Aerographite Market Outlook:

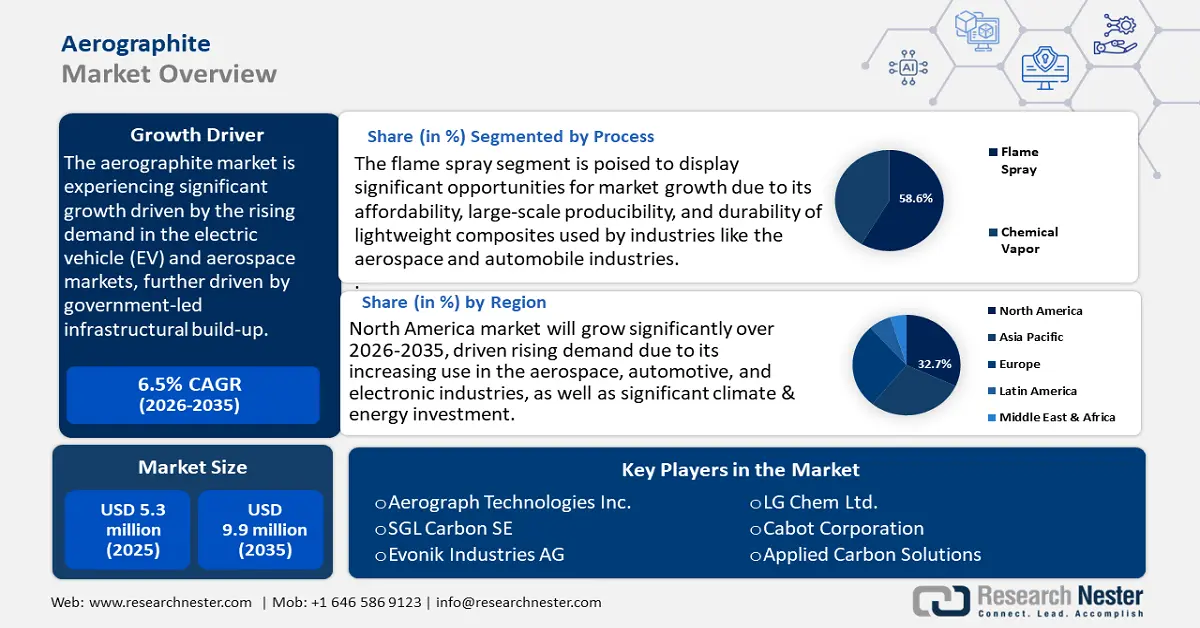

Aerographite Market size was valued at USD 5.3 million in 2025 and is projected to reach USD 9.9 million by the end of 2035, rising at a CAGR of approximately 6.5% during the forecast period, 2026-2035. In 2026, the industry size of aerographite is estimated at USD 5.6 million.

The global aerographite market is estimated to grow substantially, primarily driven by the rising demand in the electric vehicle (EV) and aerospace markets, which is further driven by government-led infrastructural build-up, encouraging the usage of sustainable power-efficient technologies. According to data reported by Our World in Data, transport accounts for around 21% of global CO₂ emissions, or 24% if considering only energy-related CO₂ emissions. Road transport alone is accountable for around 15% of total emissions, highlighting the significant role of the transport sector and reinforcing the need for lightweight materials to reduce vehicular emissions.

The projection of the growth of sales in battery-powered vehicles increased by 108% in 2021 to 6.75 million globally, prompting the automakers to consider such materials as Aerographite, boasting high ratios of strength-to-weight and electrical conductivity, which are critical in battery operation and vehicle economy. This aligns with the wider government direction of decarbonization of transport, through incentives to EV uptake, and development of high-performance materials in the aerospace lightweighting sector, which, in turn, drives demand for aerographite. For example, according to the United Nations Economic Commission for Europe (UNECE), transport accounts for about 23% of annual greenhouse gas emissions, with inland transport contributing 72% of that total 69% from road transport, 2% from inland shipping, and 1% from rail. The demand for passenger transport is expected to increase by 79%, and freight transport by 100% by 2050.

In supply chain and production capacity, Aerographite synthesis is complicated as there are limited to no suppliers around the world, and it requires unique manufacturing processes like chemical vaporization deposition and flame spray method of manufacturing the product. The U.S. Department of Energy (DOE) is committed to developing reliable, affordable, and sustainable domestic supply chains for critical minerals and materials. Their programs focus on advancing energy competitiveness and supporting key sectors such as energy, manufacturing, and transportation. The DOE emphasizes innovation and investments to promote safe and environmentally sustainable solutions, helping reduce dependence on imported strategic materials while meeting future demand. According to the current readings of the U.S. Bureau of Labor Statistics, Producer Price Index series, there is a moderate price growth in the inputs to advanced material manufacturing, 3.3% over a year ago.

Key Aerographite Market Insights Summary:

Regional Insights:

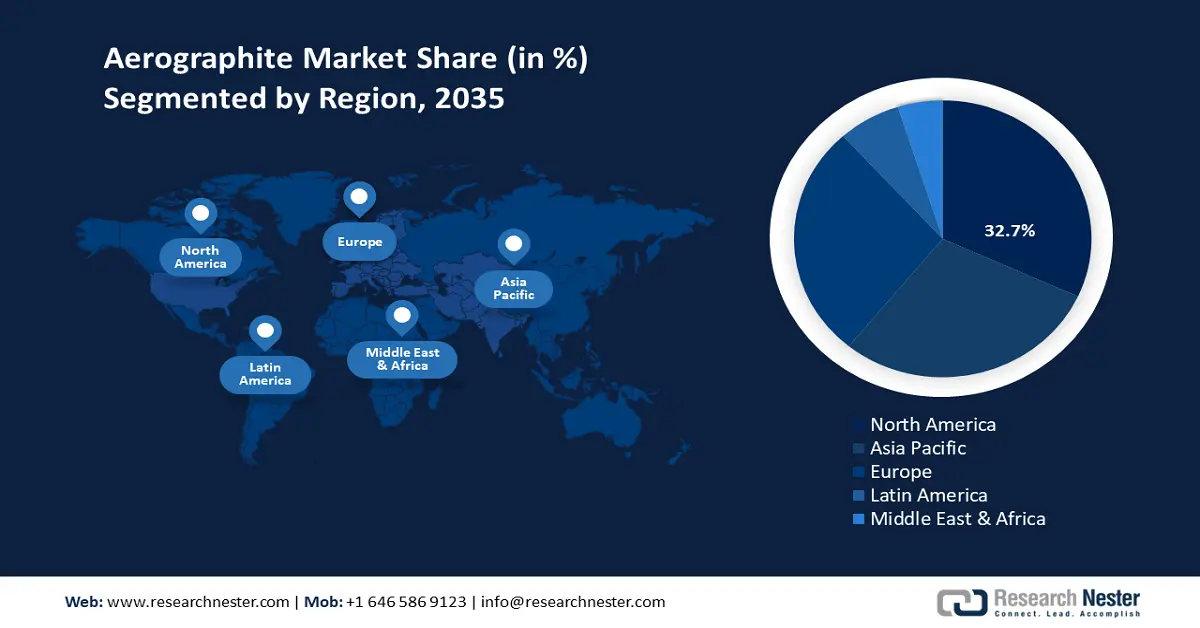

- The North American Aerographite Market is forecast to capture a 32.7% share from 2026 to 2035, supported by expanding adoption across aerospace, automotive, and electronics sectors.

- The Asia Pacific region is projected to record the fastest CAGR of 7.2% during 2026–2035, owing to rapid industrialization and rising investments in sustainable chemical technologies.

Segment Insights:

- The flame spray segment in the Aerographite Market is projected to account for 58.6% share by 2035, propelled by its affordability, scalability, and durability in lightweight composites for aerospace and automotive industries.

- The monolith foams segment is anticipated to secure a 53.3% share by 2035, spurred by its superior mechanical integrity and thermal resistance enhancing applications in energy storage and aerospace sectors.

Key Growth Trends:

- Incubation in catalytic production technology

- Nanomaterials research and development

Major Challenges:

- Market access restrictions and trade barriers

- The Implications of the newest toxic chemical regulation

Key Players: Aerograph Technologies Inc., SGL Carbon SE, Evonik Industries AG, Applied Carbon Solutions, LG Chem Ltd., Cabot Corporation, Reliance Industries Ltd., Petronas Chemicals Group, Outotec Oyj, Calix Limited.

Global Aerographite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.3 billion

- 2026 Market Size: USD 5.6 billion

- Projected Market Size: USD 9.9 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 3 September, 2025

Aerographite Market - Growth Drivers and Challenges

Growth Drivers

- Incubation in catalytic production technology: Catalytic innovations have enabled the stable scaling of aerographite manufacturing. Chemical vapor deposition (CVD) is a critical process for fabricating fine-quality graphene and other associated products, such as aerographite. The method entails deposition of material in vapor species onto target substrates through chemical reactions, where temperature, gas composition, and pressure, affecting each of these processes, are important parameters of the process.

- Catalytic substrates like Cu or Ni promote the adsorption, decomposition, and domain expansion of carbon precursors, enabling the efficient and controlled synthesis of a monolayer. This improvement reduces energy consumption and operating expenses, enhancing both the sustainability and financial viability of aerographite production. These developments are further supported by government collaborations and subsidies for eco-friendly chemical manufacturing technologies, which are accelerating their commercialization.

- Nanomaterials research and development: There is significant growth in the number of strong and sustained government investments in nanotechnology research and development, with over USD 2.2 billion requested for 2025. This cumulative federal funding has exceeded USD 45 billion since 2001, demonstrating substantial public commitment to nanomaterials and nanotechnology innovation growth over the years. This surge has enabled the field of aerographite production to undergo innovations, enhancing material properties and qualities like conductivity and mechanical strength. Increased performance indicators have widened the industrial-acceptability of aerographite, particularly in the niche aviation and energy markets, hence contributing to aerographite market growth.

- Supply chain localization activities: Localization of critical materials with supply chains in North America and Europe has led to investments in domestic production facilities and infrastructure to support advanced materials, such as aerographite. For example, in 2023, a USD 650 million investment to establish a 50,000 TPA synthetic graphite anode production facility in the US was announced by Epsilon Advanced Materials to focus on high-capacity anode materials formed through green technologies. The facility is expected to produce over USD 500 million in revenue at full capacity by 2031 and generate more than 1,500 direct and indirect jobs. The project is set to commence by 2026, aiming to energize the clean energy sector and localize the battery manufacturing ecosystem in alignment with US EV subsidies. This strategic move will lessen the dependence on imports and address the risks of global supply disruptions, stabilizing the supply and ensuring its availability to manufacturers consistently.

Challenges

- Market access restrictions and trade barriers: Aerographite market access restrictions and trade barriers are very critical for aerographite suppliers, as the inconsistent environmental and safety rules in each country are the cause of non-tariff obstacles to sending shipments, resulting in delays or reassigned shipments. Research based on the International Institute for Sustainable Development (IISD) asserted that approximately 20% of chemical trade globally is met by non-tariff barriers, which increases trade costs and inefficiency of the supply chains. These flaws restrict the inflow of innovative materials, such as Aerographite, into new markets, unwilling to globalize and grow.

- The Implications of the newest toxic chemical regulation: The EPA added amendments to the toxic chemical regulations under the Toxic Substances Control Act (TSCA) in 2023, which significantly increase the compliance costs and mostly apply to PFAS chemicals. This is estimated to add new costs to industry compliance an estimated at over USD 800 million across the industry, which means that manufacturers have to spend large amounts of resources to carry the costs of testing, reporting, and risk management. Such regulatory pressure is encouraging a move to safer and more sustainable materials like aerographite, but also presents short-term financial and operational pressures.

Aerographite Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 5.3 million |

|

Forecast Year Market Size (2035) |

USD 9.9 million |

|

Regional Scope |

|

Aerographite Market Segmentation:

Process Segment Analysis

The flame spray segment is expected to grow with the largest revenue aerographite market share of 58.6% by 2035, owing to its affordability, large-scale producibility, and durability of lightweight composites used by industries like the aerospace and automobile industries. It is capable of generating materials that have admirable strength-to-weight ratios through increasing popularity in next-generation applications. Manufacturing innovation programs sponsored by the Government further support the development of this technology and ensure its further market leadership. For example, the UK government, in collaboration with Aerospace Technology Institute (ATI), is investing 3.9 billion pounds in graphene and related 2D materials for applications in the aerospace industry. This investment fast-tracks graphene-enhanced composites research, production, and industrialisation. The objective of the investment is to advance aircraft capability, performance, and efficiency, as well as sustain the leadership of the UK’s aerospace industry.

The process of flame spray aerographite is supported by powdered aerographite and composite coatings, which are expected to majorly fuel its aerographite market growth. Powdered aerographite is preferred due to its versatility; manufacturers use it widely in the preparation of lightweight battery electrodes and conductive composites in the automotive and electronic industries. Its fine particle nature increases electrical conductivity and mechanical performance, in line with the burgeoning need for high-performance energy storage. Meanwhile, a flame-sprayed coating enhances composite coatings to give an aerospace and satellite application a wear and tear protective coating, lightweight, and a thermally resistant powder coating, which remains exceptionally crucial where fuel efficiency and durability take precedence. The anti-rust and anti-slipperiness of such coatings enhance the properties of the surface by minimizing wear and corrosion, delaying the replacement of the surface, and complying with government laws on environmental restrictions.

Form Segment Analysis

The monolith foams segment is likely to witness a significant growth trend with the revenue aerographite market share of 53.3% over the forecast period, mainly due to its better mechanical integrity and good thermal resistance, which make it broadly used in energy storage and aerospace markets. The lightweight design of the materials would also look into calls by regulators concerning the demand for increased energy efficiency and the decrease in carbon footprints. This rising adoption in industries is fuelled by the strict energy-saving guidelines put in place by regulatory bodies, including the U.S. EPA. In addition, according to Stanford research, SIPs with foam cores create highly efficient thermal barriers, minimizing heat loss and reducing the energy needed to maintain comfortable indoor temperatures.

The Monolith Foams business is majorly fuelled by high-density foams and low-density foams that contribute immensely to market expansion. High-Density Foams are excellent thermo-mechanical insulators and are strong alternatives to other materials because of their enhanced mechanical strength as well as thermal insulation properties, and are suitable where a high degree of durability and safety is required, such as in aerospace uses. The sub-segment is supported by rising aerospace investments and regulatory requirements to improve fuel efficiency and reduce emissions. On the other hand, low-density foams are in demand with their ultra-lightweight capabilities, and this aspect is a need in electric vehicle batteries and energy storage systems, where weight will result in better performance and efficiencies. These foams enable manufacturers to meet stringent government energy-saving and sustainability codes, facilitating their rapid adoption in green technologies. Composite foams further drive this growth by offering semi-hybrid solutions for specialized applications, though this segment currently holds a relatively small market share.

Application Segment Analysis

The aviation and satellite application segment is expected to grow at a aerographite market share of 46.4% from 2026 to 2035. This growth is attributed to regulatory requirements to reduce emissions from aircraft and to reduce operating costs, forcing aerospace manufacturers to work with lighter and more durable materials. For instance, the EU Emissions Trading System (EU ETS) requires all airlines operating in Europe to monitor, report, and verify their emissions and surrender allowances covering those emissions.

