Automotive Wheel Rims Market Outlook:

Automotive Wheel Rims Market size was USD 40.4 billion in 2025 and is estimated to reach USD 65.6 billion by the end of 2035, expanding at a CAGR of 5.16% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive wheel rims is estimated at USD 42.6 billion.

The automotive wheel rim industry is currently undergoing a number of industry shifts and trends that have arisen due to consumer preferences and behaviors, as well as technological developments. One of the main overarching trends is the interest in lightweight materials as manufacturers develop products that improve the fuel efficiency and performance of vehicles. Additionally, consumers are seeking customized and stylish rims that have specific and appealing designs and finishes that enhance the visual appearance of a vehicle. In part, it is these trends that have contributed to the interest and expansion of larger rim-sized and more complicated rim styles in premium/luxury vehicles.

The last trend to mention is the advent of smart rims that have sensors built into the rims that read tire pressure, temperature, and several other performance measures that also improve safety and convenience for the driver. Moreover, as the automotive wheel rim industry continues to grow, the utilization of 3D printing for even more complicated styles of rim design is becoming more accepted in the marketplace. Furthermore, sustainability is taking center stage with recycling materials and reducing the environmental impact of the manufacturing process. All these are changing the landscape of the automotive wheel rims; the demand for innovation in performance, design, and sustainable initiatives is unrelenting.

Key Automotive Wheel Rims Market Insights Summary:

Regional Insights:

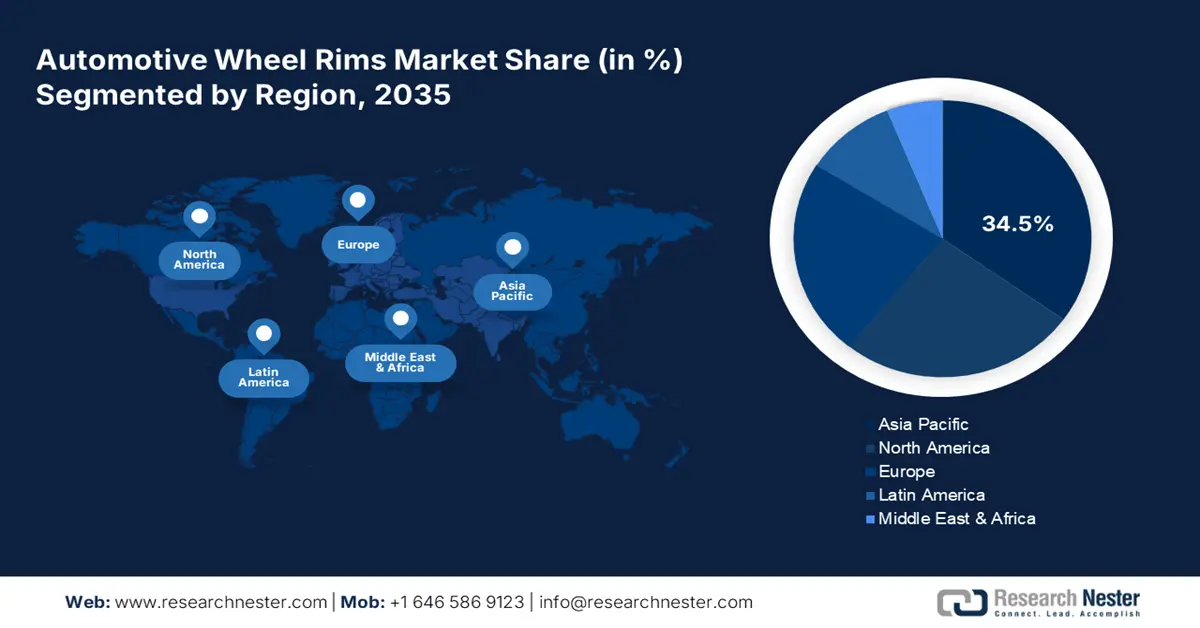

- By 2035, Asia Pacific is anticipated to command a 34.5% share of the global Automotive Wheel Rims Market, propelled by surging automotive production, EV expansion, and adoption of AI-driven manufacturing systems.

- Europe is projected to hold a 22.9% revenue share by 2035, stimulated by rapid digitalization in manufacturing and stringent CO₂ emission standards enhancing demand for lightweight, recyclable rims.

Segment Insights:

- The OEM segment is projected to capture 65.5% share by 2035 in the Automotive Wheel Rims Market, impelled by long-term automaker contracts and the growing adoption of lightweight rims aligned with emission reduction policies.

- The alloy rims segment is estimated to account for 61.9% share during 2026–2035, supported by rising demand from EVs and luxury vehicles and the emphasis on recycled content aligned with EU Circular Economy directives.

Key Growth Trends:

- Lightweight material adoption for fuel efficiency and emissions compliance

- Customization and aesthetic demand in aftermarket sales

Major Challenges:

- Complex Import Tariffs and Trade Barriers

- Infrastructure Gaps in Emerging Markets

Key Players: Maxion Wheels, Superior Industries International, Enkei Corporation, Ronal Group, Borbet GmbH, CITIC Dicastal Co., Ltd., BBS Kraftfahrzeugtechnik AG, Topy Industries, Ltd., Momo Srl, Steel Strips Wheels Ltd., SMW Engineering Sdn. Bhd., ROH Wheels, YHI International Ltd., Mangels Industrial S.A., Kosei Aluminum Co., Ltd., Maxion Wheels, Superior Industries International, Enkei Corporation, Ronal Group, Borbet GmbH.

Global Automotive Wheel Rims Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 40.4 billion

- 2026 Market Size: USD 42.6 billion

- Projected Market Size: USD 65.6 billion by 2035

- Growth Forecasts: 5.16% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Malaysia, Mexico, Brazil, Indonesia

Last updated on : 1 October, 2025

Automotive Wheel Rims Market - Growth Drivers and Challenges

Growth Drivers

- Lightweight material adoption for fuel efficiency and emissions compliance: According to the International Energy Agency, 2024 saw a 0.8% increase in total energy-related CO2 emissions, reaching a record high of 37.8 Gt CO21. Globally, stricter laws governing CO2 emissions and fuel economy are anticipated to spur a move toward lightweight, innovative materials, including magnesium, carbon fiber, and aluminum for car wheel rims. To comply with evolving regulations, leading manufacturers are adopting forged aluminum rims. They are focusing on strategic partnerships with OEMs to meet strict regulatory and market demands effectively.

- Customization and aesthetic demand in aftermarket sales: The customization trend is estimated to fuel the sales of personalized automotive wheel rims in the coming years. The aftermarket wheel rims trade in the U.S. and Germany is expected to be driven by rising demand for custom finishes, cool spoke patterns, and high-performance wheels. The top companies are capitalizing on aftermarket trade with build-to-order programs and forged monoblock designs. To stay competitive, businesses are also using customer data to create personalized options and digital tools.

- Increase in vehicle production and sales: Increasing disposable income, urbanization, and enhancement of living standards have made purchasing a car a reality for more consumers, increasing demand for durable wheel rims of high quality. Ongoing growth within the electric vehicle (EV) market adds further demand for wheel rims designed for high performance and high quality, tailored towards the unique design and performance of EVs. The increase in personalization and customization of vehicles has also created additional demand for high-quality wheel rims as visually appealing and customized aspects of premium and luxury vehicles recognize the aesthetics and customization aspects of wheel rims, accommodating the need for quality.

Production of Electric Cars by Region and Headquarters Location (2021-2024)

|

Year |

European Union (million) |

North America (million) |

Other Asia Pacific (million) |

Rest of World (million) |

Domestic Sales (million) |

|

2021 |

2.0 |

0.4 |

0.3 |

0.1 |

Domestic Sales (varied by region) |

|

2022 |

2.2 |

0.5 |

0.4 |

0.2 |

Domestic Sales (varied by region) |

|

2023 |

2.5 |

1.1 |

0.5 |

0.3 |

Domestic Sales (varied by region) |

|

2024 |

2.7 |

1.8 |

0.7 |

0.4 |

Domestic Sales (varied by region) |

Source: International Energy Agency (IEA)

World Vehicle Production by Region (2008-2023)

|

Year |

Greater China (%) |

Europe (%) |

North America (%) |

Japan/Korea (%) |

South Asia (%) |

South America (%) |

Middle East/Africa (%) |

|

2008 |

31% |

21% |

18% |

8% |

3% |

2% |

14% |

|

2013 |

25% |

23% |

16% |

10% |

5% |

3% |

18% |

|

2018 |

29% |

19% |

14% |

10% |

4% |

3% |

5% |

|

2023 |

32% |

20% |

17% |

14% |

4% |

3% |

2% |

Source: ACEA

CO2 Emissions by Country (1990-2023) and World Share in 2023

|

Country |

1990 (Mton CO2eq) |

2000 (Mton CO2eq) |

2005 (Mton CO2eq) |

2015 (Mton CO2eq) |

2020 (Mton CO2eq) |

2022 (Mton CO2eq) |

2023 (Mton CO2eq) |

2023 % of World Total |

|

EU27 |

4877.28 |

4481.45 |

4553.56 |

3879.73 |

3388.28 |

3482.31 |

3221.79 |

6.08% |

|

Global Total |

32726.23 |

36175.15 |

41296.88 |

48808.77 |

49327.54 |

51968.47 |

52962.90 |

100% |

|

Afghanistan |

12.56 |

13.92 |

15.57 |

27.41 |

26.65 |

28.61 |

29.46 |

0.06% |

|

Albania |

11.49 |

7.18 |

7.98 |

8.74 |

7.97 |

7.81 |

7.67 |

0.01% |

|

Algeria |

135.53 |

158.33 |

164.49 |

236.18 |

241.13 |

263.22 |

256.79 |

0.48% |

|

Angola |

31.94 |

67.02 |

66.45 |

81.78 |

61.68 |

67.21 |

67.70 |

0.13% |

|

Anguilla |

0.01 |

0.02 |

0.02 |

0.03 |

0.03 |

0.03 |

0.03 |

0.00% |

|

Antigua and Barbuda |

0.25 |

0.23 |

0.26 |

0.36 |

0.34 |

0.37 |

0.39 |

0.00% |

|

Argentina |

253.80 |

288.26 |

327.13 |

358.49 |

347.31 |

374.76 |

365.68 |

0.69% |

|

Armenia |

24.31 |

5.94 |

7.32 |

8.82 |

9.99 |

10.36 |

10.84 |

0.02% |

|

Aruba |

0.22 |

0.35 |

0.48 |

0.49 |

0.48 |

0.53 |

0.56 |

0.00% |

|

Australia |

460.30 |

546.51 |

578.25 |

602.06 |

584.57 |

569.01 |

571.84 |

1.08% |

|

Austria |

80.46 |

83.51 |

96.20 |

82.17 |

77.27 |

75.41 |

72.92 |

0.14% |

|

Azerbaijan |

67.84 |

39.86 |

44.83 |

53.36 |

54.72 |

59.03 |

62.55 |

0.12% |

Source: EDGAR - Emissions Database for Global Atmospheric Research

Challenges

- Complex Import Tariffs and Trade Barriers: The trade restrictions on raw materials such as aluminum and magnesium are anticipated to pose significant hurdles for global automotive wheel rim manufacturers. The high import taxes and trade tensions also contribute to the sales of automotive wheel rims. The same source also highlights that some countries are even imposing higher rates amid geopolitical tensions. Considering this, smaller and mid-sized players are expected to witness expansion barriers.

- Infrastructure Gaps in Emerging Markets: The unavailability of advanced infrastructure in the emerging markets is expected to hamper the sales of automotive wheel rims. Southeast Asia and Africa, owing to limited ICT infrastructure and smart manufacturing capabilities, are likely to slow the adoption of advanced rim production technologies. In addition, the limited supply chains and workforce attributes in these markets exacerbate the challenge of producing quality and innovative wheel rims. Without advanced smart manufacturing capabilities and automation, manufacturing is mostly manual and inefficient.

Automotive Wheel Rims Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.16% |

|

Base Year Market Size (2025) |

USD 40.4 billion |

|

Forecast Year Market Size (2035) |

USD 65.6 billion |

|

Regional Scope |

|

Automotive Wheel Rims Market Segmentation:

Sales Channel Segment Analysis

The OEM segment is projected to capture 65.5% of the automotive wheel rims market share by 2035, as long-term contracts with automakers and the increasing integration of lightweight rims for emission reduction are creating high-earning opportunities for OEMs. Also, U.S. Corporate Average Fuel Economy (CAFE) Standards and the European Green Deal are incentivizing automakers to partner with rim suppliers for forged alloy and lightweight wheels. The supportive government initiatives are also contributing to the OEM sales of wheel rims.

Rim Type Segment Analysis

The alloy rims are expected to account for 61.9% of the market share throughout the forecast period. Alloy rims are most sought after owing to their cost-effectiveness and durability. The majority of the demand was driven by EVs and luxury vehicles. Furthermore, the sustainability initiatives are promoting alloy rims with recycled content, particularly in Europe, as they align with the EU Circular Economy Action Plan requirements for recyclability and material transparency. Moreover, the emergence of eco-labeling and carbon footprints is forcing rim manufacturers to innovate in sourcing materials, efficiency of production, and end-of-life product recycling.

Vehicle Type Segment Analysis

The passenger cars category held the biggest market share in the automotive wheel rims market due to a few major reasons. Passenger cars are the most popular vehicle type worldwide, as millions of passenger cars are produced annually, leading to a significant demand for wheel rims. Moreover, consumers often prefer creative design and customization; alloy rims have emerged as the most popular form of rim because of their looks, lightweight nature, and performance capabilities. The increasing use of electric vehicles (EVs), which are primarily passenger vehicles, has increased their demand for lightweight alloy rims to increase range and improve efficiency.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Rim Type |

|

|

Sales Channel |

|

|

End user |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Wheel Rims Market - Regional Analysis

APAC Market Insights

Asia Pacific market is anticipated to hold 34.5% of the global revenue share through 2035. The swift rise in automotive production and the EV trend is likely to accelerate the sales of wheel rims in the coming years. The boom in ICT-backed smart manufacturing trends is set to propel the sales of wheel rims in Japan, China, India, Malaysia, and South Korea. In addition, the increasing deployment of AI-integrated quality control systems and IoT-based production lines is expected to boost the dominance of Asian countries in the global automotive wheel rims landscape.

China is leading the sales of automotive wheel rims owing to the expansive auto production base and smart factory policies. The hefty public-private investments are also driving the trade of automotive wheel rims. This is increasing the use of digital technologies in automotive wheel rim manufacturing. The tax incentives are also poised to increase the automotive wheel rim export activities in the coming years. Along with this, public-private investments in advanced manufacturing infrastructure and technology have played a prominent role in supporting the automotive sector. With the large expenditures on research and development (R&D) and production capacity, China is increasingly not only moving forward with the manufacturing of traditional wheel rims, but is also leading the manufacturing of specialized, lightweight alloy rims and wheel rims for electric vehicles (EVs).

There are many reasons India is stepping up as a notable challenger in the automotive wheel rims market. The nation has quickly turned into the largest hub of automotive manufacturing across the globe, with a vibrant domestic automotive industry and increasing exports, especially for small and mid-segment vehicles. High production volumes of vehicles lead to a higher demand for automotive wheel rims, which are components for OEM (Original Equipment Manufacturer) vehicle manufacture. Moreover, affordable labor and low-cost automotive manufacturing capabilities continue to draw a vast array of global automotive manufacturers to create production facilities in India.

North America Market Insights

North America automotive wheel rims market is projected to increase at a CAGR of 5.9% from 2026 to 2035. The rise in EV registrations and increasing demand for luxury and supercars are fueling the sales of advanced wheel rims. The government-backed smart manufacturing policies are expected to drive innovations in the automotive wheel rims. There exists a compelling urgency surrounding environmental sustainability across North America in the automotive sector. There are tight regulations around emissions and sustainability, so manufacturers anticipate a higher demand for recycled aluminum solutions and sustainability solutions for wheels. As part of this continuum, automakers use more recyclable materials within the wheel rim, contributing to overall growth in the marketplace.

The U.S. automotive wheel rims market is driven by the federal infrastructure and ICT integration support for innovation. According to the National Telecommunications and Information Administration (NTIA), more than USD 2.8 billion was allocated to digital infrastructure via the BEAD and Digital Equity Act in 2023 to support automation across the automotive supply chain. In addition, government support in the form of policies and funding is encouraging local manufacturers to expand their operations. Federal incentives under the Infrastructure Investment and Jobs Act rope in electrification trends, which drive OEMs to adopt lightweight alloy rims optimized for EVs.

Canada's automotive sector is mature, and it has a long history of foreign automakers and OEMs. Canada's automotive manufacturing is predominantly aimed at light- and heavy-duty vehicles, which have a wide array of requirements for durable and high-performing wheel rims. Canada continues to make automobiles, and the drive toward investment in EVs will continue the trend toward increased innovative wheel rim design, especially lighter-weight aluminum alloy wheel rims. Canada’s sustainability focus and reducing carbon footprint are also evident in the automotive sector.

Europe Market Insights

The Europe automotive wheel rims market is foreseen to account for 22.9% of the global revenue share by 2035. The rapid digitalization in manufacturing and stringent CO₂ emission standards are prime factors fueling the trade of automotive wheel rims. The demand for lightweight, recyclable materials is gaining traction in the EU-based wheel rim production facilities. The rise in Industry 5.0 initiatives and EU-led sustainability regulations is poised to promote the sales of automotive wheel rims. Furthermore, the European Green Deal is pushing automakers to incorporate advanced alloy and forged rims into electric and hybrid vehicles. Overall, the EU is an investment-worthy market for automotive wheel rim producers.

In Germany, a robust automotive manufacturing base and strategic digital policy execution are set to significantly drive the sales of wheel rims. The smart manufacturing trend, coupled with government support, is likely to accelerate the demand for advanced wheel rims in the coming years. Also, the push toward CO₂-neutral manufacturing is promoting alloy and forged rim demand, particularly for EV platforms. Overall, the digital shift is anticipated to have a strong influence on the automotive wheel rims market.

France is one of the largest manufacturers of automobiles, including car makers such as Renault, Peugeot, and Citroën. The strong automobile manufacturing industry in France creates a rising demand for high-quality wheel rims in the country, particularly alloy wheel rims. As French automobile manufacturers continue to produce significant volumes of passenger vehicles, commercial vehicles, and electric vehicles (EVs) over the coming years, the increasingly high demand for durable, lightweight wheel rims with high-performance characteristics will help to fuel the growth of the market. France is also one of the top exporters of automobile components in Europe, including wheel rims.

Key Automotive Wheel Rims Market Players:

- Maxion Wheels

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Superior Industries International

- Enkei Corporation

- Ronal Group

- Borbet GmbH

- CITIC Dicastal Co., Ltd.

- BBS Kraftfahrzeugtechnik AG

- Topy Industries, Ltd.

- Momo Srl

- Steel Strips Wheels Ltd.

- SMW Engineering Sdn. Bhd.

- ROH Wheels

- YHI International Ltd.

- Mangels Industrial S.A.

- Kosei Aluminum Co., Ltd.

- Maxion Wheels

- Superior Industries International

- Enkei Corporation

- Ronal Group

- Borbet GmbH

The global automotive wheel rims market is fairly concentrated, with major players holding a big share. These companies are investing in cutting-edge technologies to enhance their product offerings. Collaborations with raw material manufacturers are poised to streamline supply chains. They are also expected to deploy 5G to make their production smoother and more efficient. Furthermore, strategic partnerships with other players are poised to increase their market reach. Some of the big players are entering the emerging markets to expand their operations and earn lucrative gains from untapped opportunities.

Recent Developments

- In April 2025, Continental AG intends to make its ContiTech rubber and plastics subsidiary a separate company. Major German suppliers Continental, Bosch, and ZF are going through a drastic reorganization as the industry struggles with declining auto output, high prices, and an impending trade war that would impact its exports to the US.

- In May 2025, DYMAG Technologies Limited has established a strategic partnership with Advanced International Multitech Co., Ltd. (AIM). The goal of this collaboration is to accelerate the development and manufacturing of composite and carbon hybrid wheel technology for automobiles and bikes. They hope to raise the bar for lightweight, high-strength wheel options by pooling their knowledge.

- Report ID: 4522

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Wheel Rims Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.