Global Digital Biomarker Market TOC

- An Outline of the Global Digital Biomarker Market

- Market Definition

- Market Segmentation

- Industry Overview

- Assumptions & Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- Service Providers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

- Key Market Opportunities for Business Growth

- Major Roadblocks for the Market Growth

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Government Regulation: How They Would aid Business?

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Digital Biomarker Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Pipeline Analysis

- Industry Growth Outlook

- Industry Value Chain Analysis

- End User Analysis

- Competitive Positioning: Strategies to Differentiate a Company From its Competitor

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share (2023)

- Business Profile of Key Enterprise

- nQ Medical

- ALTOIDA

- ActiGraph, LLC

- VivoSense

- EVOCAL Health GmbH

- Koneksa

- Cosinuss GmbH

- Biofourmis

- Lunit Inc.

- IMVARIA Inc.

- Global Digital Biomarker Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Global Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Component

- Data Collection Tools, Market Value (USD Million) and CAGR, 2023-2036F

- Mobile Apps, Market Value (USD Million) and CAGR, 2023-2036F

- Wearables, Market Value (USD Million) and CAGR, 2023-2036F

- Biosensors, Market Value (USD Million) and CAGR, 2023-2036F

- Contact-free sensors, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Data Integration Systems, Market Value (USD Million) and CAGR, 2023-2036F

- Global Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Therapeutic Area

- Cardiovascular Diseases, Market Value (USD Million) and CAGR, 2023-2036F

- Neurodegenerative Disorders, Market Value (USD Million) and CAGR, 2023-2036F

- Parkinson’s Disease, Market Value (USD Million) and CAGR, 2023-2036F

- Multiple Sclerosis, Market Value (USD Million) and CAGR, 2023-2036F

- Alzheimer’s Disease, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Sleep and Movement Diseases, Market Value (USD Million) and CAGR, 2023-2036F

- Chronic Pain, Market Value (USD Million) and CAGR, 2023-2036F

- Gastrointestinal Diseases, Market Value (USD Million) and CAGR, 2023-2036F

- Diabetes, Market Value (USD Million) and CAGR, 2023-2036F

- Respiratory Conditions, Market Value (USD Million) and CAGR, 2023-2036F

- Other Diseases, Market Value (USD Million) and CAGR, 2023-2036F

- Global Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Application

- Wellness, Market Value (USD Million) and CAGR, 2023-2036F

- Disease Diagnosis, Market Value (USD Million) and CAGR, 2023-2036F

- Personalized Medication, Market Value (USD Million) and CAGR, 2023-2036F

- Drug Discovery and Development, Market Value (USD Million) and CAGR, 2023-2036F

- Global Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By End User

- Biopharmaceutical Companies & Labs, Market Value (USD Million) and CAGR, 2023-2036F

- Healthcare Providers, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Global Digital Biomarker Market Segmentation Analysis (2023-2036) By Geography

- North America, Market Value (USD Million) and CAGR, 2023-2036F

- Europe, Market Value (USD Million) and CAGR, 2023-2036F

- Asia Pacific, Market Value (USD Million) and CAGR, 2023-2036F

- Latin America, Market Value (USD Million) and CAGR, 2023-2036F

- Middle East & Africa, Market Value (USD Million) and CAGR, 2023-2036F

- Global Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Component

- Cross Analysis of Components w.r.t. Application (USD Million), 2023

- North America Digital Biomarker Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- North America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Component

- Data Collection Tools, Market Value (USD Million) and CAGR, 2023-2036F

- Mobile Apps, Market Value (USD Million) and CAGR, 2023-2036F

- Wearables, Market Value (USD Million) and CAGR, 2023-2036F

- Biosensors, Market Value (USD Million) and CAGR, 2023-2036F

- Contact-free sensors, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Data Integration Systems, Market Value (USD Million) and CAGR, 2023-2036F

- North America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Therapeutic Area

- Cardiovascular Diseases, Market Value (USD Million) and CAGR, 2023-2036F

- Neurodegenerative Disorders, Market Value (USD Million) and CAGR, 2023-2036F

- Parkinson’s Disease, Market Value (USD Million) and CAGR, 2023-2036F

- Multiple Sclerosis, Market Value (USD Million) and CAGR, 2023-2036F

- Alzheimer’s Disease, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Sleep and Movement Diseases, Market Value (USD Million) and CAGR, 2023-2036F

- Chronic Pain, Market Value (USD Million) and CAGR, 2023-2036F

- Gastrointestinal Diseases, Market Value (USD Million) and CAGR, 2023-2036F

- Diabetes, Market Value (USD Million) and CAGR, 2023-2036F

- Respiratory Conditions, Market Value (USD Million) and CAGR, 2023-2036F

- Other Diseases, Market Value (USD Million) and CAGR, 2023-2036F

- North America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Application

- Wellness, Market Value (USD Million) and CAGR, 2023-2036F

- Disease Diagnosis, Market Value (USD Million) and CAGR, 2023-2036F

- Personalized Medication, Market Value (USD Million) and CAGR, 2023-2036F

- Drug Discovery and Development, Market Value (USD Million) and CAGR, 2023-2036F

- North America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By End User

- Biopharmaceutical Companies & Labs, Market Value (USD Million) and CAGR, 2023-2036F

- Healthcare Providers, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- North America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Component

- North America Digital Biomarker Market Segmentation Analysis (2023-2036) By Country

- US, Market Value (USD Million) and CAGR, 2023-2036F

- Canada, Market Value (USD Million) and CAGR, 2023-2036F

- Europe Digital Biomarker Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Europe Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Component

- Europe Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Therapeutic Area

- Europe Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Application

- Europe Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By End User

- Europe Digital Biomarker Market Segmentation Analysis (2023-2036) By Country

- UK, Market Value (USD Million) and CAGR, 2023-2036F

- Germany, Market Value (USD Million) and CAGR, 2023-2036F

- France, Market Value (USD Million) and CAGR, 2023-2036F

- Italy, Market Value (USD Million) and CAGR, 2023-2036F

- Spain, Market Value (USD Million) and CAGR, 2023-2036F

- Russia, Market Value (USD Million) and CAGR, 2023-2036F

- Netherlands, Market Value (USD Million) and CAGR, 2023-2036F

- Rest of Europe, Market Value (USD Million) and CAGR, 2023-2036F

- Asia Pacific Digital Biomarker Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Asia Pacific Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Component

- Asia Pacific Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Therapeutic Area

- Asia Pacific Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Application

- Asia Pacific Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By End User

- Asia Pacific Digital Biomarker Market Segmentation Analysis (2023-2036) By Country

- China, Market Value (USD Million) and CAGR, 2023-2036F

- Japan, Market Value (USD Million) and CAGR, 2023-2036F

- India, Market Value (USD Million) and CAGR, 2023-2036F

- Australia, Market Value (USD Million) and CAGR, 2023-2036F

- South Korea, Market Value (USD Million) and CAGR, 2023-2036F

- Singapore, Market Value (USD Million) and CAGR, 2023-2036F

- Rest of Asia Pacific, Market Value (USD Million) and CAGR, 2023-2036F

- Latin America Digital Biomarker Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Latin America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Component

- Latin America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Therapeutic Area

- Latin America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Application

- Latin America Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By End User

- Latin America Digital Biomarker Market Segmentation Analysis (2023-2036) By Country

- Mexico, Market Value (USD Million) and CAGR, 2023-2036F

- Argentina, Market Value (USD Million) and CAGR, 2023-2036F

- Brazil, Market Value (USD Million) and CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD Million) and CAGR, 2023-2036F

- Middle East & Africa Digital Biomarker Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Middle East & Africa Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Component

- Middle East & Africa Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Therapeutic Area

- Middle East & Africa Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Application

- Middle East & Africa Digital Biomarker Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By End User

- Middle East & Africa Digital Biomarker Market Segmentation Analysis (2023-2036) By Country

- GCC, Market Value (USD Million) and CAGR, 2023-2036F

- Israel, Market Value (USD Million) and CAGR, 2023-2036F

- South Africa, Market Value (USD Million) and CAGR, 2023-2036F

- Rest of Middle East & Africa, Market Value (USD Million) and CAGR, 2023-2036F

Digital Biomarkers Market Outlook:

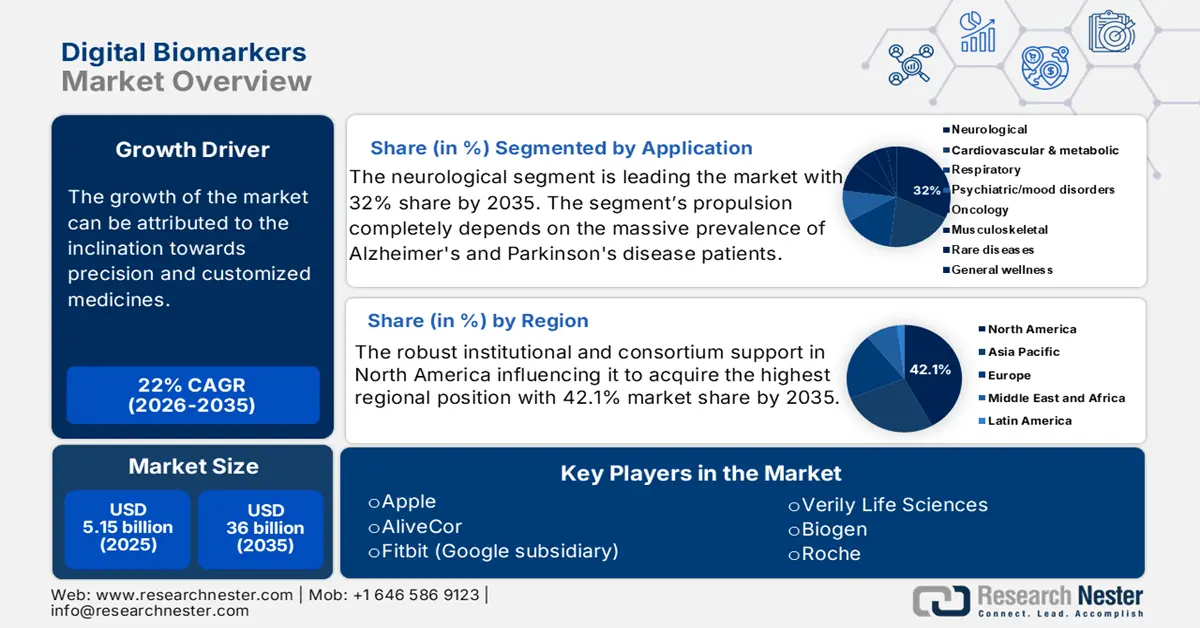

Digital Biomarkers Market size was valued at approximately USD 5.15 billion in 2025 and is projected to reach around USD 36 billion by the end of 2035, rising at a CAGR of approximately 22% during the forecast period (2026-2035). In 2026, the industry size of digital biomarkers is estimated at USD 6.2 billion.

According to the data published by the World Health Organization in 2024 stated that more than 3 billion people globally were living with a neurological condition. This is further creating a substantial consumer base for remote monitoring and early intervention solutions. Additionally, the data published by the Alzheimer’s Association more than 7 million Americans have Alzheimer's. This highlights the urgent need for AI-enabled tools for cognitive assessment. Moreover, the higher risk of developing these ailments among older citizens is stimulating market growth.

The rising research and development in digital biomarkers is changing healthcare by bringing innovation to wearable devices. Such biomarkers are rendering insights into the progression of the disease and treatment response. Digital biomarkers are capable of tracking various factors to aid in support for the early detection. Various algorithms analyze the photoplethysmography signal to anticipate the occurrence of any adverse events. Moreover, various ongoing collaborations among the leading firms are fostering innovations in healthcare to give more precise patient-centric care.

Key Digital Biomarkers Market Insights Summary:

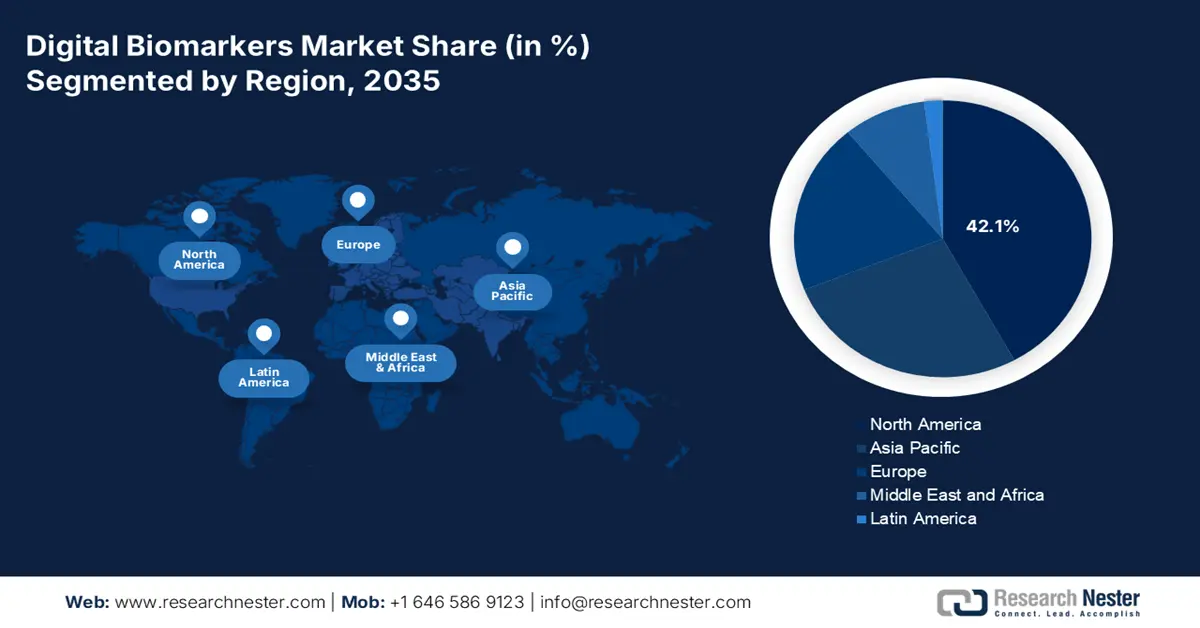

Regional Insights:

- North America is forecast to hold a 42.1% share of the Digital Biomarkers Market by 2035, fostered by robust institutional support and widespread adoption of smartphones and wearables.

- Asia Pacific is set to become the fastest-expanding region by 2035, underpinned by favorable demographics and proactive government policies.

Segment Insights:

- The neurological segment is projected to command a 32% share by 2035 in the Digital Biomarkers Market, propelled by the enlarging patient pool of Alzheimer's and Parkinson's disease.

- The wearable segment is anticipated to secure the maximum share by 2035, supported by its comfort in continuous monitoring and rising healthcare consumerism.

Key Growth Trends:

- Shift towards personalized and precision medicine

- Surge in integration of AI and ML in healthcare

Major Challenges:

- Data privacy and interoperability issues

Key Players: Apple,AliveCor,Fitbit (Google subsidiary),Verily Life Sciences,Biogen,Roche,Siemens Healthineers,Philips,Bayer,Huma,ResApp Health,Samsung Electronics,LG Electronics,Tata Consultancy Services,Wipro GE Healthcare,BioMark,Neuroglee Therapeutics,Mindstrong

Global Digital Biomarkers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.15 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 36 billion by 2035

- Growth Forecasts: 22% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Singapore, Australia, Canada

Last updated on : 9 September, 2025

Digital Biomarkers Market - Growth Drivers and Challenges

Growth Drivers

- Shift towards personalized and precision medicine: The healthcare sector is moving towards personalized medicines from a conventional “one-size-fits-all” strategy. In precision medicine, interventions and treatments are customized to individual patient profiles. Digital biomarkers are leveraging data from smartphones or wearables and monitoring the patterns of the patient consistently. For instance, devices such as Dexcom G6 or Abbott FreeStyle Libre measure glucose levels and send the obtained data to cloud platforms. Patients have achieved better glucose control with very less hypoglycemic episodes. These developments emphasize precision care, which is a prominent driver of the investment in digital biomarker technologies.

- Surge in integration of AI and ML in healthcare: According to the University of Minnesota School of Public Health in January 2025, more than 65% of the hospitals in the U.S. utilize AI-enabled predictive models. The inclusion of AI and ML algorithms directly supports the growth of digital biomarkers. The healthcare system is now ready to include real-time data for clinical decision-making. Digital biomarkers produce a vast stream of data, and the inclusion of AI provides a required infrastructure for hospitals to analyze and interpret data. Such synchronization ensures swift clinical validation and robust pathways for reimbursement, positioning digital biomarkers as the next big step in the evolution of AI-enabled healthcare.

- Rising chronic disease burden and aging population: The worldwide prevalence of chronic diseases is a major factor bolstering the market growth. According to the World Health Organization, non-communicable diseases killed at least 43 million people back in 2021. The non-communicable conditions, such as diabetes, cardiovascular diseases, etc., require continuous monitoring. Additionally, various health insurance companies are reimbursing digital health interventions, particularly in the management of chronic diseases. Digital biomarkers are offering a scalable and cost-efficient solution for the keen monitoring of long-term diseases and rendering customized care to the patients.

Challenge

-

Data privacy and interoperability issues: The market often faces delays and financial losses due to volatility in regulatory criteria and interoperability. Additionally, closed ecosystems, such as Apple HealthKit, hinder seamless integration with hospital EHR systems, limiting clinical utility and adoption, according to the 2023 NIH report. These obstacles slow market expansion and complicate the large-scale deployment worldwide. Also, clinical validation remains a major hurdle for the market. There is presence of a notable gap that undermines trust among healthcare providers and payers.

Digital Biomarkers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

22% |

|

Base Year Market Size (2025) |

USD 5.15 billion |

|

Forecast Year Market Size (2035) |

USD 36 billion |

|

Regional Scope |

|

Digital Biomarkers Market Segmentation:

Application Segment Analysis

The neurological segment is poised to dominate the digital biomarkers market over the assessed timeline with 32% of the revenue share. The leadership is primarily driven by the enlarging patient pool of Alzheimer's and Parkinson's disease. The presence of several clinical studies demonstrating the therapeutic and economic advantages of AI-powered tools in detecting and treating neurological diseases is escalating adoption in this category. According to Parkinson’s Foundation, more than 1.1 million people in the U.S. are suffering from Parkinson’s disease. These factors are augmenting the segment growth during the coming period.

Type Segment Analysis

The wearable segment is predicted to garner the maximum share, mainly because wearables are considered to be the most comfortable choice for the consumer as a continuous monitoring tool. These devices can capture real-time physiological data in very natural settings. The subsegment growth can also be attributed to the rising consumerism of healthcare. People are now actively seeking tools that track health with the use of devices from popular brands such as Apple, Fitbit, etc. Also, continuous advancements in sensors such as SpO2 and ECG are giving more accurate insights and are highly preferred by people.

End-user Segment Analysis

Hospitals and clinics mainly hold the largest market share, and the leadership stems from their primary position in delivering patient care. Hospitals and clinics are relying on wearable devices and AI-enabled analytics to get the behavioral data of the patients. The burgeoning burden of chronic diseases and demand for minimally invasive monitoring are further propelling the segment growth. Healthcare providers are the early adopters of remote patient monitoring for giving post-discharge care. Hospitals are integrating electronic health records from the digital biomarkers, which is reinforcing the largest share in the market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Clinical Practice |

|

|

Application |

|

|

End user |

|

|

System Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Biomarkers Market - Regional Analysis

North America Market Insights

North America is expected to gain the largest share of 42.1% in the digital biomarkers market by the end of 2035. The robust institutional and consortium support is a major growth-promoting factor for the market in the region. The widespread adoption of smartphones and wearables renders a strong technological base for the large-scale collection of data. The region is one of the most favorable markets for the growth of the digital biomarker, as there is a huge focus on privacy and equitable utilization for the wider social acceptance.

The U.S. dominates the regional market on account of unparalleled public and private spending on AI-driven healthcare solutions. Further, reformed policies, such as the CHIPS and Science Act tax incentives, are boosting the medical devices production capacity in the country. Additionally, the regulatory engagements with the FDA are also creating pathways for the swift approval and widespread utilization of the digital endpoints in conducting clinical trials. According to the survey conducted by the American Cancer Society in 2023, 77% cancer patients stated that biomarker testing helped in better treatment. These factors are augmenting the market growth in the coming decade.

APAC Market Insights

Asia Pacific is poised to establish its position as the fastest-growing digital biomarkers sector globally during the analyzed tenure. The favorable demographic shifts and proactive government policies are creating new opportunities for this merchandise. In China, the market growth is propelled by a massive patient pool, and substantial government investment in AI healthcare infrastructure is consolidating this leadership. Also, the rapid adoption of AI in the hospital infrastructure in the country is resulting in the increased demand for digital biomarkers.

India is propagating as the epicenter of widespread adoption in the regional digital biomarkers market, offering lucrative opportunities for affordable models. In March 2025, scientists from India joined hands with the UK to conduct research by integrating cutting-edge technologies that include blood-based biomarkers. The partnership endeavors to comprehend and prevent cognitive decline with age. Moreover, the growing awareness about the importance of AI-based imaging biomarkers and remote diagnostics in bridging healthcare gaps in rural and urban populations is fostering a strong foundation for the country in this sector.

Europe Market Insights

The Europe digital biomarkers market is growing at a steady pace, which is stimulated by regulatory tailwinds and demographic demands. The regulatory momentum in the region is also propelling the market growth, and with the advent of the region’s new Medical Device Regulation (MDR), there will be clear pathways for the approval of digital health. Also, digital health programs are receiving funding from all across the nations in EU, alongside the burgeoning investment in healthcare IT. These factors are empowering established players as well as startups to scale the solutions associated with the digital biomarkers.

Germany is maintaining its proprietorship over the Europe market with accelerated adoption through regulatory mandates and measurable clinical impact. The nation's disease-specific mandates under Medical Device Regulation (MDR) alignment make it both a compliance benchmark and a clinical effectiveness proving ground. Academic research communities such as Fraunhofer ISST are putting efforts into developing digital value chains. This is to track sclerosis rehabilitation and obtain a blueprint for converting data from wearable devices into actionable digital biomarkers. This type of research is augmenting the market growth in the coming period.

Key Digital Biomarkers Market Players:

- Apple

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AliveCor

- Fitbit (Google subsidiary)

- Verily Life Sciences

- Biogen

- Roche

- Siemens Healthineers

- Philips

- Bayer

- Huma

- ResApp Health

- Samsung Electronics

- LG Electronics

- Tata Consultancy Services

- Wipro GE Healthcare

- BioMark

- Neuroglee Therapeutics

- Mindstrong

The current dynamics of the market are defined through intense competition between tech giants and pharmaceutical leaders. Each of these players is leveraging their financial output with distinct advantages, such as wearable advancements and AI integration. Whereas pharmaceutical firms are more focused on clinical validation and therapeutic applications. This can also be exemplified by the strategic partnership between Verily and Biogen for Parkinson’s research. On the other hand, agile startups, such as Huma and ResApp, are exploring the untapped potential of niche diagnostic landscapes.

Such key players are:

Recent Developments

- In May 2025, Function Health acquired Ezra, a medical imaging provider, integrating their MRI scanning capabilities into Function Health’s preventive health platform. The merger is aiming to enhance the company’s offering by combining advanced imaging with digital diagnostics, empowering more comprehensive screening and risk assessment.

- In June 2025, Agenus and Noetik entered into a collaboration to develop AI-enabled predictive biomarkers for BOT/BAL. This reflects a growing trend of using AI to derive predictive digital biomarkers in oncology and immunotherapy.

- In May 2024, Apple launched Sleep Apnea Detection on Apple Watch. It received U.S. FDA clearance in May 2024 — making it one of the first consumer wearable-based digital biomarkers for a major chronic condition to achieve this status.

- Report ID: 3217

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Biomarkers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.