Buccal Cavity Devices Market Outlook:

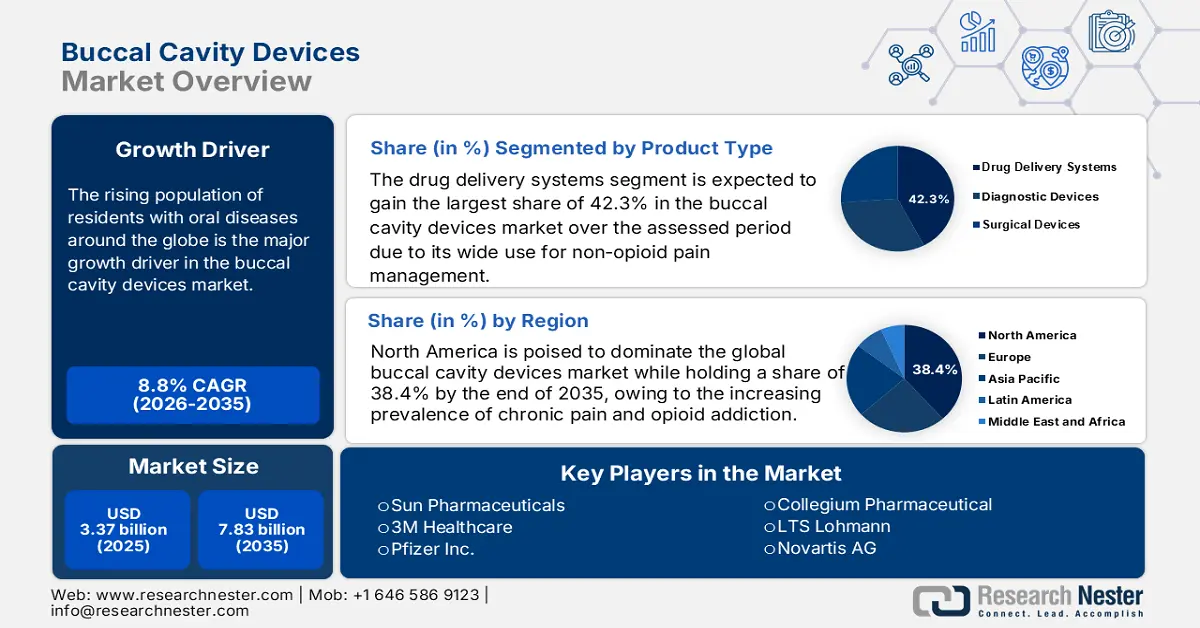

Buccal Cavity Devices Market size was over USD 3.37 billion in 2025 and is poised to exceed USD 7.83 billion by 2035, growing at over 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of buccal cavity devices is estimated at USD 3.64 billion.

The rising population of residents with oral diseases around the globe is the major growth driver in the market. Testifying this demographic expansion, the WHO reported that, more than 3.6 billion people worldwide were suffering from such illnesses till 2023. Among these, yearly over 520,010 candidates were newly diagnosed with cancer. In addition, older citizens are more prone to developing these ailments, which is propelling the surge in innovative and patient-friendly treatment options on account of rapid aging. This epidemiology represents a sustainable demand for early detection and non-invasive therapeutic solutions, creating a strong foundation for this sector.

The continuously growing inflation in payers' pricing is indicating the amplification of economic pressure on the patient population, limiting wide adoption in the buccal cavity devices market. Displaying the same, between 2023 and 2024, the U.S. Bureau of Labor Statistics observed a 4.3% year-over-year (YoY) rise in the producer price index (PPI) for available commodities in this category. This upstream trajectory is further flowing through the consumer price index (CPI) for associated healthcare services, witnessing a 5.9% hike in 2024, as per the Centers for Medicare & Medicaid Services (CMS). As patient access is crucial to maintaining a steady cash business flow in this sector, dedicated companies are focusing on alignment with reimbursement policies to avail coverage for payers.

Key Buccal Cavity Devices Market Insights Summary:

Regional Highlights:

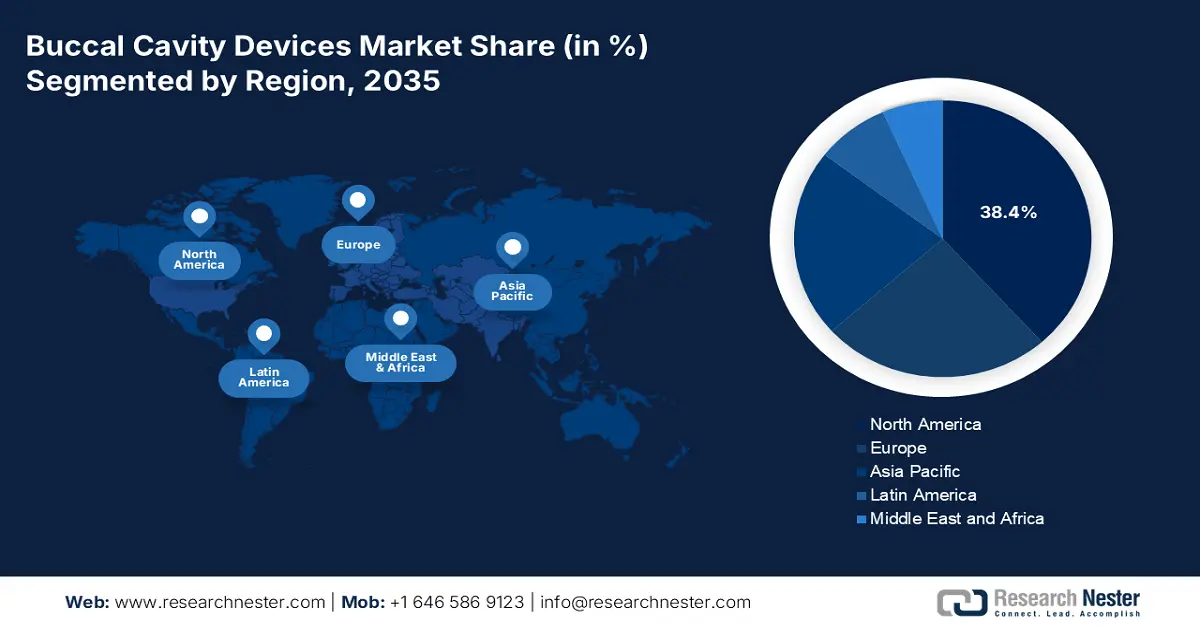

- North America dominates the Buccal Cavity Devices Market with a 38.40% share, driven by chronic pain prevalence and strong federal healthcare spending, ensuring robust growth by 2035.

- The Asia Pacific region is projected to achieve a high CAGR in the Buccal Cavity Devices Market from 2026 to 2035, driven by aging population, oral cancer prevalence, and technological advancements.

Segment Insights:

- The Pain Management segment is projected to secure a 35.1% revenue share by 2035, driven by increasing demand for safer, effective therapeutics for arthritis and neuropathic pain.

- The Drug Delivery Systems segment, holding a 42.3% share of the Buccal Cavity Devices Market, is expected to experience significant growth from 2026 to 2035, propelled by the increasing use of sublingual films for non-opioid pain management and smoking cessation therapies, driven by the rising chronic pain population.

Key Growth Trends:

- Expanding coverage of financial backup

- Proactive investment and engagement in innovation

Major Challenges:

- Obstacles in continuous outsourcing

Key Players: Pfizer Inc., Novartis AG, 3M Healthcare, Sun Pharmaceuticals, LTS Lohmann, Collegium Pharmaceutical, Dr. Reddy’s Laboratories.

Global Buccal Cavity Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.37 billion

- 2026 Market Size: USD 3.64 billion

- Projected Market Size: USD 7.83 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Buccal Cavity Devices Market Growth Drivers and Challenges:

Growth Drivers

- Expanding coverage of financial backup: The mitigation of economic disparity in the market underscores the need for consistent capital influx from authorized investors. Thus, several governing bodies are raising the volume of expenditure on this category. As evidence, in 2023, the net Medicare spending on offerings from this merchandise grew by 9.1% YoY, reaching USD 1.3 billion. Similarly, the allocation for oral mucosal drug delivery in Germany witnessed a rise in 2024 for increasing public access to cost-effective alternatives to injections, totaling USD 547.6 million, according to the Federal Ministry of Health. Moreover, the trend of procuring products in bulk for medical settings is magnifying the cash inflow in this sector.

