elevated production costs may limit DMC's affordability, particularly in price-sensitive markets. Despite its eco-friendly advantages as a phosgene-based solvent alternative, DMC's higher cost compared to conventional substitutes restricts widespread adoption across key industries. Consequently, cost-related challenges pose a significant barrier to the expansion of the DMC market.

- Raw material price volatility: The price volatility of methanol, a key raw material for Dimethyl Carbonate (DMC) production, poses a significant challenge. Since methanol is derived from natural gas, fluctuations in gas prices—driven by geopolitical tensions, supply chain disruptions, or environmental factors—directly impact DMC production costs. Additionally, stringent environmental regulations affecting carbon monoxide and methanol manufacturing can further escalate expenses. Energy costs, particularly for electricity and natural gas, also influence overall production economics, creating pricing instability in the dimethyl carbonate market . Such unpredictability in raw material availability and pricing complicates cost management, potentially hindering market growth and adoption in price-sensitive applications.

Dimethyl Carbonate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 1.17 billion |

|

Forecast Year Market Size (2035) |

USD 2.39 billion |

|

Regional Scope |

|

Dimethyl Carbonate Market Segmentation:

Grade Segment Analysis

The industrial grade (>99.0 weight%), segment in dimethyl carbonate market, with purity levels exceeding 99.0%, dominated the market in 2035, accounting for 44.7% of global demand. This high-purity grade is essential for performance-critical applications, including lithium-ion battery electrolytes, where it ensures superior conductivity and battery stability. Its exceptional purity also makes it ideal for coatings, adhesives, and pharmaceuticals, where even trace impurities can compromise product quality. For instance, in electrolyte formulations, industry-grade DMC enhances energy density and cycle life, while in coatings, it delivers consistent viscosity and durability. Daicel Corporation, a leading Japanese chemical manufacturer, produces high-purity DMC tailored for advanced industrial applications. The company emphasizes stringent quality control to meet the exacting standards of battery manufacturers and specialty chemical producers. According to Daicel’s official website, their DMC products support next-generation energy storage and sustainable chemical solutions. With its commitment to innovation, Daicel exemplifies how high-purity DMC drives efficiency across key industries.

Application Segment Analysis

The polycarbonate synthesis segment is expected to hold a substantial share in the dimethyl carbonate market by the end of 2035, driven by growing adoption across automotive, electronics, construction, and healthcare industries. The material's unique combination of impact resistance, optical clarity, and lightweight properties makes it ideal for safety-critical applications. In automotive manufacturing, polycarbonate enables lightweight lighting components that improve fuel efficiency while meeting stringent emissions standards. The electronics sector relies on its exceptional transparency and durability for optical media, display screens, and protective device casings.

SABIC, a global leader in advanced materials, demonstrates this trend through its innovative LEXAN polycarbonate resins, which are widely used in automotive glazing, electronic components, and medical devices while emphasizing sustainability. As industries increasingly prioritize high-performance, sustainable materials, polycarbonate's versatility continues to drive significant demand in the DMC market, supported by ongoing material innovations and evolving application requirements.

Our in-depth analysis of the global market includes the following segments:

|

Grade |

|

|

Application |

|

End use

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dimethyl Carbonate Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific region is expected to capture 44.5% of the global dimethyl carbonate market share in 2035, driven by robust industrial expansion and rising demand for sustainable solutions. China and India are pivotal to this growth, with China being both the largest producer and consumer of DMC, fueled by its massive electronics, automotive, and coatings industries. The country's push for green technologies and stringent VOC regulations has accelerated DMC adoption as an eco-friendly solvent. India follows closely, with rapid infrastructure development and a growing emphasis on sustainable manufacturing practices boosting DMC demand in polycarbonate synthesis and battery electrolytes.

For instance, Sweden-based Perstorp Group, through its Asian operations, supplies high-purity DMC for coatings and electronics applications, aligning with the region's sustainability goals. As both nations continue to prioritize environmental compliance and industrial modernization, their dominance in the DMC market is expected to strengthen further.

Europe Market Insights

Europe holds a significant position in the global dimethyl carbonate market, with Germany and the UK driving demand through their advanced chemical industries and strong environmental regulations. Germany, as Europe's largest chemical producer, leads in DMC consumption for polycarbonate production and lithium-ion battery electrolytes, supported by its thriving automotive and renewable energy sectors. The UK follows closely, with growing DMC adoption in eco-friendly coatings and adhesives, aligned with the country's stringent VOC emission standards and sustainability goals. Both nations benefit from well-established R&D infrastructure and government initiatives promoting green chemistry.

German chemical giant BASF SE is a key player in Europe's DMC market, offering high-purity grades for battery electrolytes and sustainable coatings applications. The company's focus on circular economic principles and low-carbon production methods reinforces Europe's leadership in environmentally responsible DMC solutions. With increasing emphasis on electrification and sustainable materials, Germany and the UK are poised to remain at the forefront of Europe's DMC market growth.

Dimethyl Carbonate Market Players:

- BASF

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Connect Chemicals

- Dongying Hi-tech Spring

- Guangzhou Tinci Materials Technology

- Haike Chemical Group

- Hebei New Chaoyang

- Kishida Chemical Co. Ltd.

- Kowa Company Ltd.

- Lotte Chemical

- Merck KGaA

- Shandong Depu

- Shandong Shida Shenghua

- Qingdao Aspirit

Leading companies like BASF, SABIC, and Mitsubishi Chemical dominate the dimethyl carbonate market through advanced production technologies, including catalytic oxidative carbonylation of methanol and urea methanolysis. They leverage green chemistry innovations, energy-efficient processes, and high-purity purification systems to enhance cost efficiency and sustainability. Strategic R&D in electrolyte-grade DMC for batteries and bio-based production methods further strengthens their market position.

Recent Developments

- In June 2023, Merck revealed plans to enhance their production capabilities for high-purity reagents at their facility in China. Although this initiative is not directly associated with DMC, it underscores the increasing significance of high-quality control and testing materials, especially within the biopharmaceutical sector.

- In July 2021, Asahi Kasei established a technology licensing agreement aimed at developing high-purity dimethyl carbonate. This process primarily employs carbon dioxide (CO2) to enhance profitability in response to the demand for Lithium-ion batteries.

- Report ID: 4890

- Published Date: May 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dimethyl Carbonate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.