Citrus Fiber Market Outlook:

Citrus Fiber Market size was valued at USD 444.8 million in 2025 and is projected to reach USD 777.6 million by the end of 2035, growing at a CAGR of 5.74% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of citrus fiber is assessed at USD 450 million.

The growing use of citrus juice processing side-streams—especially peels—to make premium, gluten-free dietary fibers drives expansion in the citrus fiber market. According to USDA Agricultural Research Service (ARS) statistics, peel biomass accounts for approximately 45% of fresh citrus weight—about 1.52 million metric tons in the U.S. alone. The rise in state-sponsored R&D, including steam explosion processing, demonstrates significant investment in enhancing fiber yield, water retention, and color quality, hence fostering industrial adoption. In manufacturing plant-based meat and beverage stabilization, citrus fibers serve as efficient emulsifiers and fat replacers.

Anchored in citrus juice facilities, mostly in Florida and São Paulo, the raw material supply chain generates huge volumes of peel trash. Steam explosion and decolorization plants are helping to increase manufacturing capacity. Citrus fiber from processing hubs within integrated assembly lines is traded worldwide. Although fiber supports worldwide food and feed industries, low per-ton tariffs and shipping expenses help to maintain consistent growth devoid of market distortions. Additionally, an upgrade in the logistics is such as refrigerated storage, is lowering spoilage and preserving functional quality during long-haul shipments.

Key Citrus Fiber Market Insights Summary:

Regional Insights:

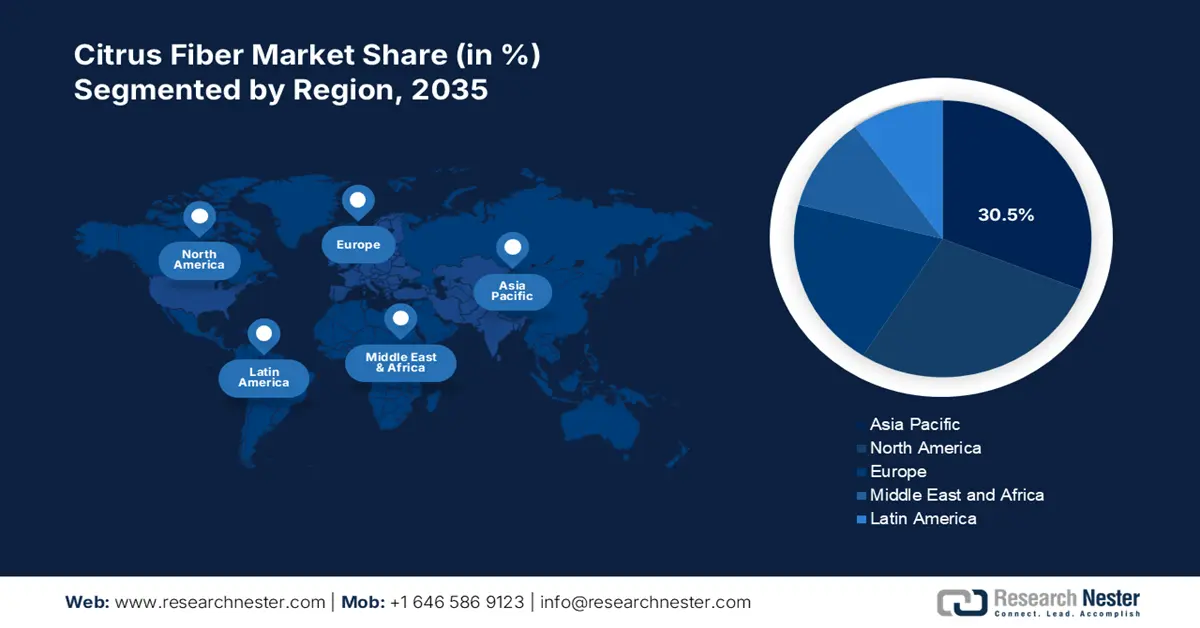

- By 2035, the Asia Pacific region is projected to command a 30.5% share of the citrus fiber market, bolstered by surging demand for functional foods and pharmaceuticals impelled by the region’s expanding nutraceutical sector.

- North America is anticipated to secure 28.2% of the market share by 2035, supported by escalating clean-label preferences and nutraceutical consumption within its robust food processing industry in the citrus fiber market.

Segment Insights:

- The orange segment is forecast to capture a 38.7% share by 2035 in the citrus fiber market, underpinned by its extensive global production and sustainability-aligned upcycled fiber sources.

- The water binding and retention segment is expected to hold the largest share by 2035, sustained by rising adoption of natural, clean-label ingredients that elevate texture and moisture retention in food and beverage applications.

Key Growth Trends:

- Rising demand for clean label ingredients

- Expansion in gluten-free and allergen-free products

Major Challenges:

- Limited raw material availability

- Competition from alternative fibers

Key Players: Cargill, Incorporated, CP Kelco (J.M. Huber Corporation), Herbstreith & Fox GmbH, FUYU Fine Chemical Co., Ltd., DuPont de Nemours, Inc. (IFF), Ceamsa, Yantai Andre Pectin Co., Ltd., Naturex (Givaudan), SunOpta Inc., FiberCreme Pty Ltd., Tata NQ (Tata Chemicals Ltd.), Halex Woolton Sdn Bhd.

Global Citrus Fiber Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 444.8 million

- 2026 Market Size: USD 450 million

- Projected Market Size: USD 777.6 million by 2035

- Growth Forecasts: 5.74%

Key Regional Dynamics:

- Largest Region: Asia Pacific (30.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Brazil

- Emerging Countries: India, South Korea, Spain, Australia, Mexico

Last updated on : 20 August, 2025

Citrus Fiber Market - Growth Drivers and Challenges

Growth Drivers

-

Rising demand for clean label ingredients: Nowadays, consumers are looking for clean labels and plant-based ingredients, which is bolstering the demand for citrus fiber. Citrus fiber is impeccable as it can replace synthetic emulsifiers and stabilizers, making it perfect for clean-label products. Research Nester anticipates that 93.2% of all U.S. households purchase clean-label products from grocery stores. This transition is reinforced by an increment in consumer vigilance for the added ingredients, with shopkeepers favoring simple formulations that are free from any artificial additives. Manufacturers are leveraging citrus fiber in bakery products and various ready-to-drink beverages.

-

Expansion in gluten-free and allergen-free products: According to Food and Agriculture Organization more than 220 million people globally have food allergies. In order to cope up with this issue, market players are opting for citrus fiber for replacing gluten-based binders and improving texture. Citrus fiber is naturally gluten-free, soy-free, and non-GMO that adds moisture to the food. It also helps in creating elasticity in baked goods without causing allergies which is helpful in making allergen-free products. The inclusion citrus fiber helpful in allergen-free products since many individuals are dealing with gluten sensitivity and celiac disease.

-

Increasing popularity of plant based and vegan diets: The expansion of plant-based food sector is expanding and thereby bolstering the demand for citrus fiber. The inclusion of the citrus fiber provides functional benefits such as water binding, emulsification, and fat replacement in meat and dairy alternatives. Citrus fiber enables plant-based meat manufacturers to imitate the juiciness and mouthfeel of animal protein while maintaining a clean-label profile. In vegan dairy products like yogurts and cheeses, citrus fiber enriches the food with creaminess and prevents separation, making it a valuable alternative to synthetic additives. According to World Animal Foundation in 2023, there were almost 88.1 million vegans in the world.

Challenges

- Limited raw material availability: Citrus fiber is mainly derived from citrus peels that have a limited shelf life and are regionally available. Climate change, diseases that have swept supplier countries (such as citrus greening) and reduced crop acreage in leading producers like Brazil and the U.S., are seen to be affecting supply chains, causing procurement delays and cost pressures on processors who use the stable availability of peel for fiber extraction.

- Competition from alternative fibers: Competition citrus fiber has to compete with lower-priced and more established products such as cellulose, chicory root fiber and pea fiber. The price competition, accessibility, and established chains of intermediaries for these alternatives hinder the penetration of citrus fiber in the functional food, beverage, and meat substitute market.

Citrus Fiber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.74% |

|

Base Year Market Size (2025) |

USD 444.8 million |

|

Forecast Year Market Size (2035) |

USD 777.6 million |

|

Regional Scope |

|

Citrus Fiber Market Segmentation:

Application Segment Analysis

The food & beverage segment is predicted to gain the largest market share of 44.4% during the projected period. The growth of the segment can be attributed to the growing preference of the consumer for clean-label and high-fiber products. Citrus fiber's ability to retain moisture and effectively blend ingredients has led to its increased presence in items including dairy, processed meats, and baked goods. According to UCSF Health experts recommend a total dietary fiber intake of almost 25-30 grams per day. This means more individuals are interested in naturally sourced fibers like citrus fiber.

Source Segment Analysis

With a 38.7% market share by 2035, the orange segment is expected to develop at the fastest rate due to its widespread production, particularly in the United States, Brazil, and Spain. According to the USDA, during 2024-25, the production of oranges reached 45.21 million metric tons. Juice leftovers are an important source of fiber, only requiring extraction. Moreover, orange peels filled with cellulose and pectin can also serve as raw materials in extensive culinary production. Also, the nature of orange fiber is upcycled, which aligns with the rising demand for sustainability by lowering food wastage. These factors position the orange-derived citrus fiber as an ethical and functional choice for the manufacturers.

Function Segment Analysis

The water binding and retention segment is anticipated to hold the maximum share, driven by the rising demand to include natural ingredients in food and beverages. There has been a rising trend of health-conscious consumers and a surge in focus on clean-label ingredients. In the bakery products, citrus fiber helps retain moisture and enhances the shelf life. Additionally, as more consumers are adopting plant-based diets, the citrus fiber renders an efficacious solution for enhancing texture. It aptly imitates the water-retaining properties and gives a suitable replacement.

Our in-depth analysis of the global citrus fiber market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Source |

|

|

Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Citrus Fiber Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold a 30.5% market share, driven by an increase in demand for functional foods, beverages, and pharmaceuticals. The growth of the market in the region can be attributed to the widespread nutraceutical industry. The spending on preventive medicine in the region has exponentially increased, resulting in increased demand for the citrus fiber. China leads the Asia Pacific citrus fiber market because its production continues to increase along with the output of citrus fruits, providing a strong manufacturing base. The quick expansion of the plant-based food and drink sector, as well as government projects encouraging agri-waste usage, is fueling the market growth. For instance, a report published by the USDA in January 2025, owing to the favorable weather, the country’s production of tangerines/mandarins is anticipated to reach 100,000 tons.

India's market for citrus fiber is growing in response to growing demand for clean-label products and expanding citrus production. According to a report published by the government of India, the citrus industry is the 3rd largest fruit industry in the country. Also, the country ranks 9th among the top orange-producing countries in the world. Furthermore, strong government support under PMFME (Pradhan Mantri Formalization of Micro Food Processing Enterprises) and increased interest from food and nutraceutical businesses are catalyzing the market growth. High availability of citrus waste from processing clusters in Andhra Pradesh and Maharashtra also helps to boost the Indian market.

North America Market Insights

North America market is expected to hold 28.2% of the market share. North America will lead in demand, fueled by a rise in clean-label and natural ingredients in food, drinks, and cosmetics. The strong food processing industry and growing focus on health and eco-friendly products have helped the region take the top spot. In U.S., more consumers are looking for citrus fiber in baked goods, dairy products, and snacks due to its health benefits and clean labels. A report published by Penn State Health News in March 2024, more than 59 million Americans use some types of supplements regularly. The rising intake of nutraceuticals is also propelling the market growth in the country.

Canada is also a prominent player in the citrus fiber market due to its increasing application in cosmetics and functional foods. Consumer demand for naturally occurring and ethically sourced ingredients is fueling this expansion. Clear labeling, compassionate legislation, and a culture that promotes healthy eating are all crucial components. Additionally, brands in Canada are investing in including citrus fiber as there are supportive regulatory environment from the government. Consumers as well as regulators are inclined towards transparent, plant-based components in personal care and food.

Europe Market Insights

The Europe market is expected to hold 25.9% of the market share by 2035. The growth of the market in the region can be attributed to the rising demand for the clean label momentum across mainstream brands. In UK, the growth is driven by rapid expansion of the food processing industry that uses in citrus fiber to enhance stability and texture. According to data published by government of UK in 2023, the country imported 2,490 thousand tones of citrus and exotic fruits. Market players are using citrus fibers to enhance the gelation and lower the syneresis. Also, the sustainability initiatives in the country and goals for circular economy are propelling the market growth.

In Germany, the growth of the market is fueled by rising demand for the plant-based product. There is a strong shift toward plant-based diets in the country that require citrus fiber to be added. Various market players are offering extensive range of the functional dietary fibers with a focus on fruit derived fibers. The dietary fiber guidelines in the country recommend the intake of fiber for adults. The rising consumer awareness and policy support for the fiber rich products, the demand for citrus fiber is rising exponentially.

Key Citrus Fiber Market Players:

- Fiberstar Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cargill, Incorporated

- CP Kelco (J.M. Huber Corporation)

- Herbstreith & Fox GmbH

- FUYU Fine Chemical Co., Ltd.

- DuPont de Nemours, Inc. (IFF)

- Ceamsa

- Yantai Andre Pectin Co., Ltd.

- Naturex (Givaudan)

- SunOpta Inc.

- FiberCreme Pty Ltd.

- Tata NQ (Tata Chemicals Ltd.)

- Halex Woolton Sdn Bhd

Fiberstar, CP Kelco, and Cargill are at the top of the global citrus fiber market, due to their new tech and strong distribution networks. European and Asian producers are quickly closing the gap with their focus on clean labeling and sourcing sustainably. Still, U.S. companies are leading the market. Microencapsulation and fiber-enhanced nutritional supplements are drawing attention among Japanese companies like FUYU Fine Chemical and Nikken Foods. Strategic initiatives include capacity expansions, regional alliances, and mergers (e.g., IFF's merger with DuPont's Nutrition business). Growing demand for natural emulsifiers and dietary fibers in clean-label meals drives intense competition, which encourages companies to invest in R&D and local customization.

Some of the key players operating in the market are listed below:

Recent Developments

- In June 2025, CEAMSA launched CEAMFIBRE as an upcycled citrus-peel fiber for clean-label innovation, highlighting its high total dietary-fiber content and stable functionality. CEAMSA actively promoting a citrus-fiber solution to formulators across bakery, meat, and sauces.

- In April 2024, CP Kelco completed a major USD 60 million expansion at its Brazil facility, boosting production capacity for its NUTRAVA and KELCOSEN citrus fiber lines to approximately 5,000 metric tons. The expansion aims to support growing demand from food, beverage, and personal care sectors globally

- Report ID: 3396

- Published Date: Aug 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Citrus Fiber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.