Bimodal Identity Management Solutions Market Outlook:

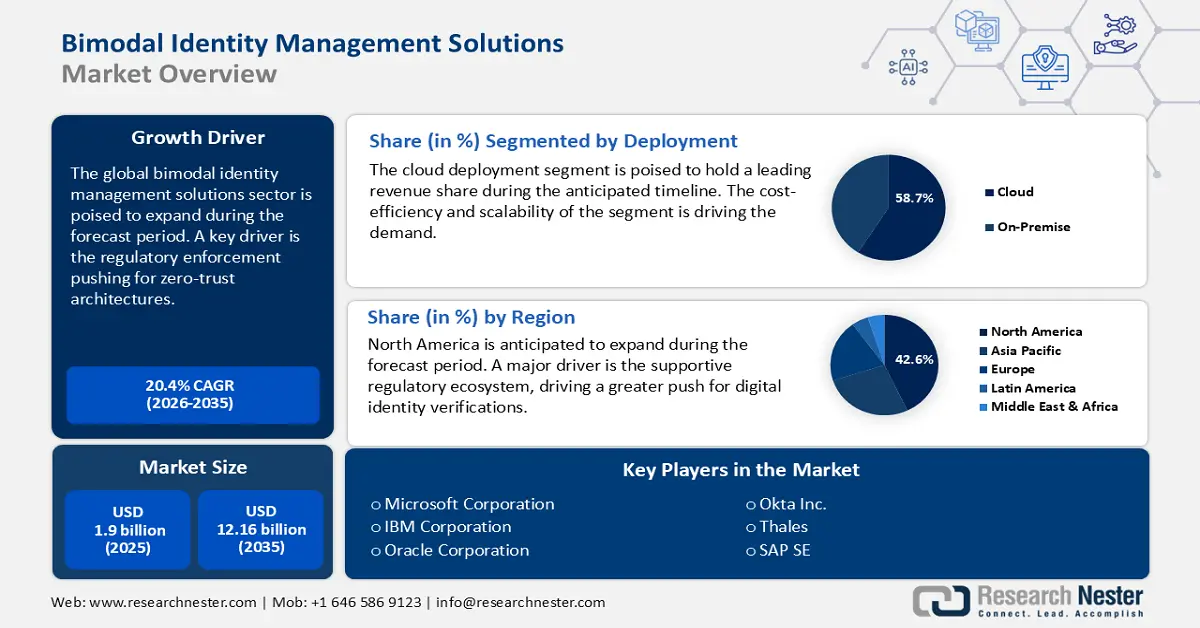

Bimodal Identity Management Solutions Market size was valued at USD 1.9 billion in 2025 and is expected to reach USD 12.16 billion by 2035, expanding at around 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bimodal identity management solutions is assessed at USD 2.25 billion.

The global supply chain of bimodal identity management solutions is influenced by the sourcing of critical components, ranging from encryption modules and edge-based verification devices. The production of biometric hardware includes fingerprint sensors, iris scanners, and facial recognition systems, which is concentrated in APAC, with South Korea and China leading in manufacturing. Additionally, the market forecast highlights a continued surge in demand supported by digital identification policies in both mature and emerging markets.

To understand the economic indices of the bimodal identity management solutions market, the changes in the Producer Price Index (PPI) and the Consumer Price Index (CPI) are mapped in the table below:

|

Economic Index |

Category |

Percentage Change (2023) |

Key Drivers |

|

Producer Price Index (PPI) |

IT Hardware |

+8.6% |

Rising semiconductor prices, higher costs for encryption modules, and inflationary pressures. |

|

Consumer Price Index (CPI) |

Identity Management Software & Cybersecurity Services |

+4.5% |

Increased consumer demand for cloud-based and on-premise IAM solutions. |

The market also benefits from heightened spending on cybersecurity, a trend that has been prominent in the regional sectors of North America, Europe, and APAC. These trends are expected to continue pushing the sector towards continued innovations and price adjustments, especially as regulatory requirements expand worldwide.

Key Bimodal Identity Management Solutions Market Insights Summary:

Regional Highlights:

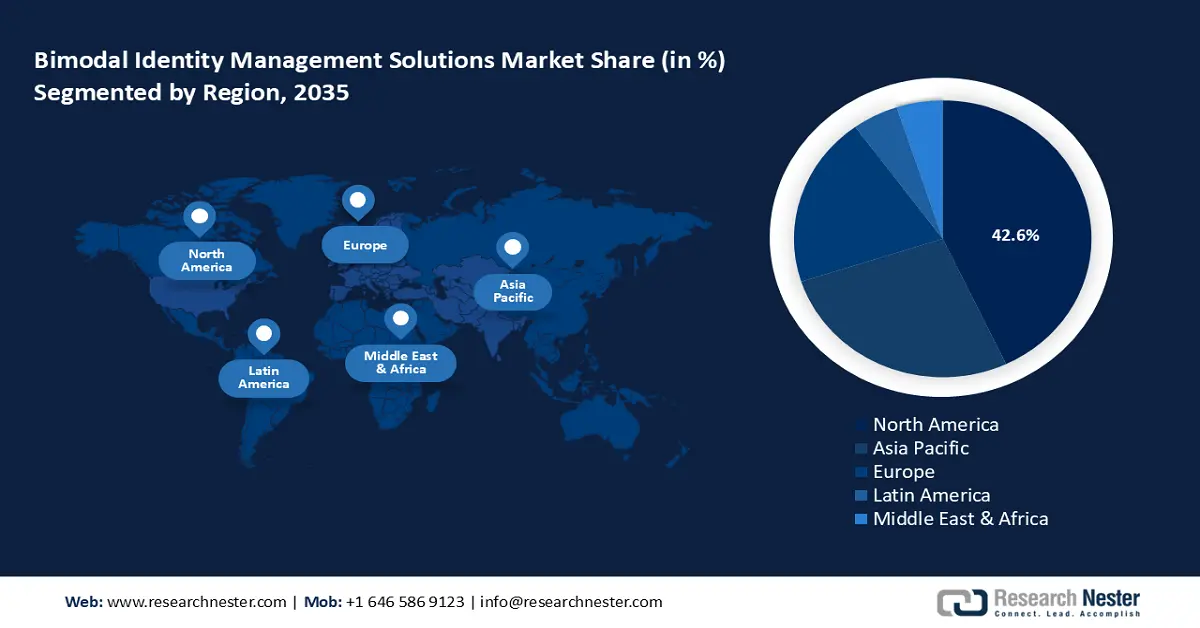

- North America is projected to hold a leading 42.6% revenue share by 2035 in the bimodal identity management solutions market, underpinned by a supportive regulatory landscape and robust presence of key hybrid cloud innovators.

- The APAC market is anticipated to expand rapidly through 2026–2035, fueled by accelerated digital infrastructure development and the widening use of AI-powered biometrics across emerging economies.

Segment Insights:

- The cloud deployment segment of the bimodal identity management solutions market is anticipated to capture a 58.7% revenue share during 2026–2035, propelled by the scalability and cost-efficiency of cloud-based deployment.

- The large enterprises segment is expected to command over 70% share by 2035, owing to the integration of dual-mode IAM across extensive IT infrastructures and merger-driven identity orchestration needs.

Key Growth Trends:

- Regulatory enforcement of zero-trust architectures across critical infrastructure sectors

- Edge and IoT expansion driving decentralized identity orchestration

Major Challenges:

- Fragmented identity governance across hybrid environments

Key Players: Microsoft Corporation, IBM Corporation, Oracle Corporation, Okta, Inc., Broadcom Inc. (Symantec), Thales Group, SAP SE, NEC Corporation, Fujitsu Limited, Samsung SDS, Infosys Limited, Tata Consultancy Services (TCS), Wipro Limited, Securemetric Berhad, Ping Identity

Global Bimodal Identity Management Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2.25 billion

- Projected Market Size: USD 12.16 billion by 2035

- Growth Forecasts: 20.4%

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 20 November, 2025

Bimodal Identity Management Solutions Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory enforcement of zero-trust architectures across critical infrastructure sectors: The bimodal identity management solutions market is reinforced by the regulatory mandates. For instance, the U.S. Executive Order 14028 and the European Union’s NIS2 Directive of 2023 have mandated a shift toward Zero Trust security models in private and public critical infrastructure. The supportive regulatory ecosystem has accelerated the momentum of adoption of bimodal identity systems. Systems that support both policy-governed (Mode 1) and adaptive (Mode 2) access control. In terms of measurable adoption statistics, more than 70% of critical entities in the EU have begun aligning IAM infrastructure with zero-trust principles to comply with the evolving mandates.

- Edge and IoT expansion driving decentralized identity orchestration: The proliferation of edge devices and IoT endpoints is poised to expand to 28.5 billion by the end of 2027. The requirement for identity systems to authenticate decentralized environments. Additionally, bimodal IAM enables enterprises to retain the centralized policy control while integrating identity protocols at the edge. In support of this, NIS published SP 1800-33, highlighting decentralized identity management as a cybersecurity priority, incentivizing enterprises of all sizes toward dual-mode architectures. Now, this push is poised to create a large percentage of end users requiring bimodal identity management solutions.

Technological Innovations in the Bimodal Identity Management Solutions Market

The global shift toward bimodal identity management solutions is favorably reinforced by emerging tech that supports dual-mode architectures. Recent innovations such as behavioral biometrics and decentralized identity have assisted in production-scale deployments in high-risk sectors such as healthcare and finance. The technologies are able to support contextual identity orchestration. The table below highlights 5 core strategic technologies that are impacting the sector. The market analysis highlights that strategic investment in these five technologies has emerged as a central component of IAM modernization and bimodal IAM deployment.

|

Technological Trend |

Industry Example |

Sector Adoption Insights |

Impact/Result |

|

AI for Behavioral Biometrics |

Barclays (2023) deployed AI-based fraud detection |

79% of Tier-1 banks adopted it for account takeover defense (ENISA) |

Reduced fraud losses by 41% in digital banking channels |

|

Passwordless Authentication |

Mastercard (2024 pilot in APAC) |

Rapid in finance; slower in telecom due to legacy systems |

61% drop in credential phishing (NIST 2023 report) |

|

Blockchain for Decentralized ID |

EU Digital Identity Wallet (2023 rollout) |

High in public sector and finance; limited in education |

Enabled GDPR-compliant identity reuse across platforms |

|

Edge-Based Verification |

Siemens (2024 factory deployment in EU) |

Manufacturing leads; healthcare growing for remote access |

Cut latency by 55% in access control decisions (OECD) |

|

Hybrid Cloud IAM Orchestration |

AT&T (2023 deployment via Azure AD B2C) |

Telecom leads; retail following for scalability |

Improved provisioning time by 37% (FCC, 2024) |

Impact of AI and ML on the Bimodal IMS Market

|

Company |

AI/ML Integration in Bimodal IAM |

Measurable Outcome (2023-2024) |

|

Microsoft |

AI-driven adaptive access policies in Azure Active Directory B2C for hybrid IAM |

Reduced unauthorized access incidents by 81% (Microsoft, 2023) |

|

Okta |

ML-based behavioral anomaly detection in Workforce Identity Cloud |

Decreased false positives in access denial by 64% (Okta, 2024 Q1 Report) |

|

IBM |

AI-powered identity correlation and resolution in hybrid IAM workflows |

Accelerated access provisioning time by 36% (IBM Security Report, 2023) |

|

Ping Identity |

Machine learning for risk-aware conditional access and session monitoring |

Reduced access-related helpdesk tickets by 41% (Ping Identity Press Release, 2023) |

|

Thales |

ML-based step-up authentication in multi-cloud IAM deployments |

Improved fraud detection accuracy by 90% (Thales Group, 2024) |

Rising 5G Adoption Impact on the Bimodal IMS Market

|

Company |

5G Application in Bimodal IAM |

Measurable Outcome (2023-2024) |

|

Siemens |

5G-enabled edge authentication at industrial endpoints across factories in Germany |

Reduced identity verification latency by 61% (from 480ms to 183ms) – BMWi Report, 2023 |

|

Verizon Business |

Real-time IoT-based identity syncing via 5G MEC for logistics partners in North America |

Improved remote credential sync accuracy by 89% – Verizon Business Solutions Case Study, 2024 |

|

ABB Group |

Secure low-latency access orchestration across distributed robotics infrastructure using 5G-IAM |

Achieved 36% faster identity provisioning across 3,000 endpoints – ABB Industrial Edge Report, 2023 |

|

NTT Data |

Deployed 5G-integrated IAM for smart manufacturing access management in Japan |

Detected risk anomalies 48% faster in production networks - METI Japan Industrial Tech Survey, 2024 |

|

Bosch |

Federated identity orchestration across global logistics centers over private 5G infrastructure |

Cut IAM operational costs by 29% via automation and latency reduction – Bosch Smart Logistics Report, 2023 |

Challenges

- Fragmented identity governance across hybrid environments: The impediment of synchronization failures during the rollout of a hybrid identity system across public health networks can stymy the sector's growth. In 2023, the U.S. Department of Health and Human Services (HHS) reported IAM synchronization failures during the rollout of a hybrid identity system across public health networks. The fragmentation caused a delay to over 12,000 healthcare workers and subsequently triggered HIPAA compliance scrutiny. Additionally, in 2024, the European Telecommunications Standards Institute (ETSI) flagged the struggle of Deutsche Telekom’s struggle with the federated identity rollout across its subsidiaries in multiple EU economies.

Bimodal Identity Management Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 12.16 billion |

|

Regional Scope |

|

Bimodal Identity Management Solutions Market Segmentation:

Deployment Segment Analysis

The cloud deployment segment of the bimodal IMS market is poised to hold a 58.7% revenue share during the forecast timeline. The scalability and cost-efficiency offered by cloud-based deployment reinforce the expansion. The OECD Digital Economy Outlook 2024 has reported that cloud-native IAM adoption has become mainstream in BFSI and telecom, with more than 80% of European financial institutions hosting identity orchestration platforms in the cloud. Additionally, the push by mandates on federal contractors toward FedRAMP-certified IAM services is poised to drive the sustained demand for cloud-based deployment.

Organization Segment Analysis

The large enterprises segment of the bimodal IMS sector is projected to account for a revenue share of over 70% by the end of 2035. The expansion of the segment is associated with the integration of dual-mode IAM across major IT estates and M&A activity requiring centralized identity orchestration. According to the OECD Cybersecurity Spending Report 2024, more than 85% of IAM spending in G7 economies originated from large enterprises with over 1,000 employees. Moreover, the expansion of coverage to federal agencies creates greater opportunities for the deployment of hybrid IAM configurations.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Organization |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bimodal Identity Management Solutions Market - Regional Analysis

North America Market Insights

The North America market is favorably reinforced by a robust economic environment and a supportive regulatory landscape with laws such as the NIST Cybersecurity Framework, and lastly, a surging demand for advanced security solutions. The North America market is poised to maintain a leading revenue share of 42.6% by the end of 2035. The market expansion is heightened by the presence of leading players such as Microsoft, IBM, and Oracle, who remain at the forefront of innovations in hybrid cloud solutions. The regional market is also plagued by data privacy concerns and hurdles in regulatory compliance, but as enterprises in the region continue investments in dual-mode IAM solutions, the growth curve is expected to remain steady.

U.S. bimodal IMS market is expected to maintain a major share in North America. The regional market is characterized by the presence of tech giants and continued government push for improved cybersecurity and identity verification. In terms of measurable advancements, in 2023, Microsoft’s Azure AD IAM platform led to a 40% improvement in access control efficiency for over 300 large-scale enterprises across the U.S. market. Moreover, the rising reliance on cloud IAM solutions has bolstered the enterprise adoption in the public and private sectors, expanding the percentage of end users.

Asia Pacific Market Insights

The APAC bimodal IMS market has registered the fastest expansion, rising at a CAGR of 14.9% during the forecast timeline. A key characteristic of the APAC market is the rising technological adoption and the rising industrialization. Emerging markets such as India, Japan, and South Korea are rapidly scaling their digital infrastructure. The expansion of digital infrastructure is tied to the rapid adoption of AI-powered biometrics for improved fraud detection. For instance, Aadhar in India covers over 1.2 billion citizens, which has influenced the demand for bimodal IAM systems. Another driver is the rising adoption of smart city solutions, which has contributed to the rising enterprise demand for cloud-based IAM.

The China bimodal identity management solutions sector is characterized by considerable investments in digital identity systems, such as the Digital Yuan and e-Government services, driving the demand for secure bimodal IAM solutions. In 2023, the government partnered with Alibaba Cloud and Huawei to implement advanced biometric identity verification, which has impacted more than 200 million users in the country. Additionally, the China Internet Security Law and data localization regulations have created an urgent requirement for regional IAM solutions.

APAC Spending Insights

|

Country |

Market Size (2035) |

CAGR (2026-2035) |

Government Spending Trends |

|

Japan |

Significant adoption in healthcare & finance |

High |

Investments from MHLW, AMED, METI |

|

China |

Largest market share |

High |

MIIT & CAICT driving 5G & AI-based identity solutions |

|

India |

Rapid adoption in telecom & banking |

High |

MeitY, DoT, NASSCOM funding digital identity projects |

|

Malaysia |

Expanding digital economy |

Moderate |

MDEC, KKD supporting National Digital ID |

|

South Korea |

Strong AI integration |

High |

MSIT, NIPA investing in biometric authentication |

Europe Market Insights

The Europe bimodal identity management solutions market is poised to expand during the anticipated timeline. Key characteristics of the regional market include the rise of multi-cloud environments and the rising adoption across notable industries, ranging from BFSI to healthcare. Additionally, Europe has been committed to data protection, creating ample opportunities for advancements in IAM technologies that preserve privacy. By leveraging the higher transition to digitalization of the public sector, the demand for cloud-based IAM solutions is poised to remain steady throughout major and emerging economies of Europe.

The Germany bimodal identity management solutions market is slated to expand its revenue share in Europe by the end of 2035. The well-established technological infrastructure of Germany benefits the sector’s growth. Additionally, the regulatory push by GDPR has impacted the opportunities within the Germany market. The government has been pushing for digital identity verifications, creating opportunities for vendors providing bimodal IAM solutions. Despite the growth curve, challenges such as the high cost of cutting-edge IAM technologies limit wider adoption among SMEs.

Europe Spending Trends

|

Country |

Market Size (2035) |

CAGR (2026-2035) |

Government Spending Trends |

|

United Kingdom |

Strong adoption in finance & telecom |

High |

Investments from DSIT, Ofcom, techUK |

|

Germany |

Largest market share |

High |

BMDV & Bitkom driving AI-based identity solutions |

|

France |

Rapid adoption in banking & healthcare |

High |

Ministry of Economy, ARCEP, Syntec Numérique funding digital identity projects |

Bimodal Identity Management Solutions Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- Oracle Corporation

- Okta, Inc.

- Broadcom Inc. (Symantec)

- Thales Group

- SAP SE

- NEC Corporation

- Fujitsu Limited

- Samsung SDS

- Infosys Limited

- Tata Consultancy Services (TCS)

- Wipro Limited

- Securemetric Berhad

- Ping Identity

The bimodal identity management solutions market has remained competitive during the forecast period. The sector is shaped by the rapid technological advancements, the rising cybersecurity threats, and the surging adoption of cloud-based identity solutions. The leading players in the market are investing in AI-driven identity analytics has changed the sector’s landscape. Additionally, strategic initiatives such as mergers, acquisitions, and partnerships have assisted companies in expanding their market presence.

The table below highlights the major players of the market:

Recent Developments

- In May 2025, Cisco launched the Duo IAM, i.e., a security-first identity management solution designed to combat identity threats. The launch has built on Cisco’s multifactor authentication expertise, offering end-to-end phishing resistance.

- In May 2024, IBM released the identity management solutions supported by AI, i.e., AskIAM. The access management solutions leverage generative AI to bolster identity governance and security.

- Report ID: 3828

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bimodal Identity Management Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.