Aluminum Composite Panels Market Outlook:

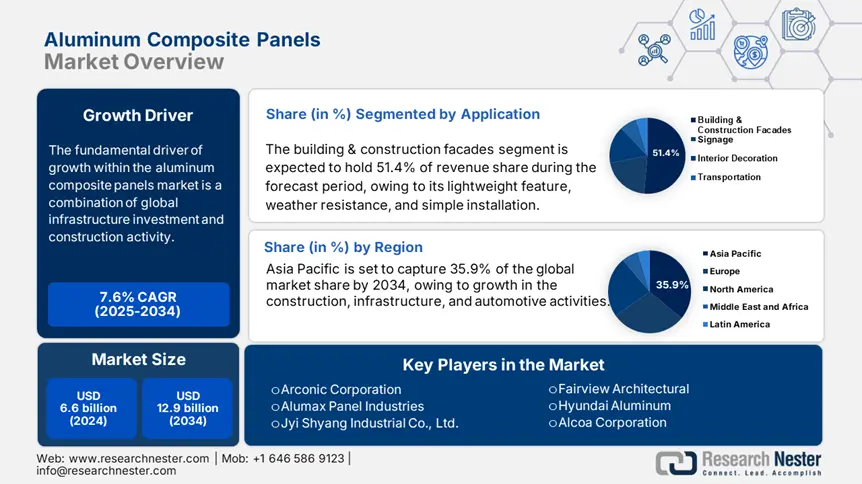

Aluminum Composite Panels Market size was estimated at USD 6.6 billion in 2024 and is expected to surpass USD 12.9 billion by the end of 2034, rising at a CAGR of 7.6% during the forecast period, i.e., 2025-2034. In 2025, the industry size of aluminum composite panels is assessed at USD 6.9 billion.

The fundamental driver of growth within the aluminum composite panels market is a combination of global infrastructure investment and construction activity, including in the U.S. From federal infrastructure spending in 2025 to a roughly 10 percent increase in domestic aluminum producer pricing, the strong demand in the aluminum market is reflected. Excluding China, primary aluminum production in the last 21 years, from 2000 to 2021, has more than doubled, from nearly 24.1 million tons to more than 69 million tons, which highlights the primary aluminum capacity expansion contributing to downstream demand for aluminum composite panels. Furthermore, U.S. primary production capacity reportedly hovered around 55 percent (~1.65 Mt) in 2021 (according to U.S. CRS), which suggests that there is upside potential for emerging demand for panels.

The raw materials supply chain for panels consists of alumina refining and primary smelting, which is controlled through Bayer process producers that provide the ingot to extrusion and ultimately the coating line. Nonetheless, there are manufacturing capacity developments, including smelter projects, targeting around 62 million tons of global primary production capacity by 2025, new extrusion and assembly investments, and capacity in the regions and countries. The Producer Price Index (PPI) for "other sheet metal electronic enclosures" reflects a jump in U.S. PPI from ~140 to ~141.3 between January and May 2025, while CPI for industrial metal products increased around 1.3%, which also reflects underlying increases in raw material prices. Historically, U.S. aluminum ingot imports from extrusion accounted for nearly 801 kt each year, which is offset by ~201 kt (for example) finished composite panel exports from the U.S. for 2023.

Aluminum Composite Panels Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand for lightweight and durable materials: Materials like aluminum composite panels (ACPs) have seen tremendous growth in demand as lightweight and durable products. It is also important to note that ACPs are much lighter compared to other materials, weighing 3.5-5.7 kg/m2, thus providing lesser structural loads. Moreover, ACPs have been shown to provide improved impact resistance, weather resistance, and thermal and sound insulation, compared to other traditional materials used for exterior cladding. This allows ACPs to be suitable alternatives to regular materials used for exterior cladding. Further, the global lightweight materials market is expected to have an 8.2% CAGR until 2030, thus providing the incentive for expanding ACP use in the construction, automotive, and signage sectors.

- Expansion in automotive applications: As ACP manufacturing continues to grow in the automotive space due to a combination of factors such as its lightweight nature, corrosion resistance, and aesthetic qualities, there is potential for expansion ahead. The global lightweight materials market is forecasted to reach USD 237 billion by 2030. Nowadays, ACPs are being used for external and internal components of electric vehicle (EV) battery enclosures, panels, and decorative trims, creating opportunities for efficiency and reducing weight, as part of a shift towards lightweight solutions with reduced fuel use/emissions.

1.Emerging Trade Dynamics

ACP Imports & Exports: 2019–2024 (USD Billion)

|

Year |

Top Exporters |

Top Export Destinations |

Total Export Value (USD Bn) |

Total Import Value (USD Bn) |

|

2019 |

China, Japan, Germany |

U.S., Canada, UAE |

$2.7 |

$2.6 |

|

2020 |

China, South Korea, EU |

U.S., ASEAN, Australia |

$2.2 |

$2.1 |

|

2021 |

Japan, China, Germany |

U.S., India, ASEAN |

$2.9 |

$2.8 |

|

2022 |

China, Japan, EU |

U.S., Canada, India |

$3.6 |

$3.4 |

|

2023 |

China, EU, Japan |

U.S., ASEAN, UAE |

$3.8 |

$3.6 |

|

2024 |

China, Japan, EU |

U.S., India, Canada |

$4.1 |

$3.9 |

Key Trade Routes

|

Route |

2019 Shipment (USD Bn) |

2022 Shipment (USD Bn) |

2024 Est. (USD Bn) |

|

Japan → Asia |

$0.46 |

$0.66 |

$0.73 |

|

Europe → North America |

$0.56 |

$0.76 |

$0.83 |

Major Trade Patterns

|

Sector |

Growth Indicator |

|

Building & Construction |

26% share of ACP demand (2022) |

|

Trade Policies |

8% tariff reduction under USMCA |

|

COVID-19 Impact |

-9% global trade dip in 2020 |

2.Aluminum Composite Panels (ACPs) – Market Overview

Price History & Unit Sales Volume:

|

Year |

Avg. Global ACP Price ($/m²) |

North America Unit Sales (million m²) |

Europe Unit Sales (million m²) |

Asia-Pacific Unit Sales (million m²) |

|

2019 |

$17.6 |

49 |

62 |

166 |

|

2020 |

$18.2 |

51 |

64 |

171 |

|

2021 |

$19.3 |

54 |

67 |

179 |

|

2022 |

$20.9 |

56 |

69 |

186 |

|

2023 |

$21.5 |

57 |

71 |

193 |

Regional Price Trends

|

Region |

Avg. Price 2019 ($/m²) |

Avg. Price 2023 ($/m²) |

CAGR % |

|

North America |

$18.3 |

$21.9 |

4.7% |

|

Europe |

$17.7 |

$21.8 |

5.7% |

|

Asia-Pacific |

$17.2 |

$20.6 |

4.7% |

Key Factors Influencing Prices

|

Factor |

Impact Evidence |

|

Raw Material Costs |

LME aluminum up 24% from 2019–2023 |

|

Geopolitical Events |

Russia-Ukraine conflict drove 31% EU energy price spike in 2022 |

|

Environmental Regulations |

EPA VOC limits added 6–9% to ACP adhesive |

Challenges

- Fluctuating aluminum prices: The aluminum composite panels market is naturally volatile since the global prices of aluminum are inconsistent. For example, the World Bank indicates that the price of aluminum increased from USD 1,750/ton in 2020 to over USD 2,701/ton in 2022 as a result of the energy crises and supply disruptions. Price fluctuations have implications on raw material pricing, which directly translates to increased manufacturing costs, impacting profit margins, delays to construction and infrastructure projects, especially in developing countries. Manufacturers deal with constant uncertainty in raw material procurement (to be able to produce AACPs), which limits their pricing strategies, and contracts in their markets require long-term arrangements.

- Fire safety concerns and regulatory bans: Risks for fires associated with ACPs that have polyethylene cores have caused strict bans in some regions. For example, the regulations that came into effect after the Grenfell (UK) disaster now prohibit the use of combustible cladding on high-rise buildings, which causes minimal demand for standard ACP products. The National Fire Protection Association (NFPA) states that the potential for loss of life during a façade fire is significantly higher for ACPs with lower fire-retardant ratings. This results in buyer preference for using more expensive fire-resistant ACP products and, conversely, inhibits the broader market from adopting standard ACP products.

Aluminum Composite Panels Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.6% |

|

Base Year Market Size (2024) |

USD 6.6 billion |

|

Forecast Year Market Size (2034) |

USD 12.9 billion |

|

Regional Scope |

|

Aluminum Composite Panels Market Segmentation:

Application Segment Analysis

The building & construction facades segment is predicted to gain the largest aluminum composite panels market share of 51.4% during the projected period by 2034, due to the rapid spread of ACP for facades has been advanced by a combination of factors, including its lightweight characteristics, weather resistance, simple installation, and aesthetic appeal, which are all necessary elements in the world of sustainable and modern construction. According to the U.S. Department of Energy, the growing retrofit of existing structures with insulated panels and the shift towards more energy-efficient building envelopes are the main causes of the rise in demand for PE Core ACP. The EU Green Deal and rehabilitation Wave Strategy also support façade rehabilitation incentives as 'drivers' for ACP expansion, according to the European Construction Sector Observatory.

Product Type Segment Analysis

The polyethylene (PE) core ACP segment is projected to have the most increase by 2034, accounting for 38.7% of the aluminum composite panels market, primarily because of its affordability in comparison to materials with comparable qualities, its adaptability in terms of design, and its widespread application in low- to mid-rise buildings. The National Institute of Standards and Technology documented PE-based composite materials as being prevalent in construction due to performance-to-price advantages; nevertheless, increased fire rules have prompted debate of adopting FR core choices in specific applications.

Our in-depth analysis of the global aluminum composite panels market includes the following segments:

| Segment | Subsegments |

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminum Composite Panels Market - Regional Analysis

Asia Pacific Market Insights

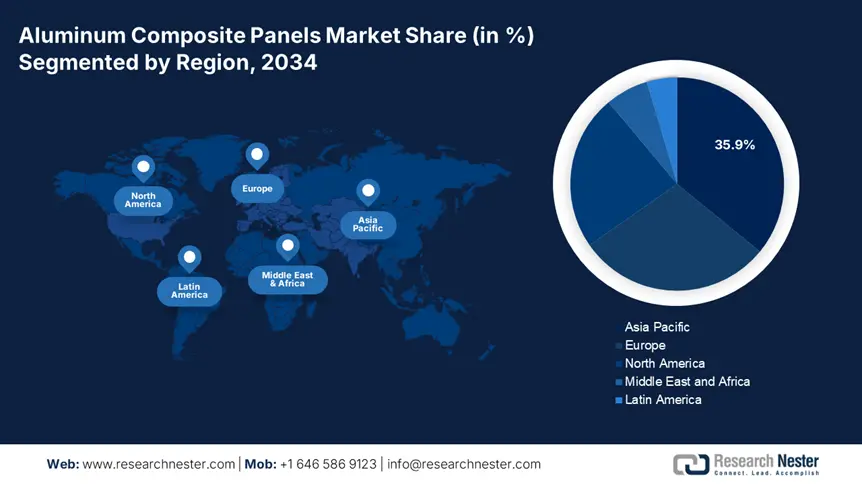

By 2034, the Asia Pacific aluminum composite panels market is expected to hold 35.9% of the market share due to growth in construction, infrastructure, and automotive activities. Growth in the region was led by rapid urbanization, expanded smart city initiatives, and further industrialization. The Asia Pacific ACP market size exceeded USD 3.6 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025-2034 due to increased commercial and residential renovation projects.

China is the largest market for aluminum composite panels, accounting for more than 31% of the global market share in 2024. The ACP market grew to about USD 2.4 billion in 2024, largely due to ongoing large-scale infrastructure development projects in accordance with the 14th Five-Year Plan. Revelation of the capacity of strong domestic manufacturing, along with the demand for replacement of aging building facades, and increasing export-oriented capabilities, aids in the growth of the market. CAGR is projected to be 6.2% from 2025 to 2034. Government procurement initiatives aimed at green buildings and compliance with standards to make building materials would be a further solidification of growth prospects.

Aluminum Composite Panels Market in APAC – Country-wise Insights

|

Country |

Booming Construction Sector |

Urbanization Trends |

Government Initiatives Promoting ACP Demand |

|

China |

- Largest construction market globally ($3.8T output in 2023). |

- 64% urbanization rate (2023), adding 15M urban dwellers yearly. |

- "Sponge City" projects (water-resistant ACP demand). |

|

India |

- $1.4T infrastructure pipeline (2023–2030). |

- 35% urban population, growing at 2.4% annually. |

- PMAY (affordable housing, 20M units by 2030). |

|

Japan |

- Post-2020 Olympics infrastructure push. |

- 92% urbanized; focus on compact cities. |

- "Zero Energy Building" standards (ACP with insulation). |

|

Vietnam |

- 8% annual construction growth (2020–2025).<br.- High-rise demand in Hanoi/Ho Chi Minh City. |

- 40% urbanized, fastest in SE Asia (3.4% growth). |

- New urban area projects (e.g., Thu Thiem Eco-Smart City) - FDI-driven industrial parks. |

|

Indonesia |

- $450B infrastructure plan (2024–2045) - New capital city (Nusantara) construction. |

- 57% urban population (Java dominance). |

- Public-private partnerships (PPPs) for highways/airports - Fire-safe ACP regulations post-2019 reforms. |

|

Philippines |

- "Build Better More" program ($155B projects). |

- 47% urbanized; Mega Manila expansion. |

- Green Building Act (ACP for thermal efficiency) - Resilient housing in typhoon-prone areas. |

|

South Korea |

- High-tech construction (modular buildings). - Eco-friendly retrofits in Seoul. |

- 81% urbanized; smart city pilots (e.g., Busan). |

- "Carbon Neutrality 2050" (low-emission ACP). - Han River redevelopment projects. |

|

Australia |

- $112B infrastructure pipeline (2024–2030). - Commercial high-rises (Sydney, Melbourne). |

- 86% urbanized; suburban densification. |

- Bushfire-resistant ACP standards (2023 update). - Sustainable Schools Initiative. |

Europe Market Insights

The European market is expected to hold 29.4% of the market share due to demand coming from the construction, automotive, and advertising industries. In 2024, the ACP market in Europe is worth approximately USD 1.8 billion and is projected to grow to USD 2.6 billion by 2034 at a CAGR of 4.5%. The increase in renovation projects, the adoption of green building standards, and fire-retardant ACP grades supported the growth of the ACP market. In order to align themselves with the EU sustainability goals, leading players have expanded their product portfolio with PVDF-coated and recyclable aluminum composite panels.

Germany has an important share of approximately 21.6% revenue share in the European market in 2024, worth USD 366 million is expected to grow to USD 531 million by 2034 at a CAGR of 4.1 %. The areas still seeing demand are architectural cladding, energy-efficient façade systems, and automotive applications. To ensure fire safety by EN 13501-1, Germany has strict regulations concerning ACP panels. German manufacturers invest heavily in R&D into alternative core materials and fluoropolymer coating technology, sometimes achieving one of the highest standards.

Country-Wise Insight for the Aluminum Composite Panels (ACP) Market in Europe

|

Country |

Construction Activity Trends |

Energy-Efficient Building Focus |

Key ACP Applications |

|

Germany |

€1.2 trillion construction output (2023), 2M homes/year renovation |

KfW Efficiency House standards, 40% energy reduction targets |

Façade cladding, solar panel integration, and interior partitions |

|

France |

€150B Grand Paris Express project, 500k new homes planned by 2030 |

RE2020 mandates positive energy buildings |

Metro station cladding, commercial signage, and modular buildings |

|

UK |

£650B National Infrastructure Pipeline, 300k homes/year target |

Future Homes Standard 2025 (zero-carbon ready) |

High-rise cladding, retail signage, transportation hubs |

|

Italy |

€200B post-COVID recovery plan, Milan urban regeneration projects |

Superbonus 110% for energy retrofits |

Historic building renovations, interior design elements |

|

Spain |

€70B EU-funded urban renewal program, 200k new homes/year |

Código Técnico energy efficiency standards |

Coastal building cladding, advertising boards |

|

Netherlands |

€30B Rotterdam urban expansion, floating buildings development |

Energy Neutral Building 2050 target |

Water-resistant applications, circular economy projects |

|

Poland |

€100B infrastructure plan, Warsaw skyscraper boom |

Thermal modernization subsidies program |

Shopping center façades, corporate branding |

|

Sweden |

€20B green construction projects, Stockholm Wood City |

Nordic Swan Eco-label requirements |

Sustainable cladding, acoustic panels |

|

Switzerland |

CHF 50B infrastructure projects, tunnel and station upgrades |

Minergie-P eco-standard compliance |

Precision architectural elements, transportation signage |

North America Market Insights

The North American market is expected to hold 23.6% of the market share due to rising sustainable construction techniques as well as retrofitting existing buildings. Currently, the North American market in 2024 is estimated to be around USD 1.3 billion. The U.S. state represents nearly 76% of the total demand. The unique growth in North America has been introduced by new energy efficiency standards and specific fire safety standards for commercial buildings. Moving into the future, it's expected that the North American ACP market will grow over the next 9 years at a CAGR of 6.3% from 2025 to 2034, further diversifying into architectural cladding and signage opportunities.

The U.S. aluminum composite panels market in 2024 was valued at roughly USD 901 million, and the rate of growth is driven by demand for aluminum composite panels in commercial building facades and retail branding applications. It is anticipated that the US market share will maintain its dominant market position in North America and maintain a CAGR of 6.5% over the period 2025-2034. Growth drivers include further expansion in LEED-certified green building initiatives, retrofitting old buildings, and expansion in both retail and transportation sectors, while also increasing imports from Asia to fulfill design and durability standards in the North American market.

Key Aluminum Composite Panels Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global aluminum composite panels market is fiercely competitive and characterized by the world’s leading panel producers increasing production capacities, diversifying their product and service portfolios, and forming strategic alliances to fortify bargaining power. For example, manufacturers such as Arconic and 3A Composites are focused on creating ACP solutions that are both fire and environmentally resistant to meet stringent building-related regulations. Indian manufacturers with regional customs, such as Alstrong and Eurobond, are looking to expand regionally. Manufacturers in Malaysia and South Korea are looking towards Southeast Asia through collaborative efforts on architectural projects. Overall, the level of rivalry is very pronounced, with little firm differentiation, forcing panel producing manufacturers to increase their focus on R&D spending, brand-building activities, and penetration pricing to maintain market shares and profitability.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Approx. Market Share (%) |

|

Arconic Corporation |

USA |

8-10% |

|

3A Composites (Schweiter Technologies) |

Switzerland |

8-9% |

|

Alcoa Corporation |

USA |

7-8% |

|

Alubond U.S.A (Mulk Holdings) |

UAE |

7-8% |

|

Alstrong Enterprises India Pvt Ltd |

India |

6-7% |

|

Eurobond (Euro Panel Products Pvt. Ltd.) |

India |

xx% |

|

Alumax Panel Industries |

Malaysia |

xx% |

|

Jyi Shyang Industrial Co., Ltd. |

Taiwan |

xx% |

|

VIVA Composite Panels Pvt. Ltd. |

India |

xx% |

|

Alucoil (Grupo Alibérico) |

Spain |

xx% |

|

Fairview Architectural |

Australia |

xx% |

|

Hyundai Aluminum |

South Korea |

xx% |

|

Yaret Industrial Group |

China |

xx% |

|

Alucobond USA (subsidiary of 3A Composites) |

USA |

xx% |

|

Laminators Incorporated |

USA |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In February 2024, Arconic introduced its Reynobond FR MAX aluminum composite panels, which are intended to surpass the new EU fire safety regulations. This line incorporates advanced halogen-free flame-retardant core chemistry, which qualifies for EN 13501-1 A2-s1, d0. Arconic’s European ACP revenue grew 18% YoY in Q1 2024 due to early adoption in Germany and France.

- In April 2024, 3A Composites introduced ALUCOBOND ecoPlus, an aluminum composite panel line produced with a post-consumer recycled aluminum ratio of 61% and a bio-based polymer core. This launch seeks LEED v4.1 and BREEAM Excellent marked green building certifications. In the first quarter, the ecoPlus series gained a 13% share of the EU green building market. This demonstrates significant demand for low-carbon construction materials.

- Report ID: 2592

- Published Date: Jul 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Composite Panels Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert