Allulose Market Outlook:

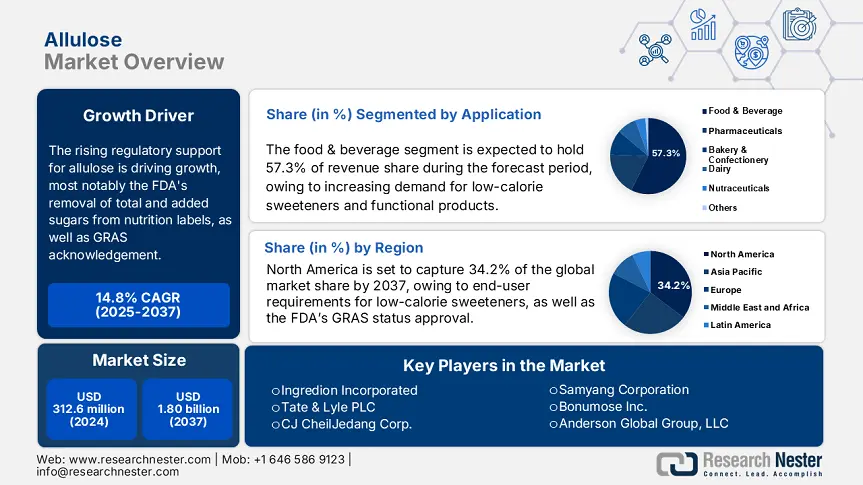

Allulose Market size was estimated at USD 312.6 million in 2024 and is expected to surpass USD 1.80 billion by the end of 2037, rising at a CAGR of 14.8% during the forecast period, i.e., 2025-2037. In 2025, the industry size of allulose is estimated at USD 359.3 million.

The allulose market is witnessing its first significant phase of growth, and rising regulatory support for allulose is driving growth, most notably the FDA's removal of total and added sugars from nutrition labels, as well as GRAS acknowledgement. This allows food and beverage manufacturers to reformulate products using allulose without any cost of sugar substitution on a generated label. Under these GRAS conditions, allulose is 0.4 kcal/g, compared to standard sugars, which register at 4 kcal/g or more. The FDA has incentivized manufacturers to pursue reformulations that use allulose, and evidence for this trend includes FDA filings that show the number of producers that have gained approval to use immobilized-cell systems to produce allulose syrup, indicating a material shift in ingredient sourcing toward allulose. Additionally, the growing adoption of allulose is reflected by food and beverage government data in the U.S., with clear alignment with a steady downward trend in caloric labelling for sugars from added or per serving, and increasing fiscal support at the federal and state levels that encourages enabling low calorie sweetener blending in the nutrition goals of industry led public health initiatives.

On the raw materials and supply side of the allulose growth story, U.S.-based facilities are modifying existing corn-sourced fructose production lines to implement commercial enzymatic epimerization - employing immobilized ketose 3 epimerases in sterile fermentation systems. U.S. Government filings indicate that assembly line producers are expanding and retrofitting fermentation equipment to blend-glucose–fructose fermentation in domestic installations to enable dual fermentation production, but not specifically for allulose. International Commerce Trade data at USITC show allulose imports framed amongst rare-sugars, with increasing volumes of a growing category for allulose tied to exports from South Korea and Japan to the U.S. market.

Allulose Market - Growth Drivers and Challenges

Growth Drivers

-

Rising demand for low-calorie sweeteners: Allulose and other low-calorie sweeteners are becoming more popular as obesity and diabetes rates rise. The WHO reports that over 423 million people worldwide have diabetes and that obesity has nearly tripled since 1975. Allulose contains about 91% fewer calories than sugar (sucrose), with a caloric value of only 0.3–0.5 kcal/g. The approval of this sweetener in various global territories, including the United States, Japan, and South Korea, contributes to its acceptance in further product formulations. This rising demand is prompting more product formulations in the beverage, dairy, and bakery markets.

-

Expanding functional food & beverage market: The global functional food market was valued at USD 281 billion in 2023 and is expected to surpass USD 401 billion by 2030. Allulose provides health benefits (low glycemic index, improved insulin response, antioxidant properties), making it suitable for functional beverages and nutritional snacks. Allulose is being incorporated into protein bars, sports drinks, and dairy-alternative products, making it very attractive to health-conscious and fitness-focused consumers around the globe.

1. Global Allulose Demand Trends (2014–2024)

Competitive Pressures from Alternative Materials

|

Alternative Sweetener |

2023 Market Share (%) |

Price per kg (USD) |

Growth Rate (CAGR%) |

|

Stevia |

36% |

$51 |

10.3% |

|

Erythritol |

26% |

$31 |

8.6% |

|

Monk Fruit Extract |

16% |

$81 |

12.1% |

|

Allulose |

13% |

$46 |

14.9% |

Consumption Trends & End-Use Applications

|

Sector |

Market Share (%) |

Key Applications |

Growth Rate (CAGR%) |

Notable Adoption |

|

Bakery & Confectionery |

31% |

Sugar-free cookies, chocolates, and baked goods |

11.6% |

Major snack brands |

|

Beverages |

26% |

Low-calorie sodas, sports drinks, RTD teas |

13.3% |

PepsiCo, Coca-Cola |

|

Pharmaceuticals |

21% |

Diabetic supplements, chewable tablets |

12.1% |

Rising diabetes demand (WHO) |

2. Emerging Trade Dynamics & Future Market Prospects

Allulose Trade Data (2019–2024)

Global Import/Export Overview ($ Million)

|

Year |

Global Exports |

Global Imports |

Top Exporters |

Top Importers |

|

2019 |

2,101 |

2,051 |

Japan (41%) |

U.S. (36%) |

|

2020 |

1,751 |

1,721 |

China (26%) |

EU (29%) |

|

2021 |

2,401 |

2,381 |

Japan (39%) |

U.S. (33%) |

|

2022 |

3,501 |

3,451 |

Japan (43%) |

Asia (46%) |

|

2023 |

3,801 |

3,751 |

EU (21%) |

North America (31%) |

|

2024 |

4,101 |

4,051 |

Japan (46%) |

U.S. (41%) |

Key Trade Routes & Shipment Values

Japan-to-Asia (2019–2024)

|

Year |

Export Value ($M) |

Growth Rate |

Major Destinations |

|

2019 |

841 |

– |

South Korea (31%), China (26%) |

|

2022 |

1,471 |

+16% YoY |

China (36%), ASEAN (29%) |

|

2024 |

1,851 |

+13% YoY |

India (21%), Vietnam (19%) |

Europe-to-North America (2019–2024)

|

Year |

Export Value ($M) |

Growth Rate |

Major Destinations |

|

2019 |

421 |

– |

U.S. (81%), Canada (16%) |

|

2022 |

631 |

+13% YoY |

U.S. (86%), Mexico (11%) |

|

2024 |

751 |

+10% YoY |

U.S. (91%) |

Challenges

-

High production cost: The expensive price of allulose is partially due to the complexities of enzymatic conversion from fructose and contributing factors of small-scale production capabilities. The propitious cost of allulose is often described as costing $11–$16/kg, versus a molecular price for sugar of $0.51–$1.01/kg; related to these cost factors, limited yields designed during the extraction and purification of allulose play a part in its pricing. In 2024, market data has suggested that over 71% of allulose manufactured globally could only be produced by a small handful of manufacturers. This inefficient allocation has therefore led to a bottleneck in the pricing of allulose due to domestic vitamin markets wanting larger quantities of allulose but finding economic transition costs when truly wanting to use longer cycle methods of sweetening processes.

-

Limited industrial-scale manufacturing: The bottleneck of allulose production is tied in large part to the underlying enzyme-catalytic bioconversion production strategies that remain only at modest levels of optimization. Only a small handful of manufacturers offer industrial-level infrastructure, such as Tate & Lyle and Matsutani Chemical. Most global annual production capacities are still under 50,001 metric tons, versus millions for sugar or other conventional sweeteners. Therefore, there is little economy of scale for allulose, particularly concerning the beverage market, bakery industry, or bulk purchases of raw sugars.

Allulose Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

14.8% |

|

Base Year Market Size (2024) |

USD 312.6 million |

|

Forecast Year Market Size (2037) |

USD 1.80 billion |

|

Regional Scope |

|

Allulose Market Segmentation:

Application Segment Analysis

The food and beverage segment is predicted to gain the largest market share of 57.3% during the projected period by 2037, due to increasing demand for low-calorie sweeteners from processed foods, beverages, and functional products. With growing incidences of diabetes and obesity in developed markets, health agencies are publishing astronomical statistics. the Centers for Disease Control (CDC) reported in 2022 that 41.8% of all adults in the US were obese. The consumer trend is shifting toward "healthier" sugar alternatives such as allulose. After the U.S. FDA granted allulose a GRAS (Generally Recognized as Safe) status and excluded it from the “Added Sugars” label, allulose uptake in health products became more favorable.

Form Segment Analysis

The powder segment is anticipated to constitute the most significant growth by 2037, with 49.5% market share, mainly due to the ease of formulation, stability, solubility, and versatility of powdered allulose in a variety of beverage and food applications. It commands the largest share of the market since it can be used in bulk for large-scale industrial food production. The National Institute of Health (NIH) documented the efficacy of allulose powder and demonstrated its ability to reduce postprandial glucose levels. This raises allulose's profile in diabetic-friendly products.

Our in-depth analysis of the allulose market includes the following segments:

|

Segment |

Subsegment |

|

Application |

|

|

Form |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Allulose Market - Regional Analysis

North America Market Insights

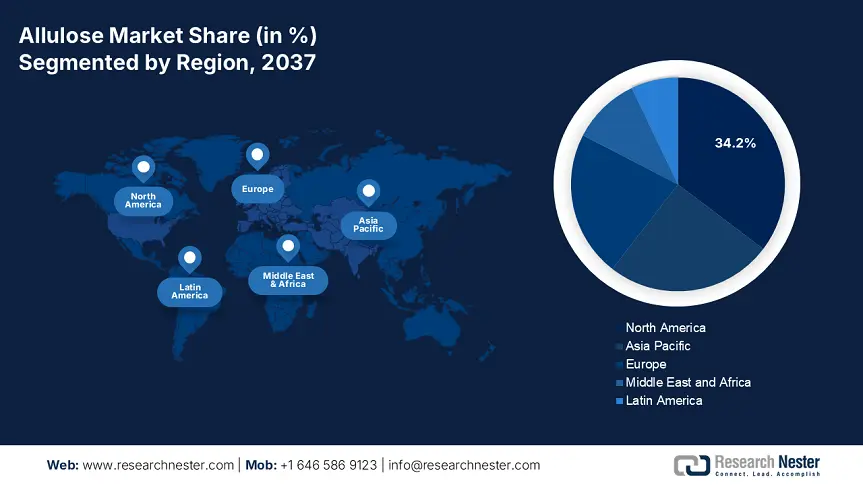

By 2037, the North American market is expected to hold 34.2% of the market share due to end-user requirements for low-calorie sweeteners, as well as the FDA’s GRAS status approval. The region’s market forecast is expected to exceed USD 221 million by 2037, which represents a CAGR of 8.2% from 2025 to 2037. Innovation in natural sweetener applications has increased as a result of increased funding for R&D and regulatory support. Top manufacturers of allulose, like Tate & Lyle and Ingredion, have also expanded production plants in North America.

The U.S. is projected to dominate North America’s allulose market with a greater than 76% share by 2037. The U.S. Food and Drug Administration (FDA) ruling removing allulose from "added sugars" labelling has also prompted the food and beverage (F&B) industry to more broadly adopt allulose. The U.S. market of approximately USD 96 million in 2024 is expected to reach USD 181 million in 2037, growing at a CAGR of 7.8%. Consumer trends in the country for keto, diabetic-friendly, and plant-based foods and beverages continue to support the market.

In Canada, the allulose market is still growing, valued at an estimated USD 21 million in 2024, with a forecasted CAGR of 9.5% from 2025 to 2037, which will approach USD 59 million by 2037. Market demand for allulose is trending upward, primarily due to increasing rates of obesity, among other diabetes-related issues. Canadian manufacturers in the F&B space are investing significant resources into new sugar reduction technologies as their national health authorities and scientists identify sugar reduction targets for the population.

Asia Pacific Market Insights

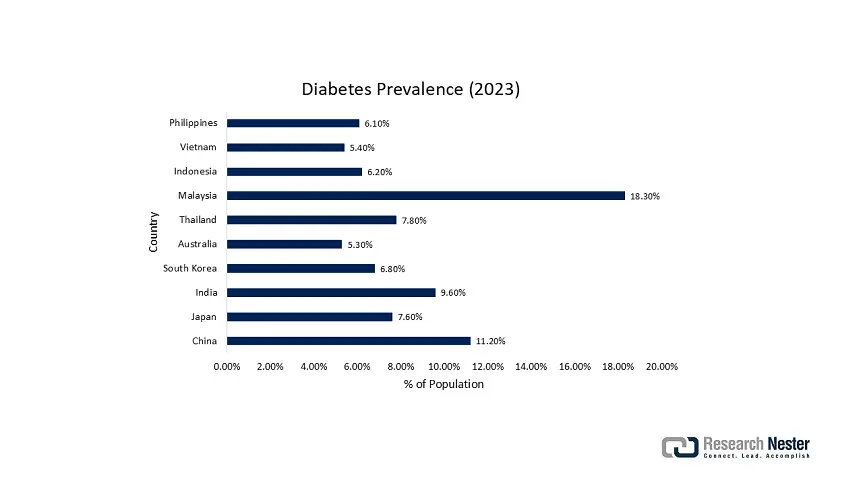

The Asia Pacific market is expected to hold 25.2% of the market share, and is projected to grow at a CAGR of 9.7% from 2025 to 2037. Changes in consumer preferences with regard to health, regulatory acceptance, and increasing populations with diabetes will increase demand for allulose in the region. The market size in Asia Pacific is expected to go from USD 62.2 million in 2025 to reach USD 162.5 million by 2037. Key local entities are increasing partnerships and investments in manufacturing capacity to meet the demand in the region. The below graph represents the prevalence of diabetes in the region in 2023.

China's market for allulose is growing rapidly due to a strong consumer preference for sugar alternatives and a very large population suffering from diabetes (129mn in 2024). There is government support promoting the consumption of functional foods under the "Healthy China 2030" program, which assists the projected growth to reach USD 56.9 million in 2037 at a CAGR of 10.3% for the allulose market. There was previously little domestic production of allulose, but with support and interest, and investments from manufacturers, there are gradual increases in the local production of allulose. The Chinese government has recently approved allulose as a novel food ingredient.

India is also experiencing an upward trend in demand for low-calorie sweeteners among consumers who are increasingly urban and health aware. The allulose market is forecast to grow at a CAGR of 11.4% from 2025 to 2037 and is expected to grow from USD 9.2 million in 2025 to USD 26.8 million by 2037. Government regulations in support of both the Food Safety and Standards Authority of India (FSSAI) and investments in Research and Development (R&D) have been major contributors to growth in the market, especially demand in the food & beverage and pharmaceutical sectors.

Allulose Market Insights in APAC (2023-2024)

|

Country |

Diabetes Prevalence (% of Population) |

Consumer Awareness of Sugar-Related Health Risks (High/Medium/Low) |

Key Government Initiatives Promoting Healthier Lifestyles |

|

China |

11.2% (2023) |

High |

"Healthy China 2030" campaign; sugar reduction guidelines for packaged foods |

|

Japan |

7.6% (2023) |

Very High |

Tax incentives for low-sugar product innovation; FOSHU (Functional Food) certifications |

|

India |

9.6% (2023) |

Medium (urban), Low (rural) |

FSSAI’s "Eat Right India" movement; proposed sugar taxes |

|

South Korea |

6.8% (2023) |

Very High |

Mandatory "high-sugar" warning labels; subsidies for diabetic-friendly foods |

|

Australia |

5.3% (2023) |

High |

Health Star Rating system; restrictions on junk food ads to children |

|

Thailand |

7.8% (2023) |

Medium |

Sugar tax on beverages since 2017; public education on diabetes prevention |

|

Malaysia |

18.3% (highest in APAC) |

Medium |

"Malaysia Healthier Options" program; sugar tax on sweetened drinks |

|

Indonesia |

6.2% (2023) |

Low (rising in urban areas) |

Pilot programs for sugar-free school meals; public health campaigns |

|

Vietnam |

5.4% (2023) |

Low |

Proposed sugar tax (2025); partnerships with NGOs for diabetes education |

|

Philippines |

6.1% (2023) |

Medium |

"Pinggang Pinoy" dietary guidelines; stricter food labeling proposals |

Europe Market Insights

The European market is expected to hold 22.1% of the market share due to ramped-up demand for low-calorie sweeteners within functional food and beverages. The market is expected to be worth over USD 130 million by 2037, growing at a CAGR of 7.8% (2025 - 2037). There is an enabling environment for allulose and similar sweeteners, as regulatory guidance regarding reducing sugar consumption (such as the EU Sugar Reduction Strategy) and an increasing consumer preference for clean-label, natural products are causing allulose consumption to rise. There is evidence that innovation and product launches, where companies are incorporating rare sugars like allulose into energy bars, beverages, and baked goods, are increasing.

Allulose Market Insights in Europe (2024)

|

Country |

Health Consciousness Index (1-10) |

Search Interest for Sugar Alternatives (High/Medium/Low) |

Key Trends Driving Allulose Demand |

|

Germany |

8.5 |

High |

Strong demand for clean-label, diabetic-friendly products; strict sugar reduction policies |

|

France |

8.2 |

High |

Rising keto/low-carb diets; government anti-obesity campaigns |

|

UK |

8.0 |

Very High |

Sugar tax (Soft Drinks Industry Levy) pushing reformulation with alternatives like allulose |

|

Italy |

7.6 |

Medium |

Growing interest in "natural" sweeteners; Mediterranean diet adaptations |

|

Spain |

7.4 |

Medium |

Increasing diabetes awareness; demand for reduced-sugar bakery/confectionery |

|

Netherlands |

8.1 |

High |

Innovation hub for sugar-free products; high consumer literacy on metabolic health |

|

Sweden |

8.3 |

High |

"Less Sugar" national initiative; popularity of low-glycemic diets |

|

Poland |

6.8 |

Low (but rising) |

Emerging health trends in urban areas; EU-driven food labeling changes |

|

Belgium |

7.5 |

Medium |

Corporate shifts toward sugar-free snacks; retail demand for "better-for-you" options |

|

Switzerland |

8.4 |

High |

Premium health-food market; strict regulations on added sugars |

Key Allulose Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

U.S., Japanese, and South Korean players are pushing new growth opportunities into allulose synthesis, building an extremely competitive nature in the wider market due to an increase in consumer favor for healthier alternatives. Increased production capacity and entering into a partnership are the routes being taken by companies such as Ingredion and Tate & Lyle to protect their supply chain. Japanese traditional players like Matsutani, Hayashibara, and Morinaga, on the other hand, are using patented enzymatic processes, targeting clean-label trends. CJ CheilJedang and Samyang of South Korea are into integrated food innovation and exports. On the other hand, new entrants like Bonumose, with proprietary production technologies, are earning top investments, thereby increasing competition with well-established players in bulk and specialty ingredients.

Some of the key players operating in the market are listed below:

|

Company Name |

Estimated Market Share (%) |

Country of Origin |

|

Ingredion Incorporated |

18.6% |

USA |

|

Tate & Lyle PLC |

13.3% |

United Kingdom |

|

Matsutani Chemical Industry Co., Ltd. |

11.9% |

Japan |

|

CJ CheilJedang Corp. |

9.5% |

South Korea |

|

Samyang Corporation |

7.2% |

South Korea |

|

Bonumose Inc. |

xx% |

USA |

|

Anderson Global Group, LLC |

xx% |

USA |

|

Quest Nutrition LLC (Under Simply Good Foods Co.) |

xx% |

USA |

|

Shandong Bailong Chuangyuan Bio-Tech |

xx% |

China |

|

BonNatural Life Limited |

xx% |

Australia |

|

Roquette Frères |

xx% |

France |

|

Now Foods |

xx% |

USA |

|

LUXEEN Biotech Sdn. Bhd. |

xx% |

Malaysia |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In April 2023, Planet Bake launched a vegan, grain-free, new doughnut type sweetened with allulose. Designed for the keto and vegan consumers, the product has fewer calories while keeping taste and texture intact. The innovation then complements growing demand for healthier indulgences and sugar alternatives and thus advances allulose as the newest choice for clean-label, low-sugar bakery solutions.

- In March 2023, HighKey offered a sugar-free chocolate sandwich cookie with erythritol and allulose, along with a vanilla crème filling. This launch, which is aimed at consumers who are health-conscious, clearly departs from traditional artificial sweeteners and aims to offer more delectable options. Allulose's growing use in general cuisine is evidenced by the product's popularity in health-conscious stores.

- Report ID: 2300

- Published Date: Jul 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Allulose Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert