Cardiovascular Diagnostic Testing Market Outlook

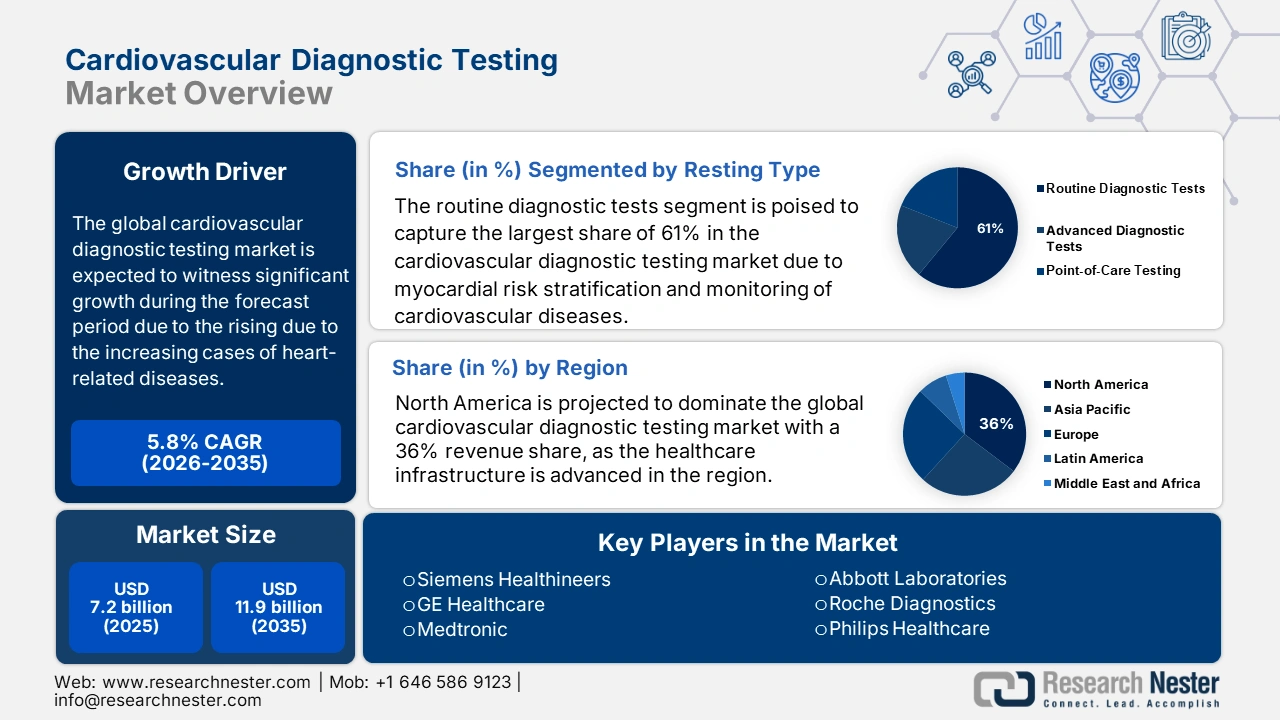

Cardiovascular Diagnostic Testing Market size was over USD 7.2 billion in 2025 and is estimated to reach USD 11.9 billion by the end of 2035, expanding at a CAGR of 5.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of cardiovascular diagnostic testing is evaluated at USD 7.6 billion.

The rising cases of heart-related diseases are becoming a global concern, which is creating a surge for early detection and intervention, hence fueling the market. According to the Centers for Disease Control and Prevention (CDC), in October 2024, 919,032 people lost their lives due to cardiovascular disease 2023. This is about one death in three. Coronary heart disease is the most common form of heart disease. There were 371,506 deaths in 2022 from coronary heart disease. This fits well with the evolution of demand for solutions available in this cardiovascular diagnostic testing market. Moreover, rapid aging among residents from across the world is also propelling the volume of this demography.

AHA Cardiovascular Disease Statistics (U.S. & Global) 2022

|

Category |

Statistic |

|

Total CVD Deaths (U.S.) |

941,652 deaths |

|

CVD vs. Other Diseases (U.S.) |

More deaths than cancer + chronic lower respiratory disease combined |

|

Leading CVD Causes (U.S.) |

CHD (39.5%), Stroke (17.6%), Other CVD (17%), Hypertensive Disease (14%), HF (9.3%), Arteries (2.6%) |

Despite worldwide adoption, the economic burden from high payers’ pricing in the market is still persistent. This is reflected in the rising inflation for the producer price index (PPI) of medical diagnostic equipment, which stood at 106.0 in August 2025, according to the September 2025 report from the Federal Reserve Bank. Hence, this inflation is due to increasing production costs resulting from shortages in the semiconductor supply chain. These country lockdowns had also interrupted supply chains, which, together with a shortage of semiconductors, raised prices passed down to and through healthcare providers and thereby patients themselves, putting a squeeze on both the public and private health infrastructures. As demand keeps rising for advanced cardiovascular diagnostic means, the question of affordability and innovation continues to be a big concern for both policy and industry.

Key Cardiovascular Diagnostic Testing Market Insights Summary:

Regional Highlights:

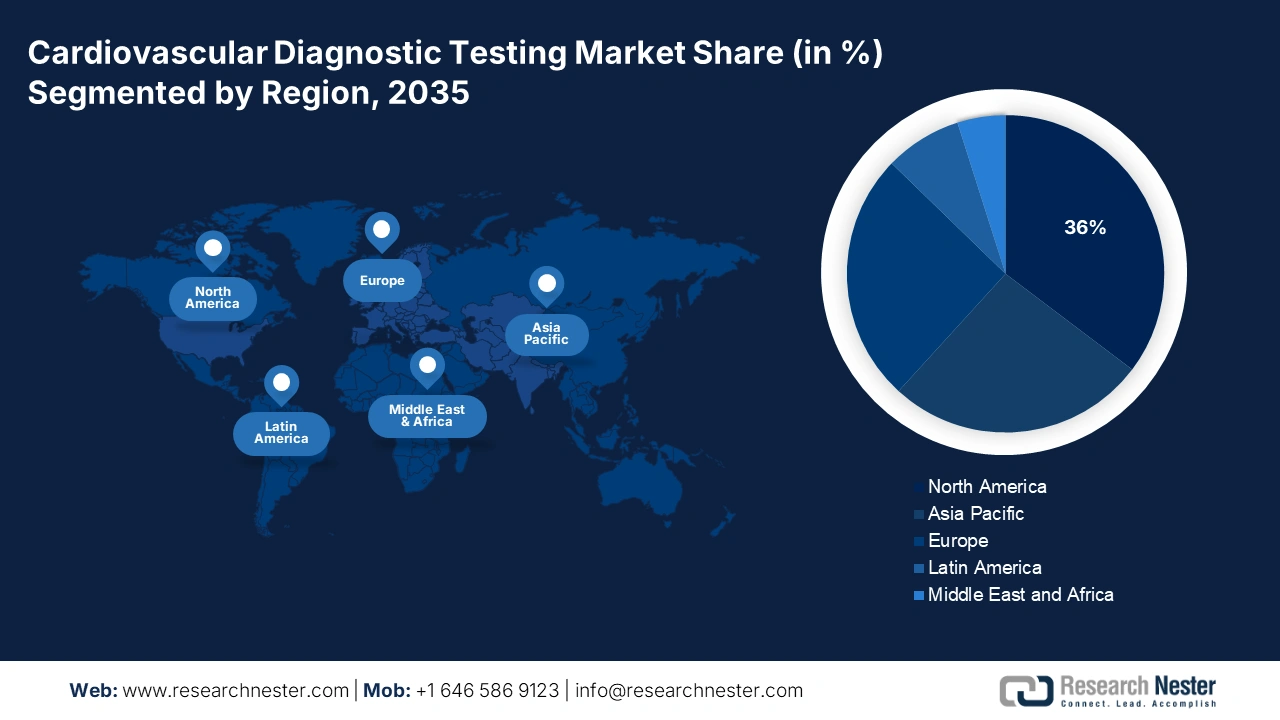

- North America is forecasted to lead the Cardiovascular Diagnostic Testing Market with a 36% revenue share by 2035, underpinned by advanced healthcare infrastructure, high purchasing power, and favorable reimbursement frameworks.

- Europe is projected to witness the fastest expansion through 2035, stimulated by the increasing cardiovascular disease burden and continuous advancements in diagnostic infrastructure.

Segment Insights:

- The routine diagnostic tests segment is projected to command a 61% share of the Cardiovascular Diagnostic Testing Market by 2035, supported by the growing emphasis on early detection and cost-effective management of cardiovascular diseases.

- The non-invasive testing segment is anticipated to dominate the technology category by 2035, propelled by the rising adoption of safer, faster, and patient-preferred diagnostic modalities.

Key Growth Trends:

- Contribution to reducing healthcare costs and mortality

- Investments and engagement in innovation

Major Challenges:

- Hurdles in attaining universal compliance

- Inconsistent payer policies across regions

Key Players: Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Medtronic, GE Healthcare, Philips Healthcare, Becton Dickinson, Danaher, BioMerieux, B. Braun, LivaNova, Mindray Medical, Trivitron Healthcare, OSANG Healthcare, Edwards Lifesciences.

Global Cardiovascular Diagnostic Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 7.6 billion

- Projected Market Size: USD 11.9 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, Brazil, South Korea, Italy, Australia

Last updated on : 6 October, 2025

Cardiovascular Diagnostic Testing Market - Growth Drivers and Challenges

Growth Drivers

- Contribution to reducing healthcare costs and mortality: The propelled pace of expansion in the cardiovascular diagnostic testing market is significantly driven by the clinical validation of its cost-saving potential. As per a report by NLM, June 2023, out of 49 studies on CVD-related screening strategies, 87.8% were found to be cost-effective, and 22.5% reported actual cost reductions. Such findings underscore the economic value of testing commodities, creating a strong foundation for this sector. The demonstrated return on investment is also driving the adoption of advanced testing solutions across care settings.

- Investments and engagement in innovation: The major funding agencies are the drivers of the future progress of intensive research and development in the market. As per a report by NLM in April 2023, AI can use variable-length heartbeats for arrhythmia detection with a high classification accuracy of 98%. Additionally, AI-enabled ECG acquired during normal sinus rhythm permitted identification at the point of care of individuals with atrial fibrillation with an area under the curve of 0.9 and an overall accuracy of 83%. These advancements highlight AI's growing role in improving early detection and diagnostic precision for cardiovascular conditions.

- Rising early-onset CVD cases: Driving the significant growth of the market is the ever-increasing burden of early manifestation of cardiovascular disease. According to the Centers for Disease Control and Prevention (CDC), in October 2024, in 2023, each 1 death in 6 is due to CVDs that took place in an adult aged 65 years, marking a shift toward younger populations being affected. With increasing awareness, early detection, timely treatment, and prevention remain much sought after. Health practitioners, therefore, have increasingly championed the case for preemptive screening and diagnosis for late health risks encountered by younger age groups.

Key Electrocardiography Datasets Supporting the Cardiovascular Diagnostic Testing Market (2023)

|

Dataset |

Subjects |

ECGs |

Leads |

Duration per Record |

Sampling Frequency (Hz) |

Diagnosis Categories |

Abnormality Rate (%) |

|

AHA [6] |

N/A |

154 |

2 |

3 hours |

250 |

8 |

100% |

|

European ST-T [7] |

79 |

90 |

2 |

120 minutes |

250 |

2 |

100% |

|

Long-term ST [8] |

80 |

86 |

1 |

21–24 hours |

250 |

1 |

100% |

|

MIT-BIH Arrhythmia [9] |

47 |

48 |

2 |

30 minutes |

360 |

1 |

100% |

|

MIT-BIH Noise Stress Test [10] |

15 |

15 |

1 |

12 × 30 min + 3 × 30 min |

360 |

1 |

100% |

|

STAFF-III [11] |

104 |

108 |

12 |

Various conditions |

1000 |

1 |

100% |

|

PTB Diagnostic ECG [12] |

290 |

549 |

15 |

2 minutes |

1000 |

9 |

81% |

|

T-Wave Alternans Challenge [14] |

N/A |

100 |

12 |

2 minutes |

500 |

1 |

100% |

|

LUDB [15] |

N/A |

200 |

12 |

10 seconds |

500 |

6 |

19% |

Source: NLM

Challenges

- Hurdles in attaining universal compliance: Delays in the regulatory approval process result in considerable financial loss for the cardiovascular diagnostic testing market via the negation of innovation and delays in product launching. For instance, due to stricter conditions of compliance, there is an increasing delay in approval in Japan. Similarly, the Breakthrough Device program of the U.S. FDA has lately faced significant bottlenecks, approving only a handful of AI cardiology tools that have been submitted for approval. These bottlenecks set barriers in front of manufacturers and increase the cost of development. Moreover, a very lengthy clearance route might limit its time in the market

- Inconsistent payer policies across regions: Inconsistent reimbursement coverage across different healthcare systems creates disparities in the market. At least such inconsistencies exist even within key markets such as the U.S., where manufacturers in turn need to contend with Medicaid differences lying in states one after another. There have been state-based waiver approvals granted for the benefit of allowing companies such as Abbott to procure additional patients. Resolving these reimbursement issues will be instrumental in ensuring the larger availability and uptake of new cardiovascular diagnostics technology

Cardiovascular Diagnostic Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 7.2 billion |

|

Forecast Year Market Size (2035) |

USD 11.9 billion |

|

Regional Scope |

|

Cardiovascular Diagnostic Testing Market Segmentation:

Testing Type Segment Analysis

The routine diagnostic tests segment is expected to hold the highest market share of 61% within the testing type segment in the market within the forecast period, encompassing conventional procedures such as performing electrocardiograms (ECG), echocardiograms, and assays of blood biomarkers. These tests are essential in the early detection, myocardial risk stratification, and monitoring of cardiovascular diseases. The widespread use of these tests ensures that clinical guidelines are useful, they cost less, and they give an immediate result, making it possible for a clinician to act upon them. According to the American Heart Association in January 2025, almost 2,500 people in the U.S. are dying every day from cardiovascular disease as of January 2025, highlighting the momentous role of routine diagnostics in the management of this public health menace.

Technology Segment Analysis

Non-invasive testing is expected to hold the highest market share within the technology segment in the cardiovascular diagnostic testing market within the forecast period. Noninvasive cardiovascular diagnostic testing technologies such as echocardiography, cardiac MRI, and wearable ECG devices have reached the zenith in acceptance as per patient choice since they carry lower risks and provide instantaneous results. As per a report by NLM in April 2025, transthoracic echocardiography remained the most-utilized test among the Medicare population in 2022, accounting for 67.7% of cardiac testing use, followed by single-photon emission CT myocardial perfusion imaging, which has dropped from 20.8% to 12.9%. This noninvasive diagnostic testing allows cardiovascular disease to be detected early and monitored continuously without employing invasive catheter procedures.

End user Segment Analysis

Hospitals and clinics are expected to hold the highest market share within the end user segment in the market within the forecast period. Due to massive infrastructural facilities, competent staff, and advanced diagnostic tools, cardiac diagnostic testing finds its prominence in hospitals and cardiac clinics. The segment is expected to grow in demand with the increasing cases of cardiovascular diseases worldwide and the emphasis on early-stage diagnosis. As per a report by the AHA in January 2025, there were 6,093 hospitals in the U.S. Moreover, the implantation of AI-based diagnostic technologies within hospitals ensures two major goal, improved accuracy and smoother workflow, and as such, higher investments funnel into such advancements.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Sub-segments |

|

Type |

|

|

End user |

|

|

Technology |

|

|

Application |

|

|

Product |

|

|

Testing Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardiovascular Diagnostic Testing Market - Regional Analysis

North America Market Insights

North America is projected to dominate the market with a 36% revenue share throughout the forecast period. With this, the purchasing power for CVD is high, notably as the healthcare infrastructure is advanced in the region. In this regard, the American Heart Association in 2024 reported that the direct and indirect costs of CVD came up to USD 422.3 billion, with direct costs to the tune of USD 254.3 billion, while lost productivity stood at USD 168.0 billion. Also, with the assistance of an advantageous framework for reimbursement, early technology adoption gains acceleration in penetration in the public and private healthcare sectors.

The U.S. is maintaining its position as the region's largest cardiovascular diagnostic testing market, backed by substantial public spending and insurer policy support. According to the Centers for Disease Control and Prevention (CDC), in October 2024, every year, 805,000 people have heart attacks in the U.S. In those 805,000 people, 605,000 have heart attacks for the first time, and 200,000 are people who had already experienced a heart attack before. Hence, this gives more opportunities and challenges to participants in this highly advanced and competitive land. Early and preventive diagnostics are becoming increasingly in demand, forcing manufacturers to innovate faster and widen their test portfolios.

The market in Canada is projected to grow at a steady pace on account of provincial government healthcare investments. According to a report by the Government of Canada in July 2022, every hour, about 14 adults in Canada, aged 20 and over with diagnosed heart disease, die. The death rate is 6.3 times higher among adults aged 40 and over with diagnosed heart failure than those without. This heavy burden of disease actually provides the impetus for the provinces to increase diagnostic services that are accessible and accurate. In addition, more grants for cardiac research and diagnostic infrastructure are facilitating the introduction of non-invasive and AI-supported testing technologies in urban as well as rural healthcare settings.

Europe Market Insights

The cardiovascular diagnostic testing market in Europe is estimated to be the fastest-growing market by 2035 due to rising cardiovascular disease burden, expanding preventive care initiatives, and upgrading diagnostic infrastructure. According to the World Health Organization Europe in May 2024, cardiovascular diseases are still at the top of the list of causes of death in the region, causing about 10,000 deaths each day and constituting more than 42.5 % of all deaths. The demand for advanced diagnostics due to the aging population, high comorbid risk factors (hypertension, diabetes, obesity), and stronger regulatory push for early detection will be maintained.

UK market is experiencing strong growth due to increased premature cardiovascular deaths, further undetected or untreated cardiovascular conditions. According to a report by ONS in October 2024, ischemic heart diseases accounted for 57,895 deaths in England in 2023. Simultaneously, several national programs, such as the NHS Health Check programme, are promoting opportunities for active screening of cardiovascular risk factors in adults. This burden of cardiovascular ill health is spurring investment into early diagnostic tools, including imaging, biomarker tests, and remote monitoring technologies.

Germany is establishing regional dominance in the cardiovascular diagnostic testing market, which is attributed to government funding. As per a report by the Journal of Health Monitoring in February 2025, based on the kinds of CVD tests, 73.5% of adults were at low risk, 7.8% remained at low risk, 6.0% at an increased risk, and 12.8% at a high risk. Conversely, 28.7% perceived themselves to be at almost no risk, 45.3% at low risk, 20.4% at moderate risk, and 5.6% at high risk. This sort of difference between measured and perceived risk of cardiovascular health brings to light a very serious gap in awareness, strengthening the need for testing that is widely available and accessible yet highly accurate within the country itself.

Cardiovascular Disease (CVD) in Europe: Mortality Rates & Economic Burden (2023)

|

Aspect |

Details |

|

Total Estimated Annual CVD Cost (EU) |

€210 billion |

|

Healthcare Costs |

€111 billion: Treatment, hospitalization, and medical care |

|

Productivity Loss |

€54 billion: Lost income/output due to illness or premature death |

|

Informal Care Costs |

€45 billion: Unpaid care provided by relatives or informal caregivers |

Source: NLM

Asia Pacific Market Insights

The cardiovascular diagnostic testing market in the Asia Pacific is estimated to grow steadily due to the spike in CVD prevalence and various government health initiatives. According to the World Health Organization (WHO) in September 2023, cardiovascular diseases account for 3.9 million deaths in the WHO South-East Asia Region every year, nearly a quarter of all deaths from noncommunicable diseases (NCDs); most of these are preventable. This increasing health burden is leading to reinvestment being pumped into early diagnostic tests, including imaging, biomarker testing, and remote monitoring technologies.

The market in China is growing due to cardiovascular diseases and government initiatives. As per a report by NLM in June 2023, almost 330 million individuals in China were affected by cardiovascular diseases, including 13 million strokes, 11.3 million cases of coronary artery disease, 8.9 million cases of heart failure, 5 million cases of pulmonary heart disease, and 4.8 million cases of atrial fibrillation. This growing health burden is driving increased investment into the development of early diagnostic means and techniques, including those of imagery and of biomarker testing, and technologies for remote monitoring.

The cardiovascular diagnostic testing market in India is growing due to the heavy burden of CVDs and government initiatives in early detection and creating awareness. As per a report by NLM in April 2025, India is anticipated to lose around USD 2.1 trillion to CVDs by 2030, according to the NLM report of April 2025. To minimize this heavy health burden, the government has consciously initiated investment in building more infrastructure and screening programs. Expanding infrastructure and diagnostics will be essential since early detection is one of the major factors in minimizing high CVD mortality and morbidity in India.

Key Cardiovascular Diagnostic Testing Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche Diagnostics

- Siemens Healthineers

- Medtronic

- GE Healthcare

- Philips Healthcare

- Becton Dickinson

- Danaher

- BioMerieux

- B. Braun

- LivaNova

- Mindray Medical

- Trivitron Healthcare

- OSANG Healthcare

- Edwards Lifesciences

The market is dominated by a consortium of MedTech innovators, including Abbott, Roche, Siemens, Medtronic, and GE, which collectively control over the global revenue. These industry leaders are driving innovation through AI integration and rigorous R&D involvement. For instance, Roche and Siemens are consolidating their position in this field with their FDA/CE-approved AI diagnostic solutions that can reduce errors. On the other hand, suppliers in emerging landscapes are localizing production in India and China to escalate adoption rates by reducing costs.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2024, Boston Scientific announced that the FDA had approved a new use for their INGEVITY+ Pacing Leads. These thin wires, which are placed inside the heart and connected to a pacemaker, can now be used for pacing and sensing in the left bundle branch area (LBBA) of the heart.

- In June 2024, AliveCor announced that the U.S. FDA had approved their new AI system, KAI 12L, and the Kardia 12L ECG device. This is the first AI technology that can detect 35 different heart problems.

- Report ID: 7762

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.