Arrhythmia Monitoring Devices Market Outlook:

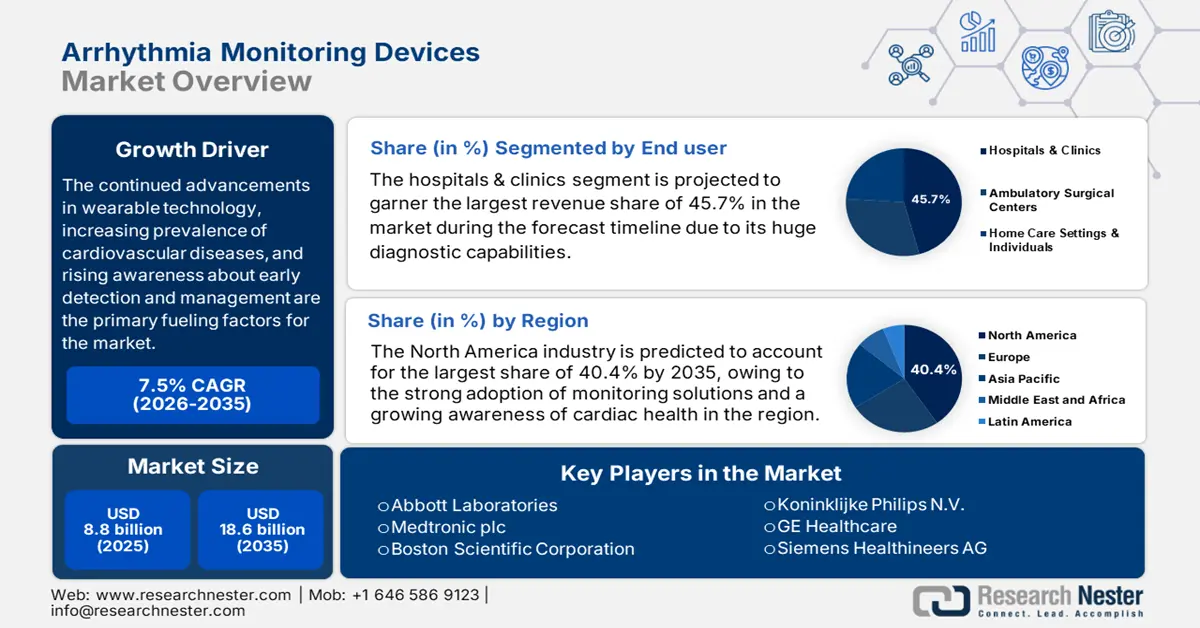

Arrhythmia Monitoring Devices Market size was valued at USD 8.8 billion in 2025 and is projected to reach USD 18.6 billion by the end of 2035, rising at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of arrhythmia monitoring devices is estimated to reach USD 9.4 billion.

The continued advancements in wearable technology, increasing prevalence of cardiovascular diseases, and rising awareness about early detection and management are the primary fueling factors for the market. This can be testified by the report from July 2025 WHO article that states that around 19.8 million individuals lost their lives due to cardiovascular diseases, out of which 85% were due to heart attack and stroke. Therefore, these statistics underscore the presence of a reliable consumer base in this field.

Furthermore, the growing adoption in healthcare settings and home care, coupled with expanding applications across various arrhythmia types, is fueling market expansion across different nations. In this regard, the study by Heart Rhythm O2 in June 2025 revealed that hospitalizations for atrial fibrillation and flutter with antiarrhythmic drug monitoring in the U.S. caused nearly USD 949 million in costs, wherein the average stay is 5 days and a mortality rate of 2.6%. Hence, this highlights the urgent need to develop faster inpatient or outpatient protocols for initiating therapies.

Key Arrhythmia Monitoring Devices Market Insights Summary:

Regional Insights:

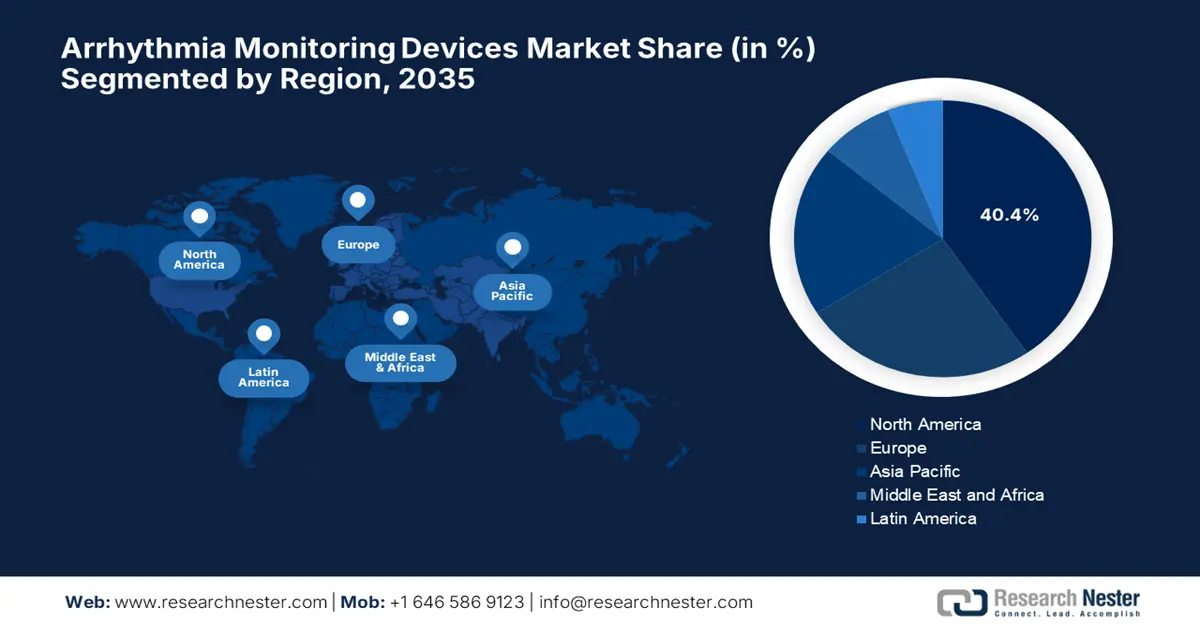

- North America is projected to dominate the Arrhythmia Monitoring Devices Market with a 40.4% share by 2035, owing to the growing adoption of innovative cardiac monitoring solutions and heightened awareness of heart health among the aging population.

- Asia Pacific is expected to witness the fastest expansion between 2026 and 2035, fueled by rapid urbanization, enhanced healthcare accessibility, and surging investments in preventive cardiac care.

Segment Insights:

- The hospitals & clinics segment in the Arrhythmia Monitoring Devices Market is predicted to account for a 45.7% share by 2035, propelled by its critical role in initial diagnosis and surgical implantation of devices such as implantable loop recorders (ILRs).

- The atrial fibrillation segment is anticipated to secure a 35.6% share by 2035, driven by the growing incidence of the condition influenced by hypertension and obesity and the enhanced treatment pathways enabled by implantable cardiac monitors.

Key Growth Trends:

- Rising aging demographics

- Continued technological advancements

Major Challenges:

- Data management & integration

- Poor compliance

Key Players: Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG, OSI Systems, Inc., Hill-Rom Holdings, Inc., Schiller AG, iRhythm Technologies, Inc., Biotronik SE & Co. KG, Compumedics Limited, BPL Medical Technologies, Mindray Medical International Limited, Lepu Medical Technology, Bionet Co., Ltd., Nurotron Biotechnology Co., Ltd.

Global Arrhythmia Monitoring Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.8 billion

- 2026 Market Size: USD 9.4 billion

- Projected Market Size: USD 18.6 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, South Korea, Brazil, Australia, Singapore

Last updated on : 3 September, 2025

Arrhythmia Monitoring Devices Market - Growth Drivers and Challenges

Growth Drivers

- Rising aging demographics: The rising instances of arrhythmias among the elderly demographics are the foundational factor for market expansion. In this regard, the report from WHO in October 2024 revealed that 1 out of 6 people will be aged over 60 by the end of 2030, whereas by 2050, the aging demographics will surpass 2.1 billion. Hence, this existence implies that the demand for reliable monitoring devices to detect and manage irregular heart rhythms, which are also rising sharply, indicates a positive market outlook.

- Continued technological advancements: Innovations in terms of wearable and implantable technologies that combine AI and telemedicine are remarkably transforming arrhythmia detection. In September 2023, Philips reported that Martini Hospital in the Netherlands has become the first in the country to implement its’ wearable ePatch which comes with the AI-powered Cardiologs analytics platform for continuous remote cardiac monitoring. The company also stated that this innovative service replaces traditional Holter monitors, thereby offering greater patient comfort and extended monitoring duration. Top of Form

- Growing adoption of home-based healthcare: There has been a surging preference for home-based and remote monitoring solutions, which is fostering a profitable business environment for the market. In October 2023, VitalConnect announced that it collaborated with Fifth Eye Inc. to integrate Fifth Eye’s FDA-cleared AHI System with VitalConnect’s wearable biosensor for enhanced remote patient monitoring. Further, this integration adds predictive analytics that detect hemodynamic instability before traditional vital signs indicate deterioration, hence benefiting overall market growth.Bottom of Form

Historic Regional Age-Standardized CVD Death Rates (per 100,000, 2019)

|

Region |

Female |

Male |

|

Central Europe, Eastern Europe, Central Asia |

345.7 |

524.1 |

|

North Africa & Middle East |

339.8 |

376.7 |

|

South Asia |

281.8 |

388.6 |

|

Sub-Saharan Africa |

299.1 |

284.6 |

|

Southeast Asia, East Asia, Oceania |

202.8 |

287.5 |

|

Latin America & Caribbean |

141.7 |

206.8 |

|

High-Income Region |

102.1 |

153.8 |

Source: World Heart Federation

Advancements in Cardiac Monitoring: Key Company Milestones

|

Year |

Company |

Initiative / Approval |

Revenue Opportunity |

|

2025 |

GE HealthCare |

Topped the FDA AI authorization list with 100 clearances. |

Growth through AI-enabled device sales across cardiology, enhancing imaging, and ultrasound diagnostics. |

|

2024 |

iRhythm |

Japanese PMDA approval for the Zio ECG monitoring system. |

Access to Japan's ~1.6 million test/year market, the second largest globally, pending reimbursement. |

|

2024 |

HeartBeam |

Presentation of AI data for VCG-based atrial flutter detection. |

Positioning for future market entry with a novel, AI-enhanced portable ECG device pending FDA approval. |

|

2023 |

BIOTRONIK |

FDA approval of BIOMONITOR IV ICM with AI-powered SmartECG. |

U.S. market expansion for implantable monitors with reduced false positives and PAC/PVC discrimination. |

Source: Company Official Press Releases

Challenges

- Data management & integration: The aspect of complex data management and integration poses a major challenge to the arrhythmia monitoring devices market to achieve desired success. The vast amount of data generated by these devices makes it challenging for healthcare providers to manage efficiently. Further, the absence of advanced analytics, clinicians might struggle to identify critical arrhythmia events promptly, thereby ultimately delaying diagnosis and treatment.

- Poor compliance: This is yet another challenge negatively impacting progress in the market. Most of the devices, such as traditional Holter monitors, can be bulky, uncomfortable, or intrusive, leading to reduced compliance among patients. This poor adherence among consumers can, in turn, lead to inaccurate monitoring data, which diminishes the effectiveness and negatively impacts the clinical outcomes.

Arrhythmia Monitoring Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 8.8 billion |

|

Forecast Year Market Size (2035) |

USD 18.6 billion |

|

Regional Scope |

|

Arrhythmia Monitoring Devices Market Segmentation:

End user Segment Analysis

Based on end user hospitals & clinics segment is projected to garner the largest revenue share of 45.7% in the market during the forecast timeline. The subtype remains the primary choice for initial diagnosis and surgical implantation of devices such as ILRs. In October 2023, InfoBionic declared that its MoMe ARC is accepted by the U.S. FDA, which is a next-generation AI-powered remote ECG monitoring device featuring a Bluetooth-enabled six-lead sensor designed for continuous cardiac monitoring without patient intervention.

Application Segment Analysis

In terms of application atrial fibrillation segment is expected to attain a share of 35.6% in the arrhythmia monitoring devices market by the end of 2035. The growth in the subtype originates from its increasing occurrence, influenced by factors such as hypertension and obesity. In May 2023 HRS article reported that continuous monitoring with implantable cardiac monitors significantly improves care pathways for patients with atrial fibrillation, which analyzed 2,458 patients which showing that those monitored with ICMs had faster initiation of antiarrhythmic drug therapy, which is 36 vs. 46 days, and earlier first ablation procedures, 5 vs. 14 months.

Product Type Segment Analysis

Based on product type mobile cardiac telemetry monitors segment is predicted to capture a significant share of 28.5% in the market during the discussed timeframe. The superior ability to provide real-time, continuous ambulatory monitoring for extended periods is the key factor reinforcing the subtype’s growth in this field. In March 2022, ZOLL Medical Corporation announced the launch of the ZOLL Arrhythmia Management System, which is a next-generation mobile cardiac telemetry solution that integrates biometric data, including heart rate, activity, respiratory rate, and body posture, with traditional ECG monitoring.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Application |

|

|

Product Type |

|

|

Technology |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Arrhythmia Monitoring Devices Market - Regional Analysis

North America Market Insights

North America is expected to grab the largest revenue share of 40.4% in the global market by the end of 2035. The strong adoption of innovative monitoring solutions and a growing awareness of cardiac health among the aging population are the key factors propelling this leadership. In February 2024, the NHLBI reported that it is launching targeted campaigns such as Yes, YOU! to raise heart disease awareness among younger women, particularly Black and Latina communities, to educate about risk factors and promote heart-healthy habits early in life, hence benefiting overall market upliftment.

The U.S. leads the regional arrhythmia monitoring devices market on account of significant investments in research and development and increasing healthcare costs. As per an August 2023 NIH article, hospitalizations drive the largest portion of the heart failure costs in the country, wherein outpatient visits and medications saw notable increases. Besides the HF-related expenses total is nearly USD 180 billion on a yearly basis, with incremental costs of USD 22.3 billion, hence suitable for market expansion.

Canada is also portraying steady growth in the market, which is supported by the increasing awareness of atrial fibrillation and other cardiac arrhythmias among both service providers and consumers. In April 2023, Icentia Inc. announced that it received FDA 510(k) clearance for CardioSTAT, which is a wireless, single-use continuous ECG monitoring device that offers flexible monitoring durations from 24 hours up to 14 days. The pay-by-duration model aims to provide cost-effective, adaptable cardiac care with streamlined data analysis options for healthcare providers.

Key U.S. Cardiovascular Disease Prevention Programs (2021-2023)

|

Program/Initiative |

Notes |

|

CDC Funding (FY 2023) |

$114 million awarded to 50 states, DC, tribes, tribal organizations, cities, health systems, and universities |

|

Paul Coverdell Program |

Improved stroke care for 1.1 million+ patients in 800+ hospitals; |

|

WISEWOMAN Program |

365,440 screenings for 256,442 participants; 502,000+ healthy behavior support services provided |

|

Million Hearts Initiative |

Trained 1,400+ clinicians; developed 50+ tools/resources; helped 700,000+ patients improve BP and cholesterol control |

Source: CDC

APAC Market Insights

Asia Pacific is predicted to emerge as the fastest-growing region in the arrhythmia monitoring devices market from 2026 to 2035. This accelerated progression is readily propelled by the rapid urbanization and improving healthcare access. Besides, technological discoveries are at a surge, wherein the wearable ECG monitors and implantable devices are becoming extremely prevalent. Also, the increasing investment in healthcare infrastructure and a growing emphasis on preventive cardiac care are creating favorable conditions for market expansion.

China is maintaining a dominant position in the regional market, facilitated by the strong focus on healthcare modernization, research ecosystem, and digital transformation. For instance, in December 2023, Singular Medical launched the clinical trial for the country’s first domestically produced implantable cardiac monitor, called the SiLu ICM. The company also stated that the trial enrolled its first participant on the same day, marking a key milestone in China’s cardiac monitoring.

India is gaining enhanced traction in the arrhythmia monitoring devices market with the emergence of affordable diagnostic technologies and expanding healthcare access. The country also benefits from constant government and private organization efforts to strengthen cardiac care. The country’s Ministry of Health in September 2023 launched a nationwide campaign to raise awareness about hypertension and promote heart-healthy lifestyles. The initiative is backed by the Global Health Advocacy Incubator, which is a large-scale effort that emphasizes prevention, treatment, and community engagement to productively address cardiovascular diseases.

Cardiac Device Implantation Statistics in China (2022)

|

Category |

Value |

|

GDP (US$ billion) |

180,600 |

|

Total Health Expenditure (% GDP) |

7.0% |

|

SCD (Sudden Cardiac Death) Patients |

540,000 |

|

Heart Failure Patients |

4,500,000 |

|

Atrial Fibrillation (AF) Patients |

8,000,000 |

|

Pacemakers |

98,619 |

|

Cardiac Resynchronization Therapy (CRT) |

5,398 |

|

Implantable Cardioverter Defibrillator (ICD) |

6,762 |

Source: APHRS

Europe Market Insights

Europe is retaining its position as the second-largest stakeholder in the arrhythmia monitoring devices market. This became possible with the increasing prevalence of cardiovascular diseases and aging populations across prominent countries such as Germany, the UK, and France. In this context, SJD Barcelona Children’s Hospital in January 2022 introduced the region’s first-ever implantable cardiac monitor with remote programming capabilities for long-term arrhythmia diagnosis in children. The organization also noted that this innovation enhances pediatric arrhythmia management by combining minimally invasive implantation with advanced digital connectivity.

Germany is representing itself as the key growth engine in Europe’s arrhythmia monitoring devices industry, fueled by a combination of advanced healthcare infrastructure and strong research and development activities. In April 2024, BIOTRONIK introduced its new BIOMONITOR IV insertable cardiac monitor at the EHRA Congress in Berlin, which also has an advanced AI-powered SmartECG technology. The company also proclaimed that the device reduces false positive arrhythmia detections, thereby providing high signal quality and reliable remote monitoring.

The arrhythmia monitoring devices market in Spain is continuously growing due to the increased adoption of innovative wearable technologies and AI-powered diagnostic platforms. In this context, Philips in May 2024 stated that it successfully deployed its wearable ePatch and AI-powered Cardiologs analytics platform across 14 hospitals in the country. Also, this ambulatory cardiac monitoring solution enhances the detection of arrhythmias such as atrial fibrillation, thereby improving patient comfort and reducing hospital stays and expenses.

Key Arrhythmia Monitoring Devices Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- OSI Systems, Inc.

- Hill-Rom Holdings, Inc.

- Schiller AG

- iRhythm Technologies, Inc.

- Biotronik SE & Co. KG

- Compumedics Limited

- BPL Medical Technologies

- Mindray Medical International Limited

- Lepu Medical Technology

- Bionet Co., Ltd.

- Nurotron Biotechnology Co., Ltd.

The global market is highly consolidated, wherein the top three players, such as Abbott, Medtronic, and Boston Scientific, have captured the maximum market share. The pioneers are intensifying the competition through continued innovation, strategic mergers and acquisitions, and a strong focus on geographic expansion. Besides, the firms are readily making investments in the development of compact, wearable, and connected devices that facilitate remote patient monitoring (RPM), which is a major industry trend.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2024, Octagos Health notified that it had raised equity of total USD 43 million to advance AI-based cardiac monitoring. The program was led by Morgan Stanley Expansion Capital, with continued participation from Mucker Capital and other investors.

- In September 2022, Medtronic plc announced that its LINQ II Insertable Cardiac Monitor system received the 510(k) clearance from the U.S. FDA, which is the first of its kind to be accepted for use in pediatric patients over the age of 2 who have heart rhythm abnormalities and require long-term, continuous monitoring.

- Report ID: 8050

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.