Dextrin Market Outlook:

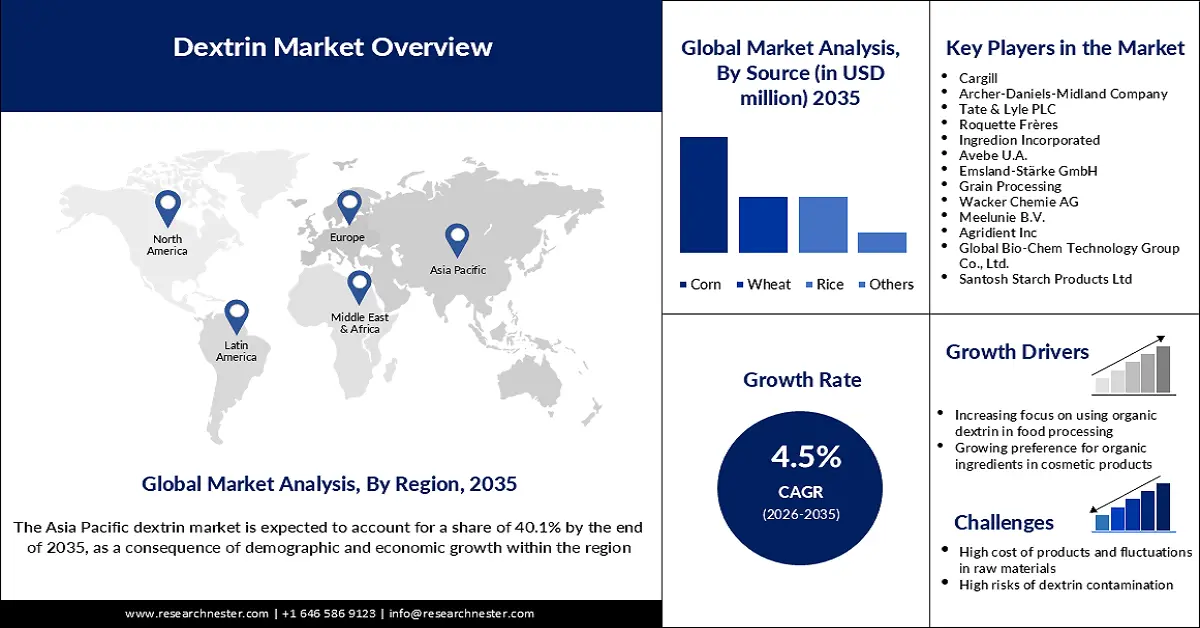

Dextrin Market size was valued at USD 2.6 billion in 2025 and is forecasted to reach a valuation of USD 3.9 billion by the end of 2035, rising at a CAGR of 4.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of dextrin is evaluated at USD 2.8 billion.

The primary factor fueling the growth of the market is the expanding industrial applications, including adhesives, foundry, and paper and textiles. Dextrin is used as a binding, sizing, and coating agent for purposes, including packaging, construction, manufacturing textile and paper products, and others. It plays a crucial role in the production of biodegradable and non-toxic adhesives. In August 2024, TOCORE, a company involved in the manufacturing of environmentally friendly adhesives, revealed its collaboration with FORLIT to enhance efficiency and sustainability in the production of paper honeycomb with the use of advanced dextrin adhesives.

Growing demand for dextrin in the food industry is also expected to boost the market growth in the coming years. Dextrin is effective in binding food ingredients together and preventing food from being dispersed due to its thickening properties. Such a feature of destrin leads to a wider use of the same in packaged soups, sweets, and baby food. Considering the need for dextrin in the food industry, companies are also producing advanced dextrin to supply the same. For example, in June 2023, for plant-based treatment and alternatives to meat, announced the launch of Tate & Lyle PLC launched a new novel tapioca- and corn-based texturizer.

Key Dextrin Market Insights Summary:

Regional Highlights:

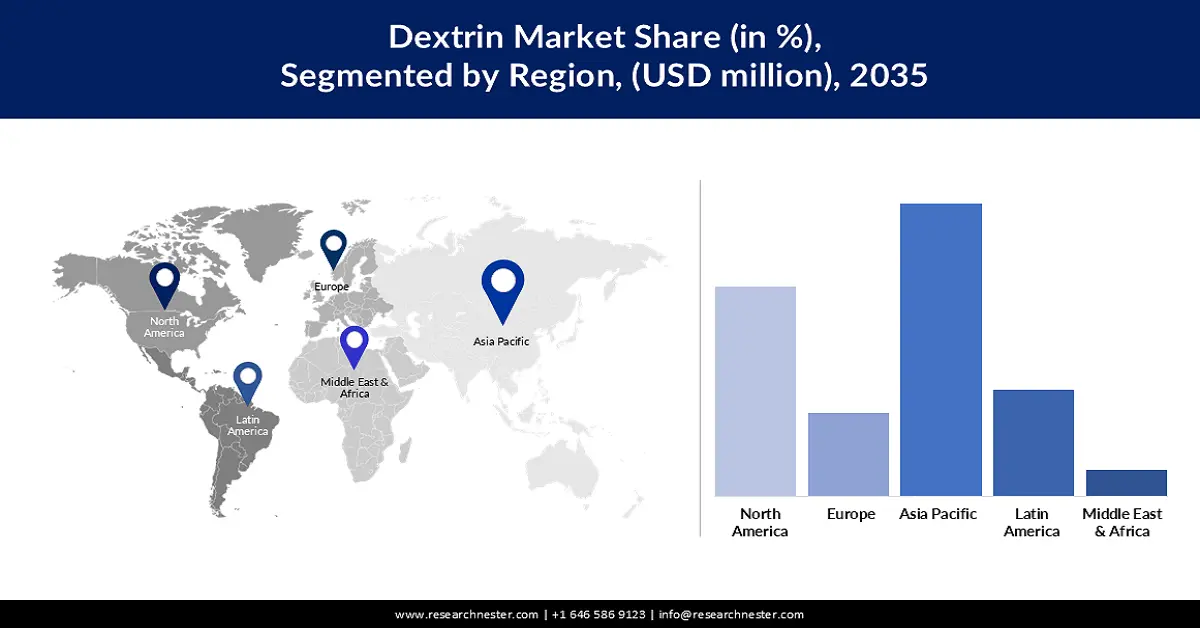

- The Asia Pacific dextrin market is projected to capture a 40.1% share by 2035, propelled by rapid demographic expansion and rising demand for healthy food consumption.

- North America is anticipated to hold 24.8% of the market revenue by 2035, attributed to the growing processed food sector and the increasing use of natural ingredients in cosmetics.

Segment Insights:

- The maltodextrin segment of the Dextrin Market is estimated to command a 45.2% share by 2035, driven by its cost-effectiveness and multifunctional properties that enhance taste, texture, and shelf life in food products.

- By 2035, the corn segment is expected to secure a 72.5% share, owing to the abundant global availability of corn and its increasing use in producing yellow corn dextrin for flavor and oil encapsulation.

Key Growth Trends:

- Rising demand for clean-label

- Preference for health-focused products

Major Challenges:

- Volatility in the prices of raw materials

- Side effects of high consumption of dextrin

Key Players: Cargill, Archer-Daniels-Midland Company, Tate & Lyle PLC, Roquette Frères, Ingredion Incorporated, Avebe U.A., Emsland-Stärke GmbH, Grain Processing Corporation, Matsutani Chemical Industry Co. Ltd., AGRANA Beteiligungs-AG, Wacker Chemie AG, Meelunie B.V., Agridient Inc, Global Bio-Chem Technology Group Co. Ltd., Santosh Starch Products Ltd.

Global Dextrin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 2.8 billion

- Projected Market Size: USD 3.9 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, South Korea

Last updated on : 5 September, 2025

Dextrin Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for clean-label: The rising demand for clean labels due to factors such as increasing awareness of food ingredients, health concerns, and high preference for organic and natural products among consumers, is expected to fuel global market growth during the forecast period. This has led companies to initiate involvement in preparing clean labels using dextrin. One such example is the launch of the first functional native, clean-label starch in February 2024 by Ingredion, effective to fulfill the needs of consumers for plant-based and indulgent texture in different food items.

- Preference for health-focused products: Preference for products that are good for health fuels the demand for dextrin, especially the resistant dextrin, due to its ameliorative impact in type 2 diabetes. Companies are also putting efforts into developing health-focused products using types of dextrin. In December 2023, Anderson Global Group (AGG) made its final amendments in the response letter submitted to the U.S Food and Drug Administration (FDA) regarding the use of resistant dextrin derived from corn in various categories of food, including baked goods, granola bars, nutrition bars, confections, cereals, and others. The use of such dextrin in such categories of food items can improve levels of blood glucose and lipid, reduce blood pressure, inflammatory response, and improve the atherosclerotic index when consumed.

- Advancements in technology and material science: The breakthroughs in material science and automation technology are expected to fuel the market growth. With the emergence of AI, the production of dextrin is also revolutionized. Most significantly, the production of the plant-based dextrin adhesives is being improved. AI plays a crucial role in improving formulation precision, managing the waste of materials, and energy utilization to make the production of dextrin reach the utmost energy efficiency. Real-time monitoring of the adhesive production process is possible with the use of AI to make the process more streamlined.

Challenges

- Volatility in the prices of raw materials: Price volatility of raw materials, including starch, catalysts, such as hydrochloric acid, and enzymes, is likely to hinder market growth. Starch is sourced from plants such as potatoes, corn, peas, and others. In June 2025, ChemAnalyst Data Private Limited reported that the price of corn starch FOB increased consecutively through May and June and reached a record USD 550/MT. With a rise in the prices of starch, the production cost of dextrin is likely to increase, which can lead to an increase in the prices of end products. This is likely to lead to deteriorating affordability of dextrin products in the market.

- Side effects of high consumption of dextrin: The consumption of dextrin, especially wheat dextrin, is prone to side effects. Consuming such dextrin, people often suffer from bloating, gastrointestinal distress, and flatulence. Individuals also face digestive discomfort with symptoms of bloating, diarrhea, and gas at the initial phase of consuming resistant dextrin.

Dextrin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.9 billion |

|

Regional Scope |

|

Dextrin Market Segmentation:

Type Segment Analysis

The maltodextrin segment is expected to account for a market share of 45.2% by the end of 2035 due to its cost-effectiveness and different functional ingredients that can be added to food items to improve their taste, texture, and shelf life. Regulators are also promoting the use of maltodextrin as a safe ingredient to be used in the production of different food items. For example, in August 2024, the Food Safety and Inspection Service agency of the U.S. Department of Agriculture listed maltodextrin as a safe ingredient suitable for use in producing meat, egg, and poultry products.

Source Material Segment Analysis

By 2035, the corn segment is anticipated to acquire a market share of 72.5%, owing to its global availability and cost-effectiveness. According to the USDA Foreign Agriculture Service agency, in 2024, around 377.63 million metric tons of corn were produced only in the U.S, while China produced 294.92 million metric tons of corn in the same business year. The rising popularity of yellow corn dextrin for the encapsulation of flavorings and water-insoluble oils, which has led companies to produce yellow corn dextrin, influences the domination of the corn segment. For instance, in March 2025, Cargill announced the establishment of a new corn milling plant in India in collaboration with Saatvik Agro Processors to make the production of corn dextrin more convenient and to meet the rising demand for high-quality and safe food solutions.

End use Segment Analysis

The food & beverage segment is expected to emerge as the largest end-use industry of dextrin by the end of 2035, acquiring a revenue share of 62.1%, due to the expanding use of the ingredient in the production of food and beverages. Rising demand of consumers for healthier and low-sugar food and beverages is another factor influencing the dominance of the segment. Organizations are also innovating in the use of dextrin in different foods and beverages. For instance, in March 2023, a conglomerate named Meiji Group, which is based in Japan, made a disclosure of the use of digestion-resistant dextrin in its home delivery specialized product, Meiji 5-Start Custom, initiated to support the health of organizational customers.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Source Material |

|

|

End use |

|

|

Functionality |

|

|

Distribution channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dextrin Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific dextrin market is expected to account for a share of 40.1% by the end of 2035, as a consequence of demographic and economic growth within the region, which is fueling the demand for healthy food consumption. As reported by the UNESCO-UNEVOC International Centre for Technical and Vocational Education and Training (TVET) in July 2025, Asia Pacific accounts for more than one-third of the global GDP at buying power parity due to a vast population of 4.3 billion. The availability of raw materials required for the production of dextrin also fuels the market growth. As reported by the Indian Council of Agricultural Research, in India, corn is the leading source of starch and related derivatives. In 2023, India produced 88.3 million tons of corn.

The dextrin market in China is set to expand rapidly, acquiring a significant revenue share by the end of 2035, on account of its global position as the largest producer of dextrin. The high starch production capacity of China is another significant factor that influences the growth of the market. As reported by the Province of Manitoba in June 2023, China accounted for 59.4% of the total production of starch in the Asia Pacific. The high amount of starch production within the country indicates accessibility to readily available and cheaper raw materials required for the production of destrin. As a result, the prices of dextrin are likely to remain stable in China, increasing its affordability in the market.

The dextrin market in India is anticipated to expand at a significant CAGR during the forecast period, owing to the expansion of the industries that are users of different dextrin products, including automotive. As reported by the National Institute for Transforming India in August 2024, during the timeframe from 2016 to 2024, EV sales in India grew from 50,000 to 2.08 million. This factor indicates an increased use of dextrin in India. Dextrin is used as a low-cost and eco-friendly binder in batteries integrated in EVs. Moreover, dextrin is used for sizing and finishing agents in textiles and garments. Government support to help the textile and garment industry achieve global exposure also boosts the market growth. As reported by the Press Information Bureau in July 2025, the recently organized Bharat TEX 2025 of the Export Promotion Councils of India was supported by the government of India to display the strengths of the nation’s textile value chain.

North America Market Insights

North America is expected to emerge as a mature market by 2035, with the acquisition of 24.8% of revenue share, as a consequence of the consistent growth of the processed food sector. This increases the demand for using the thickening properties of dextrin during the processing of food items so that their tastes can be retained. The shift of the Cosmetic Industry in North America to the use of natural ingredients across the region also influences the scope of more adoption of dextrin, especially when consumers of beauty products are also demanding sustainable product consumption. As reported by the CAS division of the American Chemical Society in May 2024, around 40% of shoppers of beauty products prioritize natural elements nowadays.

The U.S dextrin market is set to expand at a significant CAGR between 2026 and 2035, due to the growing demand for sustainable products and a high focus on producing advanced dextrin. As reported by the Institute of Food Technologies in November 2023, companies, such as Grain Processing Corporation (GPC), Marroquin Organic International, Vego, Global Organics, Ltd., are producing maltodextrin and resistant dextrin actively in the U.S. Considering the needs of U.S customers for sustainable ingredients, these companies are producing a significant amount of dextrin.

By 2035, Canada dextrin market is expected to witness a significant expansion, as a consequence of the rising demand for gluten-free products. The use of corn and tapioca as ingredients in the production of dextrin makes it a gluten-free product, and due to this factor, dextrin is likely to be increasingly adopted across different industries in Canada. The vast production of corn in Canada indicates stability in the production of dextrin. As reported by Agriculture and Agri-Food Canada in May 2025, during the financial year 2024-2025, 19.3 Mt of corn was produced in Canada.

Europe Market Insights

Europe dextrin market is expected to experience a robust expansion by end of 2035, owing to stringent environmental regulations that are promoting the use of dextrin as a suitable additive in food products. In August 2025, the European Food Safety Authority, in its re-evaluation of the safety of food additives, kept Beta-cyclodextrin permitted to be added to food items. The rising demand for sustainable packaging across Europe also fuels the market growth. Regulators are also implementing laws to promote sustainable packaging across Europe. For example, in November 2024, the adoption of the Packaging and Packaging Waste Regulation (PPWR - Regulation (EU) 2025/40) was adopted by the EU with the motive of fostering the transition to a circular and competitive economy in packaging and in the management of related waste. The nontoxicity, biodegradability, and eco-friendliness of dextrin make it an ideal ingredient to be used for sustainable packaging.

The dextrin market in Germany is expected to witness a rapid expansion during the forecast period, owing to the rising demand for processed food and clean label. Technological advancements in Germany in the production of dextrin also fuel the market growth significantly. The expansion of companies that are involved in the development of dextrin also accelerates the market growth in Germany. In March 2024, the Germany-based manufacturer of technology for the biotech and chemical sector, and cyclodextrin, revealed its year-end capitalization in the market based on shares of USD 6.6 billion as of December 2023. The year-end capitalization of the business indicates the scope of further expansion of the business due to involvement in the cyclodextrin production.

By 2035, the UK dextrin market is expected to account for a remarkable revenue share, due to the shift of consumers towards sustainable consumption. Stability inflation in the food sector of the UK fuels the market growth by influencing the use of dextrin as a cost-effective ingredient for thickening purposes.

Key Dextrin Market Players:

- Cargill

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Archer-Daniels-Midland Company

- Tate & Lyle PLC

- Roquette Frères

- Ingredion Incorporated

- Avebe U.A.

- Emsland-Stärke GmbH

- Grain Processing Corporation

- Matsutani Chemical Industry Co., Ltd.

- AGRANA Beteiligungs-AG

- Wacker Chemie AG

- Meelunie B.V.

- Agridient Inc

- Global Bio-Chem Technology Group Co., Ltd.

- Santosh Starch Products Ltd

The presence of large, medium, and small-sized companies involved in the production and supply of dextrin, and the rising demand for dextrin globally, collaboratively make the competitive landscape of the market highly intensified. The key market players, by innovating in the development of dextrin through investments in research and development, are launching advanced dextrin items to supply the same across different industries, including food and beverages, automotive, packaging, and others.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Cargill inaugurated a new facility of retail feed facility at Granger, Washington, as an expansion of the Animal Nutrition and Health business segment. The new production plant incorporates technologies to modernize organizational production, including the production of dextrin, with the use of technology.

- In July 2025, Brenntag announced the collaboration with Royal Avebe with the motive of serving the customers in the U.S with specialty starch, fiber, and proteins. The supply of such specialty starch is likely to make dextrin production more sustainable.

- In June 2025, Agrana revealed its plans to join Ingredion to expand the business in Romania. The joint venture has been planned to improve the production of starch, required for the production of dextrin.

- In February 2024, Ingerdion launched the new NOVATION Indulge 2940 functional native starch, required for the production of dextrin. It is a label-friendly ingredient that helps the company to meet the demands of health-conscious consumers who are seeking indulgent and plant-based textures in their food items.

- Report ID: 8065

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dextrin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.