Composite Preforms Market Outlook:

Composite Preforms Market size was valued at USD 298.8 million in 2025 and is projected to reach USD 519.7 million by the end of 2035, rising at a CAGR of approximately 5.9% during the forecast period from 2026 to 2035. In 2026, the industry size of composite preforms is evaluated at USD 307.3 million.

The global composite preforms market is anticipated to grow significantly by 2035, primarily due to the backlog in transportation equipment assembly, which implies future demand for preform components. As per the data of the U.S Census Bureau, Manufacturers’ Shipments, Inventories, and Orders (M3) recorded that the unfilled orders of the manufactured durable goods in June 2025 were USD 1,470.0 billion, representing high production commitments, which are expected to be converted into future composite preform use in mobility and transport markets. In addition, U.S. federal R&D investment promotes the technologies, which frequently serve as foundations of advanced materials supply. NASA has allocated USD 1.2 billion in its fiscal year 2025 budget for its Space Technology portfolio, which aims to positively improve high-performance materials and manufacturing techniques. Similarly, the U.S. Department of Energy has an Advanced Materials and Manufacturing Technologies Office (AMMTO) that supports projects to reinforce material production; for instance, USD 33 million is currently available to develop smart manufacturing and resilient materials supply systems. The Producer Price Index (PPI) of the Bureau of Labor Statistics (Other reinforced and fiberglass plastic products) increased from about 218.475 in April to 222.437 in July 2025, which shows a slow increase in costs of inputs related to composites.

A larger set of durable goods supply commitments offers some indirect information, such as the remaining orders of the manufacturers of durable goods were USD 1,470.0 billion in June 2025, is an indicator that the manufacturing line and the upstream supply chains (fiber, textile preforms, molding) will have to scale to accommodate the upcoming demand. The backlog in manufacturing at the national level is associated with international trade in raw materials like carbon and glass fiber, which usually come in through industrial goods trade codes recorded by the U.S. trade data. Infrastructure Government sponsorship in manufacturing is demonstrated in its support of facilities like those in the convergent manufacturing platform at Oak Ridge National Laboratory, funded by AMMTO and the Department of Defense Industrial Base program, which enable higher-order material and assembly-line experimentation. Additionally, NASA issued USD 50 million in awards to 14 organizations under its Hi-Rate Composite Aircraft Manufacturing (HiCAM) initiative, aiming to develop manufacturing processes and advanced composite materials for aircraft structures, advancements that support prototype development, material processing techniques, and small-scale structural performance evaluation in composite preform technologies.

Key Composite Preforms Market Insights Summary:

Regional Highlights:

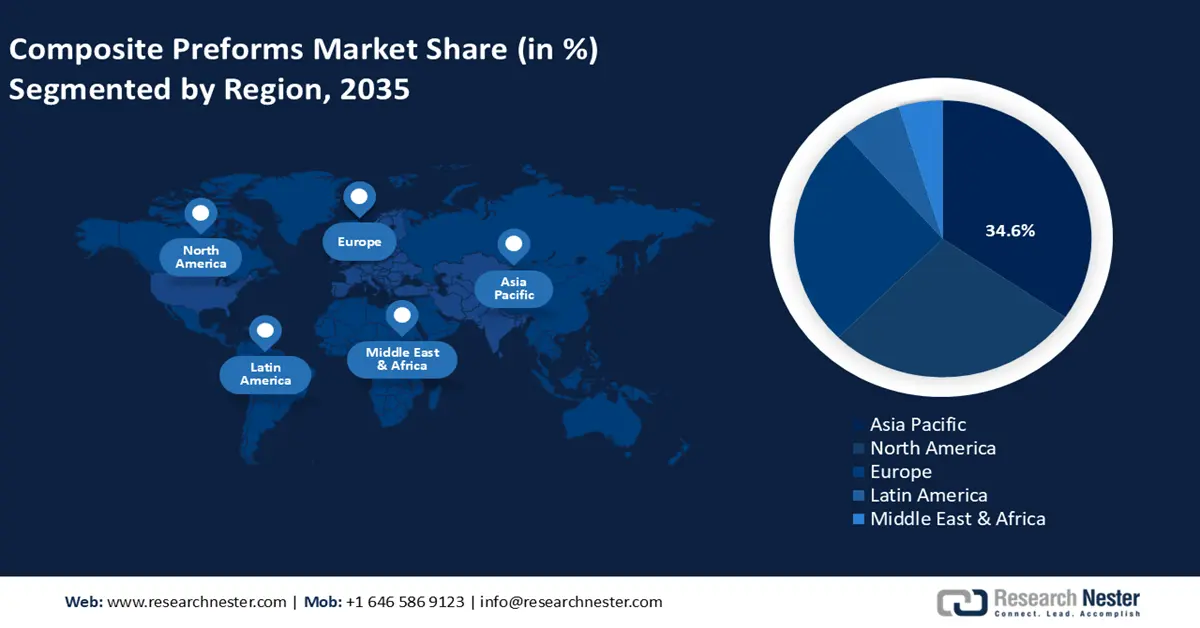

- Asia Pacific is projected to lead the composite preforms market with a 34.6% share by 2035, propelled by supportive government policies on advanced manufacturing, renewable energy expansion, and adoption of durable lightweight materials.

- North America is expected to secure a 27.8% revenue share by 2035, owing to strong federal initiatives for industrial decarbonization and funding support for domestic production of advanced composite materials.

Segment Insights:

- The carbon fiber segment is anticipated to account for a dominant 52.3% share by 2035 in the composite preforms market, propelled by its lightweight and high-strength properties supporting advancements in aerospace and defense applications.

- The aerospace and defense segment is expected to capture a 48.6% share by 2035, sustained by increasing aircraft production and defense modernization initiatives utilizing advanced composite materials.

Key Growth Trends:

- Lightweight automotive policies

- Aerospace growth commitments

Major Challenges:

- Infrastructure & logistics bottlenecks

- Sustainability mandates and green certification

Key Players: Hexcel Corporation, SGL Carbon SE, Zoltek (Toray Subsidiary), Hyosung Corporation, Owens Corning, Solvay S.A., Hexcel (France operations), Formax UK Ltd. (Hexcel JV), Oxford Performance Materials, Carbon Conversions, Inc.

Global Composite Preforms Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 298.8 million

- 2026 Market Size: USD 307.3 million

- Projected Market Size: USD 519.7 million by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Brazil, United Kingdom, France, Australia

Last updated on : 5 September, 2025

Composite Preforms Market - Growth Drivers and Challenges

Growth Drivers

- Lightweight automotive policies: Dinting that remains in the automotive policies polysomniform of composite preforms is as the regulators posed tougher emissions and efficiency standards. The U.S. Department of Transportation (DOT) and NHTSA reached a final federal rule on fuel economy, setting an average 58 miles per gallon (mpg) fleetwide goal by 2032, with a 5% improvement per year in passenger cars and a 4% in light-weight trucks. Compliance puts pressure on automakers to replace heavy metal elements with structures comprising composite material. Simultaneously, this is combined by the constant rise of electric cars, with government records indicating that in 2022, according to the U.S. Department of Energy, electric vehicles accounted for 6.1 % of new light-duty vehicle sales. By November 2023, more than 1.2 million plug-in electric vehicles had been sold, representing 9% of new light-duty vehicle sales. Composite preforms that permit high-strength light weighting in crash structures, battery enclosures, and others take centre stage in fulfilling these two mandates.

- Aerospace growth commitments: Aerospace industry is a long-term customer of composite preforms as the sector operates based on the backlog-based demand and funded development of new advanced materials by the government. The 2025 budget of NASA has a USD 1.2 billion commitment to the Space Technology Mission Directorate, and the significance lies in next-generation materials and manufacturing systems, such as high-end composites to be used in structures and propulsion systems. This aligns with commitments in global aerospace production, as in 2025, unfulfilled orders for U.S. transportation equipment, such as airliners, amount to USD 1,470.0 billion. Such backlogs guarantee a long-term pipeline of composite-intensive assemblies, including wing ribs and fuselage reinforcements.

- Energy transition & infrastructure investments: Composite preforms are an important component of the global energy transition, which is embedded in the use of wind blades, hydrogen storage, and pressure vessels. In December 2024, according to the U.S. Department of Energy, a new USD 20 million funding opportunity was announced to tackle technological and supply chain challenges in the recycling of fiber-reinforced composites such as those used in wind turbine blades, supporting innovation in preform-like materials, end-of-life processing, and sustainable composite manufacturing scale-up. In addition, U.S. installed wind capacity stood at 147.5 GW in 2023, requiring thousands of giant composite blades each year. A key area where carbon-fiber preforms will be needed in the future is hydrogen infrastructure, where the U.S. Department of Energy has allocated USD 8 million across nine CRADA projects to advance H2@Scale and support the Hydrogen Shot goal of cutting hydrogen costs by 80% within a decade. These projects utilize the ARIES platform to integrate hydrogen into future energy systems with emphasis on storage, safety, and risk mitigation. This integration labels composite performances as strategic drivers of low-carbon infrastructure, the special feature measured against policy-supported clean energy implementation.

Challenges

- Infrastructure & logistics bottlenecks: Composite preforms, particularly those for large wind blades and aerospace parts, face severe logistical constraints. According to the data of the U.S. Department of Energy, the national wind power capacity increased to 147.5 GW as of 2023. According to the National Renewable Energy Laboratory (NREL), transportation accounts for approximately 10% of the upfront capital cost of a wind project. DOE emphasises that such huge loads often face delays at ports and highways, restricting the role of just-in-time delivery to the assembly surface. This increases the working capital requirement and scheduling inefficiency in the suppliers of composite preforms, making them less competitive. These insufficiencies in infrastructure are still a structural barrier to scale and deployment of composites across the renewable energy and aerospace industries.

- Sustainability mandates and green certification: Sustainability demands are also mounting pressure on the supply of composite preforms, and compulsory certification increases the cost. As per the European Commission, the global production of chemicals is expected to double by the year 2030, which necessitates safe and sustainable chemical innovations. European Union (EU) Strategy on chemicals promotes investment in “safe and sustainable by design” chemicals that are aligned with the Green Deal. They are also in the process of eliminating dangerous chemicals while strengthening supply chain resilience. This kind of policy from the government is speeding up the transformation to eco-compliant green chemistry.

Moreover, the European Union (EU) has also introduced the EU Ecolabel, which is a voluntary award system granted to products and services that meet high environmental standards across their entire life cycle. This award aims to reduce the environmental impact and actively foster the circular economy. Undergoing a certification process that involves a lifecycle assessment system and must be approved by independent organizations to ensure that declared standards of resources, emissions, and recyclability are met, may create delay challenges for the companies. These hurdles may slow market expansion by raising barriers for smaller manufacturers and increasing overall production costs, making it harder to compete with non-certified alternatives.

Composite Preforms Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 298.8 million |

|

Forecast Year Market Size (2035) |

USD 519.7 million |

|

Regional Scope |

|

Composite Preforms Market Segmentation:

Fiber Type Segment Analysis

The carbon fiber segment is expected to grow with the largest revenue composite preforms market share of 52.3% during the projected years, owing to its lightweight and high-strength properties required in the aerospace and defense sectors. The U.S. Department of Energy (DOE) states that the weight of aircraft can be decreased by up to 20% due to carbon fiber composites, decreasing the fuel use by a substantial amount. In addition, the U.S. Department of Defense has requested USD 842 billion for Fiscal Year 2024, which includes a record USD 145 billion investment in research, development, test, and evaluation (RDT&E) and the largest-ever procurement budget of USD 170 billion. The budget also includes USD 9.1 billion for the Pacific Deterrence Initiative, a 40% increase from FY 2023, and USD 1.5 billion for Guam's missile defense. These funds enable lightweight, high-performance materials like carbon fiber composites, which are essential for future aircraft, missile systems, and defense platforms that rely on advanced composite components for enhanced performance and durability.

PAN-based carbon fiber, produced from polyacrylonitrile, dominates aerospace, automotive, and wind energy sectors because of its superior tensile strength-to-weight ratio and proven reliability in structural applications. The U.S. Department of Energy points out that over 90% of carbon fiber in the world is produced using PAN precursors, indicating their importance in light-weighting to achieve energy efficiency. In comparison, pitch-based carbon fiber is based on the tar pitch of petroleum or coal and is used in high-modulation applications with defense, satellite components, and industrial tooling. Its rigidity and dimensional stability are required in accurate systems, particularly where thermal resistance and durability of structure are needed.

End use Segment Analysis

The aerospace and defense segment is projected to grow with a notable composite preforms market share of 48.6% by 2035. The Federal Aviation Administration (FAA) estimates a growth of around 2.0 to 2.5% in U.S. passenger air travel that will stimulate new aircraft acquisitions. Airbus and Boeing make use of composite preforms in wings and fuselages, and new technology carbon fiber preforms minimize material scrap substantially. In the defensive alliance, the U.S Department of Defense and NATO partnership are upscaling the lightweight composite integration of the drones, fighter airplanes, as well as the naval ships. European Defence Agency reveals that the high adoption of composite materials in defense may result in lifecycle maintenance costs decreasing significantly, resulting in larger market penetration.

Light-weighting strategies in commercial aircraft include composites; the FAA reportedly has more than 50% of the current plane structures featuring composites, such as the Boeing 787 and the Airbus A350, with such designs permitting fuel savings of up to 20% and lowering lifecycle emissions. Meanwhile, spacecrafts and satellites are growing increasingly dependent on composite preforms which provide good high strength/weight ratios, radiation tolerance, and thermal stability. NASA describes the importance of advanced composites in launch mass reduction by 30% saving translates to thousands of dollars saved on all launches, making them invaluable in long missions and cost-effective missions.

Perform Architecture Segment Analysis

The 3D-woven preforms segment is expected to grow at a steady pace over the forecast year, driven by its advanced strength, minimized waste, and aligned regulations. The U.S. DOE documents 15% to 30% decreases in the weight of aerospace constructions, which enhances efficiency but also decreases material waste by 30%. Their impact on car safety can be found in bumper crash absorption, which raises the safety by 20% during the EU's light-weighting ambitions. The 3D-woven composite turbine blades on wind turbines have lifespans that are 15-20 years longer and reduce replacement manufacturer expenses. This is because of their balance in performance, sustainability, and economic efficiency that earns them the top spot in aerospace, automotive, and renewable energy sectors pet architecture.

Our in-depth analysis of the composite preforms market includes the following segments:

|

Segment |

Subsegment |

|

Fiber Type |

|

|

Preform Architecture |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Composite Preforms Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the global composite preforms market with the largest revenue share of 34.6% over the projected years by 2035, driven by impressive government policies on advanced manufacturing, renewable energy, and durable materials. According to the DOE, the U.S. offshore wind market is rapidly increasing, supported by robust state procurement guidelines targeting 42,730 MW by 2040 and a total of 112,286 MW capacity planned by 2050 across 13 coastal states. This development is facilitated by federal policies such as the Inflation Reduction Act, which provides tax credits and incentives to boost domestic manufacturing of wind turbine components, including blades, nacelles, towers, and foundations. Net-zero commitments by 2050, in contributions compiled in the Asia Pacific to the United Nations Framework Convention on Climate Change (NDCs), are also seeing increased investment in lightweight materials in regional governments. As industry automation and green chemistry continue to increase investment, the trend of demand in the Asia Pacific makes it the worldwide leader in manufacturing growth in composite preforms up to 2035.

By 2035, China’s composite preforms market is anticipated to lead the region, as the country is fully backed by both regional and national industrial policies. Stimulating high-tech materials, such as polymer composites and basalt fibers, authorities are pursuing in more than 80 industrial parks spanning 18 prefectures in Sichuan province, resulting in a pillar industry of trillion-level scale and greater capacity and innovation clusters. Similarly, Shanghai has issued measures to foster the high-end civil aircraft industrial chain, aiming to develop a world-class civil aviation cluster by 2026. The plan targets fostering over 60 key enterprises and supporting around 150 suppliers, with investments exceeding 70 billion yuan and an industrial scale of approximately 80 billion yuan. Monetary support includes up to 30% funding for composite-related R&D (max 100 million yuan per project), certification rewards, installation subsidy, manufacturing advancements, credit grants, and innovation platform construction to strengthen the entire large aircraft supply chain. A combination of this fiscal support, cluster development, and certification initiative enhances the domestic production of composite preform and lowers dependency on importations.

The composite preforms market in India is likely to grow with the fastest CAGR in the APAC region, during the projected years from 2026 to 2035, owing to the shifting policy frameworks that promote investment, sustainability, and innovation in processing. In accordance with the Plastic Parks scheme, the government proposes clustered processing of downstream composite and plastics-downgrades- strengthening infrastructure, prospects of exportation, and adoption of sustainable practices. In addition, the manufacturing and service-linked incentive program (UNNATI) program provides capex incentives up to 100% of the plant and equipment in manufacturing ventures to be located in specially designated zones, reducing entry barriers to composite preform plant building. Furthermore, the Defence Research and Development Organisation (DRDO) has come up with a 5 m composite bridge, which has 40% weight saved compared to a metallic bridge- exemplifying a government-led evolution in composite use. These programs are a mixture of incentives, infrastructure, and proof-of-concept projects to initiate the composite materials scenario in India.

North America Market Insights

The North American composite preforms market is projected to grow at a significant revenue share of 27.8% during the projected years, owing to government policies, such as the chemicals and petrochemicals sector, where the industry produces about 40% of industrial energy consumption and emissions, which are directly in the priorities of industrial decarbonization, according to the U.S. Department of Energy. In pursuit of transformation, the Industrial Efficiency and Decarbonization Office of DOE (IEDO) declared a USD 104 million funding facility to decarbonize chemicals, such as advanced separations and low-carbon process-heating technologies. The Advanced Materials and Manufacturing Technologies Office (AMMTO) also, in 2024, awarded domestic manufacturing of new materials USD 68 million under its SBIR programs. Such programs reduce the costs of manufacturing preforms in composite form and increase technology maturity. Additionally, federal allocations can support the needs of North American manufacturing companies such as DOE has increased the Energy Efficiency and Renewable Energy budgets by 65% between FY2021 and 2022 ($2.86B to $4.73B), thus helping execute more investments into materials and sustainable technologies. The investments make possible capacity expansions and innovation in composite preforms.

The U.S. composite preforms market is expected to lead the region, due to significant federal assistance in the industrial decarbonization and high-tech production. In September 2023, the Department of Energy (DOE) announced a funding opportunity of 104 million to fund clean-process chemicals and composites under its Industrial Efficiency and Decarbonization Office (IEDO). In March 2023, DOE issued about 6 billion in grants to decarbonize heavy industries, such as chemicals, becoming the largest industrial effort of its nature. Furthermore, DOE-sponsored Institute for Advanced Composites Manufacturing Innovation (IACMI) focuses on reducing carbon-fiber composite costs by 25%, the embodied energy by 50%, and the coverage of 80% of the composites. Better Plants Program has also assisted more than 280 industry partners to conserve energy worth 11.7 billion since 2009. These investments are speeding up the use of composite preforms in aerospace, automotive, and renewable energy in the U.S.

Canada’s composite preforms market is likely to expand at a steady pace over the forecast years, supported by federal government research and industry through the National Research Council (NRC). The NRC offers technological support in the development of composite structures, such as lightweight and high-performance parts in aerospace and transport. It has facilities such as liquid composite molding (RTM/VARTM) capabilities, automated fiber placement, and combined composite-metallic material capability. SNAP Composites is a low-cost thermoset composite technology designed to easily create low-cost volatile parts used in the automotive sector, which provides short cycles (less than 2 minutes) and system-in-one-part production. The Canadian manufacturers find it more cost-effective to use these federal programs in improving the performance of composites, supporting the adoption of composite preforms in areas experiencing high demand, such as defense, vehicle, and infrastructure.

Europe Market Insights

The European composite preforms market is predicted to grow at a substantial revenue share of 26.2%, reaching 2.8 million metric tons of production in 2022, with glass fiber dominating at nearly 95% of the region’s composite output. This growth is driven by its high adoption in the automotive, aerospace, energy, and industrial sectors, responding to the EU policies of reducing carbon intensity and promoting solutions of lightweight manufacturing. Germany is at the centre of the growth by harnessing its existing automotive industry and industrial belts to combine the high-performance composites preforms, to enhance vehicle efficiency and emissions requirements. Germany has been laying emphasis on carbon fiber and glass fiber development in order to achieve its 2030 climate goals.

Meanwhile, the UK is setting up large investments in next-generation composite technologies. The Advanced Manufacturing Plan of the UK government is investing £4.5 billion in innovation of sustainable composite performs, and a 250 million aerospace specialized decarbonization fund is being pushed towards sustainable composite performs. These efforts make Europe a leader in the sustainability of composites, and Germany continues to dominate at both the scale of industrial use and at the high technology development with high-value production in the UK. The two agencies collectively cement the position of Europe as a world centre of developed composite performers.

Key Composite Polymer Market Players:

- Hexcel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SGL Carbon SE

- Zoltek (Toray Subsidiary)

- Hyosung Corporation

- Owens Corning

- Solvay S.A.

- Hexcel (France operations)

- Formax UK Ltd. (Hexcel JV)

- Oxford Performance Materials

- Carbon Conversions, Inc.

The global composite preforms market of a leadership that is strongly controlled by large vertically integrated chemical companies that are well advanced in manufacturing. The aerospace-grade carbon fiber supply is dominated by companies such as Hexcel and Toray (Japan), having positive reinforcements of aerospace resumption research funding and exclusive resin systems. Manufacturers like SGL Carbon of Europe consolidate the market using size and regionalization of industries. Corporations like Kuraray and Teijin extend to high-performance fibers and chemistries of hybrid composites. Strategic collaborators and JV activities, like the Hexcel collaboration with Oxford Performance Materials and Carbon Conversions, that improve activities in recycled fibers, additive manufacturing, and circularity.

Top Global Composite Polymer Manufacturers

Recent Developments

- In March 2025, Teijin Carbon announced the Tenax Next HTS45 E23 24K carbon fiber filament yarn at JEC World. The new product provides 35% CO2 reduction over traditional carbon fiber yarn, a good start towards long-term, high-performance materials. The HTS45 E23 is manufactured with renewable energy and uses raw materials that are normal, sustainable, or recycled, and hence it focuses on performance and environmental responsibility. The Tenax Next line, manufactured using the established HTS high-tenacity carbon fiber with tensile strength of more than 4,800 MPa and a modulus of 240 GPa, has technical credibility without generating circularity in its production cycle.

- In January 2025, Hexcel Corporation introduced a series of high-tech composite solutions at Aero India in Bengaluru. Among the highlights were HexTow IM9 24K, the high-efficiency PAN-based carbon fiber designed to fit aerospace primary and secondary structures, and the HexPly M51 and M56 out-of-autoclave (OOA) prepregs designed to process high-rate subassemblies. Such technologies lead to compatibility with tape-laying and fiber-placement automation, which lowers the costs of manufacturing and avoids an expensive autoclave infrastructure. Another product introduced by Hexal was the Hitape, a high-performance carbon that allows automated lay-up and produces parts to a maximum of 30 mm thick.

- Report ID: 8070

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Composite Preforms Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.