- Proactive investment and engagement in innovation: Considering the clinical and financial benefits of integrating advanced technologies and product design, both public and private organizations are heavily investing in extensive R&D in the buccal cavity devices market. For instance, in 2023, Novartis dedicated USD 200.3 million to developing bio-compatible adhesive films for smoking cessation and diabetes. Simultaneously, in 2024, the total research funding from the National Institute of Health (NIH) for cultivating advanced oral drug delivery systems attained a 12.3% rise, accounting for USD 320.5 million. Furthermore, the incorporation of next-generation technologies is also strengthening the sector's pipeline expansion.

Challenges

- Obstacles in continuous outsourcing: Financial exhaustion is a major hurdle in the buccal cavity devices market, which is primarily fueled by the disruptions and volatilities in the supply chain of required active pharmaceutical ingredients (APIs). In this regard, the FDA revealed that the production of finished tools in this category in the U.S. relies on over 60.2% of API sourcing from China and India. This dependence is highly influential in raising the overall cost of treatment, which ultimately restricts wide adoption in this sector. However, the trend of localized manufacturing has significantly minimized this disparity. For instance, in 2023, producers in Europe achieved a 90.2% reduction in supply disruptions by shifting API sourcing to Germany.

Buccal Cavity Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 3.37 billion |

|

Forecast Year Market Size (2035) |

USD 7.83 billion |

|

Regional Scope |

|

Buccal Cavity Devices Market Segmentation:

Product Type Segment Analysis

In terms of product type, the drug delivery systems segment is expected to gain the largest share of 42.3% in the buccal cavity devices market over the assessed period. The widening use of sublingual films across the world as a suitable option for non-opioid pain management is the primary growth factor in this segment. Thus, the enlarging pool of patients with chronic pain is a subsequent stimulant behind this proprietorship. Testifying this, the NIH revealed that the preferred use of sublingual films as an alternative to addictive supplements was observed among 22.5% of the net population with chronic pain. In addition, the extensive application of these products in smoking cessation therapies is internationally recognized, broadening the scope of generating greater revenue.

Application Segment Analysis

Based on applications, the pain management segment is predicted to garner the highest revenue share of 35.1% in the buccal cavity devices market throughout the discussed timeframe. The rigorous search for safer and more effective therapeutics to manage the painful symptoms of arthritis and neuropathic illnesses has positioned this segment at the forefront of the worldwide cohort of oral medications. This can be displayed through the 18.3 million patient population in the U.S. relying on buccal drugs till 2024, according to the Centers for Disease Control and Prevention (CDC). In addition, the segment received validation from several clinical trials, which established its strong emphasis on this sector. For instance, in 2023, the AHRQ study demonstrated a 15.3% decrease in ER visits from the use of buccal films.

Our in-depth analysis of the buccal cavity devices market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Buccal Cavity Devices Market Regional Analysis:

North America Market Analysis

North America is poised to dominate the global buccal cavity devices market while holding a share of 38.4% by the end of 2035. The increasing prevalence of chronic pain and opioid addiction is empowering the region's predominant captivity over this merchandise. Testifying the same, in 2024, the population of buccal films-eligible residents with chronic pain in North America crossed 25.4 million, as per the CDC. This represents a substantial growth in demand for fast-acting, non-invasive drug delivery systems, including buccal components. Besides, the presence of strong capital influx from both insurers and the Federal government in developed countries, such as the U.S. and Canada, is solidifying the region's leadership in this field.

The U.S. is augmenting a predominant control over the regional revenue generation from the buccal cavity devices market. The increased spending on non-invasive treatment options for pain management, oral diseases, and neurological disorders is a major asset for the country's lead in this sector. As evidence, the CMS recorded a 15.2% rise in Medicaid expenditure in this category over the tenure from 2020 to 2024, which provided financial backup for an additional 1.3 million eligible patients. Furthermore, continuous clinical discoveries and achievements in this sector within the nation's territory reflect a progressive trading atmosphere. In support of this cohort of innovation, in 2024 alone, the FDA cleared more than 11 associated IoT-enabled devices.

Canada is also showcasing robust growth in the buccal cavity devices market, remarking on its significance in the regional landscape. The continuous funding from governing bodies is the major propeller of this escalation. For instance, in 2023, healthcare allocation by the government of Ontario rose by 18.4%, totaling USD 3.3 billion, from 2021. In addition, the nationwide acceptance of affordable generics is opening new business opportunities for global leaders in this sector. In this regard, in 2024, Health Canada provided marketing clearance for 5 new biosimilar buccal film generics to escalate public access to advanced care. Moreover, the emergence of telemedicine in this country is also contributing to the field's expansion.

APAC Market Statistics

Asia Pacific is anticipated to register the highest CAGR in the global buccal cavity devices market between 2025 and 2035. The rapidly aging population, increasing prevalence of oral cancer, and wide adoption of sedentary lifestyles across the region are accumulatively amplifying the volume of the patient pool in this sector. In response, the governing authorities in high-risk countries are commencing awareness campaigns and subsidiary initiatives to combat the widespread. For instance, in 2024, the nationwide cancer screening programs in South Korea and Malaysia raised growth in the diagnostic buccal devices segment. Furthermore, technologically advanced countries are establishing a progressive environment of business in this landscape by integrating IoT features.

China is one of the largest raw material suppliers in the global buccal cavity devices market, which fosters the potential of regional leadership. For instance, in 2023, 40.3% of the net buccal drug delivery components imported by the U.S., worth USD 1.3 billion, originated from China. Furthermore, its exceptional capacity in localized API production satisfies 70.4% of domestic demand and reduces costs by 25.2%. In addition, the country also has a large patient pool, where more than 1.5 million afflicted residents were treated by therapeutics from this sector in 2024, as per the National Medical Products Administration (NMPA). Moreover, the nation consists of a favorable field for conducting a profitable business in this category.

India is emerging as a hub of innovation and a large consumer base for the buccal cavity devices market with robust support from governing authorities and increased oral disease prevalence. In this regard, a report from the NITI Aayog revealed that the annual government healthcare funding in India rose significantly from 2015 to 2024, reaching USD 1.9 billion. Additionally, the efforts from domestic leaders to bring affordability to patients in need are magnifying the rate of adoption in this landscape. To serve the same purpose, in 2023, Sun Pharma expanded treatment access to 2.5 million patients with the introduction of affordable $15.1/month generic buccal medications.

Key Buccal Cavity Devices Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- 3M Healthcare

- Sun Pharmaceuticals

- LTS Lohmann

- Collegium Pharmaceutical

- Dr. Reddy’s Laboratories

- Mundipharma

- Teva Pharmaceutical

- Fresenius Kabi

- Hikma Pharmaceuticals

- Lupin Limited

- Endo International

- CSPC Pharmaceutical

- Hanmi Pharmaceutical

- Mayne Pharma

- Duopharma Biotech

- Mylan

The current dynamics of the buccal cavity devices market are highly controlled by the collective efforts of Pfizer, Novartis, and 3M, acquiring 32.6% of the total revenue generation. Such key players are pursuing distinct strategies to concur different regional landscapes. For instance, Pfizer applied premium pricing, 15.2% above the present market standards, for its IoT-enabled smart patches after gaining FDA approval in 2024 to extend the profit margin from globalized operations. On the other hand, Sun Pharma and Dr. Reddy are capitalizing on low-cost API production to deepen their penetration in emerging landscapes, such as India.

Top contenders of this cohort of pioneers are:

Recent Developments

- In May 2024, Sun Pharma launched BuccTab-Nicotine, a low-cost nicotine buccal tablet for smoking cessation. The product drove an 18.4% adoption rate in rural areas of India. This also contributed to the company’s 5.2% revenue growth in the APAC region, strengthening its presence in the buccal cavity devices market.

- In March 2024, Pfizer introduced BuccalFilm-XR, an extended-release buprenorphine buccal film for chronic pain. The product captured 12% of the U.S. opioid-alternative market by the 2nd quarter of 2024, reducing off-label sublingual tablet use by 20.4%, as noted in the FDA Approval Notice.

- Report ID: 7758

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Buccal Cavity Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.