Construction Software Market Outlook:

Construction Software Market size was USD 11.3 billion in 2024 and is estimated to reach USD 34.2 billion by the end of 2037, expanding at a CAGR of 8.9% during the forecast period, i.e., 2025-2037. In 2025, the industry size of construction software is evaluated at USD 12.3 billion.

The increasing adoption of modern technologies in construction and infrastructure projects is estimated to fuel the adoption of advanced software technologies. The production and supply of construction software technologies are directly proportional to the wider building and IT services field. The supply chain changes have the potential to impact the overall market growth. The U.S. Bureau of Labor Statistics (BLS) states that in 2023, the Producer Price Index (PPI) for construction machinery manufacturing increased by 5.7% YoY. This highlighted the rise in capital goods necessary for software and hardware employment. Also, the Consumer Price Index (CPI) registered a hike of 4.2%, particularly for housing-related IT services. This underlined the increasing need for digital technologies in the construction and infrastructure development projects.

The investment strategies by the government entities are creating a lucrative space for construction software manufacturers. For instance, in 2021, more than USD 1.15 trillion was allocated by the U.S. government under the Infrastructure Investment and Jobs Act (IIJA) for the production of advanced construction technologies. Such allocation of funds for the construction technology sector is contributing to the overall market growth. Furthermore, the increasing global trade for smart construction technologies is expected to open new avenues for leading companies. For instance, in 2023, the U.S. Census Bureau trade data revealed that the construction-related imports of sensors, networking tools, and smart IoT components increased by around 6.9%. Germany, Australia, Canada, and the U.S. are expected to register high demand for advanced construction software solutions in the years ahead.

Key Construction Software Market Insights Summary:

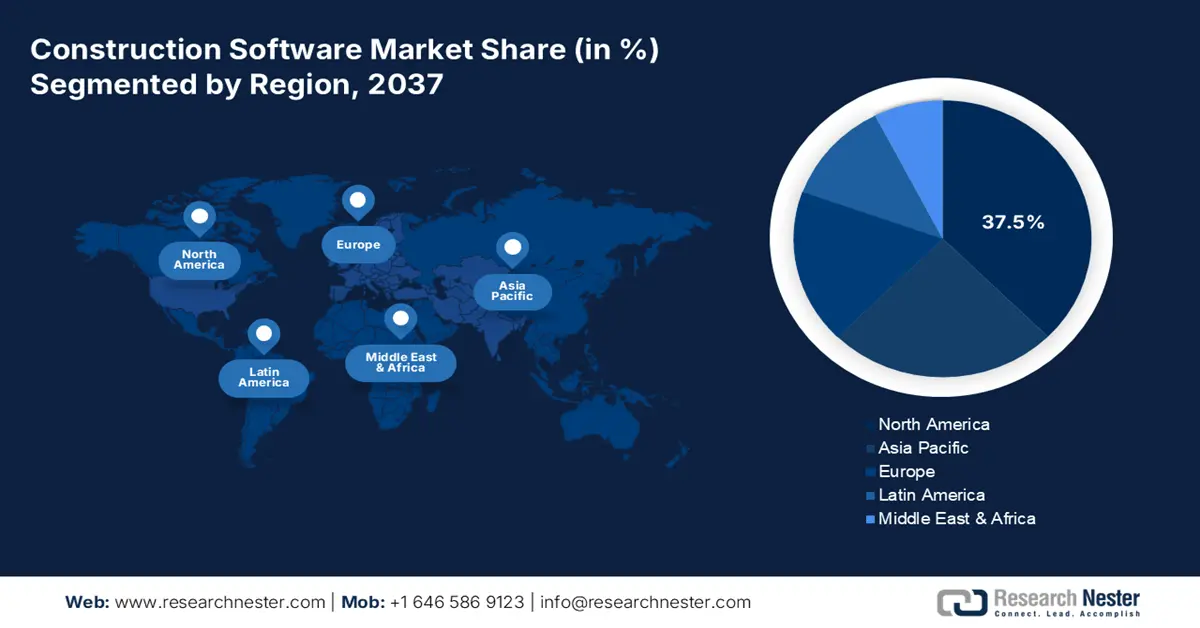

Regional Insights:

- The North America Construction Software Market is projected to secure a 37.5% revenue share through 2037, underpinned by robust residential and commercial construction investments.

- The Asia Pacific region is expected to grow at the fastest pace from 2025–2037, amplified by rising government spending on large-scale infrastructure development projects.

Segment Insights:

- The cloud-based segment of the Construction Software Market is anticipated to hold a 63.2% share by 2037, strengthened by its long-term cost advantages and versatility.

- The project management segment is set to maintain a 45.1% share throughout the forecast period, fostered by rising emphasis on reducing human error and improving project outcomes.

Key Growth Trends:

- Smart infrastructure & supportive government initiatives

- Increasing automation demand

Major Challenges:

- Complex regulations worldwide

- Strict data privacy & protection policies

Key Players: Autodesk, Inc.,Procore Technologies, Inc.,Bentley Systems, Inc.,Oracle Corporation,Trimble, Inc.,Nemetschek Group,SAP SE,Hexagon AB,PlanGrid (Autodesk Subsidiary),Corecon Technologies, Inc.

Global Construction Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 11.3 billion

- 2025 Market Size: USD 12.3 billion

- Projected Market Size: USD 34.2 billion by 2037

- Growth Forecasts: 8.9% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Australia, Singapore, United Arab Emirates

Last updated on : 6 October, 2025

Construction Software Market - Growth Drivers and Challenges

Growth Drivers

- Smart infrastructure & supportive government initiatives: The increasing investments in infrastructure development initiatives, such as smart cities, rail, and road, are likely to increase the adoption rate of construction software solutions. According to the study by the Global Infrastructure Outlook, the investment needs are expected to rise from USD 3.3 trillion in 2022 to USD 4.0 trillion by 2032. Furthermore, the supportive government programs and policies, including the U.S. Infrastructure Investment and Jobs Act and India’s PM Gati Shakti plan, are likely to accelerate the implementation of digital technologies in the construction industry.

- Increasing automation demand: The increasing costs of the workforce and shortage of laborers are emerging as fruitful opportunities for construction software producers. According to the analysis by the U.S. Bureau of Labor Statistics, the shortage of nearly 500,001 skilled workers was registered in 2023. The automation and digital trends are driving contractors to invest in advanced construction software technologies. To align with this trend, PlanGrid, a construction tech company, is concentrating on advancing the development of mobile-first solutions and automation.

Technological Advancements in the Construction Software Market

The integration of advanced technologies is set to enhance the productivity of construction contractors and other end users. IoT-driven technologies are expected to propel the capabilities and sales of construction software solutions in the coming years. The table below highlights the outcome of advanced technologies in the construction sector.

|

Technology |

Sector Application |

Company |

Metric |

|

AI & Predictive Analytics |

Infrastructure Projects |

Autodesk |

24.2% enhancement in project timeline accuracy |

|

BIM Integration |

Public Infrastructure |

Trimble |

Mandated in 73.3% of EU public construction contracts |

|

Cloud Collaboration |

Telecom Construction |

Procore |

30.2% YoY adoption rise in cloud modules |

AI & ML Integration in the Construction Software Market

The introduction of AI, ML, and predictive analysis is estimated to accelerate the productivity and efficiency of end users. Architects and designers are expected to invest heavily in the digital technologies integrated construction solution to enhance their final results and cut labor costs. The table below highlights the effectiveness of smart technologies in construction.

|

Company |

Integration of AI & ML |

Outcome |

|

Autodesk |

AI-driven design simulations for construction modeling |

35% reduction in development time |

|

Procore |

AI for supply chain/logistics planning |

22% reduction in logistics costs |

|

Bentley Systems |

ML for infrastructure modeling and predictive project planning |

28% faster project delivery timelines |

Challenges

- Complex regulations worldwide: The different regulations for software technologies are creating a major barrier to the revenue growth of key players. Companies are unable to launch their products owing to complex regulations, which are directly affecting them from earn high profits through trending opportunities. In 2023, Procore Technologies witnessed a market entry barrier in the Middle East region due to complex procurement policies, which delayed their new construction software launches.

- Strict data privacy & protection policies: The stringent data protection policies are expected to hamper the sales of advanced construction software solutions. The need to ensure data privacy compliance is increasing the operational costs for end users and lowering the launch of new solutions, which is hindering the revenue growth of producers. In 2022, the introduction of the Data Protection Bill delayed the launch of various software solutions, including the construction ones.

Construction Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.9% |

|

Base Year Market Size (2024) |

USD 11.3 billion |

|

Forecast Year Market Size (2037) |

USD 34.2 billion |

|

Regional Scope |

|

Construction Software Market Segmentation:

Deployment Type Segment Analysis

The cloud-based segment is anticipated to capture 63.2% of the global construction software market share by 2037, owing to its long-term cost benefits and versatility. According to the General Services Administration (GSA), the cloud-based construction software solutions boost the security and efficiency of federal projects. The backing from the government entities is projected to increase the importance and adoption of construction software during the foreseeable period. Furthermore, the report by the Construction Industry Institute (CII) highlights that cloud technologies have the potential to mitigate the cost of hardware. The same source also states that nearly 86.5% of the contractors are planning to use cloud software solutions in their construction projects.

