Body Composition Analyzers Market Outlook:

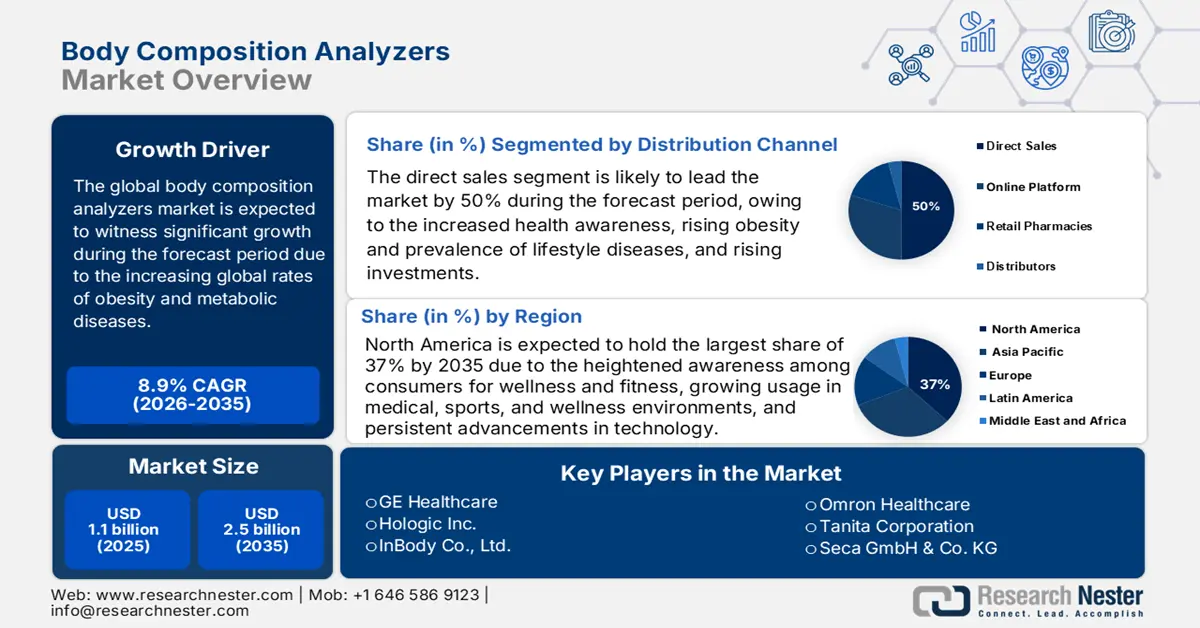

Body Composition Analyzers Market size is valued at USD 1.1 billion in 2025 and is projected to reach USD 2.5 billion by the end of 2035, rising at a CAGR of 8.9% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of body composition analyzers is estimated at USD 1.2 billion.

The market is growing due to increasing global rates of obesity and metabolic diseases in both clinical and wellness environments. Consistent user engagement at diagnostic centers and fitness facilities reflects a desire for personalized health evaluations. As per a study by the CDC in September 2024, most U.S. adults have at least one chronic illness, with obesity in adults being 40.3%, which accounts for a huge amount of total healthcare expenses, emphasizing the importance of continuous monitoring devices, such as bioimpedance, for reducing emergency visits and hospital stays. Besides, R&D investments are supported by government healthcare budgets and policies encouraging local manufacturing of medical devices and APIs.

For the body composition analyzers industry, the 3DO scanner shows strong accuracy and reliability across diverse populations. Moreover, the July 2023 NLM report demonstrated that fat-free mass and fat mass measurement by the 3DO scanner closely agreed with the standard DXA method, with concordance scores as high as 0.9 and 0.9, respectively. The device performs well in terms of body sizes, gender, and ethnicity, thereby qualifying as an instrument acceptable for application to a large population base. According to a report by the NLM in September 2024, with 51 hospitals and 1,000 clinics across seven states. Besides, providence Health is a major brand in the western US. Reusable gowns offer the dual benefits of reduced medical waste and carbon emissions, along with cost savings, improved comfort, and reduced supply chain dependencies. The helps identify the major component suppliers and final markets, whereas the supply and consumer price indexes generally follow the coarse trend shown by medical device prices monitored by industry groups.

Key Body Composition Analyzers Market Insights Summary:

Regional Insights:

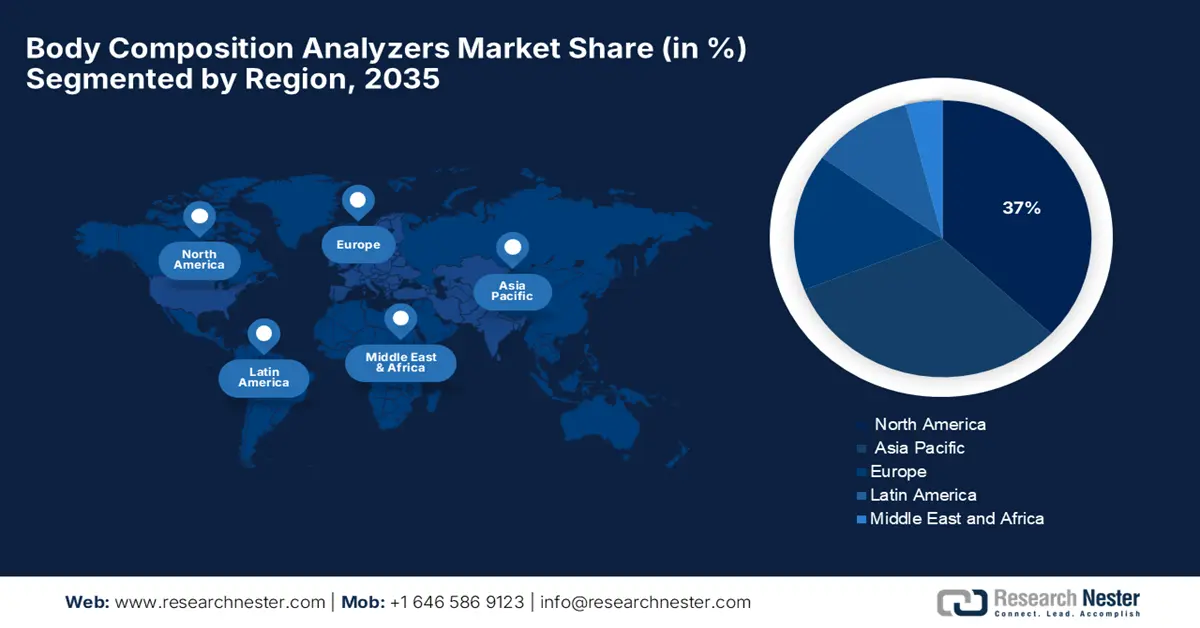

- The North America Body Composition Analyzers Market is anticipated to command a 37% share by 2035, supported by increasing wellness awareness, advancements in technology, and a rise in obesity rates.

- Europe is projected to be the fastest-growing region in the body composition analyzers market during 2026–2035, propelled by supportive government policies, rising digital health adoption, and growing preventive healthcare focus.

Segment Insights:

- The direct sales segment is forecast to account for a dominant 50% share of the body composition analyzers market by 2035, driven by heightened health awareness, lifestyle-related diseases, and growing investment in direct selling networks.

- The hospitals and clinics segment is expected to lead the end user category by 2035, owing to the increased need for precise diagnostic tools for obesity and metabolic disorder management and the expansion of preventive healthcare practices.

Key Growth Trends:

- Advanced multi-device compatibility

- Rigorous quality control to boost clinical trust and adoption

Major Challenges:

- High cost of advanced body composition analyzers

- Regulatory hurdles and calibration standards

Key Players: GE Healthcare, Hologic Inc., InBody Co., Ltd., Garmin Ltd., Xiaomi Corporation, Seca GmbH & Co. KG, Beurer GmbH, COSMED S.R.L., Bodystat Ltd., RJL Systems, Maltron International Ltd., Withings, iHealth Labs Inc., BioTekna, Selvas Healthcare.

Global Body Composition Analyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.1 billion

- 2026 Market Size: USD 1.2 billion

- Projected Market Size: USD 2.5 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: India, China, South Korea, Brazil, Australia

Last updated on : 5 September, 2025

Body Composition Analyzers Market - Growth Drivers and Challenges

Growth Drivers

- Advanced multi-device compatibility: Advancements in health technology continue to enhance the accuracy and efficiency of diagnostic tools in the body composition analyzers sector. According to a study published by NLM in September 2024, the integration of all new 3D optical scanning technologies across various devices, such as the Fit3D Proscanner, Styku S100, and Size Stream SS20, was evaluated on 145 males and 206 females, maximizing the accuracy of the data by accounting for small moments of scanner peculiarities and noise. This resulted in a 0.8 coefficient of determination between body composition and measurements, which fosters usability in multiple clinical and research settings.

- Rigorous quality control to boost clinical trust and adoption: Body composition data is dependable and consistent due to the rigorous quality control policies, such as across-site calibration and defective scan removal. Body composition analyzers are increasingly being adopted by healthcare professionals and researchers for clinical diagnostics and population health studies as a result of the high level of confidence given to these analyzers. Body composition and other pertinent data analyzers are adopted for health and clinical diagnostics and population health studies, where measurement precision and repeatability are critical. These policies further help harmonize research and clinical site operations.

- Standardized anthropometric protocols: Standardization in health assessments plays a critical role in ensuring data accuracy and comparability in the body composition analyzers market. According to a report by NLM published in January 2023, utilizing rigorous anthropometric measurement protocols aligned with NHANES standards, such as triplicate waist and hip circumference recordings to the nearest 0.1 cm, ensures high precision and reliability in body composition assessments. This standardized protocol allows for the establishment of precise, accurate, and reproducible measures that are expected to be useful clinically and for research.

Pediatric and Adult Body Composition Trends: Market Implications for Analyzer Technologies

Anthropometric and Body Composition Characteristics of 200 Obese versus Normal-Weight Children (2024)

|

Parameter |

Obese |

Normal |

% Difference |

|

Age (years) |

8.4 |

8.0 |

4.6% |

|

Weight (kg) |

43.5 |

29.5 |

38.3% |

|

Height (cm) |

126.5 |

125.1 |

1.0% |

|

BMI (kg/m²) |

23.9 |

15.6 |

41.7% |

|

Body Fat % (BF) |

31.3 |

21.6 |

37.5% |

|

Fat-Free Mass (FFM, kg) |

27.4 |

22.4 |

20.2% |

|

Total Body Water (TBW, kg) |

18.9 |

11.3 |

30.3% |

|

Muscle Mass (MM, kg) |

23.2 |

15.8 |

36.8% |

|

Bone Mass (BM, kg) |

1.0 |

0.7 |

35.3% |

Source: NLM November 2024

Challenges

- High cost of advanced body composition analyzers: DXA and 3D optical systems each require a great deal of investment in the market. This limits the ability of lower-budget outfits, such as small clinics and gym buildings, to purchase advanced systems. Due to the inability to afford such luxuries, this hinders the growth in emerging markets. Budget constraints also force clinics to consider more cost-effective and less accurate alternatives. Budgetary limitations not only restrict the availability of modern diagnostic tools, also make it tough for small clinics to offer customized health evaluations that depend on accurate body composition data.

- Regulatory hurdles and calibration standards: Regulations around the medical devices are quite stringent and require calibration, thereby blocking manufacturing in the market. Such challenges delay product approvals, raise costs of operation, erode end user confidence, and slow down scaling and global uptake for the analyzers of body composition. Moreover, the lack of harmonized international standards complicates cross-border sales and increases compliance burdens. This regulatory complexity can discourage innovation and deter smaller companies from entering the market.

Body Composition Analyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 1.1 billion |

|

Forecast Year Market Size (2035) |

USD 2.5 billion |

|

Regional Scope |

|

Body Composition Analyzers Market Segmentation:

Distribution Channel Segment Analysis

The distribution channel segment is expected to take the largest market share in the body composition analyzers market, with 50% for the direct sales segment during the forecast period, due to increased health awareness, rising obesity and prevalence of lifestyle diseases, and rising investments in the global market. According to a report by IDSA 2022, the value of the industry direct selling in India can be estimated to be around INR 19,000 crores, an increment of around 5.3% from INR 18,000 Crores (USD 2.0 million) in the year 2020-21. Additionally, the industry has demonstrated a compounded annual growth rate (CAGR) of nearly 13%, growing from INR 11,650 Crores (USD 1.3 million) between 2017 to 2018 to INR 19,000 Crores (USD 2.1 million) in 2021 and 2022.

End user Segment Analysis

Hospitals and clinics are at the highest subsegment in the body composition analyzers market of body composition analyzers in terms of the end user segment due to their primary role in chronic disease, metabolic, and obesity diagnosis and treatment. Clinics and hospitals need to have high-precision devices, including BIA and DXA systems, to help patients with easy monitoring and personalized treatment. Expansion in the preventive healthcare arena and incorporation of body composition analysis into normal clinical practice drive strong adoption in this segment.

Application Segment Analysis

The clinical and diagnostic application segment in the body composition analyzers market is dominated by the market due to the primary need for accurate measurements of body composition for medical assessment. Devices in this segment facilitate early diagnosis and treatment for obesity, osteoporosis, and cardiovascular diseases. The healthcare provider always gives great prominence to technology that gives reliable and reproducible results to treat patients effectively. As per a report by the WHO published in May 2025, 35 million children under the age of 5 were overweight in 2024. Over 390 million children and adolescents aged 5 to 19 years were overweight in 2022, including 160 million who were living with obesity. These statistics underscore the rising demand for accurate measurements of body composition for medical assessment in healthcare and wellness markets.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Sub-segment |

|

By Technology |

|

|

By Application |

|

|

By End user |

|

|

Distribution Channel |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Body Composition Analyzers Market - Regional Analysis

North America Market Insight

The market in North America is anticipated to hold the largest market share of 37% throughout the forecast period. Growth is supported by the increased awareness among consumers for wellness and fitness, growing usage in medical, sports, and wellness environments, and persistent advancements in technology. Besides, market players provide equipment that monitors fat, muscle, bone, and water, thereby suitable for the overall market in the region. Additionally, supportive government initiatives and rising obesity rates further propel market demand.

The body composition analyzers market in the U.S. is growing increasingly influenced by the growing obesity rate and the need for accurate health diagnosis in clinical and wellness segments. As per a report published by the CDC in September 2024, with 40.3% of adults classified as being obese, doctors and gyms are implementing advanced body analysis devices to support patient treatment and program achievement. The trend reflects higher B2B opportunities for device manufacturers and digital health integrators.

The body composition analyzers industry in Canada is gradually growing due to heightened public interest in health indicators, rising obesity rates, and a greater focus on preventive care. Besides, the country contributes to wide-ranging studies that improve the precision and dependability of these devices. As per a report by the Government of Canada, June 2025, the percentage of adults in Canada with a BMI that qualifies as obese is 29.5%. A further 35.5% have a BMI that falls into the overweight category. This means 65% of adults fall into the combined categories of overweight and obese. The high incidence of overweight and obese individuals is fueling the demand for advanced body composition analyzers in both clinical and consumer wellness markets throughout Canada.

Europe Market Insight

The body composition analyzers market in Europe is expected to be the fastest-growing market during the forecast period due to growing awareness of health, obesity rates, and government support for preventive healthcare. The market is driven by favorable policies and investments in digital health technology, as well as the growing use of fitness monitoring devices. Demand is also spurred by ageing populations demanding enhanced management of health. As per a report by Eurostat July 2024, in the EU in 2022, the age group 16 to 24 years had the lowest percentage of overweight individuals at 20.3%, while the highest percentage was observed in the 65 to 74 years age group at 63.6%.

The body composition analyzers sector in the UK is growing tremendously on the back of raised health consciousness, rising prevalence of chronic diseases, and improving technology. The UK market is witnessing the growing application of body composition analyzers in healthcare centers for disease management and health clubs for performance monitoring. Government policies towards healthy living and preventive care are indirectly driving the growth of the market. The market experiences the utilization in aspects of weight control programs, sports optimization, and customized health monitoring.

The market in Germany is growing at a fast pace, driven by factors such as rising awareness of fitness and health, rising obesity ratio, and technological innovation. Governmental bodies as well as medical institutions are keen on preventive treatment and encouragement of well-being, adding further impetus to growth. Body composition analyzers are also being adopted in hospitals, sports medicine centers, rehabilitation units, and fitness clubs in Germany, fueling adoption across industries.

Asia Pacific Market Insight

The Asia Pacific body composition analyzers market is expected to grow steadily due to the increasing obesity rates, increasing health consciousness, and increasing fitness markets. Support from government policies and digital adoption also adds to the growth of the market. In addition, as per a report published by Focus CBBC in May 2023, the smart sports and fitness market, consisting of fitness apps, wearables, and smart exercise equipment, contributed USD 5.2 billion to the market in 2023. The market growth is propelled by higher investment in healthcare infrastructure and greater adoption of non-invasive body composition analysis for effective obesity and chronic disease management.

The market in China is growing fast, owing to the increasing health consciousness and widespread use of wearable fitness devices (WFDs). According to the May 2025 NLM report, With shipments hitting 33.7 million units in the first quarter of 2024 and smartwatches growing at 54.1% year-on-year (YoY), the need for sophisticated health monitoring devices is intensifying. Taking advantage of health technician and consultant affordances, these gadgets offer personalized health management, creating significant growth prospects for the manufacturers and healthcare providers in China’s preventive health ecosystem.

The body composition analyzers market in India is poised for significant growth, driven by the country’s position as the third-largest wearable device market globally. As per a report by NLM published in November 2022, with 62.2% of users adopting wearable devices for health management and increasing technological acceptance, the demand for advanced body composition analyzers is rising. This creates strong opportunities for manufacturers and healthcare providers to cater to the country’s growing focus on personalized health monitoring and fitness management.

Leading Exporters and Importers of Medical Instruments Asia Pacific (2023)

|

Exporters of Medical Instruments in 2023 |

Value (USD) |

Importers of Medical Instruments |

Value (USD) |

|

China |

12.3 billion |

China |

10.6 billion |

|

Japan |

7.2 billion |

Japan |

6.4 billion |

|

Malaysia |

2.7 billion |

India |

2.4 billion |

|

Israel |

2.5 billion |

South Korea |

2.3 billion |

|

Singapore |

2.4 billion |

Singapore |

2.2 billion |

|

South Korea |

2.2 billion |

Hong Kong |

1.6 billion |

|

Thailand |

1.4 billion |

Saudi Arabia |

1.6 billion |

|

India |

1.4 billion |

Chinese Taipei |

1.3 billion |

|

Chinese Taipei |

1.4 billion |

Turkey |

1.2 billion |

|

Vietnam |

1.3 billion |

Malaysia |

1.0 billion |

|

Turkey |

708 million |

Thailand |

842 million |

Source: OEC, August 2025

Key Body Composition Analyzers Market Players:

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hologic Inc.

- InBody Co., Ltd.

- Garmin Ltd.

- Xiaomi Corporation

- Seca GmbH & Co. KG

- Beurer GmbH

- COSMED S.R.L.

- Bodystat Ltd.

- RJL Systems

- Maltron International Ltd.

- Withings

- iHealth Labs Inc.

- BioTekna

- Selvas Healthcare

The global market is led by giants, such as InBody, GE Healthcare, and Hologic. Mid-tier players, including SECA, Bodystat, and RJL Systems, drive expansion through technology differentiation and channel partnerships. Besides, Japan-based firms, such as BodyTrace, LifeSpan, Atron, HUMAN, and Withings Japan, will deliberately propel by 2035, driven by local innovation, low-cost product design, and health programs to gain traction in niche segments.

Here is a list of key players operating in the global market:

Recent Developments

- In January 2024, Neko Health, having completed over 10,000 scans with another 100,000 on the waiting list, seeked to advance its preventive health scanning research and development innovations after securing $260 million in Series B funding to scale its operations in Europe and the United States.

- In January 2022, InBody's partnership with Orangetheory Fitness progresses as it equips over 1,400 studios with 15-second body composition tests. The tests accurately measure muscle mass, body fat, and metabolism, which enhances health and fitness monitoring.

- Report ID: 5034

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Body Composition Analyzers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.