Biobased Degreaser Market Outlook:

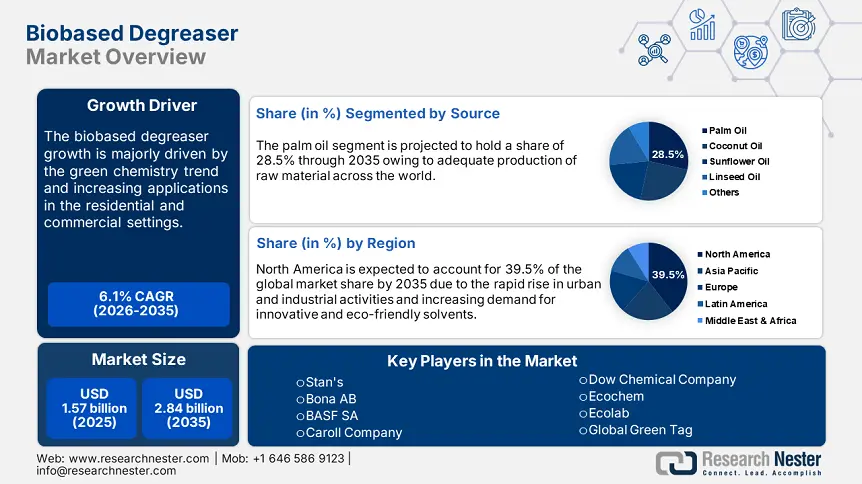

Biobased Degreaser Market size was valued at USD 1.57 billion in 2025 and is likely to cross USD 2.84 billion by 2035, expanding at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biobased degreaser is assessed at USD 1.66 billion.

The circular economy trend is estimated to positively drive the biobased chemical industry in the coming years. End users increasingly shift towards sustainability and focus on climatic commitments are creating a profitable environment for biobased degreaser manufacturers. For instance, the European Chemical Industry Council (CEFIC) states that biobased products represent over 10.0% of the entire chemical industry. The reduced dependency on non-renewable feedstocks and increasing demand for organic products are positively backing the sales of biobased degreasers. The IEA Bioenergy reports disclose that currently, the biobased chemical and polymer production is over 90 million tonnes.

Key biobased degreaser market players are continuously investing in research and development activities to introduce innovative and high-performance biobased degreasers. The integration of biosurfactants and plant-based oil solvents is leading to the production of effective and active degreasers. To uplift their positions in the biobased degreaser market, companies are employing several organic and inorganic strategies. Sustainable and organic certifications are also aiding industry giants to maintain dominance in the competitive landscape. For instance, in January 2024, Acme-Hardesty revealed that it was the first company to receive certification from the Sustainable Castor Association (SCA) in the U.S. owing to its sustainability commitments.

Key Biobased Degreaser Market Insights Summary:

Regional Highlights:

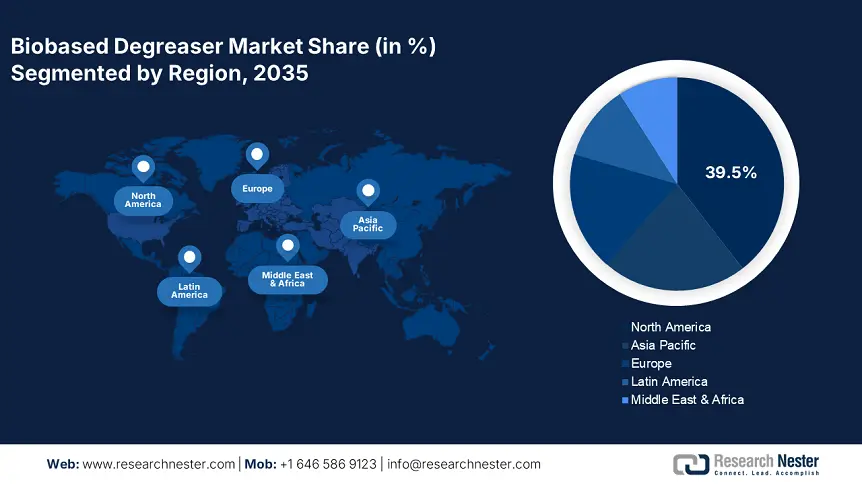

- North America holds a 39.5% share in the biobased degreaser market, fueled by the strong presence of advanced industries and strict regulations on hazardous chemical use, driving sustained growth through 2035.

- Asia Pacific's Biobased Degreaser Market is poised for rapid growth from 2026–2035, propelled by the booming industrial activities and dominance of aerospace, automotive, food processing, and oil & gas industries.

Segment Insights:

- The Industrial Cleaning segment is projected to hold a dominant share by 2035, driven by sustainability pressure, rising environmental regulations, and fluctuating petrochemical prices.

- Palm oil-based degreasers segment are projected to hold over 28.5% share by 2035, supported by adequate global production and policies promoting sustainable degreasers.

Key Growth Trends:

- Increasing preference for green cleaning solutions

- Increasing applications in domestic and commercial settings

Major Challenges:

- High prices lowering use of biobased degreaser

- Limited efficiency a short-term challenge

Key Players: Stan's, Bona AB, BASF SA, Caroll Company, Dow Chemical Company, Ecochem, and Ecolab.

Global Biobased Degreaser Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.57 billion

- 2026 Market Size: USD 1.66 billion

- Projected Market Size: USD 2.84 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Biobased Degreaser Market Growth Drivers and Challenges:

Growth Drivers

- Increasing preference for green cleaning solutions: The strict regulations on hazardous gas emissions and chemical use are propelling the demand for organic cleaning solutions including biobased degreasers. To align with sustainability trends and to reduce their environmental impacts, end users are widely investing in green cleaning solutions. Considering the shift towards eco-friendly solutions is posed to promote the adoption of biobased degreasers.

- Increasing applications in domestic and commercial settings: The organic and clean labeling trends are fueling the demand for biobased cleaning solutions including degreasers in both residential and commercial settings. The customer’s increasing focus on what goes into products is backing the sales of biobased degreasers, particularly in residential settings. The strict restrictions of local authorities on the use of VOC cleaning products are further increasing the application of biobased degreasers in commercial structures.

Challenges

- High prices lowering use of biobased degreaser: Biobased solutions are often derived from renewable feedstocks that are costly compared to conventional counterparts. These further uplift the final product costs and act as a challenge for their sales, particularly in price-sensitive biobased degreaser markets. The budget-conscious customers deter employing expensive biobased solutions and are more focused on investing in cost-effective conventional degreasers.

- Limited efficiency a short-term challenge: The biobased product’s low-end results compared to conventional or chemical-based counterparts are major drawbacks to the revenue growth of key biobased degreaser market players. End users’ thin reaction to the employment of bio-based degreasers potentially hinders overall sales growth. However, it is considered a short-term challenge as industry giants are focused on continuous investment in research and development activities to improve the performance of biobased degreasers.

Biobased Degreaser Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.57 billion |

|

Forecast Year Market Size (2035) |

USD 2.84 billion |

|

Regional Scope |

|

Biobased Degreaser Market Segmentation:

Source (Coconut Oil, Palm Oil, Sunflower Oil, Linseed Oil, Others)

Palm oil segment is set to hold over 28.5% biobased degreaser market share by the end of 2035. The adequate production of palm oil across the world is pushing the sales of biobased degreasers. Asia is expected to dominate the production and commercialization of palm oil-based degreasers owing to the excess availability of raw materials. The supportive government policies and increasing market for organic chemicals are further contributing to the sales of palm oil-based degreasers. Clean marketing trends, corporate sustainability goals, and the increasing importance of green chemistry are driving palm oil-based degreaser sales.

|

Top Palm Oil Producing Countries |

% of Global Production |

Total Production (2024/2025, Metric Tons) |

|

Indonesia |

58% |

46.5 million |

|

Malaysia |

24% |

19.2 million |

|

Thailand |

5% |

3.7 million |

|

Colombia |

2% |

1.9 million |

|

Nigeria |

2% |

1.5 million |

|

Guatemala |

1% |

990,000 |

|

Papua New Guinea |

1% |

830,000 |

|

Brazil |

0.75% |

600,000 |

|

Cote d'Ivoire |

0.75% |

600,000 |

|

Honduras |

0.75% |

595,000 |

Source: U.S. Department of Agriculture (USDA)

End user (Industrial Cleaning, Automotive, Oil & Gas, Food & Beverages, Aerospace, Healthcare, Agriculture, Others)

The industrial cleaning segment is estimated to hold a dominant biobased degreaser market share throughout the forecast period. The high pressure on companies to ensure sustainability in overall operations is fueling the adoption of eco-friendly products including biobased degreasers. The fluctuating prices of petrochemical-based alternatives are further driving the attention of end use industries to seek more sustainable and stable cleaning solutions such as biobased degreasers. The strict environmental regulations governing industries are also substantially pushing applications of biobased degreasers.

Our in-depth analysis of the global biobased degreaser market includes the following segments:

|

Source |

|

|

Product Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biobased Degreaser Market Regional Analysis:

North America Market Forecast

North America in biobased degreaser market is poised to hold over 39.5% revenue share by the end of 2035. The strong presence of advanced industries is amplifying the biobased degreaser trade. The strict regulations on hazardous chemical use are propelling the sales of biobased counterparts. Climatic commitments and emission goals are further backing the commercialization of biobased degreasers. The aerospace, automotive, and oil & gas sectors are majorly pushing the demand for biobased degreasers in the U.S. and Canada.

In the U.S. the expanding oil and gas production is driving high demand for biobased degreasers. For instance, the U.S. Energy Information Administration (EIA) revealed that the oil and natural gas production in the country amounted to 13.3 million barrels per day (b/d) and 128.8 billion cubic feet per day (Bcf/d), respectively, in December 2023. The growth of the oil and gas sector is estimated to positively influence the consumption of biobased degreasers. Furthermore, the continuous demand for sustainable and specialized materials and substances in the aerospace sector is expected to generate a profitable environment for biobased degreaser manufacturers.

Canada’s robust automotive sector is expected to double the revenue growth of biobased degreaser producers in the years ahead. The need for innovative cleaning products and high compliance with environmental regulations is projected to promote the sales of biobased degreasers in the coming years. The Statistique Canada report highlights that the zero-emission vehicle registrations in the country rose from 52,685 in the fourth quarter of 2023 to 75,636 in Q3 of 2024. The positive curve growth in the automotive sector is poised to augment the demand for biobased degreasers in the coming years.

Asia Pacific Market Statistics

The Asia Pacific biobased degreaser market is estimated to increase at the fastest CAGR between 2025 to 2035. The boasting industrial activities in the region are augmenting the sales of biobased degreasers. The dominance of aerospace, automotive, food processing, and oil & gas industries is backing the trade of biobased degreasers. The urban growth is also fueling the demand for eco-friendly cleaning products. Online platforms are playing a vital role in the sales of biobased degreasers in residential settings in Asia Pacific. China, India, South Korea, and Japan are the most opportunistic marketplaces for biobased degreaser producers owing to the positive supply of raw materials.

China’s strong industrial base and swift rise in urban actions are opening lucrative doors for biobased degreaser manufacturers. The lead in automobile production is increasing the sales of biobased degreasers. The climatic commitments and zero emission goals are further backing the need for eco-friendly cleaning solutions including biobased degreasers. The report by the Observatory of Economic Complexity (OEC) states that the total care export trade of China amounted to USD 74.5 billion in 2023. Russia (USD 9.97 billion), Germany (USD 2.7 billion), and Mexico (USD 2.2 billion) were the fastest-increasing export markets for Chinese cars.

The booming organic chemical trade in India is expected to positively influence the sales of biobased degreasers in the coming years. The supportive government initiatives and 100% foreign direct investment (FDI) policies are also contributing to the biobased degreaser trade. The India Brand Equity Foundation (IBEF) report explains that in Q2-Q3 2024 the export trade of organic and inorganic chemicals was calculated at USD 14.09 billion. The chemical sector contributes around 7.0% to the country’s economy. Continuous innovations and the increasing importance of sustainability are set to uplift the sales of biobased degreasers in the coming years.

Key Biobased Degreaser Market Players:

- Stan's

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bona AB

- BASF SA

- Caroll Company

- Cortec Corporation

- DEWALT

- Dow Chemical Company

- Ecochem

- Ecolab

- Global Green Tag

- Huntsman Corporation

- Henkel Investment Co. Ltd

- Nugeneration Technology

- Renewable Lubricants Inc.

- Soy Technologies LLC

- Victory Polychem

- Uzay Kimaya

The biobased degreaser is emerging as the most profitable business for both industry giants and new companies owing to strict government regulations on hazardous chemical use. Key biobased degreaser market players are employing several organic and inorganic strategies such as new products launched, technological innovations, partnerships & collaborations, mergers & acquisitions, and global expansions to earn high profits and maximize their reach. The introduction of new and innovative solutions is attracting a wider customer base. Entering untapped biobased degreaser markets is creating high-earning opportunities for biobased degreaser producers.

Some of the key players include:

Recent Developments

- In September 2024, Stan's announced the launch of its USDA-certified bio-based degreaser product line. The series includes wet lube, dry lube, forkboost, bike wash, grease, degreaser, and suspension oil.

- In May 2023, Bona AB introduced a 99% biobased all-purpose cleaner lime basil spray with a fresh lime-basil scent. This plant-based formula is approved by the USDA and also meets the U.S. EPA product standards.

- Report ID: 7290

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biobased Degreaser Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.