Application Segment Analysis

The project management segment is foreseen to hold 45.1% throughout the forecast period. The need to reduce human error and enhance the outcome, the majority of constructors are investing in project management technologies. The National Institute of Building Sciences (NIBS) underscores that the use of building information modeling with other technologies, including cloud platforms, increases the interoperability and productivity. The robust growth in the smart infrastructure activities worldwide is estimated to double the revenues of construction service producers during the foreseeable period.

Our in-depth analysis of the construction software market includes the following segments:

|

Segment |

Subsegment |

|

Deployment Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Construction Software Market - Regional Analysis

North America Market Insights

The North America construction software market is projected to account for 37.5% of the global revenue share through 2037. The robust investments in the construction sector, both residential and commercial, are set to open lucrative doors for construction software manufacturers. In 2022, the housing completions increased by around 6.0% in the U.S., according to the Census Bureau. The supportive government regulations and programs, including the U.S. Bipartisan Infrastructure and Innovation and Canada’s Science and Economic Development (ISED), are accelerating modernization in the construction sector.

The market for construction software in the U.S. is estimated to be valued at USD 6.3 billion by 2037. Ahead in new technology adoption, the country is poised to drive the sales of construction software solutions in the years ahead. The U.S. Census Bureau underscores that in 2023, over 7.5 million employees in the construction sector were using software solutions to increase their efficiency. The ongoing and planned public investments in the construction sector are also contributing to the smart tech solution sales.

Canada is expected to witness a high demand for construction-based cloud and project management solutions in the coming years. Swiftly increasing construction projects in the country are accelerating the demand for innovative software solutions to boost productivity and efficiency. The analysis by Statistics Canada projects that around 9.3% growth in the construction contracts was registered in 2024. Furthermore, the government’s funding support for modern construction technologies is backing the overall market growth. In 2023, the ISED of Canada allowed nearly USD 199.5 million of 5G innovation grants to support digital construction.

APAC Market Insights

The Asia Pacific construction software market is set to expand at the fastest CAGR between 2025 to 2037. The increasing government spending on infrastructure development projects is estimated to fuel the demand for construction software solutions. The digitalization trend in China, India, South Korea, and Japan is likely to offer high revenue-generating opportunities to construction software companies in the years ahead. The positive foreign direct investments in the tech and construction sectors are projected to propel the overall market growth in the Asia Pacific countries.

The heavy public investments in the ICT infrastructure are set to drive innovations in the construction software technologies in China. The active support of the Ministry of Industry and Information Technology (MIIT) is estimated to offer double-digit percent revenue growth opportunities to construction software companies. Overall, the Research Nester’s study states that the rapid space urbanization and industrialization in the country registered over 11.0% growth in construction-tech spending in the last 5 years.

The smart city projects and digital infrastructure developments are generating profitable opportunities for construction software producers in India. The rail, airport, and road infrastructure growth is emerging as a significant trend in the construction software production. Supportive government policies and foreign direct investments are poised to positively fuel the market shares of construction software producers. The India Brand Equity Foundation (IBEF) study estimates that the FDI in the construction development and activity sectors totaled USD 27.7 billion and USD 35.2 billion, between April 2000 and September 2024.

Key Construction Software Market Players:

- Autodesk, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Procore Technologies, Inc.

- Bentley Systems, Inc.

- Oracle Corporation

- Trimble, Inc.

- Nemetschek Group

- SAP SE

- Hexagon AB

- PlanGrid (Autodesk Subsidiary)

- Corecon Technologies, Inc.

The key players in the construction software market are uplifting their market position by investing heavily in research and development activities. Innovative product launches are attracting tech-savvy companies and doubling the revenues of end users. The cross-border partnerships are also maximizing the production of construction software solutions. Several market players are entering into strategic partnerships to boost their market reach and market presence on a global scale. The organic and inorganic marketing strategies are likely to propel the revenues of construction software companies in the years ahead.

Recent Developments

- In July 2024, HammerTech announced that it had raised around USD 70.1 million from Riverwood Capital to improve its AI-driven safety platform. The funding integrates advanced digital technologies, enhancing worker safety and productivity.

- In July 2024, Nemetschek Group launched a tailored ERP solution for the construction sector in India. This move led to a rise of 12.1% in the revenue of Nemetschek in the third quarter of 2024.

- Report ID: 3726

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Construction Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.