Anesthesia Breathing Circuits Market Outlook:

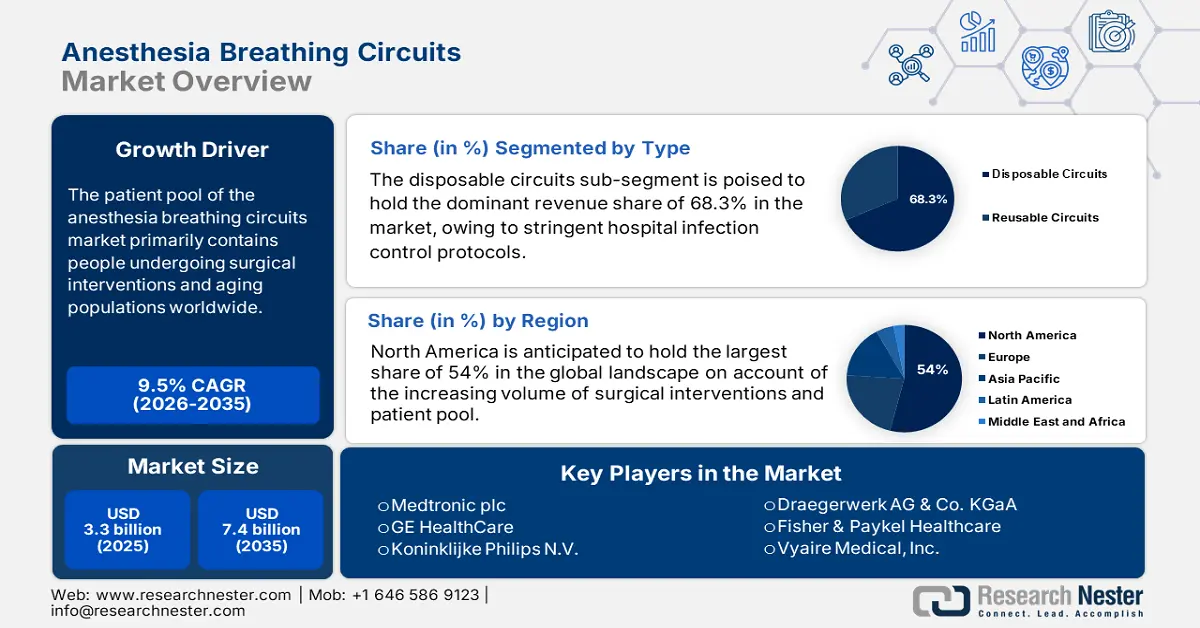

Anesthesia Breathing Circuits Market size was over USD 3.3 billion in 2025 and is estimated to reach USD 7.4 billion by the end of 2035, expanding at a CAGR of 9.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of anesthesia breathing circuits is evaluated at USD 3.6 billion.

The patient pool of the market primarily contains people undergoing surgical interventions and aging populations worldwide. According to the NLM, by 2023, 313 million surgeries were being performed every year around the globe. Besides, the World Health Organization (WHO) predicted the number of elderly people across the world to surpass 1.4 billion by 2030. Additionally, the increasing occurrence of chronic illnesses, such as cardiovascular disorders, cancer, and orthopedic conditions, is becoming the underlying driver of the surgical demography.

The overall payers’ pricing of services and products related to anesthesiology varies with the changes in insurance coverage policies and volatilities in the supply chain. Evidencing the same, in February 2022, a study was published by the Columbia University Mailman School of Public Health. It unveiled that the intervention of physician management companies (PMCs) led to a notable price increase for anesthesia services, ranging between 16.5% and 26%. This may ultimately result in a lower adoption rate in the market, which requires prioritization of value-based healthcare practices.

Key Anesthesia Breathing Circuits Market Insights Summary:

Regional Highlights:

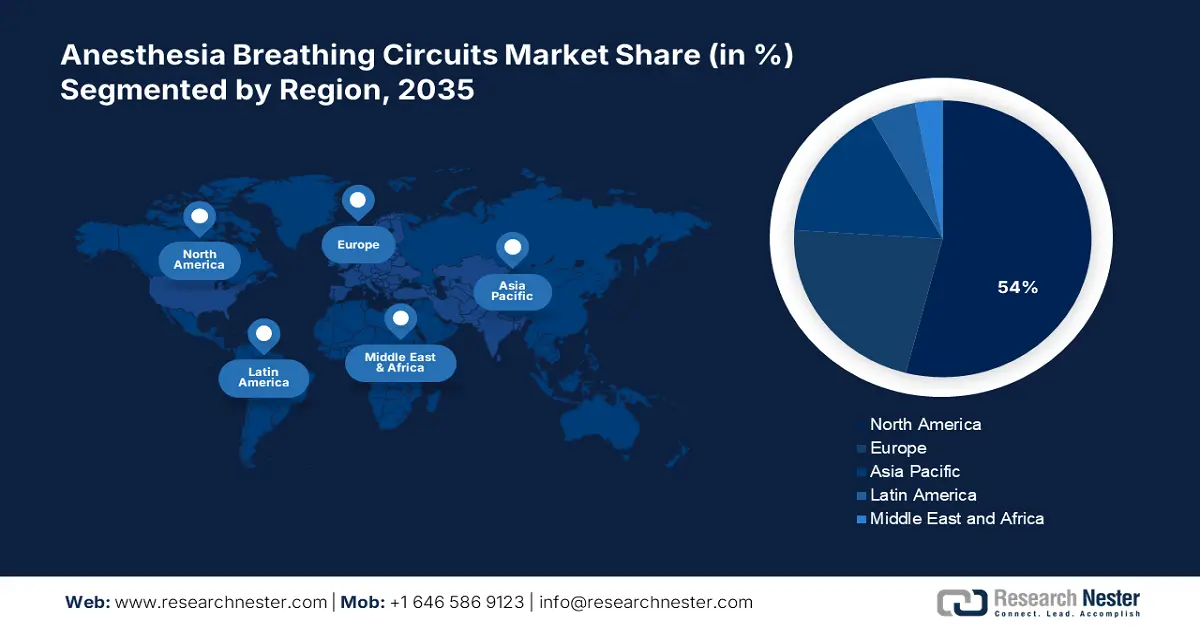

- North America is anticipated to hold a 54% share by 2035, driven by developed medical facilities, high surgical volumes, and strict healthcare-associated infection regulations.

- The Asia Pacific region is expected to emerge as the fastest-growing market by 2035, owing to rapid healthcare infrastructure development, rising surgical volumes, and increasing intensive care awareness.

Segment Insights:

- The disposable circuits sub-segment is projected to secure a 68.3% share by 2035, driven by stringent hospital infection control protocols and rising incidences of ventilator-associated pneumonia.

- The adult procedures application is expected to account for 62.6% of the market by 2035, owing to the growing patient pool of adults with chronic ailments requiring surgical interventions.

Key Growth Trends:

- Importance in pediatric and neonatal care

- Public investments in infrastructural development

Major Challenges:

- High upfront R&D and manufacturing costs

- Variability in standardization policies

Key Players: Medtronic plc (Ireland), GE HealthCare (U.S.), Koninklijke Philips N.V. (Netherlands), Draegerwerk AG & Co. KGaA (Germany), Fisher & Paykel Healthcare (New Zealand), Vyaire Medical, Inc. (U.S.), Teleflex Incorporated (U.S.), ICU Medical, Inc. (U.S.), Ambu A/S (Denmark), Flexicare Medical Limited (UK), Smiths Medical (UK), Medline Industries, LP (U.S.), Armstrong Medical (U.S.), SunMed (U.S.), Intersurgical Ltd. (UK), Mercury Medical (U.S.), Asid Bonz GmbH (Germany), MEKICS Co., Ltd. (South Korea), Allied Medical Ltd. (UK), Becton, Dickinson and Company (U.S.), BioCote Ltd. (UK)

Global Anesthesia Breathing Circuits Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.3 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 7.4 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (54% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, China

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 29 August, 2025

Anesthesia Breathing Circuits Market - Growth Drivers and Challenges

Growth Drivers

- Importance in pediatric and neonatal care: The individual needs of children and newborns create a surge in highly specialized and size-appropriate commodities from the anesthesia breathing circuits sector. The notable rise in premature births is also contributing to higher usage in this sector, as they need dedicated neonatal surgical care. In this regard, an article from the Healthy Newborn Network revealed that approximately 1 million neonatal deaths occurred worldwide in 2022 alone, where 900 thousand of them could be prevented through effective intensive care. This signifies the growing demand in this sector.

- Public investments in infrastructural development: Government-backed health authorities, specifically from emerging economies, are now actively investing in heavy reinforcement in hospitals, surgical centers, and ICUs. This is creating a fresh consumer base for this merchandise, along with a steady capital influx. Exemplifying the same, the expenditure by the PM Ayushman Bharat Health Infrastructure Mission (PM-ABHIM) in India increased from Rs. 2,230 crores to Rs. 3,567 crores from 2023-24 to 2024-25. Moreover, government efforts to make surgery more accessible to larger populations are benefiting the market.

- Tech-based advances in products and procedures: The anesthesia breathing circuits market is evolving, as more healthcare systems modernize. This is prompting innovation in materials, connectors, humidification features, and compatibility, expanding the existing pipeline and enhancing acceptance for these tools at a large scale. Moreover, the integration of smart sensors and real-time monitoring reduces airflow resistance, minimizes dead space, and improves patient comfort, encouraging companies to invest more in extensive R&D. This can be testified by the outcomes of using AI in ultrasound-guided regional anesthesia, highlighting an accuracy of 99.7% in identifying specific anatomical structures, as per the 2025 Frontiers article.

Global Historic Trends in the Patient Pool of the Market

Epidemiology of Preterm Births & Deaths (2022-2023)

|

Studied Region |

Preterm Birth Count |

Preterm Death Count |

|

North America, Europe, Australia, and New Zealand |

1,039,000 |

14,300 |

|

West Asia and North Africa |

1,057.800 |

70,900 |

|

Latin America and the Caribbean |

32,200 |

870,000 |

|

South Asia |

4,778,900 |

3,38,400 |

|

Sub-Saharan Africa |

3,913,200 |

3,54,800 |

|

East Asia, South-East Asia, and Oceania |

1,717,600 |

79,500 |

Source: NLM

Payers’ Pricing Dynamics Related to the Market

Cost Analysis of Different Anesthesia Services

|

Territory of Study |

Anesthesia Service Type |

Cost Information/Comparison |

Year of Study |

|

North America |

Local Anesthesia (LA) |

The mean anesthesia-related cost of performing hand surgery under LA as a wrist and/or digital block was $236 ± 30 |

2022 |

|

Japan vs South Korea |

Interventional Pain Treatment |

The cost of trigger point injections is 1.06x higher in Japan than in Korea; epidural and peripheral nerve block costs vary |

2024 |

|

Colombia |

Balanced General Anesthesia vs TIVA |

Desflurane anesthesia is 1.2x more costly than TIVA; TIVA is 2.5x costlier than isoflurane balanced anesthesia |

2022 |

Source: NLM and Colombian Journal of Anesthesiology

Challenges

- High upfront R&D and manufacturing costs: The development of new pipelines in the market requires substantial investment in R&D, human factors testing, and production. Besides, the regulatory criteria for Good Manufacturing Practices (GMP) add an extensive need for capital. These collectively increase the pricing of the final products, restricting access for budget-constrained medical settings and shrinking the volume of cash inflow in this sector. The inflationary factors also discourage small-sized manufacturers from participating in this category.

- Variability in standardization policies: As international standards and quality requirements vary with regional differences, the volatility in the global expansion of the anesthesia breathing circuits sector is highly evident. Besides, the cost-effectiveness and safety benchmarks of individual countries often have unique labeling, language, and minor regulatory deviations, which makes the process of commercialization complex and expensive in this sector. On the other hand, this forces pioneers to create customized pipelines, creating barriers to cross-border operations.

Anesthesia Breathing Circuits Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 3.3 billion |

|

Forecast Year Market Size (2035) |

USD 7.4 billion |

|

Regional Scope |

|

Anesthesia Breathing Circuits Market Segmentation:

Type Segment Analysis

The disposable circuits sub-segment is poised to hold the dominant revenue share of 68.3% in the anesthesia breathing circuits market by the end of 2035. The position is primarily consolidated by stringent hospital infection control protocols, which demand adequate resources for single-use interventional instruments. Such implementations are majorly followed by the rising occurrences of ventilator-associated pneumonia (VAP), where the 2024 NLM study obtained that the VAP incidence in the ICU accounted for 30%. It also highlighted the mortality among patients with multidrug-resistant VAP to range between 30% and 50%. In response, public authorities are actively promoting the use of medical devices with lower contamination risks, including disposable anesthesia breathing circuits (ABC).

Application Segment Analysis

Adult procedures are expected to be the largest field of application in the anesthesia breathing circuits market throughout the analyzed timeframe, capturing a 62.6% share. The vast and growing patient pool of chronic ailments in this age group, requiring surgical intervention, is the major driver behind the leadership. Testifying to the same, in a July 2025 article, the National Council on Aging unveiled that approximately 93% of adults aged 65 and over have at least one chronic condition, while around 79% have two or more. This creates a consistent and inelastic consumer base for anesthesia circuits designed for adult use.

End user Segment Analysis

Hospitals are predicted to become the dominant end-user in the anesthesia breathing circuits market over the discussed period, while accounting for approximately 75.3% revenue share. This strong presence is empowered by the high volume of surgical procedures performed in hospital settings, where anesthesia administration is critical. Due to having a wide range of patient populations across various departments, including surgery, intensive care, and emergency care, these facilities require advanced, reliable, and sterile breathing circuits at a large scale. The growing trend of government-backed centralized procurement processes and higher budget allocations in hospitals also contribute to their significance in this field.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anesthesia Breathing Circuits Market - Regional Analysis

North America Market Insights

North America is anticipated to hold the largest share of 54% in the global anesthesia breathing circuits market by the end of 2035. The developed medical facilities, high volume of surgeries, and the enlarging patient pool of chronic conditions are solidifying the region’s forefront position in this sector. The presence of globally leading research institutions and MedTech pioneers, coupled with strict healthcare-associated infection (HAI) regulations, is creating a favorable environment for this merchandise. The progressive characteristics of the landscape can further be testified by the launch of a new sustainable model for anesthesia by UCSF Health in February 2025, which is equipped with multi-use breathing circuits.

According to a study published by the NLM in September 2024, the expense of each VPA incidence in the U.S. accounted for $40.1 thousand. Besides, chronic illnesses are attributable to an annual expenditure of $1 trillion for the country’s healthcare system, where 50% of nationwide preventable disease deaths originate from sedentary lifestyles, such as inactivity, poor nutrition, tobacco use, and excessive alcohol consumption, as unveiled by another 2024 NLM findings. These figures display a clear picture of the underlying growth factors in the market.

Canada also plays a prominent role in the North America anesthesia breathing circuits sector on account of its publicly funded healthcare system. The steady rise in procedural volumes across the country also proves the presence of a sustainable demand in this sector. This can be evidenced by a report from the Canadian Institute for Health Information, published in October 2024. It revealed that the number of day surgeries alone surged by 10% between the timelines 2019-2020 and 2023-2024. Another NLM study calculated the count of new and death cases of cancer in Canada to surpass 247.1 thousand and 88.1 thousand, respectively, in 2024.

APAC Market Insights

Asia Pacific is poised to emerge as the fastest-growing region in the global anesthesia breathing circuits market during the assessed tenure. Rapid infrastructural development in healthcare, increasing surgical volumes, and rising intensive care awareness across developing countries, such as China, India, and Japan, are propellers of the region’s augmentation in this field. The growing middle-class population, expanding access to advanced medical services, and government investments in healthcare modernization are also accelerating the pace of growth in the region. Besides, the rising occurrence and mortality of chronic ailments and a growing elderly population are amplifying the interventional volumes, which ultimately contribute to the escalating position of the region in this sector.

China is establishing itself as the growth engine of the Asia Pacific anesthesia breathing circuits industry, which is fueled by its robustly expanding medical device industry and increasing demand for surgical procedures. The demographic expansion across the nation can further be exemplified by the count of preterm births in 2023 alone, accounting for 0.7 million, according to the NLM findings. China is also indicating its significance in this sector through its excellence in localized production of reliable and cost-effective ABC integrated systems.

India is witnessing rapid progress in the anesthesia breathing circuits market, backed by an increasing number of surgeries, a large patient population, and developing healthcare infrastructure. Government initiatives aimed at improving access to quality medical facilities, along with the rise of private hospitals and medical tourism, are fueling demand for effective and affordable anesthesia equipment. In this regard, an NLM report unveiled that an average of 2770 surgeries were being performed in India per 100 thousand people till 2023.

Countries with the Highest Preterm Birth Rates in APAC (2023)

|

Country |

Preterm Birth Rates (in %) |

|

India |

13.0 |

|

Pakistan |

14.4 |

|

Bangladesh |

16.2 |

Source: NLM

Europe Market Insights

Europe is expected to maintain a consistent growth in the anesthesia breathing circuits market over the timeline between 2026 and 2035. Such augmentation of the region in this sector is empowered by the strong presence of well-developed healthcare infrastructure and high patient safety standards. Currently, technologically developed countries, such as Germany, the UK, and France, are the leading contributors in this landscape with a high volume of surgical procedures and ongoing innovation in medical technologies. Furthermore, the enlarging geriatric population and increasing prevalence of chronic conditions also contribute to sustained demand for anesthesia services, and hence, Europe offers lucrative opportunities for both domestic and foreign pioneers.

The UK empowers the regional progress in the market with ongoing healthcare reinforcement initiatives. The regulations enacted by the National Health Service (NHS) play a critical role in ensuring widespread access to surgical care, contributing to consistent demand for anesthesia equipment. On the other hand, the rising surgical caseload, with over 0.1 million surgical operations performed across the UK between 2023 and 2024, creates a substantial surge. However, the shortfall of trained anaesthetists may impact the overall adoption rate in this sector.

Germany is one of the leading contributors to the Europe anesthesia breathing circuits market. The increase in MedTech innovation and procedural volume is magnifying the country’s significance in this sector. Besides, the growing focus on hospital hygiene and infection prevention also promotes advancements in breathing circuits. Additionally, rapid aging among citizens, where 18.6 million people in Germany were aged 65 and over, and 6.1 million of them were 80 years and older, is boosting demand in this category.

Country-wise Density of Anesthetists (2022)

|

Country |

Anesthetists per 100,000 People |

|

Germany |

37.4 |

|

Switzerland |

30.9 |

|

Russia |

27.1 |

Source: ROCA

Key Anesthesia Breathing Circuits Market Players:

- Medtronic plc (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Draegerwerk AG & Co. KGaA (Germany)

- Fisher & Paykel Healthcare (New Zealand)

- Vyaire Medical, Inc. (U.S.)

- Teleflex Incorporated (U.S.)

- ICU Medical, Inc. (U.S.)

- Ambu A/S (Denmark)

- Flexicare Medical Limited (UK)

- Smiths Medical (UK)

- Medline Industries, LP (U.S.)

- Armstrong Medical (U.S.)

- SunMed (U.S.)

- Intersurgical Ltd. (UK)

- Mercury Medical (U.S.)

- Asid Bonz GmbH (Germany)

- MEKICS Co., Ltd. (South Korea)

- Allied Medical Ltd. (UK)

- Becton, Dickinson and Company (U.S.)

- BioCote Ltd. (UK)

The market is highly competitive and dominated by a mix of established multinational medical-device corporations and emerging innovators. This cohort of leaders is consolidated by GE Healthcare, Drägerwerk AG & Co. KGaA, Teleflex Incorporated, Smiths Medical, Fisher & Paykel Healthcare, Ambu A/S, Medline Industries, Intersurgical Ltd., and Medtronic. These players solidify their industry presence with pipeline expansion, strategic partnerships, and regional operations. Currently, the global pioneers are highly focused on developing more advanced hygienic disposables to reinforce competitiveness and secure market relevance.

Such key players are:

Recent Developments

- In April 2025, Draegerwerk launched its Atlan A100 anesthesia workstation in India. Its heated breathing system includes and interacts with anesthesia breathing circuits to support both low and minimal flow applications, while minimizing anesthetic agent consumption and environmental impact.

- In April 2025, BioCote partnered with Eakin to produce an antimicrobial heated breathing circuit, AquaVENT. The partnership was based on the use of BioCote Antimicrobial Technology in breathing circuit tubing, which is built upon inorganic silver ion particles dispersed homogeneously throughout the tubing polymer.

- Report ID: 5127

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.