Aspirin Exacerbated Respiratory Disease Market Outlook:

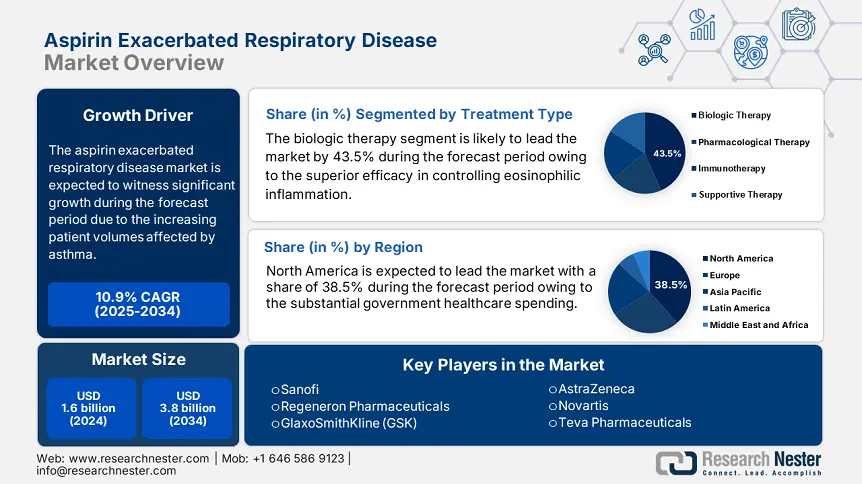

Aspirin Exacerbated Respiratory Disease Market size was valued at USD 1.6 billion in 2024 and is projected to reach USD 3.8 billion by the end of 2034, rising at a CAGR of 10.9% during the forecast period, 2025 to 2034. In 2025, the industry size of aspirin exacerbated respiratory disease is estimated at USD 1.7 billion.

The global aspirin exacerbated respiratory disease market is rising rapidly and is fueled by increasing patient volumes affected by asthma. Most people affected by asthma disease have 8% to 11% impact on aspirin exacerbated respiratory disease, mainly those with comorbid chronic rhinosinusitis and nasal polyposis. As per the CDC report, 25.6 million people in the U.S. are estimated to have asthma in 2023, and 1.9 million to 2.7 million people are expected to have aspirin exacerbated respiratory disease in the U.S. The NIH has reported that aspirin exacerbated respiratory disease is a severe disease caused by severe asthma, qualifying it for inclusion in multiple federally funded therapeutic trials and research.

A multi-stage international supply chain is used to produce drugs and biologics for AERD therapy, particularly corticosteroids, leukotriene modifiers, and monoclonal antibodies. API synthesis is mostly done in China and India, bulk drug production is done in Europe and the U.S., and final product formulation and assembly are carried out in facilities with GMP certification throughout the EU and North America. The producer price index has increased by 5.2% in 2024 for pharmaceutical preparations, and the consumer price index has risen to 2.9% for medical care commodities. These values impact the demand for drugs related to respiratory such as biologics used in managing AERD. On the import side, as per the U.S. International Trade Commission data, nearly 3.5 billion API related to respiratory APIs in the U.S., with 30.2% imported from China and 40.5% from India. These trades enhance the supply environment in the aspirin-exacerbated respiratory disease globally.

Aspirin Exacerbated Respiratory Disease Market - Growth Drivers and Challenges

Growth Drivers

- Increased government spending via Medicare and Medicaid: Medicare Part D spending on asthma-related biologics in the U.S., such as Dupilumab (Dupixent) and Mepolizumab (Nucala), reached USD 4.9 billion in 2023. Dupixent reached nearly USD 1.7 billion for chronic respiratory inflammation, impacting the federal investment in targeted therapies. This has highlighted the rising adoption of biologics and aligns with Medicare for cost-effective, high-need patient groups via reimbursable specialty pharmaceuticals. Further, the expansion of reimbursement under Medicare improves patient access and stimulates the growth of the aspirin exacerbated respiratory disease market.

- Healthcare quality improvement and cost reduction initiatives: According to the AHRQ report in 2022, the initiation of biologic treatment in the initial phases of aspirin-exacerbated respiratory disease asthma phenotypes experienced a 35.4% decrease in emergency hospitalizations. This directs cost savings of USD 460.4 million over two years. These results are consistent with the integration of biologics into evidence-based treatment guidelines for the management of asthma and sinusitis. Further, the AHRQ suggested that such interventions for general healthcare quality improvement emphasize their ability to reduce hospital dependence and lower total system costs. These findings have shaped payer payment policies and facilitated value-based care implementation.

Challenges

High treatment costs and patient affordability: The cost of biologics related to aspirin exacerbated respiratory disease, such as dupilumab, reached USD 40,002 per patient annually in the U.S., making a burden for private and public healthcare systems. As per the CDC report, nearly 38.3% of asthma patients are eligible under Medicare and received access to biologics therapies in 2023, mainly due to restrictive cost-based eligibility. These access issues limit the adoption of aspirin-exacerbated respiratory disease treatment mainly in underserved populations. Further, manufacturers are experiencing the pressure of cost-effectiveness to offset out-of-pocket costs.

Aspirin Exacerbated Respiratory Disease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

10.9% |

|

Base Year Market Size (2024) |

USD 1.6 billion |

|

Forecast Year Market Size (2034) |

USD 3.8 billion |

|

Regional Scope |

|

Aspirin Exacerbated Respiratory Disease Market Segmentation:

Treatment Type Segment Analysis

Under the treatment type, the biologic therapy dominates the segment and is poised to have a aspirin exacerbated respiratory disease market share of 43.5% by 2034. The segment is driven by superior efficacy in controlling eosinophilic inflammation related to aspirin-exacerbated respiratory disease. As per the NIH report, the data from the National Heart, Lung, and Blood Institute, biologics including dupilumab, benralizumab, and mepolizumab experience a reduction of 40.3% to 60.4% in nasal polyp size and asthma exacerbations, mainly in patients unaffected by corticosteroids. Trials funded by the NIH, such as NCT02925302, support the use of biologics in the long-term management of AERD.

End user Segment Analysis

In the end-user category, hospitals and specialty clinics have the largest revenue share and are anticipated to grow to 38.8% in 2034. The segment is driven by the function of delivering biologic therapies and managing complicated aspirin-exacerbated respiratory disease cases. The increasing use of targeted therapies like IL-4 and IL-5 inhibitors in inpatient and outpatient hospital care is being fueled by supportive reimbursement practices under Medicare and private insurance plans in developed markets, including the U.S., Canada, Germany, and Japan. Specialty clinics are experiencing a rising patient footfall with the availability of advanced diagnostic equipment and customized treatment protocols. These combined dynamics are driving a consistent move towards differentiated, value-added respiratory care in the end-user market.

Our in-depth analysis of the global aspirin exacerbated respiratory disease market includes the following segments:

|

Segment |

Subsegment |

|

Treatment Type |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

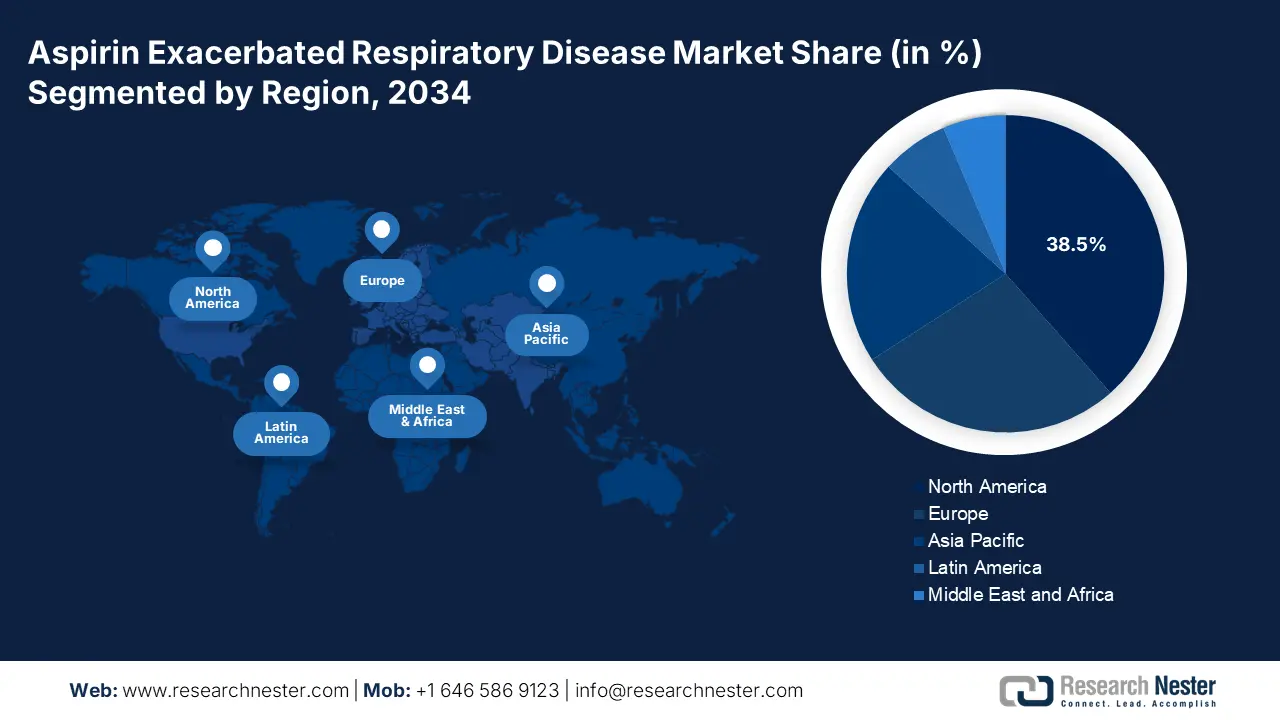

Aspirin Exacerbated Respiratory Disease Market - Regional Analysis

North America Market Insights

The aspirin exacerbated respiratory disease market in North America dominates the region and is projected to have a market share of 38.5% at a CAGR of 10.2% by 2034. The aspirin exacerbated respiratory disease market is fueled by the increasing prevalence of asthma and chronic rhinosinusitis with nasal polyposis, rising biologics adoption, and substantial government healthcare spending. The U.S. leads the aspirin exacerbated respiratory disease market by the support of Medicare and Medicaid coverage due to the rising patient cases, with over USD 4.9 billion in asthma-related diseases in 2023. Further, Canada has allocated 8.2% of its healthcare budget in 2023 for aspirin-exacerbated respiratory diseases. The North America market is expanded by strategic partnerships among pharmaceutical companies and healthcare providers, enhancing treatment accessibility and cost.

The U.S. is the biggest market for Aspirin Exacerbated Respiratory Disease treatments is supported by increasing biologic adoption, high prevalence of the disease, and inclusive public spending. In 2023, the U.S. spent USD 5.3 billion, or 9.4% of the federal healthcare budget, on AERD-related diseases through organizations such as CDC and AHRQ. Further, the AHRQ asthma quality initiative has facilitated early-stage intervention, leading to a 15.4% rise in Medicare reimbursement expenditure between 2020 and 2024. Medicaid also widened its coverage, allocating USD 1.5 billion in 2024 for AERD procedures and making coverage possible for an additional 10.3% of patients. Demand is set to remain on an upward trend, driven by payer reforms and government investment in chronic respiratory care.

Asia Pacific Market Insights

The APAC is the fastest-growing region in the aspirin exacerbated respiratory disease market and is projected to have a market share of 20.9% at a CAGR of 10.5% by 2034. The aspirin exacerbated respiratory disease market is driven by rising diagnostic rates, increased government healthcare spending, and urban respiratory disease burden. China leads the region by having a patient population of 1.7 million diagnosed with aspirin-exacerbated respiratory disease in 2023, with a 15.5% rise in government healthcare spending for asthma-linked conditions for the past five years. Further, the aspirin exacerbated respiratory disease market is also driven by the rising awareness of the healthcare systems, expanded biologic availability, and digital diagnostic tools.

China holds the maximum share in the aspirin exacerbated respiratory disease market and is expected to hold the market share of 36.7% in 2034. China experienced a 15.3% growth in government spending on aspirin-exacerbated respiratory disease conditions in the last five years, fueled by increasing asthma prevalence and massive investment in hospital facilities. As per the National Medical Products Administration (NMPA) report, more than 2.0 million patients were diagnosed with AERD phenotypes in 2023. The government Healthy China 2030 strategy has further surged the investment into respiratory disease initiatives and local biologic drug production. These initiatives are expected to enhance countrywide access to complex therapeutics and narrow the urban-rural gap in treatment, making China an important growth market for AERD therapeutics.

APAC Government Investment and Funding (2021–2025)

|

Country |

Year Launched |

Investment Initiative |

Budget Allocation |

|---|---|---|---|

|

Australia |

2022 |

Inclusion of biologics for severe asthma under PBS |

AU USD 240.4 million (2022–2025) via Pharmaceutical Benefits Scheme |

|

Japan |

2024 |

Respiratory Biologics Innovation Program via AMED & MHLW |

USD 3.3 billion increase from 2022; 12.4% of the national healthcare budget |

|

India |

2023 |

National Chronic Respiratory Disease Strategy Implementation |

USD 2.2 billion annually for AERD-related care |

|

South Korea |

2021 |

HIRA integration of AERD into asthma & CRSwNP reimbursement plans |

Nationwide rollout of biologics under National Health Insurance |

|

Malaysia |

2023 |

MOH-led biologics procurement and digital asthma registry launch |

20.6% increase in AERD funding since 2013; doubled patient coverage |

Europe Market Insights

The Europe market for aspirin-exacerbated respiratory disease is steadily expanding and is projected to have a market share of 27.4% at a CAGR of 8.8% by 2034. Countries including the UK, France, and Germany are leading the EU market and are expected to hold over 70.2% of the revenue share by 2034. As per the European Medicines Agency report, the national health programs are prioritizing biologics and focused therapies for respiratory diseases. Funding for research, medication development, and fair access to cutting-edge treatments has been allocated €2.8 billion via EU-wide policy frameworks, including the European Health Data Space and the EU4Health initiative. The cross-border clinical trial initiatives are surging with the rapid development of next-gen AERD therapies.

Germany has become Europe's biggest aspirin exacerbated respiratory disease market and is expected to hold a market share of 28.8% by 2034. According to the Federal Ministry of Health and EMA. Germany has achieved €4.3 billion in expenditure through 2024, a growth of 12.5% over demand for 2021. The wide availability of biologics for severe respiratory diseases is facilitated by Germany's robust public insurance coveraage. The Federal Joint Committee (G-BA) and Institute for Quality and Efficiency in Health Care (IQWiG) facilitate market access for new treatments within a timely manner, usually 7 to 10 months after EMA approval. The government has also allocated more than €450.4 million towards innovation funds on respiratory research, such as trials of dupilumab and mepolizumab in chronic sinusitis with AERD.

Europe Government Investment and Budget (2021–2025)

|

Country |

Launch Year |

Policy / Investment Initiative |

Budget / Funding Allocation |

|---|---|---|---|

|

United Kingdom |

2023 |

NHS Biologics Expansion Plan for Chronic Respiratory Diseases |

8.4% of healthcare budget (~£11.6 billion for AERD care) |

|

France |

2023 |

ALD Protocol Expansion for Severe Asthma & Nasal Polyposis Treatments |

7.5% of total health budget (~€2.8 billion) |

|

Italy |

2022 |

AIFA Respiratory Disease Therapeutic Reimbursement Policy |

6.8% of national healthcare budget allocated to AERD therapies |

|

Spain |

2021 |

National AERD Biologic Drug Procurement and Public Coverage Initiative |

6.1% of health budget; steady 10% increase in respiratory drug spend |

Key Aspirin Exacerbated Respiratory Disease Market Players:

- Sanofi

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Regeneron Pharmaceuticals

- GlaxoSmithKline (GSK)

- AstraZeneca

- Novartis

- Teva Pharmaceuticals

- Amgen

- CSL Limited

- Mitsubishi Tanabe Pharma

- Hanmi Pharmaceutical

- Lupin Limited

- Cipla

- BioMérieux

- Glenmark Pharmaceuticals

- Dr. Reddy’s Laboratories

- Chugai Pharmaceutical (Roche Group)

- Biocon Biologics

- Pharmaniaga Berhad

- Takeda Pharmaceutical

- Torrent Pharmaceuticals

The global aspirin exacerbated respiratory disease market is dominated by multinational players such as Sanofi, Regeneron, and GSK, with a market share of more than 34.4%. These players are heavily investing in biologic treatments like anti-IL-4, IL-5, and IL-13 monoclonal antibodies to treat complicated AERD phenotypes. Strategic partnerships between Sanofi and Regeneron for Dupixent have surged the aspirin exacerbated respiratory disease market growth. Meanwhile, companies in India, Japan, and South Korea are using biosimilars, generics, and local manufacturing joint ventures to compete on price and availability. Diagnostic innovation from companies such as bioMérieux is improving patient phenotyping and informing personalized AERD treatment regimens.

The top 20 cohort of such key players include:

Recent Developments

- In March 2024, Sanofi and Regeneron Pharmaceuticals expanded EMA label for Dupixent to treat patients with chronic rhinosinusitis. This expansion has led to a 9.7% increase in Europe market share.

- In April 2024, AstraZeneca launched a subcutaneous auto-injector device for Benralizumab to enhance patients’ use. This device has contributed to a 7.2% rise in patient uptake in Italy and France.

- Report ID: 4139

- Published Date: Jul 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aspirin Exacerbated Respiratory Disease Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert