Chronic Kidney Disease Market Outlook:

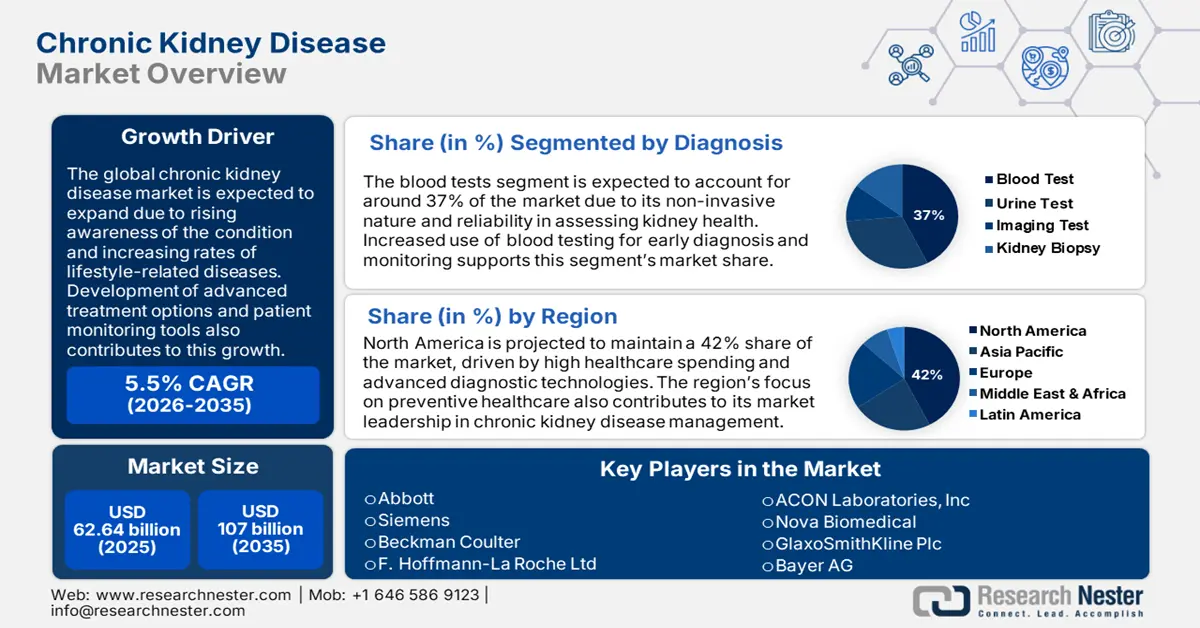

Chronic Kidney Disease Market size was valued at USD 62.64 billion in 2025 and is expected to reach USD 107 billion by 2035, expanding at around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chronic kidney disease is assessed at USD 65.74 billion.

The chronic kidney disease market is witnessing steady growth as the prevalence of CKD rises globally, driven by increasing rates of diabetes, hypertension, and aging populations. Furthermore, the demand for early diagnostic tools and effective treatments is expanding as healthcare providers seek to mitigate disease progression and improve patient outcomes. In July 2023, the European Commission granted approval to Boehringer Ingelheim and Eli Lilly for Jardiance, a drug used to treat chronic kidney disease, further underpinning industry interest in new treatments. Governments and health organizations are also boosting their efforts toward tackling CKD through public awareness campaigns and ensuring better access to its treatment for patients, thus indicating a growth trajectory for the chronic kidney disease market.

Governments worldwide are prioritizing chronic kidney disease care, with initiatives that emphasize early diagnosis and management to reduce the economic and health burden of the disease. In 2023, the diagnosed cases of CKD in the U.S. were reported to stand at 5 million and are likely to increase. In addition, North America and Europe fund research gives access to innovative treatments, further pushing the market. The increasing prevalence of chronic kidney disease, coupled with proactive intervention through governments, opens lucrative growth opportunities for players in the chronic kidney disease market.

Key Chronic Kidney Disease Market Market Insights Summary:

Regional Highlights:

- North America's 42% share in the Chronic Kidney Disease Market is driven by high prevalence of CKD and strong healthcare infrastructure, ensuring robust growth prospects through 2035.

- Asia Pacific’s chronic kidney disease market is expected to see moderate growth by 2035, driven by rising diabetes cases and increasing healthcare spending.

Segment Insights:

- The Drugs segment is projected to capture more than 45% market share by 2035, driven by increasing demand for managing chronic kidney disease and related comorbidities like hypertension and diabetes.

- The Blood Tests segment of the Chronic Kidney Disease Market is projected to hold over 37% share by 2035, driven by their crucial role in early diagnosis and monitoring of chronic kidney disease.

Key Growth Trends:

- Increasing prevalence of diabetes and hypertension

- Advancements in diagnostic technologies

Major Challenges:

- Gaps in healthcare accessibility to CKD treatment

- Regulatory and approval barriers to new therapies

- Key Players: Abbott, Siemens, Beckman Coulter, F. Hoffmann-La Roche Ltd, ACON Laboratories, Inc, Nova Biomedical, AstraZeneca, GlaxoSmithKline Plc, and Bayer AG.

Global Chronic Kidney Disease Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 62.64 billion

- 2026 Market Size: USD 65.74 billion

- Projected Market Size: USD 107 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

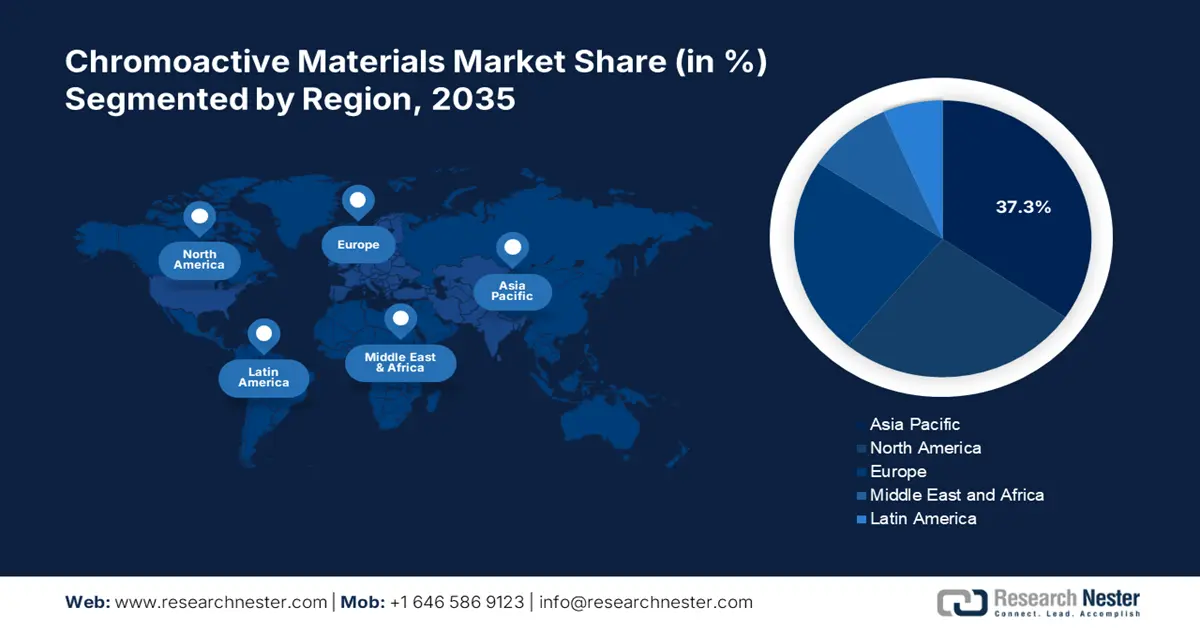

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

Chronic Kidney Disease Market Growth Drivers and Challenges:

Growth Drivers

- Increasing prevalence of diabetes and hypertension: The increase in the prevalence of diabetes and hypertension, being the already established causes of chronic kidney disease, strongly influences the chronic kidney disease market dynamics for CKD. As more people pick up these chronic ailments, the risk of acquiring CKD also goes upward, thereby opening ways for treatments that could work effectively. In July 2021, Bayer received US FDA approval for KEREND.

- Advancements in diagnostic technologies: Assistance regarding diagnosis with the availability of eGFR and imaging tests for new diagnostic technologies significantly supports early therapies, which delays disease development. For example, DaVita Kidney Care collaborated with Verily in August 2023 to develop digital health tools that would help improve chronic kidney disease care access. This ascertains true diagnostic tools that are timely and accessible, thus proving a driver in the growth of the chronic kidney disease market.

- Increasing awareness for the risk factors of CKD: Increasing awareness of the risk factors for chronic kidney disease has, in turn, bolstered demand for preventive care and early diagnostics of the disease. Public health campaigns increase awareness among the at-risk population and make them aware of check-up schedules. For instance, in August 2023, Novartis launched a global effort in an attempt to build awareness about chronic kidney disease and improve access to care. The example shows the industry's commitment to the prevention and management of CKD. This has been one of the growth factors for this chronic kidney disease market, as it increases the focus on preventive care.

Challenges

- Gaps in healthcare accessibility to CKD treatment: Inaccessibility of healthcare in poor-income regions is one of the major hindrances to the proper diagnosis and treatment of CKD. The absence of infrastructural facilities in regard to chronic kidney disease management prevents diagnostic and therapeutic essentialities from becoming available in these very regions. Distance and costs to higher healthcare facilities translate to delayed diagnosis and treatment for many patients, constraining better health outcomes. Besides, advanced diagnostics and therapies are highly restricted in their availability owing to high costs. Therefore, there is a greater need for affordable and scalable solutions tailored according to the requirements of underserved populations.

- Regulatory and approval barriers to new therapies: Stringent new therapy regulatory processes in CKD could further delay market entry and poor access for patients to new and innovative treatments. The resource- and time-consuming nature of overcoming these kinds of regulatory hurdles can often be prohibitive for smaller pharmaceutical companies. In addition, the different regulatory requirements across different regions contribute further to this complexity, with a possible consequence of poor global accessibility of newer and more effective chronic kidney disease therapies.

Chronic Kidney Disease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 62.64 billion |

|

Forecast Year Market Size (2035) |

USD 107 billion |

|

Regional Scope |

|

Chronic Kidney Disease Market Segmentation:

Diagnosis (Blood Test, Urine Test, Imaging Test, and Kidney Biopsy)

Blood tests segment is predicted to account for chronic kidney disease market share of more than 37% by the end of 2035, as they are crucial to the diagnosis of chronic kidney disease through important markers such as the eGFR and creatinine levels. These tests are quite needed in early detection and subsequently in further monitoring due to the fact that clinicians can assess kidney function and disease progression. In March 2022, Nova Biomedical introduced the Nova Max Pro Creatinine/eGFR Meter System to advance point-of-care kidney screenings. This will bridge the gap in the diagnosis of CKD, as blood tests remain an essential prerequisite. Growing utilization of blood testing is thus expected to strengthen the segment's leading position in the market, as health practitioners would seek greater support from these diagnostics in their quest for timely management of disease conditions.

Treatment (Drugs, Dialysis, and Kidney Transplant)

In chronic kidney disease market, drug segment is anticipated to account for revenue share of more than 45% by the end of 2035, due to increasing demand for drugs managing CKD and its comorbidities, like hypertension and diabetes. In September 2023, the FDA granted approval for Jardiance (empagliflozin) for chronic kidney disease treatment, marking a significant advancement in pharmaceutical options. New drugs being introduced further underscore the importance of the segment, as drugs remain an important factor in slowing the progress of CKD and alleviating its symptoms. Ongoing development of targeted therapies supports continued innovation within the drug segment, improving treatment efficacy while widening the choices of chronic kidney disease patients.

Our in-depth analysis of the global market includes the following segments:

|

Diagnosis |

|

|

Treatment |

|

|

Indication |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chronic Kidney Disease Market Regional Analysis:

North America Market Analysis

North America industry is estimated to account for largest revenue share of 42% by 2035, owing to its high prevalence of chronic kidney disease and well-established infrastructure for healthcare services. Due to the high investments in CKD research and campaigns related to raising awareness, North America continues to be one of the largest markets when it comes to diagnosis and treatment options for CKD. The collaboration between public health organizations and private companies is encouraging new forms of treatment, which is driving market growth.

The U.S. chronic kidney disease market is anticipated to be driven by a high prevalence of diabetes and hypertension, favoring conditions for chronic kidney disease. In July 2022, Health Canada accepted GlaxoSmithKline's New Drug Submission for daprodustat which is an oral HIF-PHI for anemia related to underlining that the focus of North America is on advanced treatments. The demand for advanced therapies keeps growing and is reinforcing the U.S. position as one of the leading contributors to the market. The U.S. market also benefits from comprehensive insurance coverage for chronic kidney disease treatments, which allows patients in need to easily access them.

Emphasis on early diagnosis and prevention in the healthcare system propels Canada chronic kidney disease market and supportive governmental healthcare programs. The health authorities in Canada are active in the creation of chronic kidney disease awareness and early treatment, hence increasing demand for diagnostic and treatment services within the country. With this focus in place, Canada supports North America in its commitment to holistic CKD care, which makes it an integral contributor to the regional market. Also, such infrastructural setup for healthcare is firm in Canada, thereby helping early interventionists to push chronic kidney disease patients in most parts of the country.

Asia Pacific Market Analysis

Asia Pacific chronic kidney disease market is expected to grow at a steady CAGR through 2035, driven by increasing cases of diabetes and healthcare expenditure across the region, particularly in India, China, and Japan. Public health awareness campaigns also create more awareness about chronic kidney disease and its prevention, thus contributing to this region in the market. Most importantly, higher employment toward international firm practices coupled with the development of CKD diagnostics and therapies drives the emergence of the market rapidly across the geographical region.

The chronic kidney disease market in India is rising owing to the increasing incidence of diabetes and a lack of early diagnostics. Bayer launched a finerenone drug in India for chronic kidney disease patients suffering from type 2 diabetes in August 2022, which underpins this growth in demand for accessible treatments. In this respect, this development demonstrates the increasing significance of CKD care in India, where timely intervention and treatment options are incredibly important. In addition, government-backed programs to help improve rural healthcare access will continue to support growth in this market segment.

Government-driven healthcare reforms in China and growing awareness of kidney health supplement the growth of the chronic kidney disease market in the region. In May 2024, Everest Medicines launched a delayed-release capsule, Nefecon, for IgA nephropathy, one of the most common subtypes of chronic kidney disease in China. The launch indicates that the country is paying attention to the therapies for CKD, favoring regional market growth. Furthermore, the Chinese government is highly investing in healthcare technologies and infrastructures, facilitating access to innovative CKD therapies.

Key Chronic Kidney Disease Market Players:

- Abbott

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens

- Beckman Coulter

- F. Hoffmann-La Roche Ltd

- ACON Laboratories, Inc

- Nova Biomedical

- GlaxoSmithKline Plc

- Bayer AG

The chronic kidney disease market is fiercely competitive with leading players such as Abbott, Siemens, Beckman Coulter, F. Hoffmann-La Roche Ltd, ACON Laboratories, Inc., Nova Biomedical, AstraZeneca, GlaxoSmithKline Plc, and Bayer AG-the better-known leaders in the industry. These companies develop diagnostic and pharmaceutical solutions to improve chronic kidney disease care while creating a market presence through R&D, partnerships, and product launches. As chronic kidney disease prevalence further increases in the world, companies put a huge amount of money into innovative solutions for treatment and market expansion.

In September 2023, Fresenius Medical Care was granted FDA breakthrough device designation for its hemodialysis machine, a further indication of how the competition within the landscape pivots on advanced technology with respect to dialysis. This also underlines the continued commitment of leading companies in driving innovation inside CKD care through solutions that promote better patient outcomes coupled with seamless treatments. The intensity in competition among leading companies is propelled by advancements in CKD treatment and diagnostics, improving the quality of life among chronic kidney disease patients worldwide

Here are some leading players in the chronic kidney disease market:

Recent Developments

- In May 2024, WELL Health Technologies Corp and HEALWELL AI announced the launch of the second-generation WELL AI Decision Support (WAIDS). This enhanced version builds upon the original release by adding advanced screening capabilities for chronic diseases, following the initial launch six months prior, which focused on rare disease detection. WAIDS aims to provide comprehensive support for healthcare providers managing a broader range of conditions.

- In October 2023, Medtronic initiated a clinical trial to assess the safety and efficacy of its new renal denervation catheter, developed for treating chronic kidney disease (CKD). This trial represents a key step toward expanding CKD treatment options, coinciding with the recent U.S. approval of AstraZeneca’s Farxiga for CKD treatment. Medtronic’s trial underscores the growing interest in innovative CKD therapies.

- Report ID: 6698

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.