The revised EU ETS aims for at least a 55% reduction in greenhouse gases by 2030 and climate neutrality by 2050. It supports increased use of sustainable aviation fuels and innovation in fuel-efficient technologies, including lightweight materials to reduce aircraft emissions and operating costs. Full auctioning for the sector will begin in 2026, and monitoring of non-CO2 aviation effects will start in 2025 to further address aviation’s climate impact. The high physical properties of aerographite fit the harsh aerospace and space environments. The existence of comprehensive policy movements by the EPA and the EU ECHA further boosts the need for such highly developed materials.

Our in-depth analysis of the aerographite market includes the following segments:

|

Segment |

Subsegments |

|

Process |

|

|

Form |

|

|

Application |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerographite Market - Regional Analysis

North America Market Insights

The North American aerographite market is expected to hold a dominant position with the highest revenue share of 32.7% from 2026 to 2035, attributed to an increase in its use in the aerospace, automotive, and electronic industries. The U.S. Inflation Reduction Act (IRA) of 2022 represents the largest climate and energy investment in American history, significantly boosting government support for clean energy. It allocates approximately USD 11.7 billion to the Loan Programs Office (LPO), increasing loan authority by about USD 100 billion to finance clean energy projects, including the production of clean energy chemicals. Additionally, it funds new programs to repurpose and upgrade energy infrastructure, with expanded support for clean technology manufacturing, driving a substantial increase in federal investments compared to previous years.

Sustainable chemical processes have been implemented as a result of the regulatory efforts, including the EPA Green Chemistry Program, which has reported significant successes such as eliminating 830 million pounds of hazardous chemicals annually, saving 21 billion gallons of water, and preventing 7.8 billion pounds of CO2 emissions each year. Advances in manufacturing technologies, particularly for high-performance materials like aerographite, are a significant driver of market growth. A high level of focus on environmental compliance and safety schemes that are supported by the agencies enhances innovations and efficient production in the region. Moreover, growing capital investment in chemical manufacturing infrastructure, coupled with strategic research partnerships, is building a robust supply chain that supports aerographite's growth. Generally, the North American industry has a substantial policy framework and industrial vitality and is expected to record a substantial CAGR by 2035.

The U.S. aerographite market is projected to dominate the region with the largest share by 2035, driven by substantial investments in clean energy and the development of advanced technologies in manufacturing. In the Inflation Reduction Act (IRA) of 2022, the Energy Infrastructure Reinvestment (EIR) Program was allotted USD 5 billion to modernise energy infrastructure, and the direct loans under the Advanced Technology Vehicles Manufacturing (ATVM) program were USD 3 billion. The IRA also provides an amplification of the Tribal Energy Finance Program loans amounting to USD 20 billion, an upsurge in aggregate clean energy investments, and promotes the transition of the United States to a net-zero economy.

The EPA Green Chemistry Challenge Awards have honoured 133 winning technologies to date that avoided 830 million pounds of hazardous substances and solvents annually, saved 21 billion gallons of water each year, and avoided 7.8 billion pounds of carbon dioxide emissions, the equivalent of taking 770,000 cars off the road. Moreover, the research on lightweight materials such as aerographite aims to enhance the energy efficiency in the car industry and the aerospace industry. They come in the forms of tough regulations and an augmented investment in research and development, which will stimulate new growth and expansion.

Canada’s aerographite market is expected to grow at a steady pace over the forecast years, attributed to the support of government policy backing clean technology and green manufacturing. The energy industry in Canada was reported to have invested USD 92 billion in capital expenditures, and it had invested simply in clean technology projects valued at USD 159 billion in 2023. In 2022-23, federal and provincial governments jointly invested around USD 1,485 billion into energy research, development, and demonstration, and this was a considerable indicator of support focused on clean energy. Joint ventures between research institutions and companies in the advanced materials, like aerographite, stimulate research. Moreover, the positive initiative of Canada in terms of environmental practice and willingness to implement the green chemistry-based approach will support the upcoming aerographite market growth at a stable rate.

Asia Pacific Market Insights

The Asia Pacific aerographite market is anticipated to grow with the fastest CAGR of 7.2% during the projected period from 2026 to 2035, owing to high growth in terms of industrialization and a surge in demand in the aerospace, auto, and electronics industries. There is positive government support as investments in sustainable chemical technologies have increased significantly over the past years. For example, at COP28 in 2023, the Monetary Authority of Singapore launched the FAST-P blended finance initiative, committing up to USD 500 million to raise to USD 5 billion to fund green and transition projects in the region. This fund is a public-private and philanthropic infusion of capital to de-risk and finance sustainable projects to support climate and nature impact investments. The regulatory environment that aims at carbon reductions and energy efficiency fosters the use of Aerographite to a large extent.

Activity at the national and global levels in collaborative innovation programs and similarly government-supported green chemistry programs encourages research and development activity in new materials. For instance, the Global GreenChem Innovation and Network Program (GGINP), which helps innovators in many countries to find sustainable chemistry solutions through cooperation, capacity building, and upscaling technology, is led and funded by UNIDO and the Global Environment Facility. The transformation of manufacturing infrastructure boosts the resilience of the regional supply chain that ensures large-scale manufacturing and exports. The prioritization associated with mitigating or decreasing the impact on the environment can be well associated with the Aerographite eco-friendly properties, as well as with its lightweight characteristics. All these contribute to the fact that the Asia Pacific is emerging to become an important growth hub in the global Aerographite market.

By 2035, the aerographite market in China is likely to lead the Asia Pacific region, driven by government expenditure on sustainable chemical technologies, and rise by one quarter of existing volumes during the last five years. In China, the commitment to green development has been expressed with an increase in installed renewable energy capacity up to 1.2 billion kilowatts (reported in the yearly government work report published in 2023). The clean energy use increased by 5.8%, bringing it to 25.5% and the CO2 emission decreased by 14.1%. It further indicated the emerging growth trends in new energy vehicle sales by 93.4% as compared to 2021, which portrays the extent of green transformation activity. The National Development and Reform Commission (NDRC) places high priority on energy-efficient chemical production in its five-year plans.

By establishing individual targets to curb energy usage and carbon emissions in several major sectors, such as the petrochemical and chemical sectors, it was possible to help targeted sectors figure out how to meet their targets. The plan has requirements of saving 40 million tons of standard coal equivalent in energy and cutting 110 million tons of CO2 by 2025 in the chemical sector. Additionally, existing government subsidies and tax incentives encourage adoption in the aerospace and automotive industries, which augur well to support the projected strong growth of the market. The above factors are augmented by infrastructure development and innovation centers that are promoting the rapid increase in Aerographite production in China and focus on the country as a global center.

India’s aerographite market is predicted to grow at a steady pace during the projected years, due to increasing government support and investment in green chemical technology at a high rate. For example, in June 2024, the World Bank approved the provision of a further USD 1.5 billion to assist India in its low-carbon transition, emphasising targeting green hydrogen production, renewable energy growth, and the mobilization of climate finance. The funding is intended to enhance financing towards green hydrogen and renewable infrastructure, and will target achieving 450,000 metric tons of green hydrogen and 1,500 MW of electrolyzers per year by 2025-26. This initiative will align with India to achieve its net-zero goals and cut down emissions by 50 million tons annually. As of 2023, India is successfully developing sustainability in its chemical sector, owing to efforts being undertaken by the Ministry of Chemicals and Fertilizers.

Many of these programs have led to the establishment and spread of environmentally friendly processes and technologies among chemical companies, spurring industrial upgrading and compliance with the environment. This indicates an increased focus on becoming sustainable in its activities, as policies in the country and innovation take precedence. Government support of the use of renewable energy and growth of the electronics industry are factors that boost Aerographite consumption. P3s, infrastructure investments, and policy developments further increase the production capacity and advance innovation that is making India the fastest-growing Aerographite industry in the region of Asia Pacific region.

Europe Market Insights

The European aerographite market is set to witness an upward trend over the forecast years, primarily due to strict environmental legislation, strong automotive and aerospace sectors, and an upsurge in investment in environmentally friendly chemical solutions. The ECHA and the CEFIC played a key role in the formulation of policies that have helped initiate innovations and green manufacturing. There is a growing demand associated with advanced materials, including those associated with Gallium Arsenide Wafer chemicals, and national budgets are diverting ever-greater percentages of their funding to supply sustainable chemicals. Gallium Arsenide (GaAs) wafers have substantial environmental issues that arise during the production process since wastes will contain large quantities of toxic chemicals, including arsenic and gallium.

Recycling of GaAs wafers comes with the advantage of reducing emissions and wastage of rare materials and reducing environmental impacts due to less harvesting of new sources of the raw materials. For example, the UK government, in its 2023 National Semiconductor Strategy, shows a boost in clean technology investments on Gallium Arsenide wafers. The strategy pledges between £200 million and £1 billion in 2023-25 and up to £1 billion over the following five years to fund R&D, manufacturing infrastructure, and supply underpinning the semiconductor industry. In Germany, one of the companies in the chemical sector has committed over €630 billion up to 2025 in a bid to grow, and also under stimulus economic packages, their targets are on innovation, sustainability, and digitalization.

Key Aerographite Market Players:

- Aerograph Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SGL Carbon SE

- Evonik Industries AG

- Applied Carbon Solutions

- LG Chem Ltd.

- Cabot Corporation

- Reliance Industries Ltd.

- Petronas Chemicals Group

- Outotec Oyj

- Calix Limited

The global aerographite market has a competitive environment punctuated by some major players, mainly in Japan, the USA, and Europe. NGK Spark Plug, Showa Denko, Mitsubishi Chemical, and Asahi Kasei are some of the Japanese firms holding a massive market share because of their reliability in advanced R&D and innovation. Major companies currently embark on strategic approaches such as the purchase of renewable production centers, ventures in collaboration with the aerospace and electronics industries, and the extension of manufacturing facilities to address increasing global demand. In the U.S. and Europe, players mainly deal with the development of eco-efficient material in line with compliance with the regulation, whereas there is more intensive investment in scale-up and the adoption of technology by the emerging manufacturers of South Korea, India, and Malaysia.

Recent Developments

- In April 2025, BASF introduced the new readily biodegradable dispersants Sokalan CP 301, more specifically developed to be used in plant production. The product is in line with the emerging global regulatory trends, such as the EU Green Deal, that encourage safer and greener chemical solutions. Sokalan CP 301 cleans up quickly in the environment since it is biodegradable, yet it does not compromise the performance or stability of other ingredients used in formulations. A major market requirement addresses the agricultural additives that are not exhausted. This launch reaffirms BASF’s status as an innovator of green chemistry and taking advantage of the rising demand in markets for products with environmentally sound practices to achieve sustainable goals globally.

- In early 2025, TX's Collins Aerospace introduced Powered by Collins, which incorporates the use of the advanced Aerographite composites into aerospace manufacturing. This initiative is in line with lighter materials that increase efficiency in aircraft production, thus reducing emissions. The Aerographite composites have increased the performance of the materials largely used by Collins Aerospace in aerospace composites manufacturing. The initiative has pioneered a higher market share of Aerographite materials in the aviation industry as the industry moves towards efficient, greener technology. It is a tactical gesture that highlights the potential of new materials in the development of aerospace sustainability as well as efficiency.

- Report ID: 8044

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aerographite Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.