Ceramic Matrix Composites Market Outlook:

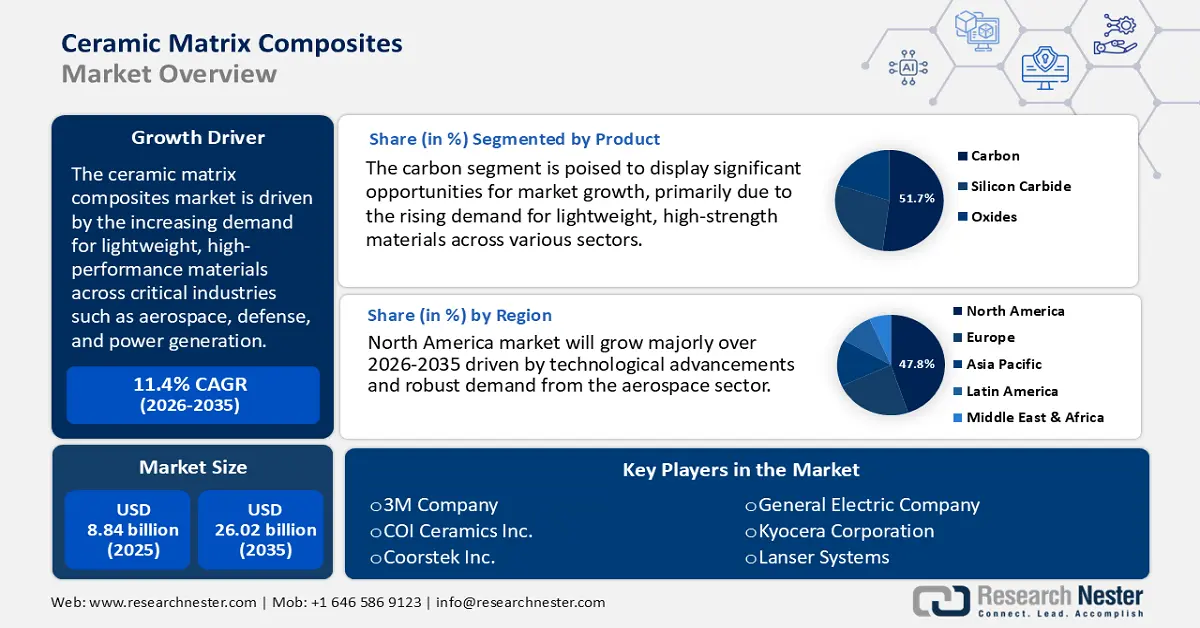

Ceramic Matrix Composites Market size was valued at USD 8.84 billion in 2025 and is expected to reach USD 26.02 billion by 2035, registering around 11.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ceramic matrix composites is evaluated at USD 9.75 billion.

The ceramic matrix composites are attributed to the increasing demand for lightweight, high-performance materials across critical industries such as aerospace, defense, and power generation. CMCs are particularly valued for their superior mechanical properties, including exceptional heat resistance, reduced weight, and high structural integrity, such as quality essential in high-stress applications. In aerospace and defense, CMCs are increasingly used in jet engine components, turbine blades, thermal shields, and missile systems to enhance fuel efficiency, reduce emissions, and meet stringent environmental regulations.

The energy sector further propels market expansion, with CMCs being deployed in gas turbines and nuclear reactors, where extreme temperature tolerance and long-term reliability are paramount. As the world transitions toward cleaner and more efficient energy sources, CMCs have become indispensable in both conventional and renewable power systems. Technological innovations also contribute significantly to the market trajectory. Advances in additive manufacturing and hybrid CMC processing methods are enhancing scalability and cost-effectiveness, opening new avenues for industrial applications. Major industry players are investing heavily in research & development to improve performance and reduce production costs.

General Electric (GE Aerospace) is a prominent player leveraging CMCs in the aerospace sector. The company has successfully integrated CMCs into components of its LEAP aircraft engines, significantly reducing weight and improving fuel efficiency. GE’s continued investment in CMC production facilities and materials innovation exemplifies how industry leaders are setting benchmarks for large-scale CMC adoption across critical sectors.

Key Ceramic Matrix Composites Market Insights Summary:

Regional Highlights:

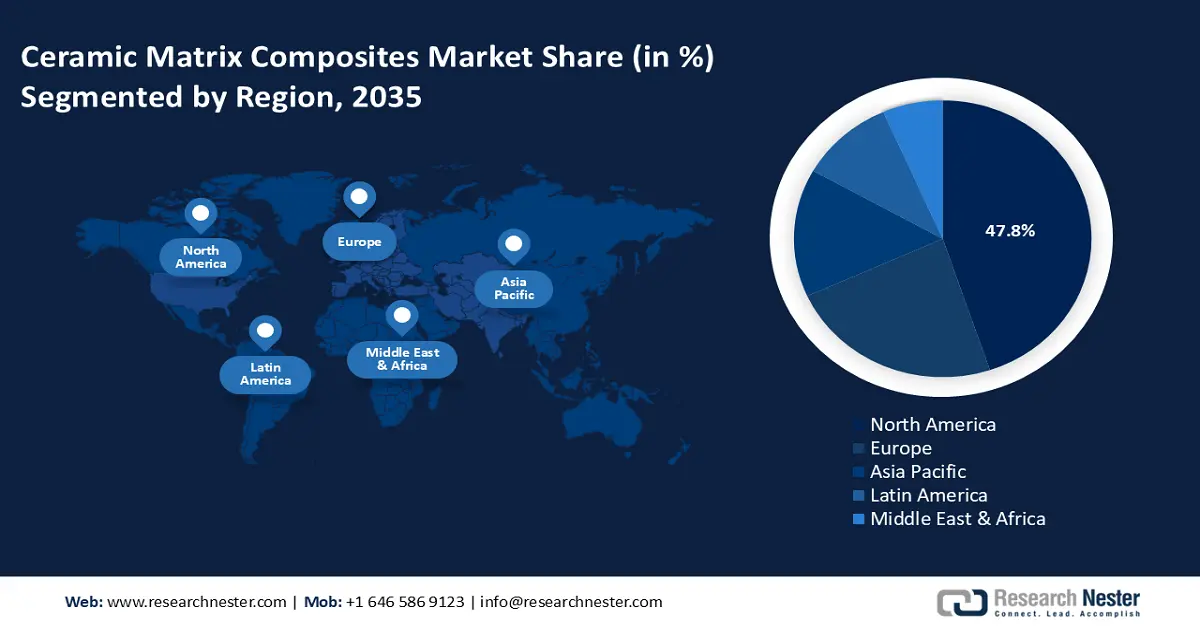

- North America ceramic matrix composites market is expected to command a 47.8% share by 2035, driven by technological advancements and robust demand from the aerospace sector.

Segment Insights:

- The carbon segment in the ceramic matrix composites market is projected to hold a 51.70% share by 2035, fueled by demand for lightweight, high-strength materials.

- The aerospace segment in the ceramic matrix composites market is expected to capture a dominant share by 2035, driven by the need for high-performance materials in aerospace.

Key Growth Trends:

- Expansion of end-users

- Advancements in manufacturing technology

Major Challenges:

- High cost for production

- Material brittleness

Key Players: 3M Company, COI Ceramics, Inc., Coorstek, Inc., General Electric Company, Kyocera Corporation, Lancer Systems LP, Ultramet, Inc., Ube Industries, Ltd., Applied Thin Films, Inc., CeramTec, Kyocera Corporation, Lancer Systems LP, Rolls-Royce Plc, .

Global Ceramic Matrix Composites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.84 billion

- 2026 Market Size: USD 9.75 billion

- Projected Market Size: USD 26.02 billion by 2035

- Growth Forecasts: 11.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 May, 2025

Ceramic Matrix Composites Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of end-users: The growing adoption of ceramic matrix composites across diverse end-use sectors is significantly accelerating the expansion of the global market. CMCs offer outstanding thermal stability, mechanical strength, and corrosion resistance, making them ideal for demanding environments. Their high-performance attributes at extreme temperatures have led to increased utilization in the aerospace, energy, and defense industries.

In aerospace, CMCs are being integrated into gas turbines, re-entry vehicle thermal protection systems, and engine components to reduce weight, enhance fuel efficiency, and withstand intense heat. The energy sector benefits from CMCs in applications such as heat exchangers and fusion reactor walls due to their superior oxidation and radiation resistance. Furthermore, advancements in defense technologies have spurred demand for durable and lightweight materials, positioning CMCs as essential in ballistic protection, missile systems, and hypersonic vehicles. This broadening scope of applications is fueling robust ceramic matrix composites market growth and encouraging further innovation.

A notable instant is the Safran Group, which has made significant advancements in CMC technology, particularly for aircraft engine applications. Through its subsidiary Safran Ceramics, the company focuses on developing and producing advanced CMC components to enhance engine performance and reduce fuel consumption. Safran uses CMCs in hot-section parts of aircraft engines due to their lightweight and heat-resistance properties, which contribute to thermal efficiency and lower emissions.

- Advancements in manufacturing technology: Recent innovations in manufacturing technologies have significantly propelled the growth of the ceramic matrix composites market by addressing key challenges related to scalability and complexity. Techniques such as additive manufacturing and hybrid processing methods are enabling manufacturers to produce intricate CMC components with enhanced precision and material efficiency. Additive manufacturing enables the production of intricate shapes that were once challenging or unfeasible to create with conventional manufacturing techniques. This has resulted in decreased material waste, expedited production cycles, and enhanced customization options.

Hybrid processing methods, combining elements of different fabrication techniques, further enhance the mechanical and thermal properties of CMCs, making them more suitable for demanding applications in aerospace, energy, and defense sectors. These technological strides are instrumental in overcoming the historically high costs and limited scalability of CMC production. CoorsTek, a global leader in engineered ceramics, has been actively leveraging advanced manufacturing techniques, including additive and hybrid processes, to enhance the performance and affordability of its CMC product. This has allowed CoorsTek to cater to critical applications across energy, aerospace, and electronic industries.

Challenges

- High cost for production: The intricate manufacturing process, the need for specialized equipment, and skilled labor make CMCs expensive to manufacture. Their complex and labor-intensive manufacturing process, including fiber reinforcement, matrix infiltration, densification, and precision finishing, requires specialized equipment and highly skilled labor. These factors, coupled with stringent quality control protocols and low production yield rates, result in elevated overall costs. Additionally, material wastage and high scrap rates during fabrication further contribute to production inefficiencies. Despite their superior performance characteristics, these cost constraints limit CMC usage to high-end applications, primarily in aerospace and defense, restraining broader market penetration across cost-sensitive industries.

- Material brittleness: While strong at high temperatures, CMCs can be brittle under certain mechanical stresses, limiting their application in some dynamic environments. This brittleness restricts their use in dynamic environments where components are subject to impact, vibration, or fluctuating stress. As a result, industries such as automotive and heavy machinery often face limitations in fully adopting CMCs for broader applications. Addressing this issue requires continued innovation in composite design, reinforcement techniques, and hybrid materials to enhance toughness while retaining the high-performance characteristics of CMCs.

Ceramic Matrix Composites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.4% |

|

Base Year Market Size (2025) |

USD 8.84 billion |

|

Forecast Year Market Size (2035) |

USD 26.02 billion |

|

Regional Scope |

|

Ceramic Matrix Composites Market Segmentation:

Product Segment Analysis

In 2035, the carbon segment led the ceramic matrix composites market, securing a significant revenue share of 51.7%. This expansion is mainly due to the increasing need for lightweight, high-strength materials in multiple industries. Carbon-based Ceramic Matrix Composites (CMCs) demonstrate outstanding mechanical characteristics, such as high thermal resistance, an excellent strength-to-weight ratio, and stability in extreme environments. These features are critical in applications such as jet engines, brake systems, and structural components, where reducing overall weight without compromising performance is essential.

Moreover, the growing focus on fuel efficiency and the reduction of carbon emissions has significantly expedited the integration of carbon-based CMCs in transportation technologies. Their application not only improves operational efficiency but also supports global sustainability objectives. Toki Carbon is a prominent manufacturer of carbon-based materials, focusing on high-performance carbon and graphite products used in advanced CMC applications. The company develops carbon fiber-reinforced composites designed for high-temperature, high-strength environments, serving industries such as aerospace, automotive, and industrial processing. Their expertise in producing ultra-high temperature-resistance carbon materials makes them a key player in the CMC supply chain, particularly in applications requiring lightweight components with superior thermal and mechanical stability. Tokai Carbon’s commitment to innovation and material science continues to strengthen its position in the global CMC market.

Application Segment Analysis

The aerospace segment emerged as the leading contributor to the ceramic matrix composites market, capturing a dominant revenue share in the global market. This growth is primarily attributed to the increasing demand for materials that offer high-performance capabilities under extreme conditions. CMCs exhibit outstanding properties such as high-temperature resistance, excellent mechanical strength, reduced weight, and superior fatigue resistance compared to traditional metal alloys. These characteristics enable their application in critical aerospace components, including turbine blades, combustor liners, and exhaust systems.

The integration of CMCs significantly enhances fuel efficiency and engine performance while also reducing emissions, an essential advantage as the aerospace industry aligns with global sustainability goals and stringent environmental regulations. A prominent instance is Rolls-Royce, which has been actively advancing the use of CMCs in its next-generation jet engines. The company has invested in research and development to incorporate CMC materials into engine components, thereby improving heat resistance and operational efficiency while achieving notable reductions in overall engine weight and emissions.

Our in-depth analysis of the global ceramic matrix composites market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ceramic Matrix Composites Market Regional Analysis:

North America Market Insights

North America led the ceramic matrix composites market with a revenue share of 47.8%, driven by technological advancements and robust demand from the aerospace sector. In the U.S., the thriving aerospace industry continues to fuel CMC adoption, particularly in turbine engines, thermal shields, and airframes. These composite materials provide exceptional mechanical strength, resistance to high temperatures, and lightweight characteristics, which are essential for improving fuel efficiency and performance in aircraft used for commercial, military, and space exploration purposes. The growing emphasis on next-generation aerospace technologies, including hypersonic and reusable space vehicles, further strengthens the U.S. market outlook.

Canada is also contributing to the regional ceramic matrix composites market through increasing investments in advanced materials research and sustainable aviation initiatives. The country’s commitment to decarbonizing aerospace and defense operations encourages the exploration of innovative high-performance materials like CMCs. Raytheon Technologies, through its Pratt & Whitney division, serves as a prominent instance in this region. The company integrates CMCs into advanced jet engine components to enhance thermal efficiency and durability, supporting performance goals while aligning with environmental mandates.

Europe Market Insights

Europe's strategic transition towards sustainable energy and advanced manufacturing is driving the expansion of the ceramic matrix composites market, especially in the UK and Germany. In the UK, the emphasis on next-generation energy solutions, including nuclear fusion and high-efficiency thermal systems, has increased the demand for CMCs because of their exceptional resistance to high temperatures and radiation. These composites are increasingly used in components for nuclear reactors and clean energy infrastructure, supporting the UK’s long-term energy resilience and decarbonization targets.

On the other hand, Germany is witnessing rapid CMC adoption in the automotive sector. As a global automotive hub, Germany is prioritizing lightweight, high-performance materials to enhance vehicle efficiency and meet stringent emission regulations. Ceramic matrix composites are being integrated into high-temperature vehicle components such as brake discs, turbochargers, and exhaust systems. Their capacity to enhance fuel efficiency and endure harsh conditions renders them crucial for the advancement of electric and high-performance automobiles. Brembo collaborates with SGL Carbon Ceramic Brakes GmbH to supply advanced CMC brake systems to top automotive brands, including Porsche and Ferrari, reinforcing Germany’s leadership in high-performance mobility solutions.

Ceramic Matrix Composites Market Players:

- Axiom Materials Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company

- COI Ceramics, Inc.

- Coorstek, Inc.

- General Electric Company

- Kyocera Corporation

- Lancer Systems LP

- Ultramet, Inc.

- Ube Industries, Ltd.

- Applied Thin Films, Inc.

- CeramTec

- Kyocera Corporation

- Lancer Systems LP

- Rolls-Royce Plc

- SGL Carbon Company

- Starfire Systems, Inc.

Key players in the ceramic matrix composites market utilize advanced manufacturing technologies, including chemical vapor infiltration, melt infiltration, and additive manufacturing. These innovations enable the production of lightweight, high-strength components with superior thermal resistance, positioning them as leaders in the aerospace and energy sectors.

Recent Developments

- In April 2023, SGL Carbon announced a strategic partnership with Lancer Systems to collaboratively develop Ceramic Matrix Composites (CMCs) intended for thermal protection systems. This alliance represents a dedicated initiative to improve materials suited for use in extreme thermal conditions. By merging SGL Carbon's advanced materials expertise with Lancer Systems' technological strengths, the partnership seeks to deliver innovative solutions to the CMC sector, especially concerning thermal protection systems across diverse industries.

- In July 2021, Pratt & Whitney, a subsidiary of Raytheon Technologies Corp., inaugurated a 60,000-square-foot engineering and development facility dedicated to ceramic matrix composites (CMC) in Carlsbad, California. This state-of-the-art facility is intended to serve as a fully integrated hub for engineering, research, and low-volume manufacturing, specifically concentrating on CMCs for aerospace applications.

- Report ID: 5135

- Published Date: May 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ceramic Matrix Composites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.