Colorectal Cancer Therapeutics Market Outlook:

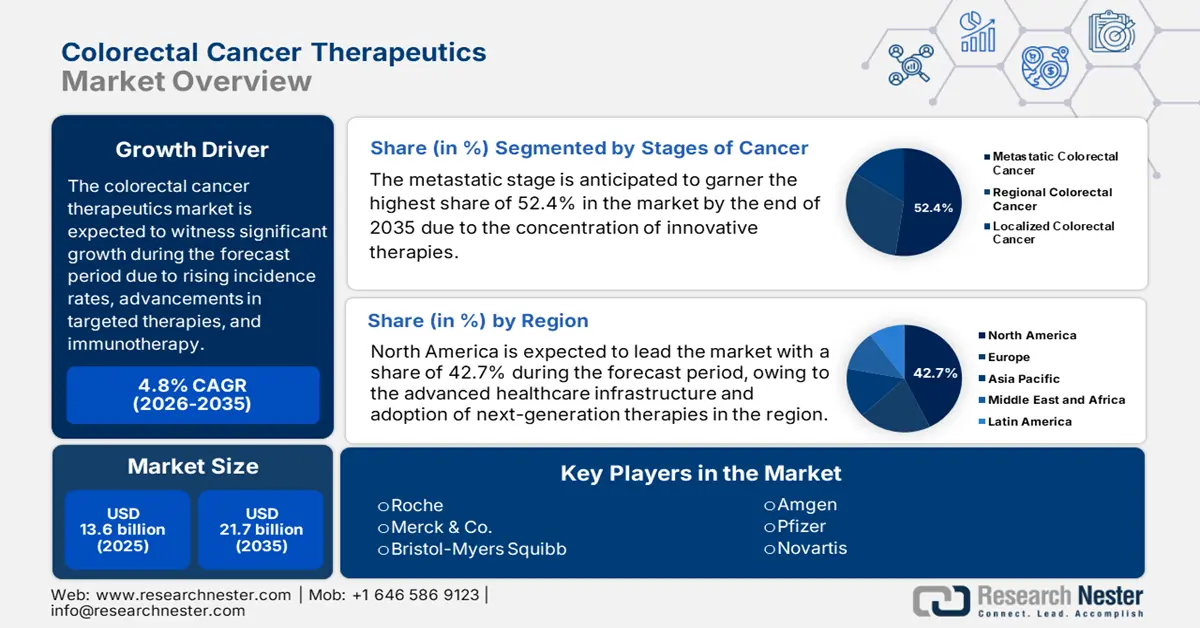

Colorectal Cancer Therapeutics Market size was valued at USD 13.6 billion in 2025 and is projected to reach USD 21.7 billion by the end of 2035, rising at a CAGR of 4.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of colorectal cancer therapeutics is evaluated at USD 14.2 billion.

The escalating instances of colorectal cancers and associated mortalities across all nations are primary drivers behind the robust growth of the market. Colon cancer is the 4th leading cancer in the world. As evidence in 2022, the Global Cancer Observatory report states that nearly 1,142,286 colon cancer were registered in 2022, and the death cases were 538,167. Further, as per the WHO 2022 report, the prevalence of colon cancer in the U.S. in the next five years is estimated to be 562,771. This rise demands the therapeutics, surgery, and the drugs related to the diseases.

According to an NLM article released in September 2024 on colorectal cancer, depicts that by 2030 the colorectal cancer may experience a rise of 71.5% in males and 60.0% in females. To address this issue, new developments in colorectal cancer therapeutics based on the immune therapy and targeted therapies are aiming to overcome the challenges with the less side effects and higher effectiveness. Advanced treatment in targeting RAS mutants by using RAS direct inhibitors, targeting the downstream pathways, and targeting RAS via metabolic pathways is demanding the treatment. On the other hand, the latest drugs approved by the FDA, such as Adagrasib, Alymsys (Bevacizumab), Avastin (Bevacizumab), Bevacizumab, Camptosar (Irinotecan Hydrochloride), Capecitabine, and more, are improving the care and treating the cancer effectively.

Key Colorectal Cancer Therapeutics Market Insights Summary:

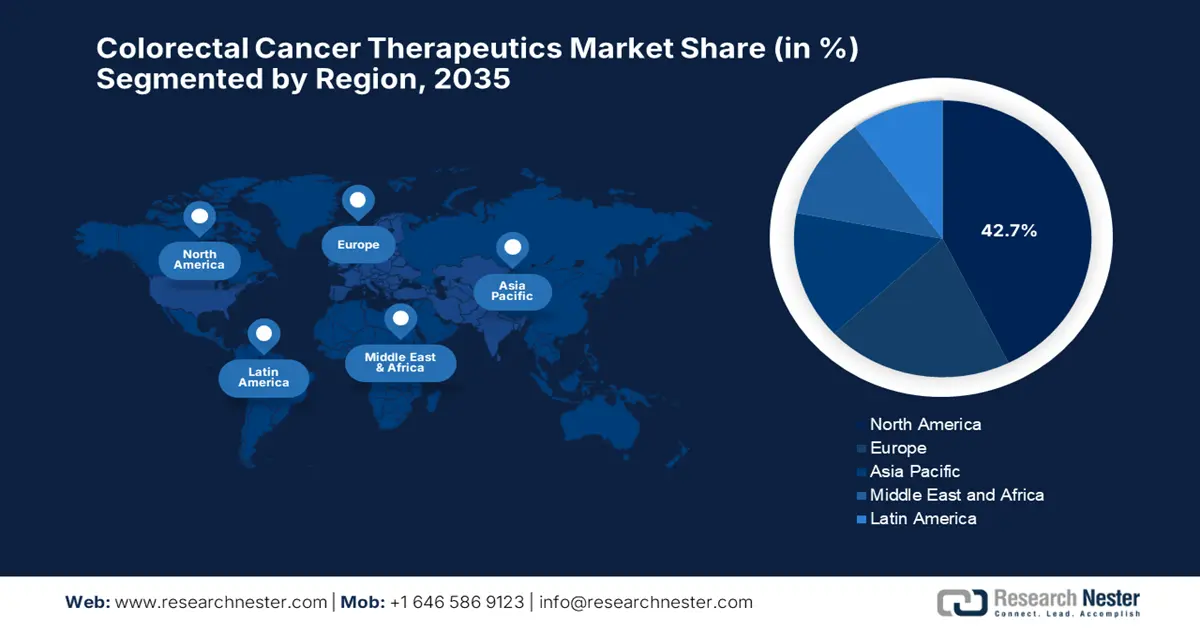

North America market is projected to account for the largest market share of 42.7% in the colorectal cancer therapeutics market during the forecast period.

Europe is likely to maintain its status as the second-largest contributor in terms of revenue throughout the assessed timeframe.

Asia Pacific is expected to register the fastest growth rate of 8.5% in the colorectal cancer therapeutics market during the projected period.

The metastatic stage is forecasted to secure the highest share of 68.4% in the colorectal cancer therapeutics market by 2035, based on cancer stage.

The targeted therapy segment is anticipated to achieve a substantial share of 52.5% in the market over the forecast timeline.

Key Growth Drivers:

- Critical benefits offered by early interventions

- Vigorous strategies implemented by global giants

Key Players:

- Roche, Merck & Co., Bristol-Myers Squibb, Amgen, Pfizer, Novartis, Sanofi, AstraZeneca, Eli Lilly, Bayer, Johnson & Johnson, GSK (GlaxoSmithKline), Celltrion, Biocon

Global Colorectal Cancer Therapeutics Market Forecast and Regional Outlook:

2025 Market Size: USD 13.6 billion

2026 Market Size: USD 14.2 billion

Projected Market Size: USD 21.7 billion by 2035

Growth Forecasts: 4.8% CAGR (2026-2035)

Largest Region: North America

Fastest Growing Region: North America

Last updated on : 22 August, 2025

Colorectal Cancer Therapeutics Market - Growth Drivers and Challenge

Growth Drivers

- Critical benefits offered by early interventions: With the proven validations offered by reputed organizations, the market displays greater acceptance. Testifying to the same, the National Cancer Institute report published in March 2025 states that a new blood test called Shield was approved by the FDA in 2024 for early detection of colon cancer. Further, the report states that 8000 people where test using the new test and 83% of the people results were positive. Such evidence and scaling liquid biopsy-based screening in emerging markets is anticipated to replicate the cost savings witnessed in the U.S. and EU.

- Vigorous strategies implemented by global giants: Considering the efficacy and acceptance offered by the colorectal cancer therapeutics sector, the global players are implementing continued strategies to facilitate revenue. For instance, in 2024, the U.S. FDA reported that Roche, in partnership with EU hospitals, deployed AI-based CRC technologies. Simultaneously, In September 2024, Merck’s KEYTRUDA has approved Plus Pemetrexed and Platinum Chemotherapy, which is a first line treatment for adult patient with advanced or metastatic malignant pleural mesothelioma.

- Precision medicine & biomarker-driven therapies: Biomarker testing (KRAS, NRAS, BRAF, MSI/dMMR) and companion diagnostics are demanding the targeted therapies and immunotherapies by enabling patient selection and higher response rates. Further, increased guideline recommendations and payer acceptance for molecular profiling expand the eligible patient pool and justify premium pricing for companion drug–diagnostic bundles. Manufacturers should prioritize co-development or partnerships with diagnostic firms to secure preferred access and real-world evidence programs.

Historical Patient Growth and Death Rate 2010–2022

|

Year |

New Cases per 100,000 Persons |

Death per 100,000 Persons |

|

2010 |

40.7 |

15.6 |

|

2011 |

39.5 |

15.2 |

|

2012 |

38.1 |

14.8 |

|

2013 |

37.0 |

14.6 |

|

2014 |

37.7 |

14.3 |

|

2015 |

36.8 |

14.2 |

|

2016 |

37.2 |

13.9 |

|

2017 |

36.3 |

13.7 |

|

2018 |

35.8 |

13.4 |

|

2019 |

35.5 |

13.1 |

|

2020 |

32.2 |

12.9 |

|

2021 |

35.7 |

12.9 |

|

2022 |

35.4 |

12.8 |

Source: National Cancer Institute

Analyzing the Cost Metrics of Colorectal Cancer Between India and U.S. (2022)

|

Common Metric |

India |

U.S. |

|

Median Total Cost of Colorectal Cancer Treatment |

₹407,508 |

US$93,967 |

|

Median Out-of-Pocket Payment (OOPP) |

₹330,277 |

US$4,417 |

|

Surgery Cost |

₹85,944 |

Reflected in perioperative OOP median US$2,146 |

|

Radiotherapy Cost |

₹55,525 |

+US$842 to OOP |

|

Chemotherapy Cost |

₹14,780 |

+US$1,368 to OOP |

Sources: PMC October 2022, PMC April 2022

Challenge

- Regulatory and clinical trial recruitment hurdles: Constraints in terms of bureaucratic delays and hurdles in clinical trial recruitment significantly hampers growth in the colorectal cancer therapeutics sector. As per the FDA report, the clinical trial enrollment lacks diversity, with some pivotal studies reporting no participation from certain racial or ethnic groups, while Japan’s PMDA notes that additional domestic clinical data requirements can extend review timelines compared to the U.S. and EU. However, organizations address these with domestic trials and the launch of specific trial portals, thereby boosting participation and mitigating these roadblocks.

Colorectal Cancer Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 13.6 billion |

|

Forecast Year Market Size (2035) |

USD 21.7 billion |

|

Regional Scope |

|

Colorectal Cancer Therapeutics Market Segmentation:

Stages of Cancer Segment Analysis

In the stages of cancer segment, the metastatic stage dominates the segment in the colorectal cancer therapeutics market and is expected to hold the share value of 52.4% by 2035. As per the SEER data released in 2021, nearly 23% of colorectal cancers are diagnosed at the metastatic stage. Further, the advancements in systemic therapy, such as first-line targeted regimens and immunotherapy for diagnosing MSI-high tumors, have improved the overall survival rate. NIH-funded studies are also increasing ctDNA monitoring's role in the management of metastatic disease. High incidence and emerging treatment options combined are anticipated to maintain mCRC's market revenue leadership.

End user Segment Analysis

Hospitals dominate the end user segment in the colorectal cancer therapeutics market. This dominance is driven by the advanced oncology infrastructure, access to novel targeted and immunotherapies, and multidisciplinary treatment teams. The National Cancer Institute in the U.S. states that hospital-based programs for cancer deliver systematic therapy for colorectal cancer patients, mainly for complex regimens for patients requiring close monitoring. Further, hospitals also participate in clinical trials, making early access to pipeline drugs. The rising cases of cancer burden hospitals, and the investments continue to strengthen the market share.

Distribution Channel Segment Analysis

Hospital pharmacies lead the distribution channel segment by 2035 and are driven by the integration of cancer care centers to provide cancer-related medications to both inpatients and outpatients. The American Society of Health-System Pharmacists depicts that hospital pharmacies play a crucial role in managing the preparation of chemotherapy, biologics handling, and personalized dosing adjustments for patients. As per the NLM article released in 2025 April, the cancer related treatment cost is expected to reach USD 246 billion in 2030, highlighting the role of hospital pharmacies in cancer care sectors. Further, expanding formulary access to targeted agents and oral chemotherapy will boost hospital pharmacy dominance in this market.

Our in-depth analysis of the global market includes the following segments:

| Segment | Subsegment |

|

Drug Class |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

End user |

|

|

Therapy Type |

|

|

Stages of Cancer |

|

|

Biomarker Status |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Colorectal Cancer Therapeutics Market - Regional Analysis

North America Market Insights

The North America colorectal cancer therapeutics market is expected to hold the largest market share of 42.7% during the forecast tenure. The proprietorship of the region is effectively attributable to the accelerated adoption of next-generation therapies, with CAR-T and bispecific antibodies entering late-stage trials for refractory cases. With the evidence from the 2025 NIH report, the cancer cases registered in the U.S. is 2,041,910 in 2025, out of which 618,120 people have a severe health condition. Further, the government funding for oncology research is solidifying its dominance in the market.

The U.S. is steadily augmenting its position in the regional colorectal cancer therapeutics industry with the dominance of immunotherapy and liquid biopsy adoption. The International Agency for Research on Cancer in 2022 announced that the cases of colorectal cancer in the next five years are expected to hold 552,771 cases, including both men and women, with the proportion of 165.1 per 100,000 people expected to suffer from colorectal cancer. To reduce this ratio, several drugs have been invented. Recently FDA in January 2025 approved Therascreen KRAS RGQ PCR Kit, which is a diagnostic device for identifying patients suffering from colorectal cancer.

Colorectal Cancer in U.S. and Canada

|

Country |

Year |

Sex |

Incidence (as per 100,000 standard population) |

Death (as per 100,000 standard population) |

|

U.S. |

2025 |

Male |

41.4 |

15.1 |

|

U.S. |

2025 |

Female |

32.5 |

10.7 |

Source: CDC, June 2025

|

Country |

Year |

Sex |

Incidence (% distribution of in the population) |

Death (% distribution of in the population) |

|

Canada |

2023 |

Male |

10.9% |

11.2% |

|

Canada |

2023 |

Female |

9.2% |

10.2% |

Sources: Canadian Cancer Statistics, 2023

Europe Market Insights

Europe is estimated to retain its position as the second-largest revenue holder in the colorectal cancer therapeutics market through the assessed timeframe. The region’s standard in upliftment is attributed to precision medicine adoption and nationwide healthcare initiatives. Further, the European Commission report has announced that the cancer cases is expected to rise by 24% by 2035. Apart from the rising cases, the region has also allocated €4 billion of funding towards cancer plan which includes €1.25 billion from the EU4Health programme.

Germany is prospering in a profitable atmosphere with a dominating share in the regional market. This is propelled by its robust ecosystem in terms of innovation and development. According to the evidence of European Cancer Inequalities Registry in 2022, colorectal cancer is the second common cancer registered in the Germany, with 11% of total cancer cases occurrence in the country. On the other hand, the German Cancer Society has shown advances in targeted therapies including immune checkpoint inhibitors and EGFR, to improve the survival rate and expand oncology centers. The combination of an aging population and investment rate by government in driving the market.

APAC Market Insights

Asia Pacific is anticipated to exhibit the fastest growth rate of 8.5% in the colorectal cancer therapeutics market throughout the assessed timeframe. The vigorous burden of colorectal cancer, improved diagnostics, and government-led healthcare reforms are key factors contributing to the growth of the region. Japan is leading the market with innovations and has allocated with a budget of 47.3 trillion yen for healthcare, stated by Pharma Japan article in September 2024. Besides reimbursement reforms for targeted therapies in South Korea and public-private collaborations in Malaysia, fosters appreciable growth on a larger scale.

China is maintaining its regional dominance in the colorectal cancer therapeutics market, owing to the disease incidence and government medical expenditure. Testifying to the same, the country reports 517,106 CRC cases in 2022 stated in World Cancer Research Fund article. Furthermore, the domestic manufacturers such as Hengrui Pharma and others are leading the market with domestic production, denoting an intensifying landscape. This growth trajectory is aided by national initiatives under the Healthy China 2030 plan, which emphasize early cancer screening and expanded access to advanced therapeutics.

Country-Wise Government Initiatives

|

Country |

Government Health Funding & Agencies |

Budget (USD) |

Year |

Focus Area |

|

Australia |

Medical Research Future Fund (MRFF) |

$24 billion |

June 2025 |

Transform health and medical research and innovation to improve lives |

|

India |

Government Health Expenditure |

₹9,04,461 crore |

January 2025 |

Universal access to high-quality healthcare, strengthened public health infrastructure, and advancements in medical education |

|

Malaysia |

Ministry of Health |

RM45.3 billion |

2025 |

Enhancing hospital infrastructure and quality care |

Source: CodeBlue, PIB, Australia Government

Key Colorectal Cancer Therapeutics Market Players:

- Roche

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co.

- Bristol-Myers Squibb

- Amgen

- Pfizer

- Novartis

- Sanofi

- AstraZeneca

- Eli Lilly

- Bayer

- Johnson & Johnson

- GSK (GlaxoSmithKline)

- Celltrion

- Biocon

- Takeda Pharmaceutical

- Daiichi Sankyo

- Astellas Pharma

- Otsuka Pharmaceutical

- Eisai Co.

- Chugai Pharmaceutical

The market hosts an intensifying landscape with giants such as Roche, Merck, and Bristol-Myers Squibb dominating with the presence of immunotherapies and targeted drugs. Besides the U.S. and Europe-based players lead in terms of checkpoint inhibitors, whereas emerging economies such as India and South Korea contribute biosimilars at an affordable cost. Further, the strategic collaborations opted for by Chugai and Roche shape innovation in this sector.

Here is the list of some prominent players in the industry:

Recent Developments

- In May 2025, Pfizer announced the Phase 3 BREAKWATER trial evaluating BRAFTOVI, which is the first and only combination regimen with targeted therapy used to improve the survival outcomes. The launch has reported a 47% risk reduction in disease progression.

- In Jan 2025, Amgen announced the FDA approval of LUMAKRAS in combination with Vectibix to treat adults with mutated metastatic colorectal cancer. This combination is used to improve patients' quality of life.

- Report ID: 436

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.