Amniocentesis Needle Market Outlook:

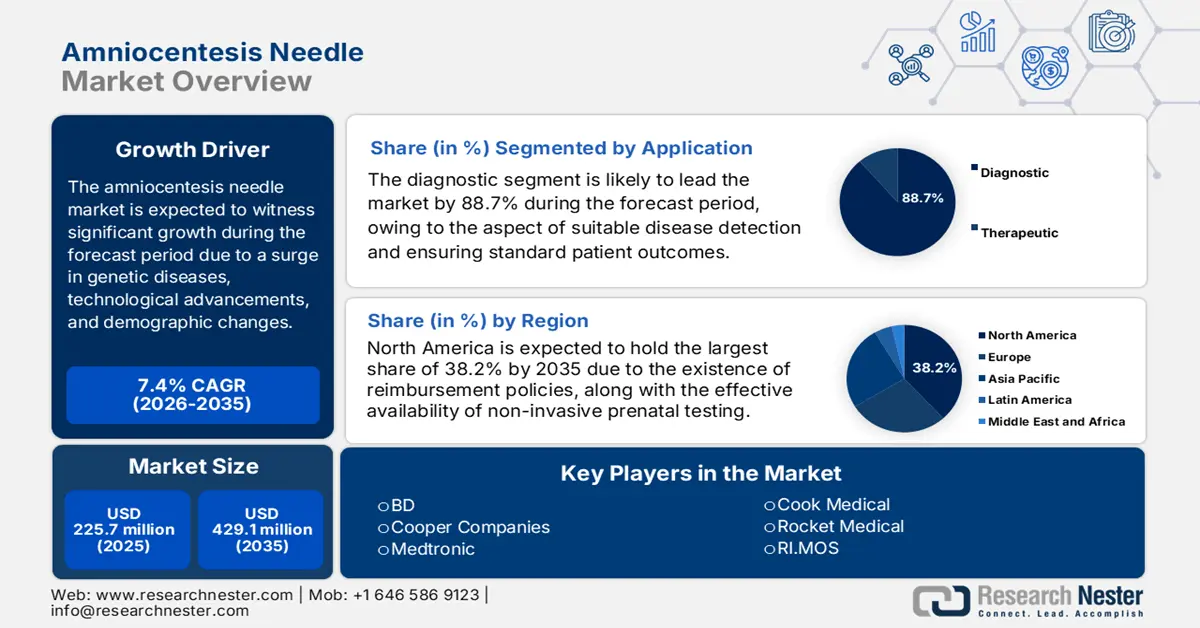

Amniocentesis Needle Market size was USD 225.7 million in 2025 and is anticipated to reach USD 429.1 million by the end of 2035, increasing at a CAGR of 7.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of amniocentesis needle is estimated at USD 242.4 million.

The market growth is highly driven by evolving clinical practices, technological progressions, and demographic shifts. An increase in maternal age, a surge in the genetic disorders prevalence, along with birth defects, technological progression in needle design, and clinical requirements. In the case of maternal age surge, a clinical study was conducted on 843 women over 35 years of age, which was published by the NLM in December 2022. In the study, patients were categorized into Group A, comprising 35 to 40 years, and Group B, comprising more than 40 years of age. Besides, 18.5% of participants readily underwent assisted reproductive techniques (ART) for conception in comparison to Group A, while neonatal results in terms of preterm birth at less than 35 weeks were observed in Group B, thereby enhancing maternal morbidity.

Patient Distribution Based on Comorbid Medical Conditions

|

Diseases |

Group A |

Group B |

|

Cardiac Disease |

13 (1.8%) |

14 (8.9%) |

|

Chronic Renal |

8 (1.2%) |

6 (3.8%) |

|

Diabetes |

17 (2.5%) |

34 (21.7%) |

|

Chronic Hypertension |

9 (1.3%) |

44 (28.2%) |

|

Thyroid |

46 (6.7%) |

45 (28.8%) |

|

Bronchial Asthma |

23 (3.3%) |

12 (7.7%) |

|

Chronic Liver |

12 (1.7%) |

5 (3.2%) |

|

Autoimmune |

34 (4.9%) |

23 (14.7%) |

Source: NLM, December 2022

Moreover, the market is also continuously developing, owing to suitable reimbursement policies, growth in healthcare infrastructure in emerging nations, and a rise in patient awareness and advocacy. According to an article published by Value in Health Regional Issues in May 2022, there has been an increase in consumer prices for inpatient services by 195%, along with 200% for outpatient healthcare services, as well as 100% for medical services. Besides, consumer prices for prescription medications have also readily doubled, while medical equipment expenses have enhanced by 50% over the past two years. Therefore, all these increased prices are effectively responsible for uplifting the overall market globally.

Key Amniocentesis Needle Market Insights Summary:

Regional Insights:

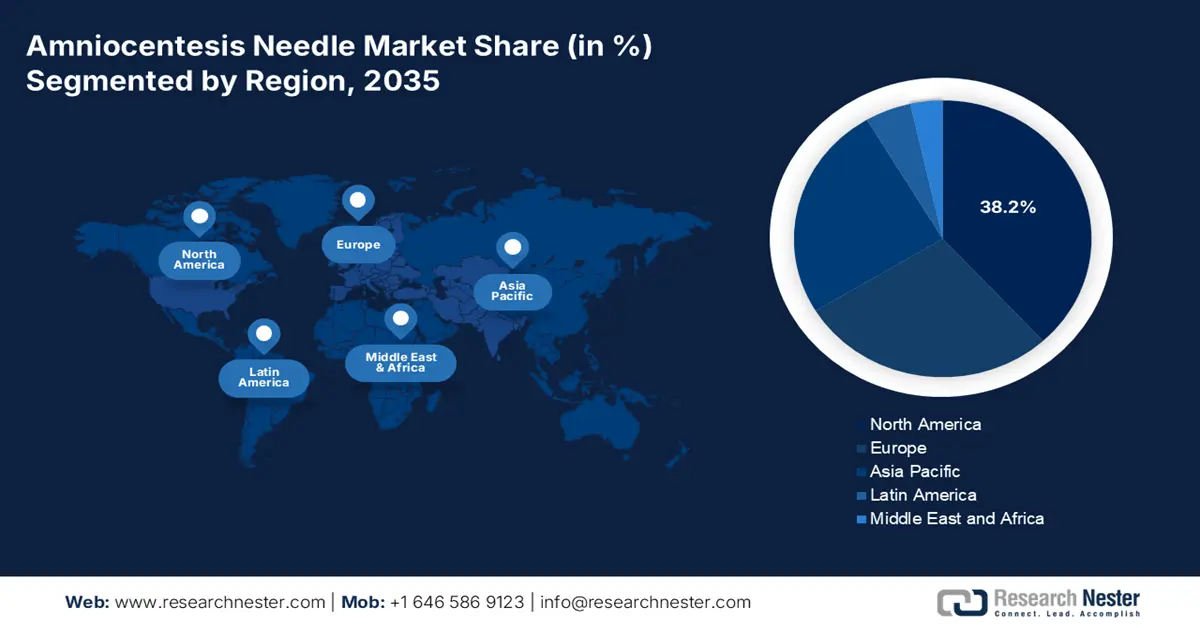

- North America in the amniocentesis needle market is projected to secure a 38.2% share by 2035, supported by expanding NIPT adoption and structured reimbursement frameworks owing to increasing congenital anomaly cases.

- Asia Pacific is anticipated to emerge as the fastest-growing region during 2026–2035, underpinned by harmonized regulatory policies and national volume-based buying strategies impelled by reduced medicine expenses through pooled procurement.

Segment Insights:

- The diagnostic segment in the amniocentesis needle market is set to command an 88.7% share by 2035, strengthened by its role in ensuring precise and timely disease detection culminating in minimized diagnostic errors.

- The amniocentesis segment is anticipated to attain the second-highest share during 2026–2035, reinforced by its relevance as a prenatal test that identifies fetal chromosomal abnormalities via fetal cell analysis.

Key Growth Trends:

- Expansion in therapeutic applications

- Strict administrative mandates for needle safety

Major Challenges:

- Prolonged and strict administrative pathways

- Government-based tendering processes and price controls

Key Players: CooperSurgical, Inc. (U.S.), Medtronic plc (Ireland), Cook Medical Inc. (U.S.), Rocket Medical plc (UK), RI.MOS. (Italy), Laboratoire CCD (France), TSK Laboratory (U.S.), GRI-Alleset (U.S.), Theragenics Corporation (U.S.), Argon Medical Devices, Inc. (U.S.), INTRAMEDIC (Germany), DTR Medical (UK), Sterylab (Italy), VOGT Medical (Germany).

Global Amniocentesis Needle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 225.7 million

- 2026 Market Size: USD 242.4 million

- Projected Market Size: USD 429.1 million by 2035

- Growth Forecasts: 7.4%

Key Regional Dynamics:

- Largest Region: North America (38.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 29 August, 2025

Amniocentesis Needle Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in therapeutic applications: This is one of the significant growth areas of the amniocentesis needle sector globally, with a focus on optimizing treatment results by ensuring efficient, data-powered, and personalized care. As per an article published by Drug Discovery Today in February 2025, through research and development (R&D), several pharmaceutical organizations transformed their business models and successfully achieved 65% of new drug clearances from the U.S. FDA. Besides, the success rate of clinical development ranges from 7% to 25%, with approximately 10% being the most common rate, thus suitable for the market’s growth.

- Strict administrative mandates for needle safety: The existence of stringent policies for ensuring needle safety is yet another driver for the amniocentesis needle market, due to implementing engineering controls, providing training for safety practices, and successfully establishing procedures to combat needlestick risks. As per an article published by NLM in January 2024, the yearly occurrence of needlestick and sharp injuries amounted to 385,000, particularly among hospital-based healthcare workers, owing to which standard policies are required to maintain safety and efficacy, which in turn, is uplifting the overall market across different infrastructures.

- Growth in medical tourism: The amniocentesis needle industry upliftment is highly driven by its capability to provide high-quality and cost-effective treatment, ensure accessibility to specialized procedures, diminish waiting duration for critical care, and offer the convenience of combined treatment. In this regard, the January 2022 Ministry of Tourism report noted that wellness travelers account for 89% of overall trips, along with 86% of the expenditure. In addition, domestic wellness travel caters to 82% of total trips, along with 65% of spending, therefore denoting a surge in the market’s exposure globally.

Rare Genetic Diseases (RGDs) 2023 Global Demographic Data

|

Race |

Non-RGD |

RGD |

Total |

|

White |

427,448 (68.7%) |

27,123 72.6%) |

454,571 (68.9%) |

|

Africa or Black America |

88,495 (14.2%) |

4,824 (12.9%) |

93,319 (14.1%) |

|

Asia |

16,894 (2.7%) |

948 (2.5%) |

17,842 (2.7%) |

|

Middle East |

1,808 (0.2%) |

255 (0.6%) |

2,063 (0.3%) |

|

Native Hawaii |

1,122 (0.1%) |

58 (0.1%) |

1,180 (0.1%) |

|

America Indian and Alaska |

847 (0.1%) |

57 (0.1%) |

904 (0.1%) |

|

Others |

20,049 (3.2%) |

948 (2.5%) |

17,842 (2.7%) |

Source: NLM, August 2024

Ultrasonic Medical Scanners 2023 Export and Import Data

|

Countries |

Export |

Import |

|

China |

USD 1.2 billion |

USD 522 million |

|

U.S. |

USD 976 million |

- |

|

South Korea |

USD 668 million |

- |

|

Netherlands |

- |

USD 399 million |

|

Germany |

- |

USD 377 million |

Source: OEC, August 2025

Challenges

- Prolonged and strict administrative pathways: The aspect of effectively navigating the international regulatory landscape is one of the primary barriers to gaining entry in the amniocentesis needle market. Agencies, such as Health Canada, the U.S.FDA, and Medical Device Regulation, require extended clinical proof, a rigid quality management system audit, and strong post-market surveillance plans. For instance, the shift to the Europe Union MDR has developed a few backlogs and enhanced the compliance expense, which has resulted in delayed product launches, thereby negatively impacting the overall market.

- Government-based tendering processes and price controls: The presence of national health systems denotes powerful monopsonistic purchasers that readily leverage their respective buying ability to significantly enforce drastic price controls. This model has effectively prioritized expenses above all, eventually compressing profit margins, wherein only large-scale manufacturers can effectively compete with the most efficient production. Besides, for payers and governments, this is a cost-containment approach, while it develops a race-to-the-bottom environment that has discouraged investment in advancement for product generations in the future.

Amniocentesis Needle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 225.7 million |

|

Forecast Year Market Size (2035) |

USD 421.9 million |

|

Regional Scope |

|

Amniocentesis Needle Segmentation:

Application Segment Analysis

Based on the application, the diagnostic segment in the amniocentesis needle market is anticipated to garner the highest share of 88.7% by the end of 2035. The segment’s upliftment is highly driven by its capacity to enable accurate and timely disease detection, resulting in optimized treatment strategies and suitable patient outcomes. In this regard, the 2025 OECD report indicated that the direct financial burden of overdiagnosis, underdiagnosis, and misdiagnosis is jointly estimated to account for 17.5% of the overall health expenditure. Therefore, the aspect of diminishing diagnostic error leads to potential cost savings through healthcare optimization, thus suitable for the segment’s growth.

Procedure Segment Analysis

Based on the procedure, the amniocentesis segment in the amniocentesis needle market is expected to account for the second-highest share during the forecast timeline. The segment’s growth is highly driven by its significance as a prenatal diagnostic test that ensures vital information regarding the health of a fetus by effectively analyzing fetal cells and detecting any chromosomal abnormalities. According to an article published by NLM in August 2023, this particular test can be conducted from 15 weeks of gestation till delivery, with a risk of loss catering to 0.1% in experienced hands. In addition, there lies the risk of amniotic fluid leakage, ranging between 1% to 2%, effectively corresponding to reduced activities and fetal demise.

End user Segment Analysis

Based on the end user, the hospitals segment in the amniocentesis needle market is predicted to capture the third-highest share by the end of the projected period. The segment’s upliftment is highly fueled by its comprehensive role as a center for providing high-risk prenatal care services. In addition, the demand for complicated procedures to be conducted in settings with advanced equipment and imaging technology, along with increased accessibility to multidisciplinary specialists and on-site cytogenetic laboratories, is also driving the segment. Besides, strict clinical guidelines are available to effectively manage potential complications, thus boosting the segment’s demand globally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Procedure |

|

|

End user |

|

|

Product |

|

|

Gauge Size |

|

|

Material Composition |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amniocentesis Needle Market - Regional Analysis

North America Market Insights

North America in the amniocentesis needle market is projected to be the dominant region by garnering a share of 38.2% by the end of 2035. The market’s growth in the region is propelled by an increase in the non-invasive prenatal testing (NIPT) adoption, which is followed by the presence of reimbursement and litigation environmental codes, provincial formularies, and centralized procurement. As stated in the December 2023 NIH report, 1 in every 33 infants in the U.S. is born with congenital anomalies every year, which is increasing the market’s demand in the region. Besides, the August 2023 NLM report indicated that 25% to 50% of pregnant women from the U.S. readily utilize NIPT, which positively impacts the market’s growth.

The amniocentesis needle sector in the U.S. is growing significantly, owing to the presence of a complicated regulatory-payer landscape, along with technological premiumization. In addition, the existence of a supportive reimbursement framework, guidelines from the American College of Obstetricians and Gynecologists (ACOG), a surge in maternity shift, gauze sourcing, and safety-engineered needles integration are also driving the market in the country. As per the May 2025 EPA report, the Local Governments Reimbursement (LGR) Program made a provision of USD 25,000 per incident to local governments as a fund for responsive actions, thus contributing to the market’s growth.

The amniocentesis needle market in Canada is also growing due to the existence of a province-based healthcare system, public fund provision, and priority for cost control, along with equitable accessibility. As per the December 2024 NLM article, Prison Needle Exchange Programs (PNEPs) were launched in Canada across 2 federal prisons, and during mid-June 2022, approximately 10% of people utilized PNEP for injecting drugs. Therefore, with the presence of government-approved and standard programs, the country readily enforces safety regulations for utilizing needles during any health evaluation.

Gauze 2023 Export and Import in North America

|

Countries |

Export |

Import |

|

U.S. |

USD 2.0 million |

USD 7.7 million |

|

Mexico |

USD 119,000 |

USD 1.0 million |

|

Canada |

USD 8,070 |

USD 1.2 million |

|

Guatemala |

USD 3,900 |

USD 348,000 |

|

Nicaragua |

USD 970 |

- |

|

Barbados |

USD 689 |

- |

|

Trinidad and Tobago |

USD 610 |

- |

|

Costa Rica |

- |

USD 115,000 |

|

Dominion Republic |

- |

USD 113,000 |

|

Panama |

- |

USD 28,800 |

Source: OEC, August 2025

APAC Market Insights

Asia Pacific in the amniocentesis needle market is expected to emerge as the fastest-growing region during the projected timeline. The market’s upliftment in the region is highly fueled by harmonization in regulatory policies, the presence of a national volume-based buying (VBB) strategy, centralized procurement, and critical market polarization, along with out-of-pocket spending. According to an article published by SSM - Health Systems in December 2025, there has been a 30% reduction in medicine expenses after pooled procurement was adopted, which denotes a huge growth opportunity in the market.

The amniocentesis needle industry in China is growing steadily, owing to the National Medical Products Administration (NMPA) enforcement, the presence of strict registration for overall medical devices, the Volume-Based Procurement (VBP) program, and the focus on optimizing prenatal screening rates. As per an article published by NLM in July 2023, the country has successfully integrated 7 rounds of national VBP and effectively diminished the price of almost 294 multiple drug formulations by 53%. Besides, the country has displayed that the pooling of purchasing power is a significant tool to gain bargaining benefits, thereby denoting a positive outlook for the overall market.

The amniocentesis needle market in India is also developing due to significant reliance and vast heterogeneity on out-of-pocket expenses. Additionally, the domestic government’s Ayushman Bharat Digital Mission (ABDM) implementation for developing a suitable health ecosystem and ensuring diagnostic procedure volume is also fueling the market’s exposure in the country. According to the June 2025 Frontiers Organization report, the out-of-pocket spending in the country accounts for 47.1% of the overall health expenditure, and this spending has doubled, resulting in USD 8.5 trillion, which is 9.8% of the international GDP, thereby suitable for the market’s development.

Europe Market Insights

Europe in the amniocentesis needle market is predicted to account for a considerable share by the end of the projected period. The market’s development in the region is highly propelled by the presence of the regional medical device regulation (MDR), administrative harmonization, the provision of an innovation fund, early benefit assessment, syringes sourcing, and the existence of the transparency committee and stringent CE processes. According to the October 2024 NLM article, the 1993 Council Directive 93/42/EEC on medical devices, the first 1990 Council Directive 90/385/EEC on active implantable medical device, and the 1998 Directive 98/79/EC of the Europe-based Parliament have been readily upgraded with the present current device‐related regulations to Regulation (EU) 2017/745, thus suitable for the market’s growth.

The market in Germany is steadily growing, owing to the presence of the federal structure, preference for high-quality and evidence-specific medical technology, the existence of the Institute for the Hospital Remuneration System (InEK), and the robust medical technology sector. As per the May 2025 Deutschland article, there have been the conduct of 524 industry-based clinical trials, based on which the country ranks in fourth position globally, as of 2022. Additionally, 30 drugs with the latest active ingredients were successfully placed in the market in 2023 that targeted infectious, immunological, and cancer diseases, while 400 biotechnological medications with 350 active ingredients received clearance in the country.

The amniocentesis needle industry in France is also developing due to its state-controlled and centralized healthcare system that has prioritized medical benefit and cost control. In addition, the Haute Autorité de Santé (HAS) and the national health insurance coverage are also driving the market’s demand in the country. Besides, the statutory health insurance (SHI) in the country comprises the general scheme, the self-employed scheme, and the agricultural scheme. According to the 2024 Euro Health Observatory article, more than 95% of the population has private health insurance, and nearly 20% benefit from state-funded health insurance, thereby contributing towards the market upliftment.

Syringes 2023 Export and Import in Europe

|

Countries |

Export |

Import |

|

France |

USD 857 million |

USD 770 million |

|

Switzerland |

USD 790 million |

- |

|

Germany |

USD 755 million |

USD 905 million |

|

Italy |

USD 421 million |

USD 371 million |

|

Netherlands |

USD 203 million |

USD 309 million |

|

Belgium |

USD 179 million |

USD 386 million |

|

Hungary |

USD 152 million |

USD 80.9 million |

|

UK |

USD 146 million |

USD 197 million |

|

Spain |

USD 117 million |

USD 252 million |

|

Denmark |

USD 104 million |

USD 109 million |

Source: OEC, July 2025

Key Amniocentesis Needle Market Players:

- BD (Becton, Dickinson and Company) (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CooperSurgical, Inc. (U.S.)

- Medtronic plc (Ireland)

- Cook Medical Inc. (U.S.)

- Rocket Medical plc (UK)

- RI.MOS. (Italy)

- Laboratoire CCD (France)

- TSK Laboratory (U.S.)

- GRI-Alleset (U.S.)

- Theragenics Corporation (U.S.)

- Argon Medical Devices, Inc. (U.S.)

- INTRAMEDIC (Germany)

- DTR Medical (UK)

- Sterylab (Italy)

- VOGT Medical (Germany)

The international market is severely consolidated and readily characterized by the dominance of suitable and multinational med-tech organizations and numerous key players. Notable companies, such as BD, Medtronic, and CooperSurgical, successfully leveraged their respective extended product portfolios, strong R&D capabilities, and robust worldwide distribution networks to effectively maintain suitable market shares. Their ultimate tactical strategies focus on technological advancement, leading to the creation of ultrasound-enhanced and safely engineered needles to categorize their products and validate premium pricing, thus suitable for the amniocentesis needle sector globally.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Apotex Inc. notified that Health Canada has successfully cleared Aflivu, which is a biosimilar to Eylea, deliberately indicated for aiding neovascular age-based macular degeneration.

- In January 2025, BD declared additional investments in its manufacturing network, which is located in the U.S., to provide the capacity for severe medical devices, such as needles, syringes, and IV catheters.

- Report ID: 8036

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amniocentesis Needle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.