Cell Sorter Market Outlook:

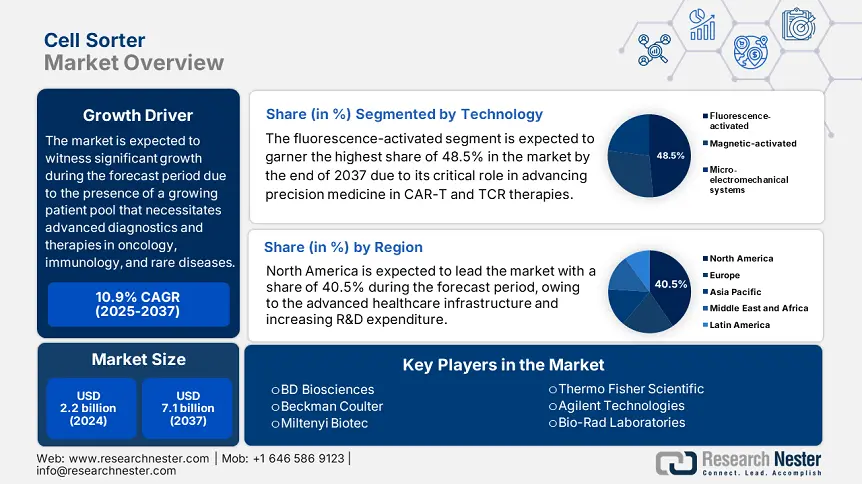

Cell Sorter Market size was valued at USD 2.2 billion in 2024 and is projected to reach USD 7.1 billion by the end of 2037, rising at a CAGR of 10.9% during the forecast period, i.e., 2025-2037. In 2025, the industry size of cell sorter is assessed at USD 2.5 billion.

The worldwide market is readily expanding owing to the presence of a growing patient pool that necessitates advanced diagnostics and therapies, especially in oncology, immunology, and rare diseases. Based on this factor National Institute of Health stated that an estimated 1.8 million cancer cases were diagnosed in 2024 in the U.S., resulting in a heightened demand for circulating tumor cell analysis and CAR-T cell sorting. Besides, the World Health Organization notes that there is a 12% annual increase in terms of autoimmune disorders, hence creating a prolific market opportunity.

Furthermore supply chain is yet another aspect positively influencing the market that relies on specialized components such as optical fibers, lasers and microfluidic chips which are primarily sourced from Germany, Japan and the U.S. ITC stated that U.S. imported USD 480 million worth of cell sorter components in 2024 critically from the EU and exported USD 620 million assembled systems to Asia Pacific. On the other hand, investments in R&D for cell sorting technologies reached USD 3.3 billion in 2024, out of which 72% was allocated towards automation and AI-based sorters.

Cell Sorter Market Growth Drivers and Challenges:

Growth Drivers

- Rising patient pool: The dramatic transformation in the patient pool has shaped the present dynamics in the market. Based on this factor, it is noted that Germany has 500,000 patients requiring cell-sorted therapies, which marks a 45% increase from 2018. Simultaneously Centers for Disease Control and Prevention states that North America accounts for 40% of the global demand owing to the increasing prevalence of cancer and autoimmune diseases, thereby attracting more companies to invest in this field.

- Early intervention and cost savings: The clinical validation gained through numerous studies has established a strong foundation for the market. In this context, the study by AHRQ in 2022 revealed that early-stage cell sorting for leukemia diagnosis reduced hospitalizations by 25%, thereby saving USD 1.4 billion in U.S. healthcare expenditure in a span of two years. Moreover, the hospitals leveraging high-purity cell sorters reported 16% low rates of misdiagnosis, hence denoting a positive outlook.

Manufacturer Strategies Shaping the Market Expansion

The presence of prominent manufacturers in the market is transforming the sector with the aspect of product innovation, well-planned collaborations, and geographic expansions. In this regard, BD Biosciences in 2023 launched FACSymphony A5, which grabbed an additional revenue of 14%, further enhancing throughput by 40.7%, hence suitable for standard growth. Simultaneously, Sony Biotechnology announced a partnership with the foremost cancer centers in the U.S., thereby gaining revenue of USD 160 million. Moreover, manufacturers are also focusing on cost optimization to penetrate the emerging nations, thereby displaying a shift towards affordability.

Revenue Growth Opportunities for Cell Sorter Manufacturers (2023-2025)

|

Company |

Strategy |

Revenue Impact (USD Million) |

Market Share Change |

|

BD Biosciences |

Launched high-throughput FACSymphony |

+$330M |

+14% |

|

Sony Biotechnology |

AI-integrated LEAP sorter rollout |

+$160M |

+9% |

|

Miltenyi Biotec |

APAC expansion (new factories) |

+$95M |

+8% |

|

Beckman Coulter |

Cost-optimized DxFLEX launch |

+$80M |

+6% |

Feasible Expansion Models Shaping the Future Market

The business models for future trends consist of strategies adopted by global leaders in the market. The pathway comprises three crucial dominant models, including domestic collaborations, subscription-based rentals, and AI-based automation. For instance, in India, suppliers such as Tata Medical Systems collaborated with state hospitals to deploy affordable cell-sorters, increasing revenue by 13.3 % from 2022 to 2024. Therefore, these models underscore the significance of localization and financing for market upliftment.

Feasibility Models for Market Expansion (2022-2024)

|

Region |

Model |

Revenue Growth |

Adoption Rate Increase |

|

India |

Hospital partnerships |

+13.3% |

+26% |

|

Germany |

Public-private R&D funding |

+€94M |

+19.5% |

|

U.S. |

Medicare reimbursement |

+$230M |

+17.4% |

Challenges

- Regulatory restraints: The presence of bureaucratic hurdles in the market can often cause major restraints, delaying the product entry and exacerbating costs on manufacturers. As evidence, in Japan, the stringent regulatory approvals led to a 6-month delay for new cell sorters. Simultaneously, the U.S. FDA extended its timeline from 10 months in 2022 to 14 months in 2024, increasing R&D expenses. Therefore, this can be challenging for niche manufacturers to navigate, thereby delaying innovation in the field.

- Competitive domestic production: This is yet another challenging restraint, imposing significant hurdles in the market. For instance, in emerging countries such as China, domestic manufacturers are setting the ground by offering 32% low-cost alternatives, hindering opportunities for international players. Also, these domestic players currently hold 26% of the market share, creating pressure on global firms to reduce prices or risk losing competition in the merchandise.

Cell Sorter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

10.9% |

|

Base Year Market Size (2024) |

USD 2.2 billion |

|

Forecast Year Market Size (2037) |

USD 7.1 billion |

|

Regional Scope |

|

Cell Sorter Market Segmentation:

Technology Segment Analysis

Based on technology, the fluorescence-activated segment is expected to garner the highest share of 48.5% in the market by the end of 2037. The dominance of the segment is effectively attributed to its critical role in advancing precision medicine, especially CAR-T and TCR therapies. The regulatory support for the segment has been phenomenal, with the U.S. FDA approving next-generation sorters such as the FACSLyric system, offering enhanced throughput and accuracy, which resulted in the widespread adoption both in research and clinical settings. Moreover, the technology can perform multi-parameter analysis at high speeds, making it preferable for immunology and oncology applications, indicating a positive segment demand.

Application Segment Analysis

Based on the application, the clinical segment is projected to grow at a considerable rate, with a share of 35.8% in the market during the forecast period. The segment is pledged for growth with the rising burden of cancer cases and expanded insurance coverage for cell-based therapies. Based on this factor, WHO estimates the cancer cases to reach 32 million by the end of 2030, reflecting a particular set of individuals requiring advanced diagnostics such as circulating tumor cell analysis and minimal residual disease monitoring. Therefore, the segment is gaining dual traction due to disease burden and payer support, denoting a wider segment scope.

Our in-depth analysis of the cell sorter market includes the following segments:

|

Technology |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Sorter Market Regional Analysis

North America Market Insights

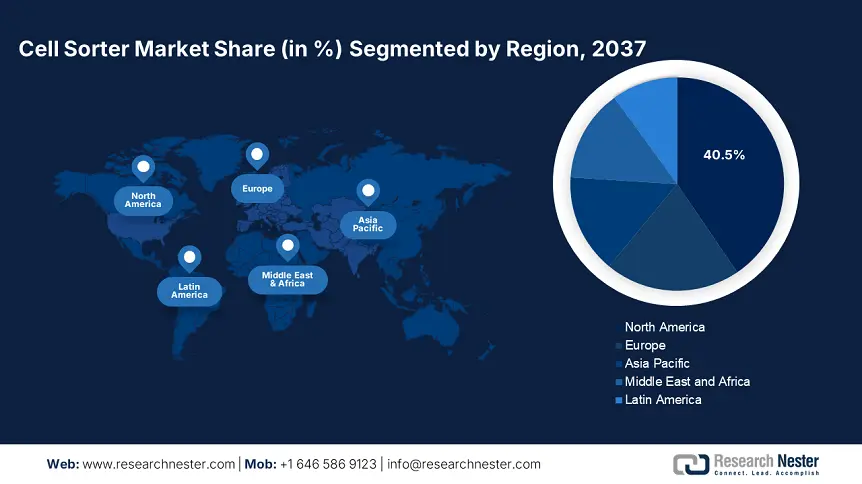

The North America cell sorter market is set to dominate, capturing the largest share of 40.5%, rising at a CAGR of 9.4% by the end of 2037. The leadership of the country is attributable to the advanced healthcare infrastructure and booming expenditure in terms of research and development. Moreover, the region hosts favorable reimbursement policies that further accelerate clinical adoption. Besides, cross-border collaborations between U.S. and Canada-based research institutes, such as NIH-CIHR jointly funded programs, are enhancing access to innovative cell sorting technologies.

U.S. is at the forefront, presenting predominant captivity in the regional cell sorter market, grabbing 85.6% of the share in North America. This became possible with the facilitation of funding grants and Medicare expansion. NIH extends its support with USD 2.9 billion for single-cell research, whereas Medicaid granted USD 1.2 billion for clinical cell sorting, which is a 20% year-over-year increase. Besides, the CDC report states that there is a 22% increase in cancer diagnostics from 2022 to 2024, thereby creating a positive market demand. Further U.S. FDA fast-tracked five new devices in 2025.

The Canada cell sorter market is drawing the focus of nationwide leaders with the presence of strong federal and provincial healthcare investments. The country’s market grows at 8.3% CAGR, effectively attributed to USD 910 million federal healthcare grants in 2025. Besides, Ontario’s 2024 budget prioritized cell therapy infrastructure, boosting adoption by 16.8%. On the research front, CIHI unveils that there is a 13% annual growth in biotech R&D spending on MACS-based systems, further propelling growth in this sector. Public Health Agency of Canada projects a 30% increase in genomic medicine demand by the end of 2030.

Europe Market Insights

The cell sorter market in Europe is projected to exhibit standard growth, holding a 30.5% share by the end of the assessed time frame. The region benefits from a substantial cancer population, government-backed precision medicine initiatives, and phenomenal R&D investment in the biopharmaceutical sector. As evidence, it is noted that the EU Health Data Space allocated €2.6 billion for single-cell research for the duration 2023 to 2037, accelerating the adoption of high-throughput sorters. On the other hand, regulatory bodies such as EMA‘s accelerated pathway reduced approval timelines by 26%, hence fostering further innovation in the sector.

Germany is boosting its augmentation in the regional market with a 33% share during the forecast timeline. The growth in the country is effectively fueled by the annual healthcare expenditure and a heightened demand for cancer diagnostics. The country witnessed domination with €4.5 billion in annual spending, further supported by BMG’s €520 million grants for automated sorters. On the other hand, Germany hosts robust reimbursement policies covering over 88% of clinical sorters, further propelling growth in the country.

The cell sorter market in the UK is poised for growth with a significant share of 28.7% in the regional market. The growth in the country is highly facilitated by the presence of the NHS’s centralized procurement and CRUK’s £300 million investment in liquid biopsy R&D. Moreover, the aspect of advanced technologies, expansion of pharmaceutical and biotechnological industries, enables efficient and accurate separation procedures, thereby providing a revolutionary opportunity for the domestic manufacturers.

Asia Pacific Market Insights

The cell sorter market in Asia Pacific is set to witness the fastest expansion, rising at a CAGR of 11.6%. The region’s propagation is highly stimulated by rising cancer incidence, government-led precision medicine initiatives, and increasing investments in the biopharmaceutical sector. Testifying to this factor, Japan witnessed growth, allocating nearly 13% of its healthcare budget towards cell sorting, which is especially for CAR-T and regenerative medicine. On the other hand, in South Korea, the automated sorters are adopted by 32% of hospitals, with a great demand for AI-integrated systems.

Government Policies and Funding for Market in APAC (2021–2025)

|

Country |

Government Initiative / Funding |

Budget/Funding (Approx.) |

Launch Year |

|

Australia |

National Health and Medical Research Council (NHMRC) grants for single-cell research |

AUD 60 million |

2022 |

|

Japan |

Moonshot R&D Program for Cell Analysis Technologies (Cabinet Office) |

JPY 20 billion |

2021 |

|

South Korea |

Ministry of Science & ICT - Next-Gen Biomedical Equipment Development (incl. cell sorters) |

KRW 40 billion |

2021 |

|

Malaysia |

Ministry of Health (MoH) & MOSTI - High-Impact Research Grants for Medical Diagnostics |

MYR 30 million |

2024 |

China is the dominating player in the regional market with the highest share of 46.7%, owing to the presence of the USD 1.3 billion National Precision Medicine Initiative. Simultaneously, NMPA accelerated its approvals, particularly offering 42% faster clearances for domestic devices. Besides local players, such as Mindray takes over 32% of demand with affordable systems whereas 1.6 million cancer patients in 2023 boosted clinical demand. Furthermore, the government’s Made in China 2025" policy reduces import reliance, thereby improving the supply chain sector.

India is predominantly growing in the market with a compound annual growth rate of 18.6% during the assessed timeframe. The growth in the country is fueled by the government's PM-JAY scheme, which grants USD 1.9 billion yearly for advanced diagnostics. Besides, the country reports 85% reliance on the expensive private labs due to limited public infrastructure. On the other hand, domestic manufacturers such as Tata MD are focusing on affordability, reducing costs by 25% through local production, hence readily allowing growth for local pioneers.

Key Cell Sorter Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The worldwide market comprises leading organizations that present a bifurcated landscape between clinical giants such as BD, Beckman, and Asia-based innovators. The U.S.-based firms readily dominate with an intensifying competition between BD Biosciences, Beckman Coulter, Miltenyi Biotec, and Thermo Fisher Scientific, grabbing the maximum revenue share. Simultaneously, prominent players of emerging markets focus on affordability and accessibility to widen adoption in niche areas.

Here is the list of some prominent players in the market:

|

Company Name (Country) |

Market Share |

Industry Focus |

|

BD Biosciences (U.S.) |

23.7% |

Flow cytometry & clinical cell sorters (FACSAria, FACSMelody) |

|

Beckman Coulter (U.S.) |

19.5% |

High-throughput sorters (MoFlo Astrios, CytoFLEX) |

|

Miltenyi Biotec (Germany) |

13.2% |

MACS® magnetic sorters (AutoMACS, CliniMACS) |

|

Thermo Fisher Scientific (U.S.) |

9.6% |

Research & clinical sorters (BigFoot, Attune NxT) |

|

Agilent Technologies (U.S.) |

7.4% |

Compact benchtop sorters (NovoCyte, ACEA) |

|

Bio-Rad Laboratories (U.S.) |

xx% |

Droplet-based single-cell sorters (S3e, ZE5) |

|

Cytonome/ST (U.S.) |

xx% |

Microfluidic sorters (VLX, C1) |

|

Union Biometrica (U.S.) |

xx% |

Large-particle sorting (COPAS, BioSorter) |

|

Mindray (China) |

xx% |

Cost-effective clinical sorters (BC6800, ExCyte) |

|

Cytek Biosciences (U.S.) |

xx% |

Spectral cytometry (Aurora, Northern Lights) |

|

NanoCellect Biomedical (U.S.) |

xx% |

Gentle cell sorting (WOLF G2) |

|

BioMedical Solutions (Australia) |

xx% |

Portable sorters for remote labs |

|

Bioneer (South Korea) |

xx% |

Automated lab-on-a-chip sorters |

|

Tata Medical Systems (India) |

xx% |

Affordable FACS for emerging markets |

Below are the areas covered for each company under the top global manufacturers:

Recent Developments

- In May 2024, Sony Biotechnology introduced the LEAP Pro with AI-driven purity validation, adopted by over 30 cancer centers for its 99.9% sorting accuracy.

- In March 2024, BD Biosciences launched the FACSDuet, FDA 510(k)-cleared a dual-laser sorter for CAR-T manufacturing, capturing 16% of the clinical sorter market within 3 months.

- Report ID: 7763

- Published Date: Jun 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Sorter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert